Lesson 1

advertisement

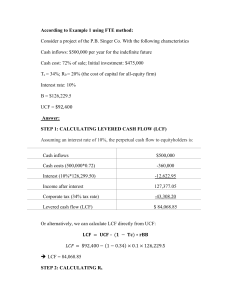

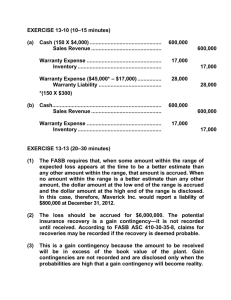

FA3 - Lesson 6 Accounting for income tax Lesson 6 deals with accounting issues related to measuring and reporting income tax in the financial statements. Various alternatives are reviewed, and then the lesson examines the Canadian measurement and disclosure standards. Complications caused by changes in tax rates are reviewed, as are the intricacies of accounting for the benefit of a tax loss. What is an intraperiod tax allocation? Income tax expense must be allocated to: continuing operations, discontinued operations, extraordinary items, and retained earnings items. Why are accounting income and taxable income different? Permanent differences Temporary differences What is a permanent difference (PD)? Items of revenue, expense, gains, or losses that are reported for accounting purposes but never enter into the computation of taxable income. Also those rare items that enter into taxable income but are never included in accounting income. What is a temporary difference (TD)? Temporary differences arise when the tax basis of an asset or liability is different from its carrying value in the financial statements. Or, components of accounting income entered into the computation of taxable income, but in a different period. What is the objective of comprehensive interperiod income tax allocation? The objective of comprehensive interperiod income tax allocation is to recognize the income tax effect of every item when that item is recognized in accounting net income. Alternatives to comprehensive allocation are the flow-through method and partial allocation. How are the effects of TDs measured? Using tax rates when the item originated (deferral method). Or, using tax rates expected when the item reverses (liability or accrual method). The liability or accrual method is Canadian GAAP. What tax rate is used under the liability method? Use the currently-enacted or substantiallyenacted rate that will apply in the period that the temporary difference is expected to reverse. Balances in FIT (Future Income Tax) are updated annually to new tax rates. How are future income taxes classified? FIT is a current asset/liability if the temporary differences are caused by a current asset or liability. FIT is long-term if caused by long-term assets or liabilities. Current FITs can be netted with other current FITs. The same applies to non-current FITs. How is income tax expense calculated? 1. Calculate tax payable. 2. Calculate the change in future income tax. 3. Combine 1 and 2 to obtain tax expense. There is a table that aids the calculation of item 2. What is an investment tax credit? Investment tax credits are reductions of tax caused by capital expenditure. The tax credit is recorded as a reduction to capital assets or in a separate deferred credit. It is amortized over the life of the asset. What are the rules for tax losses? Tax losses may be carried back and offset against taxable income in the three previous years (LCB). Tax receivables are based on the tax actually paid. Then, the tax loss may be carried forward for seven years (LCF). If the tax loss isn’t used within this period, it expires. Can you record the LCF in the year of the loss? The future benefits of tax loss carryforwards should be recognized in the year of the loss only if there is a greater than 50% probability that the benefits will be realized. What happens if the probability shifts in a later year? An unrecognized LCF can be set up in years following the loss if the probability of realization becomes greater than 50%. If the likelihood shifts to less than 50%, the LCF has to be written off. What is disclosed in the financial statements for income tax? Companies must disclose income tax expense (current and future) and the effect of LCF recognition. Unrecognized LCFs are disclosed in the notes. continued... What is disclosed in the financial statements for income tax? (continued) Public companies must explain in a note the difference between the effective tax rate reported in the financial statements and the statutory rate. The effective tax rate is the income tax expense (including future income taxes) divided by the pretax net income. continued... What is disclosed in the financial statements for income tax? (continued) The cash flow statement will include only the amounts of taxes actually payable or receivable for the year. All allocations, whether for temporary differences or for tax loss carryforwards, must be adjusted out.