1) Global trends controlling structure of enterprises.

advertisement

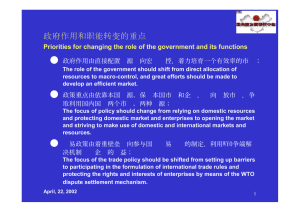

Conquering the China Market Topic: China – the future battlefield: Strategy & Tactics. By: Adjunct Professor - CBS, Visiting Senior Research Fellow ISEAS, Jørgen Ørstrøm Møller. www.oerstroemmoeller.com Singapore September 10, 2005. Prelude The old Poodle, the Leopard, the Monkey. Wisdom, Strength, Smartness. Who are you? Virgin flight attendant. Key sentence: Find your competitive parameter. 1) Global trends controlling structure of enterprises. - The economic gravity moves from goods to the immaterial economy – service, entertainment, audio-visual world, infocom, dream society, education. - Consumption patterns changes from price and cost to values, set of values, ethics, preferences – do we share the same basic attitude. 1) Global trends controlling structure of enterprises. - Consumers cease to be just that. Changes into an asset base for the enterprise taking a part, an interest, engage themselves in the evolution of the enterprise, congruous set of values. They become capital value to be listed on the asset side of the balance sheet. - Staff goes the other way. Less motivated to work HERE more interested in money. A transfer market for the best and the brightest. A wage squeeze for the water boy. In short: Enterprise-staff becomes Economics/Costs. The trigger mechanism. Outsourcing and off shoring.. 1. Global trends ... a) Outsourcing. - No longer primarily lower end of the scale production. Moving upwards from simple production to IT to BPO to KPO. Newest trends are: Diamond Cluster http://www.atimes.com/atimes/China/GF09Ad01.html - Skepticism moves in. 2005 Global IT Outsourcing. The number of buyers prematurely terminating an outsourcing relationship has doubled to 51%,.The number of buyers satisfied with their providers has plummeted from 79% to 62%. - China moves in. In 2004, only 6% of survey respondents planned to establish operations in China. 2005 number is 40%. China is starting to look like India did 10 years ago. - Contact to end users. Feed back 1. Global trends ... b) Off Shoring Heard about Innocentive http://www.innocentive.com/ ? You should. Big enterprises (Boeing, Dupont, Procter & Gamble) start to put their research & development jobs on the net. Auction. Who is offering the best and most cost effective solution. Out of the window own R&D department. More than 100 labs in Bangalore live by off shoring. Prairie fire. 1. Global trends ... c) Implications for enterprises Less horizontal. Less box the compass. Number of employees: Down. Size of capital value: Up. - The virtual enterprise emerges. Controlled by values (customers), capital value (competitive parameter, ability to pay resource persons, transfer market), cost squeeze (outsourcing), R&D ∑ off-shoring, hunt for talent and ideas (make one kill, not 100). 1. Global trends ... c) Implications for enterprises - The ownerless enterprise. Too much liquidity chasing too few assets. Too many enterprises bought at a too high price. By whom? Where is the money coming from? You feed the dog with its own tail. Three possibilities: Run the enterprise better, split up the enterprise, discount in advance high/rising profits. Why? What happens if it goes wrong? 2. Consumption Private consumption vital for sustainable growth in Asia and consequently vital for global growth. a) The middle class will be decisive. Few people realises what global cities signifies. The trendsetters live in global cities finding themselves at ease inside this cultural framework. The Hub concept. Branding, consumer preferences. - L'Oreal, Avon, Christian Dior, LVM. - Shanghai, Beijing, Guangzhou-Hong Kong-Macau, Mumbai, Calcutta, may be Tokyo. Sub-hubs Bangkok, Saigon, Singapore-Johore, Sydney. Many more. Centre-Periphery-Hinterland. All the new hubs will be in Asia. All. Not a single one outside Asia. 2. Consumption b) Not only that. Mass consumption. Recall Rostow’s theory of economic development with mass consumption as the crucial stage? Ask Wal-Mart, Carrefour, Metro. They are here expanding like a sparkler. Or Wumart established in 1995, 453 stores, revenue of more than 300 mio Us dollars, profitable (25 mio Us dollar) and Chinese. Table 2 – Domestic Consumption Legacy of Export - Led: UnderDeveloped Domestic Consumption United States Japan Korea Malaysia Singapore Taiwan Private Consumption changes % of GDP 70 55 58 50 46 63 Table 3 – Consumption in the Middle Class The Consumption Revolution: Massive Expansion of the Middle Class Size of the middle class 2002 (million) 2010 (million) China 64 155 Hong Kong 6 7 Taiwan 18 23 Korea 39 42 Malaysia 7 13 Thailand 10 21 Indonesia 11 13 (defined as those earning US$5,000 and more per year) 2. Consumption c) Now listen to this. Every time consumption takes one percent point more of GNP consumption goes up with 70 billion Us dollars (approx 40% of DKs GNP). 3. China as the spider in the net a) It is not China or India. It is China AND India. The political imperative will overshadow any misgivings. The figures. Trade beginning 90´s: approx 150 mio Us dollars. 2004 14,96 bio Us dollars equal multiplication by 100 in about 12 years! China is negotiating a FTA with Asean. India has started to negotiate a FTA with Asean. March 2005 Chinese Prime Minister Wen Jiabao in India: Start FTA. About 2012 a FTA with 3 bio people, average GNP pr capita about 1500 Us dollars, average growth 6-7%. The Chinese look at integration in East Asia in a strategic perspective. This is the VISION for Asia in the next decades and it will change the world 3. China as the spider in the net b) The Chinese currency - Yuan Asia was a de facto US dollar block. The US pressure for revaluation of the Yuan . Justified? May be but irrelevant. The rest of Asia did – partly - follow Yuan. The end of Asia as a Us dollar zone. US policy: He shot himself in his remaining foot! A seminal shift. 