Walgreen Co.

advertisement

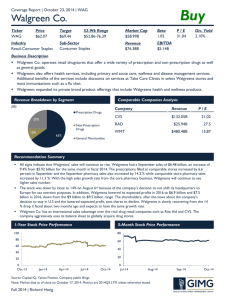

Walgreen Co. (WAG) Presented April 19, 2007 Investment Managers Jessica Boghosian jboghos2@uiuc.edu Shengdong Zhu szhu4@uiuc.edu Company Overview Incorporated in 1909, headquartered in Deerfield, Illinois. Nation’s largest drugstore based on sales Engaged in the retail sale of prescription and nonprescription drugs and general merchandise including: beauty care, personal care, household items, candy, photofinishing, greeting cards, seasonal items, and convenience foods. Recorded its 32nd year of consecutive earnings and sales growth. During the year, Walgreen Co. had a net increase of 476 stores, totaling to 5,461 stores located in 47 states and Puerto Rico. Company Overview Success is dependent upon continuously opening new Walgreens stores. Walgreen Co. plans to operate more than 7,000 stores by 2010. Walgreen Co. is in the business of strategically locating new stores as well as relocating/closing existing stores. New Walgreens Co. Stores Fiscal Year # of New Stores 2000 462 2001 474 2002 471 2003 430 2004 436 2005 435 2006 570 Over the past 7 years, Walgreen Co. has opened on average 1.28 stores/day. National Store Distribution Walgreen Co. has made it a point to open the most stores in the states that are the popular locations for aging baby boomers to retire. Image: Walgreen Co. Annual Report 2006 Product Class Attribution to Sales Fiscal Year 2006 Fiscal Year 2005 Fiscal year 2004 Prescription Drugs 64% 64% 63% NonPrescription Drugs 11% 11% 12% General Merchandise 25% 25% 25% Pharmacy Sales Pharmacy sales continue to become a larger portion of Walgreens’ business. Walgreens filled 529 million prescriptions in 2006, totaling to an increase of 8.1% from the 2005 fiscal year. Sales trends are expected to continue to grow for the following reasons: Aging population Introduction of lower priced generics Continued development of innovative drugs Medicare Part D Medicare Part D is a government initiated program to subsidize the costs of prescription drugs to individuals covered by Medicare. Part D was implemented in January of 2006. Walgreens has obtained a larger share of senior citizen patients due to this program. • 35% of the prescriptions filled under this program in the first eight months were new customers to Walgreens. New Developments Dial-a-Pharmacist Available in 14 languages, this system allows customers to discover where there is a Walgreens pharmacist that speaks his or her language. Solar Power Usage 100 stores utilize solar energy, making Walgreens the largest retail user of this source of energy. Highway Signs A new federal law allows signs to be placed on highways informing drivers of the location of 24 hour pharmacies. Several have already been planted with many more to come. Source: Walgreen Co. Annual Meeting, January 2006 Corporate Risk Walgreen Co. faces intense competition with local, regional, and national companies, many of which are infiltrating Walgreens’ existing markets. Extreme competition can have an adverse affect on prices. Third-party payors of prescription drugs are attempting to reduce costs and pharmacy reimbursement rates. On February 8th, 2006, President Bush signed the Deficit Reduction Act of 2005 • This Act will ultimately reduce Medicaid reimbursement rates to retail pharmacies. • Further reduction in these rates are foreseeable. RCMP Position Originally owned 1000 shares of WAG, purchases on October 6th, 1999 for $25.00/share. On September 20th, 2006, 500 shares were sold @ $49.94/share for a realized gain of $12,470. Currently own 500 shares of WAG, trading at $45.96 as of April 19, 2007 for an unrealized gain of $10,480 or 83.84%. Role in Portfolio WAG 7% AEE 6% SRZ 7% AEO 19% SRCL 5% MVSN 1% MS 9% CPRT 9% KMB 6% FR 7% JPM 14% FR 7% JKHY 3% Walgreen Co. currently comprises 7% of our portfolio. Correlation Matrix AEE AEE AEO CPRT FR JKHY JPM KMB MVSN MS SRCL SRZ WAG Portfolio AEO CPRT FR JKHY JPM KMB MVSN MS SRCL SRZ WAG Portfolio 1.00 -0.08 1.00 0.35 0.21 1.00 0.49 -0.02 0.36 1.00 0.17 0.40 0.38 0.21 1.00 0.32 0.47 0.45 0.15 0.55 1.00 0.30 0.08 0.47 0.14 0.31 0.22 1.00 0.21 0.44 0.33 0.20 0.57 0.51 0.06 1.00 0.17 0.50 0.39 0.11 0.46 0.68 0.15 0.57 1.00 -0.25 0.13 -0.08 -0.03 0.09 0.04 -0.07 -0.11 0.06 