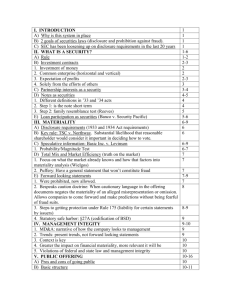

Securities Regulation

advertisement

Securities Regulation Materiality What matters to investors? (last updated 12 Jan 11) Securities Fraud Action • Parties – Plaintiff (purchasers or sellers) – Defendant (primary violator / including company) • Elements – – – – – – Material Misrepresentation or omission Scienter Reliance Causation Damages • Required nexus – Jurisdictional nexus (federal court) – Transactional nexus (“in connection with purchase or sale of securities”) Materiality “test” TSC Industries v. Northway (US 1976): A fact is material if "there is a substantial likelihood a reasonable investor would consider it important" in deciding how to vote [whether to buy or sell stock.] Put another way, there must be a substantial likelihood that the disclosure of the omitted fact would have been viewed by the reasonable investor as having significantly altered the "total mix" of information made available. Materiality contexts Forward-looking information Historical facts Opinions Total mix Forward-looking information Basic Inc. v. Levinson (US 1987): • What kind of lawsuit? • What did plaintiffs allege? • What were company’s arguments? – Overwhelm investors – Need secrecy – Knowability • What does 6th Circuit say? • What does Supreme Court hold? Forward-looking information Basic Inc. v. Levinson (US 1987): ... with respect to contingent or speculative information or events .... materiality "will depend at any given time upon a balancing of both the indicated probability that the event will occur and the anticipated magnitude of the event in light of the totality of the company activity" Justice Harry Blackmun Hypothetical #1 The CEOs of Six Feet and Dearly Departed (two publicly-traded mortuary companies) have discussed a merger. Price? Ratio? Survivor? Antitrust scrutiny? A reporter from Eulogy Magazine interviews David and asks, “Does Six Feet have any acquisitions in the pipeline?” David turns to you, his lawyer. What do you whisper to him? Basic Inc. v. Levinson (US 1987): ... a factfinder will need to look to indicia of interest in the transaction at the highest corporate levels. Without attempting to catalog all such possible factors, we not by way of example that board resolutions, instructions to investment bankers, and actual negotiations between principals or their intermediaries may serve as indicia of interest. fn 17. To be actionable, of course, a statement must also be misleading. Silence, absent a duty to disclose, is not misleading under Rule 10b-5. "No comment" statements are generally the functional equivalent of silence. Justice Harry Blackmun Hypothetical #2 The Six Feet and Dearly Departed merger plans continue apace, but still no final deal on price and structure. Six Feet is about to file its annual report with the SEC. CEO David turns to you again. Must Six Feet mention the possibility of a merger? Regulation S-K, Item 303 Full Fiscal Years. ... (a)(1) Identify any known trends or any known ... events ... that will result in or that are reasonably likely to result in the registrant's liquidity increasing or decreasing in any material way. *** Rule 12b-20 In addition to the information expressly required to be included in a statement or report, there shall be added such further material information, if any, as may be necessary to make the requirement statements, in the light of the circumstances under which they are made not misleading. Materiality contexts Forward-looking information Historical facts Opinions Total mix Ganino v. Citizens Utilities Co (2d Cir 2000) • Why are steadily increasing earnings so important? – Why did Citizens recognize 1995 fees in 1996? “store income”? – What happened when company comes clean? 4/97 – rumors, 8/97 10Q – Why should investors be concerned if fees from Hungarian company constituted only 1.7% of total revenues? • What did the court decide? SEC Staff Accounting Bulletin • “qualitative factors may cause misstatements of quantitatively small amounts to be material” • (1) whether misstatement makes a change in earnings or other trends (2) whether misstatement hides a failure to meet analysts’ consensus expectations for the enterprise. In re Merck & Co. Sec Litig (3d Cir 2005) • What was the Medco IPO? And why was it scuttled? • What was Medco’s “revenue recognition” policy? – Why recognize revenues that are later netted out in computing net profits? – Why is Merck’s stock price affected by sub’s “net zero” revenue recognition? • What is Merck’s argument that Medco’s revenue recognition was not material? • What does the court conclude about Merck’s “delayed, piecemeal” disclosure? 