4. One of the strongest consumption patterns the world has ever seen will be triggered off by mass emigration from Chinas countryside to the cities. There is not enough water to sustain development in the countryside and in the cities at the same time. China must choose. It will almost certainly choose the cities and industry, technology. Imagine, just think about it, what emigration of about 400 mio people will mean for consumption, investment, infrastructure. E (environment), E (energy, oil, LNG, nuclear, sustainable, coal), W (water). 5) China and India jumps ahead in creating multinational companies. Start by looking at Japan. Multinational companies? No way. Japanese companies operating worldwide. Chinas way. Buying. Lenovo-IBM. CNOOC-Unical. HaierMaytag. But what do they buy? Knowledge, distribution network, consumer loyalty. India's way. Like Japan but smarter and more clever. Now: Chinese and Indian companies entering each other markets. Infosys, Wipro, Tata become household names in software in China. Haier, Konka, Lenovo, TCL become household names in India. 5) China and India jumps ahead in creating multinational companies. China sees Indian consumer markets as springboard for expansion to other markets. India values software markets in China as a growth sector. China software – yes domestic market and may be Korea, Japan. Indian software global potential power. Strategic perspective. Why ´jolly good old fellow´ when buying US government bonds but ´who the hell do you think you are?´ when trying to buy Unocal with only approx 0,3% of US oil consumption.. The implications for Good Corporate Governance of emerging Chinese and Indian multinational enterprises. 6) China – Japan. Stumble or not?. The question remains however do we all want to be Japanese?´ Why did the Japanese growth machine come to a halt. The trends turned against Japan. Economic policy wrong. Too dependent on export. Japanese enterprises balance sheet focused. Why the Chinese growth machine may slow down but not stop. 6) China – Japan. Stumble or not?. China is a total – global - economy in itself. A clear political objective. Extremely competent political leadership knowing the problems and trying to deal with them in time. Stick my neck out: How will China look in one or two decades? Economic model Political system 7) China – India. Rivals, competitors or what? Energy. Trying to pool efforts. A long list of measures to ensure energy supply. Central Asia. Russia. China looking at the rest of South Asia. China looking at South East Asia. What is India looking at? Central Asia a pivotal role. 8) CdI2E – the keys on the managers control panel. a) Communication. KISS. Customers: Set of values, what do we stand for. Staff: How do we do things here. Illustrations: Intel inside, Runs on Oracle, Due diligence. The indirect communication: SAS and environment. How to get across. Illustrations from military history. b) Command. Basically three models. Rule based, control based, value based. With the virtual enterprise only one is viable. Risk is the risk! The enterprise kept together by invisible strings/values and interacting with customers (new word sought please) on the basis of shared set of values. No control. No rules. Illustration. Every time something is done, not being output, ask the question why? 8) CdI2E – the keys … c) Control. The odd word. d) Culture. The enterprise needs a cultural profile reflecting what it stands for. -God, Royalty, Sex, Mystery. - Set of values generally applicable, possessing survivability - Adaptable to local circumstances without sacrificing main principles. - Sex, race, religion, other taboos. There must be some mystique around the enterprise. The court jester. Oxford University philosophy exams. 8) CdI2E – the keys …. e) f) g) Information. Need to know – forget it fellows. Info all over the board. Capable of acting here and now. Cultural profile tells what to do, info tells when to do it. Contingency plan. It always go wrong in the cover up phase! Intelligence. Know your competitors, know the markets, know your surroundings? Nope fellows know about yourself. Spy on your own enterprise. Set up a guerrilla unit. CoC. ( Mao Zedongs cultural revolution, Schumpeter's creative destruction). Illustrations. IBM in early 90´s. EAC in the 70´s. Company after company being outmanoeuvred by new technology. You name them. Entertainment. We need to have some fun here. Illustration Southwest Airlines in the US. 9) The three core’s a) Core business. What are we actually doing here. Directed at the staff. Production oriented. Inward looking. Improving our performance. Product concept. b) Core value added. Why the customer should buy our product instead of the competitors. Ever thought about that. Why our product, why not X or Y. Aiming at the costumer. c) Core message. What do we want the customer to associate us with. How do we want the staff to see the enterprise. Remember a crucial phrase from politics: It goes wrong if a gap arises between how we (political leaders) present the reality and how it is perceived by the public. Precisely the same applies for business. 10) The dirty linen Espionage and propaganda. OK OK OK You are all nice fellows we know that don’t we? Do you recall the phrase spoken by president John F. Kennedy’s father ´the nice fellows are the losers´. Business competition becomes more and more like war in the sense that the instruments and tactics of war find their way into the boardrooms. Prepare for it. The others do. J. Oerstroem Moeller, www.oerstroemmoeller.com