seminar in finance notes

advertisement

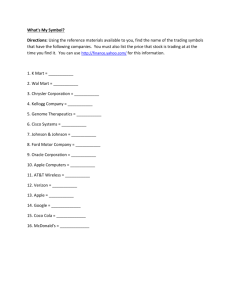

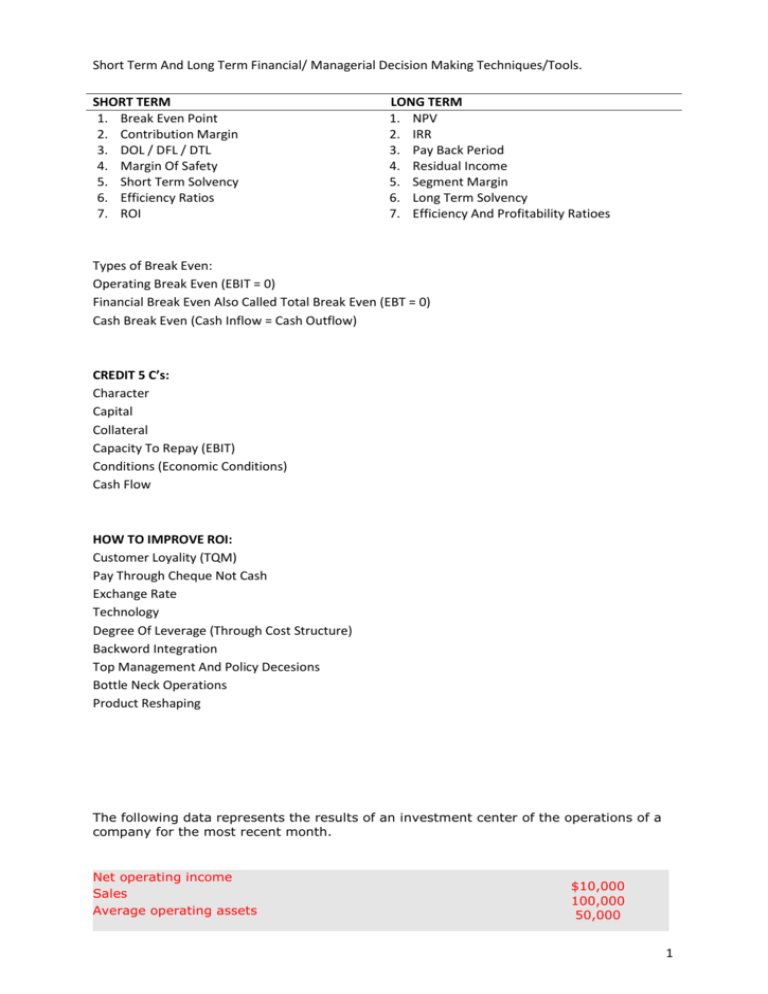

Short Term And Long Term Financial/ Managerial Decision Making Techniques/Tools. SHORT TERM 1. Break Even Point 2. Contribution Margin 3. DOL / DFL / DTL 4. Margin Of Safety 5. Short Term Solvency 6. Efficiency Ratios 7. ROI LONG TERM 1. NPV 2. IRR 3. Pay Back Period 4. Residual Income 5. Segment Margin 6. Long Term Solvency 7. Efficiency And Profitability Ratioes Types of Break Even: Operating Break Even (EBIT = 0) Financial Break Even Also Called Total Break Even (EBT = 0) Cash Break Even (Cash Inflow = Cash Outflow) CREDIT 5 C’s: Character Capital Collateral Capacity To Repay (EBIT) Conditions (Economic Conditions) Cash Flow HOW TO IMPROVE ROI: Customer Loyality (TQM) Pay Through Cheque Not Cash Exchange Rate Technology Degree Of Leverage (Through Cost Structure) Backword Integration Top Management And Policy Decesions Bottle Neck Operations Product Reshaping The following data represents the results of an investment center of the operations of a company for the most recent month. Net operating income Sales Average operating assets $10,000 100,000 50,000 1 The rate of return generated by the company for this investment center is as follows: ROI = Margin × Turnover (Net operating income / Sales) × (Sales / Average operating assets) ($10,000 / $100,000) × ($100,000 / $50,000) 10% × 2 = 20% As we stated above that manager can increase sales, reduce expenses, or reduce the operating assets to improve the ROI figure. Approach 1: Increase sales: Assume that the manager is able to increase sales from $100,000 to $110,000. Assume further that either because of good cost control or because some costs in the company are fixed, the net operating income increases even more rapidly, going from $10,000 to $12,000 per period. Assume that operating assets remain constant. The new ROI will be: ROI = ($12,000 / $110,000) × ($110,000 / $50,000) 10.91% × 2.2 24% Approach 1: Reduce expenses: Assume that manager is able to reduce expenses by $1,000 so that net operating income increases from $10,000 to $11,000. Assume that both sales and operating assets remain constant. The new ROI would be: ROI = ($11,000 / $100,000) × ($100,000 / $50,000) 11% × 2.2 22% Approach 3: Reduce operating assets: Assume that the manager of the company is able to reduce operating assets from $50,000 to $40,000, but that sales and operating income remain unchanged. Then the new ROI would be: ROI = ($10,000 / $100,000) × ($100,000 / $40,000) 11% × 2.2 22% 2 1. Look for Multiple Positives A multiple positive is an activity that generates a positive return in more than one area. These are great for ROI because they multiply returns and incur fewer losses. One of my best multiple positives is working on this website. It’s something that I find extremely entertaining, it contributes to a small (but steadily growing) stream of income, and it develops skills that I’ll be able to use the rest of my life like writing, web design, and networking. Every individual will have different multiple positives, the important part is finding ones that work for you. A multiple positive for a software developer might be working on open source or a personal project. It can even be as simple as playing basketball, a fun game that’s also great exercise. The key to finding multiple positives is finding areas where different positive actions intersect. If I can find a way to get paid to eat delicious food I’ll be golden. 2. Avoid Multiple Negatives Multiple negatives are the same as multiple positives, except the complete opposite. These are activities that detract from multiple areas of life. One of my favorite weaknesses is going out drinking. This hurts me in three ways: the time spent isn’t productive, drinks are expensive, and the effect of staying up late and being hungover usually ruins the following day. If I don’t have a good time, this is basically the worst possible scenario. I’m not saying you should never go out and have a good time. To be happy we need socialization and excitement. My point is that we should always try to minimize the negative impact of our actions. I try to do this by minimizing the amount I drink and only going out when I know it will be enjoyable. Often we get caught in a pattern of poor investment. Over time, the benefits fade away and what remains is mostly negative, but we keep doing it out of habit. This can be avoided by periodically analyzing our behavior. Is it still a good investment, or is it time to make a change? 3. Utilize the Power of Compounding I’m sure that everyone reading this understands the power of compound interest. When you invest money you earn interest. Then you start earning interest on the money you earned from interest. Over many years this continues to compound and eventually leads to a very large sum of money. The same concept applies to time. If you invest time by working hard when you’re young, you put yourself in a position to succeed that will continue compounding for the rest of your life. If you waste time when you’re young, you can’t make up for it later because you’ve lost the opportunity to utilize the power compounding. 3