Chapter 2 Homework due

advertisement

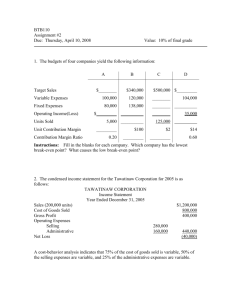

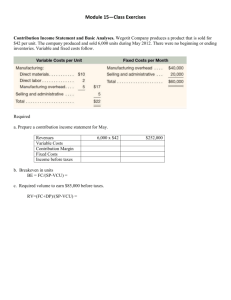

Chapter Three Cost – Volume – Profit Analysis • Jeff Jamail is evaluating a business opportunity to sell cookware at trade shows. Mr. Jamail can buy the cookware at a wholesale cost of $210 per set. He plans to sell the cookware for $350 per set. He estimates fixed costs such as plane fare, booth rental cost, and lodging to be $5,600 per trade show. • How many cookware sets must Mr. Jamail sell in order to breakeven? Cost-Volume-Profit Relationship There are 3 methods to analyze: (1.) Contribution Margin per Unit (2.) Contribution Ratio (3.) Equation Method NOTE: Each method yields the same results. Cost-Plus Pricing Strategy • It sets prices at cost plus a mark-up • For example: – Product cost $20 to make – Mgmt decides to mark-up 30% – Selling Price = $20 + ($20 * 30%) = $26 Break-Even Point Point where Total Revenue = Total Costs Break-even Volume in Units = Fixed Costs / Contribution Margin per Unit Once fixed costs have been covered, net income will increase per unit contribution margin for each additional unit sold Determining the Break-even Point Bright Day produces one produce called Delatine. The company uses a cost-plus-pricing strategy; it sets prices at cost plus a markup of 50% of cost. Delatine cost $24 per bottle to manufacture, so a bottle sells for $36 ($24 + [50% × $24]). The contribution margin per bottle is: Sales revenue per bottle Variable cost per bottle Contribution margin per bottle $ 36 24 $ 12 The company’s first concern is if can sell enough bottles of Delatine to cover it fixed costs and make a profit! Determining the Break-even Point The break-even point is the point where total revenue equals total costs (both variable and fixed). For Bright Day, the cost of advertising is estimated to be $60,000. Advertising costs are the fixed costs of the company. We use the following formula to determine the break-even point in units. Break-even Fixed costs = volume in units Contribution margin per unit = $60,000 = 5,000 units $12 Determining the Break-even Point For Delatine, the break-even point in sales dollars is $180,000 (5,000 bottles × $36 selling price). Determining the Break-even Point Once all fixed costs have been covered (5,000 bottles sold), net income will increase by $12 per unit contribution margin. Revenue @ $36 Variable Expenses @ $24 Contribution Margin @$12 Fixed Expenses Net Income 4,998 $ 179,928 (119,952) 59,976 (60,000) $ (24) Number of Units Sold 4,999 5,000 5,001 $ 179,964 $ 180,000 $ 180,036 (119,976) (120,000) (120,024) 59,988 60,000 60,012 (60,000) (60,000) (60,000) $ (12) $ $ 12 5,002 $ 180,072 (120,048) 60,024 (60,000) $ 24 $12 What will be the increase in net income if units sold increase from 5,000 units to $5,600 units? Determining the Break-even Point What will be the increase in net income if units sold increase from 5,000 units to $5,600 units? New Units Sold Previous Units Sold Increase in Units Sold Contribution Margin Per Unit Increase in Income Revenue @ $36 Variable Expenses @ $24 Contribution Margin @$12 Fixed Expenses Net Income 5,600 5,000 600 $ 12 $ 7,200 Number of Units Sold 5,000 5,600 $ 180,000 $ 201,600 (120,000) (134,400) 60,000 67,200 (60,000) (60,000) $ $ 7,200 Reaching a Target Profit Level Bright Day’s president wants the advertising campaign to produce profits of $40,000 to the company. Break-even Fixed costs + Desired profit = volume in units Contribution margin per unit = $60,000 + $40,000 $12 = 8,333.33 units Reaching a Target Profit Level At $36 per unit selling price, the sales dollars are equal to $300,000, as shown below: Units sold Revenue @ $36 Variable Expenses @ $24 Contribution Margin @$12 Fixed Expenses Net Income Income 8,333.33 $ 300,000 (200,000) 100,000 (60,000) $ 40,000 Check Yourself Matrix, Inc. manufactures one model of lawnmower the sells for $175 each. Variable expenses to produce the lawnmower are $100 per unit. Total fixed costs are $225,000 per month, and management wants to earn a profit in the coming month of $37,500. Matrix must sell the following number of lawnmowers: 1. 3,000. 2. 3,500. 3. 4,000. 4. 4,500. $225,000 + $37,500 = 3,500 $75 Effects of Changes in Sales Price The Marketing Department at Bright Day suggests that a price drop from $36 per bottle to $28 per bottle will make Delatine a more attractive product to sell. The president wants to know what such a price drop would have on the company’s stated goal of producing a $40,000 profit. You have been asked to determine the number of bottles that must be sold to earn the $40,000 profit at the new $28 selling price per bottle. See if you can provide an answer to the president before going to the next screen! Effects of Changes in Sales Price Step 1 New Selling Price Per Bottle $ 28 Variable Expenses Per Bottle 24 New Contribution Margin $ 4 Step 2 Break-even Fixed costs + Desired