1.00 0.14 0.21 0.43 0.20 0.40 0.40 0.01 0.50 0.48 0.07 1.00 0.07 0.09 0.11 -0.18 0.02 0.16 0.26 -0.07 0.18 0.07 -0.17 1.00 0.33 0.63 0.66 0.34 0.74 0.78 0.35 0.76 0.76 0.11 0.62 0.15 1.00 5-Year Growth vs. S&P 500 Competitors Who CVS/Caremark Corp. (CVS) Rite Aid Corp. (RAD) Why Industry Specific Business Segment Specific (prescription and non-prescription drugs and general merchandise) Out-performing Its Competitors Prescription Volume WALGREEN CO. 263/day Chain Drugstores 180/day Mass Retailers 143/day Grocery 131/day Independents 100/day Source: Walgreen Co. Annual Meeting, January 2006 Out-performing Its Competitors Earnings per square foot WALGREEN CO. $46 Chain Drugstores <$23 Grocery $12 Source: Walgreen Co. Annual Meeting, January 2006 1-Year Comparables 5-Year Comparables Comparable Analysis Qtrly Rev Growth (yoy): Gross Margin (ttm): EBITDA (ttm): Oper Margins (ttm): EPS (ttm): P/E (ttm): WAG 14.60% 28.08% 3.77B 5.97% 1.938 23.72 CVS 24.00% 27.25% 3.24B 5.57% 1.6 21.61 P/S (ttm): ROA 0.9 11.82% 0.66 8.76% RAD Industry -4.40% 12.30% 26.94% 25.26% 615.95M 1.70B 1.97% 3.79% -0.009 1.6 3.44 26.95 0.2 3.53% 0.66 Assumptions Organic growth continues to be the primary growth vehicle Future growth was estimated assuming to be in line with increasing medical costs and increasing store numbers. We assume that future growth will continue at a 13% annual rate but will gradually decrease to 9% over the next five years and then remain at a 3% annual growth rate thereafter Discounted Cash Flow Analysis FY 2007 forecasted Net sales: Less: Operating costs Taxes paid Net investment ∆ ? Working capital = Free Cash Flow FY 2009 forecasted FY 2010 forecasted 53,164.21 64,610.11 70,276.59 (50,160.43) (61,088.86) (66,516.79) (1,158.91) (1,414.90) (1,561.02) (416.81) (199.87) (73.89) 881.04 1,052.47 1,338.22 1,428.06 1,906.49 2,124.88 Discounted Cash Flow Analysis Since Walgreen Co. is 100% equity financed, WACC=ke. Beta: Regression 0.1 vs. Bloomberg .66 Average = .4 rf = β= r m= ke= 4.77% 0.4 11.00% 7.26% Discounted Cash Flow Analysis Year 1 2 3 4 5 FY 2007 forecasted FY 2008 forecasted FY 2009 forecasted FY 2010 forecasted Terminal Value Free cash flow Terminal Value PV of FCFs Total Enterprise Value= 1,428.06 1,331.35 1,665.55 1,906.49 1,447.61 1,544.81 2,124.88 1,605.18 51330.50475 36,150.11 42,079.06 Total enterprise value over Shares outstanding =Price Per Share 42,079.06 1,025.40 + 10% 45.14 - 10% 36.93 41.04 A Note On Capital Structure Walgreen Co. is an all equity financed firm. The company owns a mere ~18% of it’s store base. The other ~82% is leased. These leases hold Walgreen Co. responsible for $26.078 billion, but this obligation is not seen on the balance sheet as a liability to the firm. This poses potentially risk to Walgreen Co. Lets call these lease obligations “quasi-debt.” THEREFORE, it is important to keep in mind this accounting structure when valuing WAG. Sensitivity Analysis WACC Growth Rate 5.50% 6.00% 6.50% 7.00% 7.50% 8.00% 8.50% 9.00% 9.50% 3.00% 71.36 59.13 50.40 43.86 38.79 34.73 31.42 28.67 26.34 3.50% 88.09 70.07 58.07 49.51 43.10 38.12 34.14 30.89 28.19 4.00% 115.97 86.48 68.81 57.04 48.64 42.35 37.46 33.56 30.38 4.50% 171.73 113.84 84.92 67.58 56.03 47.79 41.62 36.82 33.00 5.00% 339.00 168.55 111.76 83.39 66.37 55.04 46.96 40.90 36.20 Most likely to range from 34.73 to 57.04 Portfolio Fit Sharpe Ratio a measure of the mean excess return per unit of risk in an investment asset or a trading strategy Including WAG generates a higher Sharpe Ratio Risk-free Rate Sharpe Ratio (Include) Sharpe Ratio (Exclude) Month 0.2% 8.6% 8.1% Annual 2.3% 31.1% 29.2% RCMP Fall ’06 Decision 500 Shares of WAG were sold last semester at $49.94. Why? Lease Obligations • WACC was adjusted upward based on the risk of outstanding lease obligations After this adjustment, the company appeared to be trading at a “significantly inflated price that, in the long term, could not be sustained.” Recommendation HOLD. Why? • • • • Healthy management vision Stable, growing company Solid performer Leader in its class But what about these lease obligations and other business risks!? • Acknowledge that every company has risk, with Wagreen Co. as no exception. • We have already taken action as conservative investors by selling 500 shares.