Chapter 18

Income Taxes

Prepared by:

Dragan Stojanovic, CA

Rotman School of Management, University of Toronto

Income Taxes

Current

Income

Taxes

Future/Deferred

Income Taxes

Income Tax Loss

Carryover Benefits

•Tax basis

•Accounting

income and

taxable income

•Future income tax

liabilities

•Introduction to tax

losses

•Calculation of

taxable income

•Calculation of

current income

taxes

•Future income tax

assets

•Income tax

accounting objectives

•Multiple differences

illustrated

•Tax rate

considerations

•Loss carryback

illustrated

Presentation,

Disclosure, and

Analysis

•Balance sheet

presentation

•Loss carryforward

illustrated

•Income and other

statement

presentation

•Carryforward with

valuation allowance

•Disclosure

requirements

•Review of future

income tax asset

account

•Analysis

IFRS /

Private

Entity GAAP

Comparison

•Comparison

chart

•Looking ahead

•Outstanding

conceptual questions

2

Income Taxes

Current

Income

Taxes

Future/Deferred

Income Taxes

Income Tax Loss

Carryover Benefits

•Tax basis

•Accounting

income and

taxable income

•Future income tax

liabilities

•Introduction to tax

losses

•Calculation of

taxable income

•Calculation of

current income

taxes

•Future income tax

assets

•Income tax

accounting objectives

•Multiple differences

illustrated

•Tax rate

considerations

•Loss carryback

illustrated

Presentation,

Disclosure, and

Analysis

•Balance sheet

presentation

•Loss carryforward

illustrated

•Income and other

statement

presentation

•Carryforward with

valuation allowance

•Disclosure

requirements

•Review of future

income tax asset

account

•Analysis

IFRS /

Private

Entity GAAP

Comparison

•Comparison

chart

•Looking ahead

•Outstanding

conceptual questions

3

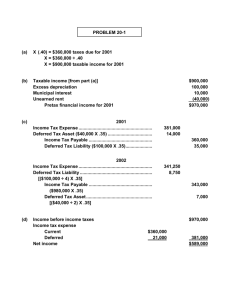

Fundamentals

Accounting income (per GAAP) ≠ Taxable

income (per Income Tax Act)

Accounting income → Income tax expense

(current and future)

Taxable income → Income tax payable and

current income tax expense

Income tax expense ≠ Income tax payable

4

Accounting Income and

Taxable Income:

Reconciliation of Accounting Income

and Taxable Income:

Accounting income

± differences

= Taxable income

Taxable income × current tax rate =

taxes payable and current income tax

expense

5

Future Tax Liability Example

Chelsea Inc. - 2010

Accounting

Revenue

Tax

$130,000

$100,000

60,000

60,000

Income

$ 70,000

$ 40,000

Tax @ 40%

$ 28,000

$ 16,000

Expenses

6

Future Tax Liability Example

Chelsea Inc.

2012

2010

2011

$70,000

Accounting Income

$70,000

$70,000

Adjust for revenue

taxable in future

period

(30,000)

20,000

10,000

Taxable Income

$ 40,000

$ 90,000

$ 80,000

Tax payable @

40%

$ 16,000

$ 36,000

$ 32,000

7

Permanent, Timing, and

Temporary Differences

• Taxable income is determined by starting with

accounting income and adjusting it for

permanent and reversible (or timing)

differences in the year

8

Permanent Differences - Examples

• Items, recognized on income statement,

but never for income tax purposes:

• Non-tax-deductible expenses (e.g. fines,

golf dues, expenses related to non-taxable

revenue)

• Dividends from taxable Canadian

corporations

• Items, recognized for tax purposes, but not

for

financial accounting purposes:

• Depletion allowance of natural resources in

excess of cost

9

Summary of Permanent Differences

Sources of PERMANENT DIFFERENCES

Some items

are recorded

in books

but never

on tax return

Other items

are never

recorded in books

but recorded

on tax return

No future tax effects

for permanent differences

10

Reversible Differences

• Are treated the same for books and tax—but in

different periods.