7/5 – 4th S-1 Filing 4/17 – 1st S-1 filing 6/21 – WSJ story 7/9 – end of class period An efficient market? Materiality contexts Forward-looking information Historical facts Opinions Total mix Va Bankshares v. Sandberg (US 1991) Proxy statement: The Plan of Merger has been approved by the Board of Directors because it provides an opportunity for the Bank’s public shareholders to achieve high value for their shares. The price to be paid is about 30% higher than the [last trade price before announcement of the proposal]. The $42 per share to be paid public holders represents a premium of approximately 26% over book value. Va Bankshares v. Sandberg (US 1991) Supreme Court (actionability of statements of opinion) … Shareholders know that directors usually have knowledge and expertness far exceeding the normal investor’s resources … … statements of belief are factual in two senses: directors hold the belief stated … statement about belief expressed. … disbelief, standing alone, is insufficient to satisfy element of fact Justice David Souter Materiality contexts Forward-looking information Historical facts Opinions Total mix Longman v. Food Lion, Inc (4th Cir 1999) 8/90 – UFCW labor union alleges widespread labor violations / FL denies employee mistreatment 11/91 – UFCW brings DOL complaint and issues press release / company says has clear policy against “off the clock” 11/92 – PrimeTimeLive trashes Food Lion’s labor practices and sanitation – Employees forced to work off the clock / big $$$ back pay liability – Meat pulled out of dumpster and bleached / Ees re-date packages – Stock falls 11% Longman v. Food Lion, Inc (4th Cir 1999) Fourth Circuit: … nature of the off-the-clock claims and the claims’ risk to earnings were in fact well known to the market before the PTL broadcast [no price drop after DOL settlement] … statements [about cleanliness] are a kind of puffery … most of broadcast was inadmissible hearsay … isolated instances of workplace errors Sec Reg Record? Would you invest in this man? Management Discussion & Analysis: “The partnership [to build an Atlantic City mega-casino] believes that funds generated from the operation of the Taj Mahal will be sufficient to cover all of its debt service ... Elsewhere in the prospectus: “… no history of earnings … its operations will be subject to all of the risk inherent in the establishment of a new business enterprise” “… [timing of payments] could adversely affect its ability to pay interest" “… no assurance can be given that Taj Mahal will generate cash flow sufficient to pay debt service" The “Donald” Materiality in context Context (1) Historical facts (2) Speculative (3) Opinion (4) Contextual Test TSC v. Northway (“reasonable investor”) Basic v. Levinson (“prob + magnitude” Va Bankshares (“reasons + subject”) “Truth on market” / “bespeaks caution” Materiality in context Context (1) Historical facts (2) Speculative (3) Opinion (4) Contextual Test TSC v. Northway (“reasonable investor”) Basic v. Levinson (“prob + magnitude”) Va Bankshares (“reasons + subject”) “Truth on market” / “bespeaks caution” Materiality in context Context (1) Historical facts (2) Speculative (3) Opinion (4) Contextual Test TSC v. Northway (“reasonable investor”) Basic v. Levinson (“prob + magnitude” Va Bankshares (“reasons + subject”) “Truth on market” / “bespeaks caution” Materiality in context Context (1) Historical facts (2) Speculative (3) Opinion (4) Contextual Test TSC v. Northway (“reasonable investor”) Basic v. Levinson (“prob + magnitude” Va Bankshares (“reasons + subject”) “Truth on market” / “bespeaks caution” Materiality contexts Forward-looking information Historical facts Opinions Total mix Management integrity Philosophy “Sunlight is said to be the best of disinfectants; electric light the most efficient