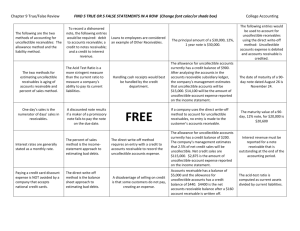

CHAPTER 5

advertisement

©2009 The McGraw-Hill Companies, Inc. Chapter 5 Receivables and Sales 5-2 Credit sales o Are common for large business transactions in which buyers don’t have sufficient cash available or where credit cards cannot be used because the transaction amount exceeds typical credit card limits. o Revenue is recognized at the time of a credit sale. o An asset (accounts receivable) is recognized at the time of a credit sale. ©2009 The McGraw-Hill Companies, Inc. Part A Recognition of Accounts Receivable 5-4 LO1 Recognize Accounts Receivable o Credit sales transfer products and services to a customer today while bearing the risk of collecting payment from that customer in the future. o Even though the seller does not receive cash at the time of the credit sale, the firm records revenue immediately, as long as future collection from the customer is reasonably certain. o Along with the recognized revenue, at the time of sale the seller also obtains a legal right to receive cash from the buyer. The legal right to receive cash is valuable and represents an asset of the company. 5-5 Recording of Credit Sales Jay’s Dental charges $500 for teeth whitening. Dee Kay decides to take advantage of the service, has her teeth whitened on March 1, but doesn’t pay cash at the time of service. Dee promises to pay the $500 whitening fee to Jay by March 31. Jay makes the following entry at the time of the cleaning. 5-6 Other types of receivables Nontrade receivables • Are receivables from those other than customers and include tax refund claims, interest receivable, and loans by the company to other entities including stockholders and employees. Notes receivable • Are receivables that are accompanied by formal credit arrangements made with written debt instruments (or notes). 5-7 Trade Discounts o o o Represent a reduction in the listed price of a product or service. Companies don’t recognize trade discounts directly when recording a transaction. Instead, they recognize trade discounts indirectly by recording the sale at the discounted price. Let’s go back to Jay’s Dental, which typically charges $500 for teeth whitening. Jay offers a 20% discount on teeth whitening to any of his regular patients. LO2 Understand contra revenues–sales discounts, returns, and allowances– associated with sales Sales Discount o o o Represents a reduction, not in the selling price of a product or service, but in the amount to be paid by a credit customer if payment is made within a specified period of time. It’s a discount intended to provide incentive for quick payment. The amount of the discount and the time period within which it’s available usually are communicated in short-hand terms such as 2/10, n/30. o o The term “2/10,” indicates the customer will receive a 2% discount if the amount owed is paid within 10 days. The term “n/30,” means that if the customer does not take the discount, full payment is due within 30 days. 5-8 5-9 First scenario, assume Dee pays on March 10th, which is within the 10-day discount period 5-10 First scenario, assume Dee pays on March 10th, which is within the 10-day discount period 5-11 Second scenario, assume that Dee waits until March 31 to pay, which is not within the 10-day discount period Jay records the following entry at the time he collects cash from Dee. Notice that there is no indication in recording the transaction that the customer does not take the sales discount. This is the typical entry to record a cash collection on account when no sales discounts are involved. 5-12 Sales Return and Allowances a. b. Sales Return If a customer returns a product it is sales return. After a sales return, we reduce the customer’s account balance if the sale was on account or we issue a cash refund if the sale was for cash. Sales Allowances If a customer does not return a product, but the seller reduces the customer’s balance owed or provides at least a partial refund because of some deficiency in the company’s product or service, we call that a sales allowance. 5-13 Sales Return and Allowances On March 5, after Dee gets her teeth cleaned but before she pays, she notices that another local dentist is offering the same procedure for $350. Dee brings this to Jay’s attention and because Jay’s policy is to match any competitor’s pricing, he offers to reduce Dee’s account balance by $50. Jay records the following sales allowance entry. ©2009 The McGraw-Hill Companies, Inc. Part B Valuation of Accounts Receivable 5-15 LO3 Record an allowance for future uncollectible accounts o The right to receive cash from a customer is a valuable resource for the company. This makes accounts receivable an asset to be recognized in the company’s balance sheet . o To be useful to decision makers, it should be reported at net realizable value, which is the amount of cash the firm expects to collect. Should companies sell goods and services to their customers on account, or should they accept only cash payment at the time of purchase? The upside, allowing customers the ability to purchase on account and pay cash later boosts sales. The downside of extending credit to customers is that not all customers will pay fully on their accounts 5-16 Allowance Method Involves recording an adjusting entry at the end of each period to allow for the possibility of future uncollectible accounts. The adjusting entry has the effect of 1. reducing accounts receivable by an estimate of the amount we don’t expect to collect and 2. recording an expense to reflect the cost of offering credit to customers. 