• Relate to income statement differences

• Cause the balance of a temporary difference to

change from period to period

• Originating timing difference

– Cause of the initial difference (e.g. the $30,000

non taxable revenue in 2010 in Chelsea

example)

• Reversing timing difference

– Causes a temporary difference to decrease (e.g.

the $20,000 and $10,000 amounts taxed in 2011

and 2012 in Chelsea example)

11

Calculation of Current Income

Taxes

Two methods:

1. Taxes payable method

• Allowed under PE GAAP

• Current Income Taxes

= Taxable income x Tax rate

2. Future income taxes method

• Called balance sheet liability method in IFRS

• Required by IFRS and option under PE GAAP

• Starts with Current Income Taxes and

• Adjusts for future (or “deferred”) income tax

assets and liabilities,

• To also get future (or “deferred”) income tax

expense

12

Terminology

• PE GAAP and IFRS use different terminology for the

asset and liability approach to income taxes

• Under PE GAAP

– This method is called the future income taxes method

– Related tax accounts are called future income tax

assets, future income tax liabilities, and future income

tax expense

• Under IFRS

– This method is called the balance sheet liability

method

– Related tax accounts are called deferred income tax

assets, deferred income tax liabilities, and deferred

income tax expense

• As a result, you will see the terms “future” and “deferred” used

interchangeably.

13

Income Taxes

Current

Income

Taxes

Future/Deferred

Income Taxes

Income Tax Loss

Carryover Benefits

•Tax basis

•Accounting

income and

taxable income

•Future income tax

liabilities

•Introduction to tax

losses

•Calculation of

taxable income

•Calculation of

current income

taxes

•Future income tax

assets

•Income tax

accounting objectives

•Multiple differences

illustrated

•Tax rate

considerations

•Loss carryback

illustrated

Presentation,

Disclosure, and

Analysis

•Balance sheet

presentation

•Loss carryforward

illustrated

•Income and other

statement

presentation

•Carryforward with

valuation allowance

•Disclosure

requirements

•Review of future

income tax asset

account

•Analysis

IFRS /

Private

Entity GAAP

Comparison

•Comparison

chart

•Looking ahead

•Outstanding

conceptual questions

14

Temporary Differences

= accumulated timing differences

= difference between book value of an

asset or liability and its tax value

• Is either a deductible temporary difference

(i.e. will be deducted from accounting

income in calculating taxable income in the

future), giving rise to a future tax asset, OR

15

Temporary Differences

• …a taxable temporary difference (i.e. will be

added to accounting income in calculating

taxable income in the future), giving rise to a

future tax liability.

16

Future Tax Asset and

Future Tax Liability - Sources

• Future tax accounts on the balance sheet may

be a:

– Future income (or “deferred”) tax liability, or

– Future income (or “deferred”) tax asset

17

Future Tax Asset and

Future Tax Liability - Sources

• Future tax liability

– When the future recovery of an asset, or future

settlement of a liability, that is reported on the

balance sheet will result in paying future income

taxes

– Arises from taxable temporary differences

• Future tax asset

– When the recovery of an asset or settlement of a

liability results in future income tax reductions or

benefits

– Arises from deductible temporary differences

18

Future Tax Liability Example

Chelsea Inc. - 2010

Books

Tax

Accounts receivable

$30,000

0

Income reported

in 2010

$70,000

$40,000

Tax rate = 40%

Future Income tax liability

(30,000 x 40%)

12,000

Income tax payable

(40,000 x 40%)

16,000

Income Tax Expense (total)

28,000

19

Chelsea Inc. – example continued

2011

2012

Total

Future taxable

amounts

$20,000

$10,000

$30,000

Future tax rate

40%

40%

40%

Future income

tax liability

$ 8,000

$ 4,000

$ 12,000

20

Recording Journal Entries

– e.g. Chelsea Inc. -2010

Journal Entries:

Current Income Tax Expense 16,000

Income Tax Payable

16,000

Future Income Tax Expense

Future Income Tax Liability

12,000

12,000

21

Future Income Tax Liability

Net Assets reported

Accounts receivable (in

assets)

Future income tax liability

(in liabilities)

Net assets reported

Note: Balance sheet

reflects eventual cash

impact of recovering the

A/R

End of

2010

End of

2011

$30,000

$10,000

12,000

4,000

$ 18,000

$ 6,000

22

Future Tax Asset – Example

• Cunningham Inc. sells microwave ovens with

a 2 year warranty

• In 2011, estimated warranty expense is

$500,000

• Actual warranty costs are $300,000 in 2012

and $200,000 in 2013

23

Future Income Tax Asset:

Example

Books

Warranty liability

Tax

$500,000

0

Tax rate = 40%

Future Income tax asset

(500,000 x 40%)

200,000

Income tax payable (assumed)

(Taxable Income x 40%)

600,000

Income Tax Expense (total)

400,000

24

Future Income Tax Asset:

Example

Journal Entries:

Current Income Tax Expense 600,000

Income Tax Payable

600,000

Future Income Tax Asset

200,000

Future Income Tax Expense

200,000

The total income tax expense of $400,000 is

made up of a current tax expense of $600,000

and a future income tax benefit of $200,000

25

Future Income Tax Asset:

Example

In subsequent years (2012 and 2013):

- warranty expense of $500,000 deducted

for tax, but not for books

- Income taxes payable reduced by

$500,000 × 40% = $200,000

- Entry in future, therefore:

Income tax expense

$x

Future income tax asset

$ 200,000

Income taxes payable

$x − 200,000

26

Valuation of Future Income Tax

Asset

• Income tax assets and liabilities meet the

conceptual framework conditions for

recognition as “asset” or “liability”

• Future income tax assets must be reviewed

at year end to ensure they are not reported at

more than recoverable amount

– This depends on whether taxable income will

be earned in the future, against which

temporary differences can be deducted

27

Income Tax Expense

= total of current tax expense (or benefit) and future

tax expense (or benefit)

Current income tax expense (or benefit)

= income taxes payable/receivable, based on

taxable income for current year

Future income tax expense (or benefit)

= amount of adjustment needed to the future

income tax asset/liability account on the balance

sheet

28

Future Tax Rates

• Should use the rates that are expected to

apply when the tax assets are realized or

the tax liabilities are settled

– i.e. the enacted rate (or substantively

enacted) at the balance sheet date

29

Future Tax Rates

• The effect of future tax rate changes

should be immediately recognized on all

future tax accounts

• Rate changes are treated as an

adjustment to the future income tax

expense/benefit

• Accounting standards prohibit discounting

of future income tax assets and liabilities

• IFRS requires separate disclosure of future

tax expense or benefit due to a change in

tax rates

30

Future Tax Rate - example

Hostel Corp. had the following at end of 2009:

Property, plant, and equipment:

Net book value (NBV)

= $4,000,000

Tax value (Undepreciated

capital cost, UCC)

= 1,000,000

Taxable temporary difference

= 3,000,000

(to reverse by $1,000,000 each year in 2011,

2012 and 2013)

Tax rate

40%

Future tax liability

1,200,000

31

Future Tax Rate - example

Assume a new income tax rate is enacted from

40% to 35%, effective January 1, 2012

• Recalculate Future tax liability as follows:

2011 $1,000,000 x 40% = $400,000

2012 $1,000,000 x 35% = $350,000

2013 $1,000,000 x 35% = $350,000

Total

$1,100,000

Required Adjusting Entry:

Future Income Tax Liability 100,000

Future Income Tax Benefit

100,000

(1,200,000 - 1,100,000)