policeman.” Louis Brandeis Other People’s Money (1913) Corporate federalism “Thus social standards newly defined [by the Securities Act of 1933] gradually establish themselves as new business habits.” Felix Frankfurter ”creator of ’33 Act” In Matter Franchard Corp (SEC 1964) Investors Glickman Class A shares Franchard Corp. Venada Corp. Class B shares Glickman -• withdraws $2.4 MM from company • pledges stock on $4.2 MM loans (24% interest) • departs after being caught in more lies In Matter Franchard Corp (SEC 1964) Disclosure of self-dealing • “Of cardinal importance in any business is the quality of management” – Withdrawals = 1.5% book value – Diversion to Venada = Glicksman dominated – Pledges of stock = personal loans – Default terms on loans = change of control possible • Is all self-dealing “material”? Beyond SEC line items? Rule 12b-20 [See also Rule 408] In addition to the information expressly required to be included in a statement or report, there shall be added such further material information, if any, as may be necessary to make the requirement statements, in the light of the circumstances under which they are made not misleading. Corporate federalism “To generally require information … as to whether directors have performed their duties in accordance with the standards of responsibility required of them under State law would stretch disclosure beyond the limitations contemplated by the statutory scheme … William Cary Chair, SEC (1961-1964) Criminal behavior … SEC v. Fehn (9th Cir 1996) Would you have invested – – “blind pool” public offering? – Earlier securities law violations? – Not disclose CEO Wheeler? – Manipulate price in aftermarket? Should lawyer be responsible? – What is “aiding and abetting”? – What if CEO identity not required by line-item form? – Must incriminate / disclose possible illegality? Hypothetical Intersection of securities law and other regulatory regimes Self incrimination Drug kingpin Pablo Escobar hires your client Key Airways, Inc to bring “cargos” into the United States. The contract It represents 1.5% of total revenues. Must Key Airways, a public company, disclose this contract in its upcoming quarterly report? Including possible criminality? Self incrimination “The mere possibility of incrimination is insufficient to defeat the strong policies in favor of disclosure.” California v. Byers (US 1971) *** “… the distinction between “mere” bribes to foreign officials] and bribes coupled with kickbacks to the directors … is fundamental to a meaningful concept of materiality …. And the preservation of state corporate law.” Gaines v. Houghton (9th Cir. 1981) The end Oran v. Stafford (3d Cir 2000) Oran v. Stafford (3d Cir 2000) Timeline: • 2/94 – Belgian cardiologist notices link to heart valve leaks • 11/95 – AHP knows of 31 European cases / FDA panel approves drug • 3/97 – AHP learns from Mayo Clinic of heart-valve abnormalities in 17 fen-phen users • 7/97 – Mayo data disclosed to public / AHP says “investigating” • 9/97 – FDA says survey shows 1/3 fen-phen users have heart troubles • Investors who bought while AHP knew more than public sue. What theory? – 3/97 annual report (new drugs big hit, no mention of European, Mayo data) – 4/97 press release (responds to news reports that drugs “safe & effective” – 7/97 press release (discusses Mayo data, but no mention knew 3 mos ago) – AHP withdraws drug / stock price falls 5% – WSJ reports possible lawsuits / price drops another 6% • Should have disclosed: – Mayo and European data – Misled FDA – Knew data earlier than said Oran v. Stafford (3d Cir 2000) Third Circuit (Materiality of omissions): – AHP stock price went up after 7/97 press release on Mayo data – European data was not statistically significant / “inconclusive” – AHP description of FDA approval process was factually correct – Mayo and European data was “purely speculative” until FDA notified AHP of link Oran v. Stafford (3d Cir 2000) Third Circuit (Failure to satisfy SEC rules): – Even if obligated to disclose in periodic reports (item 303, Reg SK), no private cause of action – SEC standard of materiality “signficantly beyond” price +magnitude test of Basic – Violation of SEC line-item rules not necessarily violation of 10b-5