5-17 Estimating Uncollectible Accounts Kimzey specializes in emergency outpatient care. It doesn’t verify the patient’s health insurance, It understands that a high proportion of fees for emergency care provided will not be collected. In 2010, it bills customers $50 million. By the end of the year, $20 million remains due from customers. Of this amount, it estimates that 30% is likely to be uncollected. The year-end adjusting entry to allow for these future uncollectible accounts is as follows: 5-18 Bad Debt o Equals the amount of the adjustment to the allowance for uncollectible accounts, representing the cost of estimated future bad debts charged to the current period. This expense is included in the same income statement as the credit sales revenue it helps generate. o There is no cash outflow associated with bad debts. o It is not possible to record actual future bad debts in the current period because we don’t know the future expense when preparing the current period’s financial statements. 5-19 Match Future Bad Debts with Current Credit Sales 5-20 Accounts Receivable Portion of the Balance Sheet After we adjust for future uncollectible accounts, the accounts receivable portion of Kimzey’s year-end balance sheet appears below 5-21 LO4 Apply the procedure to write off accounts receivable as uncollectible On February 23, 2011, Kimzey receives notice that one of its former patients, Bruce, has filed for bankruptcy. He believes it is unlikely Bruce will pay his account of $4,000. Remember, Kimzey previously allowed for the likelihood that some of its customers would not pay. Now it knows a specific customer will not pay, it can adjust the allowance and reduce the accounts receivable. Kimzey makes the following entry. 5-22 Collection of Accounts previously Written Off Later in 2011, on September 8, Bruce’s bankruptcy proceedings are complete. Kimzey had expected to receive none of the $4,000 Bruce owed. After liquidating all assets, Bruce is able to pay each of his creditors 25% of the amount due them. Kimzey records the following two entries. 5-23 Balance of Kimzey’s Net Accounts Receivable Total accounts written off by Kimzey during 2011 equaled $5 million but that $1 million of this amount was collected by the end of the year. The timeline of events related to accounts receivable during 2010 and 2011 is this: (1) Accounts receivable total $20 million at the end of 2010. (2) Made an adjusting entry at the end of 2010 for estimated bad debts of $6 million. (3) Actual accounts wrote off as uncollectible in 2011 total $5 million. (4) Of the $5 million written off, $1 million later appears receivable. (5) Received $1 million cash for the accounts re-established in (4). 5-24 Estimating Uncollectible Accounts in the following year At the end of 2011, Kimzey must once again estimate uncollectible accounts and make a year-end adjusting entry. Suppose that in 2011 it bills customers for services $80 million, and $30 million are still receivable at the end of the year. Of $30 million receivable, it estimates 30% will not be collected. For what amount would it record the year-end adjusting entry for bad debts in 2011?. The current balance of the allowance account is 5-25 Estimating Uncollectible Accounts in the following year Based on all available information at the end of 2011, Kimzey estimates that the allowance for uncollectible accounts should be $9 million. Allowance account needs to increase from its current balance of $2 million credit to the estimated ending balance of $9 million credit. It can accomplish this by adjusting the account for $7 million as follows: 5-26 Estimating Uncollectible Accounts in the following year 5-27 LO5 Use the aging method to estimate future uncollectible accounts o Management can estimate this percentage using historical averages, current economic conditions, industry comparisons, or other analytical techniques. o A more accurate method than assuming a single percentage uncollectible for all accounts is to consider the age of various accounts receivable, and use a higher percentage for “old” accounts than for “new” accounts. This is known as the aging method. o For instance, accounts that are 60 days past due are older than accounts that are 30 days past due. The older the account, the less likely it is to be collected 5-28 Use the aging method to estimate future uncollectible accounts Kimzey Medical Clinic – How aging of accounts receivable can be used to estimate uncollectible accounts. Recall that accounts receivable at the end of 2011 totaled $30 million. Below image shows its accounts receivable aging schedule at the end of 2011. 5-29 Use the aging method to estimate future uncollectible accounts. LO6 Contrast the allowance method and direct write-off method when accounting for uncollectible accounts 5-30 Direct Write-Off Method o o Recording bad debt expense at the time we know the account to be uncollectible. The direct write-off method is used for tax purposes but is generally not permitted for financial reporting. Suppose a company provides services for $10,000 on account in 2010, but makes no allowance for uncollectible accounts at the end of the year. On September 17, 2011, $2,000 is considered uncollectible. The company records the write-off as follows. Comparison of the Allowance Method and the Direct Write-off Method for Recording Uncollectible Accounts Assume that by the end of 2010 we estimate $2,000 of accounts receivable won’t be collected. Also assume that our estimate of future bad debts turns out to be correct, and actual bad debts in 2011 total $2,000. 