32

Income Taxes

Current

Income

Taxes

Future/Deferred

Income Taxes

Income Tax Loss

Carryover Benefits

•Tax basis

•Accounting

income and

taxable income

•Future income tax

liabilities

•Introduction to tax

losses

•Calculation of

taxable income

•Calculation of

current income

taxes

•Future income tax

assets

•Income tax

accounting objectives

•Multiple differences

illustrated

•Tax rate

considerations

•Loss carryback

illustrated

Presentation,

Disclosure, and

Analysis

•Balance sheet

presentation

•Loss carryforward

illustrated

•Income and other

statement

presentation

•Carryforward with

valuation allowance

•Disclosure

requirements

•Review of future

income tax asset

account

•Analysis

IFRS /

Private

Entity GAAP

Comparison

•Comparison

chart

•Looking ahead

•Outstanding

conceptual questions

33

Tax Loss Carryback and

Carryforward

• The amount reported is the tax calculated from the

loss

• May be carried back three years, or forward for the

next twenty years

• When applying the carry back, it is usually applied

to the oldest available year first

• The benefit of a tax loss carryforward is recorded

(i.e. booked) if it is more likely than not that taxable

income will be earned in future periods to apply it

against

34

Tax Loss Carryback

• Refile prior year’s tax returns, reduce prior

taxable incomes with current year’s loss

• Claim back taxes previously paid:

Income Tax Refund Receivable xx

Current Income Tax Benefit

xx

• If loss still remains, carry it forward

35

Tax Loss Carryforward

Can you recognize (book) the tax benefit of a

loss carryforward?

•If more likely than not (i.e. probable) that benefit

will be realized (i.e. company will generate

taxable income in the future to apply loss

against), then recognize tax benefit as an asset:

Future Income Tax Asset xx

Future Income Tax Benefit

xx

36

Tax Loss Carryforward

(Cont’d)

• If future taxable income not likely (i.e. not

likely that benefit will be realized), then do not

record the tax benefit

• Instead, report existence of loss carryforward

in notes to the financial statements

• Disclose the amounts and expiry dates of

unrecognized income tax assets related to

the carryforward of unused tax losses

37

Tax Loss Carryforward (Cont’d)

Assuming tax benefit was recognized as a

Future Tax Asset, when co. applies the losses

against taxable income in the future:

Future income tax expense xx

Future income tax asset

xx

38

Tax Loss Carryforward

(Cont’d)

• If benefit was not “booked” and company does

generate taxable income in the future and uses the

unrecognized losses to reduce taxable income:

Income tax payable

xx

Current income tax benefit

xx

• Separate disclosure of the tax benefit from realization

of unrecorded loss carryforward is not required under

PE GAAP, but is required under IFRS if it makes up a

major component of tax expense

39

Carryforward with Valuation

Allowance

• This approach permitted under PE GAAP (but not

permitted under IFRS)

• Assuming a $150,000 loss carryforward where it is

unlikely that benefit will be realized in the future:

Future Income Tax Asset

60,000

Future Income Tax Benefit

60,000

(150,000 x 40%)

Future Income Tax Expense 60,000

Allowance to Reduce Future Income Tax

Asset to Expected Realizable Value

60,000

40

Carryforward with Valuation

Allowance (continued)