5-31 LO7 Calculate key ratios investors use to monitor a company’s effectiveness in managing receivables o o o o o The amount of a company’s accounts receivable is influenced by a variety of factors, including the level of sales, the nature of the product or service sold, and credit and collection policies. More liberal credit policies—allowing customers a longer time to pay or offering cash discounts for early payment—often are initiated with the specific objective of increasing sales volume. Management’s choice of credit and collection policies results in trade-offs. Investors, creditors, and financial analysts can gain important insights by monitoring a company’s investment in receivables. Two important ratios that help in understanding the company’s effectiveness in managing receivables are the o o receivables turnover ratio and the average collection period. 5-32 5-33 Receivables Turnover Ratio It shows the number of times during a year that the average accounts receivable balance is collected. Receivables turnover ratio = Net Sales Average accounts receivable The average collection period is another way to express the same measure. It shows the approximate number of days the average accounts receivable balance is outstanding. Average collection period = 365 Days Receivables turnover ratio 5-34 Receivables Turnover Ratio Net credit sales are $400,000 for the year and the average accounts receivable balance is $40,000. We could say the turnover ratio is 10, or average receivables were collected 10 times during the year. If the turnover is 10 times a year (365 days), then the average balance is collected every 36.5 days. ©2009 The McGraw-Hill Companies, Inc. Part C Notes Receivable LO8 Apply the procedure to account for notes receivable, including interest calculation 5-36 o Notes receivable are similar to accounts receivable but are more formal credit arrangements evidenced by a written debt instrument, or note. o Notes receivables are classified as either Current or Noncurrent depending on the expected collection date. o If the time to maturity is longer than one year, the note receivable is a long-term asset. 5-37 Notes Receivable February 1, 2010, Kimzey has a patient, Justin Payne, who has a severely past due account receivable of $10,000. In place of the account receivable, it accepts a six-month, 12% promissory note from him. An example of a typical note receivable is shown below. It records the note as follows. 5-38 Interest Calculation o o Many of the same issues we discussed concerning accounts Receivable, apply also to notes receivable. One issue that applies to notes receivable but not accounts receivable is interest. Kimzey issued a six-month, 12% promissory note. It will charge Justin Payne one-half year of interest. Interest on its note receivable is calculated as follows. 5-39 Collection of Notes Receivables We record the collection of notes receivable the same way as a collection of accounts receivable, except we record interest earned as interest revenue in the income statement. August 1, 2010, the maturity date, Justin repays the note and interest in full as promised. Kimzey will record the following entry. 5-40 Accrued Interest o o o o o It happens that notes are issued in one year and the maturity date occurs in the following year. What if Justin issued the previous six-month note to Kimzey on November 1, 2010, instead of February 1, 2010? $10,000 face value and $600 interest on the six-month note are not due until May 1, 2011. The length of the note and interest rate remain the same, the total interest charged to Justin remains the same. Kimzey will record interest revenue for two months of the sixmonth note, and four months in the next year. 5-41 Accrued Interest Remember, interest is earned as time goes by, so Kimzey earns two months’ interest ($200) in 2010 even though it won’t collect it until 2011. On May 1, 2011, the maturity date, It records the collection of the note receivable and interest receivable as well as the revenue related to four months’ interest earned in 2011. 5-42 Calculating Interest Revenue over Time for Kimzey Medical Clinic On May 1, 2011, it has received the note receivable recorded on November 1, 2010, and the interest receivable recorded on December 31, 2010, and has eliminated their balances. The remaining four months’ interest occurs in 2011 and it recognizes as revenue then. Interest receivable from its sixmonth, $10,000, 12% note is $100 per month (= $10,000 x 12% x 1/12). ©2009 The McGraw-Hill Companies, Inc. Appendix Percentage of Credit Sales Method 5-44 LO9 Estimate uncollectible accounts using the percentage of credit sales method. Percentage of receivables method Based on the estimate of bad debts on a balance sheet account—accounts receivable Balance sheet method Percentage of Credit sales method Based on the estimate of bad debts on a income statement account—credit sales Income statement method 5-45 Adjusting for Estimates of Uncollectible Accounts 5-46 Financial Statement: Effects of Estimating Uncollectible Accounts ©2009 The McGraw-Hill Companies, Inc. End of chapter 5