• The second entry indicates that the company

cannot conclude that it is more likely than not

that the company will benefit from the tax loss

in the future

• The financial statements would be the same

whether the allowance method is used or the

future income tax asset is not recognized at

all

41

Income Taxes

Current

Income

Taxes

Future/Deferred

Income Taxes

Income Tax Loss

Carryover Benefits

•Tax basis

•Accounting

income and

taxable income

•Future income tax

liabilities

•Introduction to tax

losses

•Calculation of

taxable income

•Calculation of

current income

taxes

•Future income tax

assets

•Income tax

accounting objectives

•Multiple differences

illustrated

•Tax rate

considerations

•Loss carryback

illustrated

Presentation,

Disclosure, and

Analysis

•Balance sheet

presentation

•Loss carryforward

illustrated

•Income and other

statement

presentation

•Carryforward with

valuation allowance

•Disclosure

requirements

•Review of future

income tax asset

account

•Analysis

IFRS /

Private

Entity GAAP

Comparison

•Comparison

chart

•Looking ahead

•Outstanding

conceptual questions

42

Balance Sheet Presentation

• Under IFRS

– All deferred tax assets and liabilities are recorded as

noncurrent

• Under PE GAAP

– Future tax asset or liability is classified as current or

noncurrent based on the classification of the underlying

asset or liability giving rise to the specific temporary

difference

– If the a future asset or liability is not related to specific

asset or liability (e.g. expensed research costs deferred

for tax purposes), classification is based on date that

temporary difference is expected to reverse or tax

benefit expected to be realized

43

Intraperiod Tax Allocation

• Income tax expense is reported with its

related item, such as discontinued operations,

other comprehensive income, adjustments to

RE, etc.

• Intraperiod Tax Allocation

– Tax expense is allocated within the financial

statements of the current period

• Interperiod Tax Allocation

– Tax expense is allocated between years,

and results in the recognition of future

income taxes

44

Intraperiod Tax Allocation:

Example

• Assume the following information for Copy

Doctor Inc.:

– Tax rate of 35%

– A loss from continuing operations of $500,000

– Income from discontinued operations of

– Unrealized holding gain of $25,000 on investment

accounted for at FV-OCI

• Prepare the journal entries to record current and

future tax expenses

45

Intraperiod Tax Allocation:

Example

Current Income Tax Expense

(discontinued operations)

241,500

Current Income Tax Benefit

(continuing operations)

175,000

Income Tax Payable

66,500

Calculations:

• income of 690,000 x 35% = 241,500 expense

• loss of 500,000 x 35% = 175,000 benefit

46

Intraperiod Tax Allocation:

Example

Future Income Tax Expense (OCI)

Future Income Tax Liability

8,750

8,750

Calculations:

• 25,000 x 35% = 8,750

47

Disclosure Requirements

• IFRS has more extensive disclosure requirements than

PE GAAP, including:

–

–

–

–

–

–

Major components of income tax expense or benefits

Sources of both current and future taxes

Amount of current and future tax recognized in equity

Reconciliation of effective and statutory tax rates

Information about unrecognized future tax assets

Information about each type of temporary difference and

future tax asset or liability recognized on statement of

financial position

48

Analysis

• Extensive disclosure help users asses

quality of earnings, as well as assist in

better prediction of future cash flows

49

Outstanding Conceptual Issues

• Asset-liability method (or balance sheet liability

approach) is considered most conceptually sound

method of income tax accounting

• Significant conceptual questions remain about:

– Lack of discounting (and therefore, no difference

between short-term deferral and long-term deferral)

– Recognition of future tax assets

50

Income Taxes

Current

Income

Taxes

Future/Deferred

Income Taxes

Income Tax Loss

Carryover Benefits

•Tax basis

•Accounting

income and

taxable income

•Future income tax

liabilities

•Introduction to tax

losses

•Calculation of

taxable income

•Calculation of

current income

taxes

•Future income tax

assets

•Income tax

accounting objectives

•Multiple differences

illustrated

•Tax rate

considerations

•Loss carryback

illustrated

Presentation,

Disclosure, and

Analysis

•Balance sheet

presentation

•Loss carryforward

illustrated

•Income and other

statement

presentation

•Carryforward with

valuation allowance

•Disclosure

requirements

•Review of future

income tax asset

account

•Analysis

IFRS /

Private

Entity GAAP

Comparison

•Comparison

chart

•Looking ahead

•Outstanding

conceptual questions

51

Looking Ahead

• Additional changes are expected as IASB

and FASB revisit the income tax standard

52

COPYRIGHT

Copyright © 2010 John Wiley & Sons Canada, Ltd.

All rights reserved. Reproduction or translation of

this work beyond that permitted by Access Copyright

(The Canadian Copyright Licensing Agency) is

unlawful. Requests for further information should be

addressed to the Permissions Department, John

Wiley & Sons Canada, Ltd. The purchaser may make

back-up copies for his or her own use only and not

for distribution or resale. The author and the

publisher assume no responsibility for errors,

omissions, or damages caused by the use of these

programs or from the use of the information

contained herein.

53