profit = volume in units Contribution margin per unit Step3 $60,000 + $40,000 = = 25,000 units $4 Effects of Changes in Sales Price The required sales volume in dollars is $700,000 (25,000 units × $28 per bottle) as shown below: Units sold Revenue @ $28 Variable Expenses @ $24 Contribution Margin @$4 Fixed Expenses Net Income Income 25,000 $ 700,000 (600,000) 100,000 (60,000) $ 40,000 Target Costing 1. Determine the market price at which product will sell • This is the Target Price 2. Must develop the product at a cost that will enable company to be profitable selling the product at the target price • This is known as TARGET COSTING Changes in Variable Costs Bright Day is considering an alternative mixture for Delatine along with new packaging. This new product would sell for $28 per bottle and have a variable cost per bottle of $12. The president is not in favor of the new product but wants to know how many units must be sold to produce the desired profit of $40,000. You have been asked to determine the units that must be sold and the total sales revenue that will be produced! Changes in Variable Costs Step 1 New Selling Price Per Bottle $ 28 Variable Expenses Per Bottle 12 New Contribution Margin $ 16 Step 2 Break-even Fixed costs + Desired profit = volume in units Contribution margin per unit Step3 $60,000 + $40,000 = $16 = 6,250 units Changes in Variable Costs At $28 per unit selling price, the sales dollars are equal to $175,000 as shown below: Units sold Revenue @ $28 Variable Expenses @ $12 Contribution Margin @$16 Fixed Expenses Net Income Income 6,250 $ 175,000 (75,000) 100,000 (60,000) $ 40,000 Changes in Fixed Costs Bright Day’s president has asked you to determine the required sales volume if advertising costs were reduced to $30,000, from the planned level of $60,000. Break-even $30,000 + $40,000 = volume (units) $16 Units sold Revenue @ $28 Variable Expenses @ $12 Contribution Margin @$16 Fixed Expenses Net Income = 4,375 units Income 4,375 $ 122,500 (52,500) 70,000 (30,000) $ 40,000 Calculating the Margin of Safety The margin of safety measures the cushion between budgeted sales and the break-even point. It quantifies the amount by which actual sales can fall short of expectations before the company will begin to incur losses. With a selling price of $28 per unit and variable costs of $12 per unit, and a desired profit of $40,000, budgeted sales were: Break-even $30,000 + $40,000 = volume (units) $16 = 4,375 units Break-even unit sales assuming no profit would be: Break-even = volume (units) $30,000 = 1,875 units $16 Calculating the Margin of Safety Budgeted sales Break-even sales Margin of safety In Units 4,375 (1,875) 2,500 In Dollars $ 122,500 (52,500) $ 70,000 Management considers a new product, Delatine that has a sales price of $36 and variable costs of $24 per bottle. Fixed costs are $60,000. Breakeven is 5,000 units. Management want to earn a $40,000 profit on Delatine. The sales volume to achieve this profit level is 8,334 bottles sold. Marketing advocates a target price of $28 per bottle. The sales volume required to earn a $40,000 profit increases to 25,000 bottles. Target costing is employed to reengineer the product and reduces variable cost per unit to $12. To earn the desired profit of $40,000, sales volume decreases to 6,250 units. Target costing is applied and fixed costs are reduced to $30,000. The sales volume to earn the desired $40,000 profit is 4,375 units. Decrease in Sales Price with an Increase in Sales Volume The marketing manager believes reducing the sales price per bottle to $25 will increase sales volume by 625 units. Previous sales volume was: Break-even $30,000 + $40,000 = volume (units) $16 = 4,375 units Anticipated changes: In Dollars New selling price Variable costs per unit Contribution margin $ 25 (12) $ 13 Previous units sold Additional units sold Expected sales volume In 4,375 625 5,000 Decrease in Sales Price with an Increase in Sales Volume Current Situation Units sold Revenue @ $28 Variable Expenses @ $12 Contribution Margin @$16 Fixed Expenses Net Income Income 4,375 $ 122,500 (52,500) 70,000 (30,000) $ 40,000 Because budgeted income will fall by $5,000, the proposal should be rejected! Proposed Situation Units sold Revenue @ $25 Variable Expenses @ $12 Contribution Margin @$13 Fixed Expenses Net Income Income 5,000 $ 125,000 (60,000) 65,000 (30,000) $ 35,000 Increased in Fixed Costs and Increase in Sales Volume After the previous project was rejects, the advertising manager believes that buying an additional $12,000 in advertising can increase sales volume to 6,000 units. The contribution margin will remain at $16. Should the company buy the additional advertising? Profit = Contribution margin – Fixed cost Profit = (6,000 × $16) – $42,000 = $54,000 Proposed Situation Current Situation Units sold Revenue @ $28 Variable Expenses @ $12 Contribution Margin @$16 Fixed Expenses Net Income Income 4,375 $ 122,500 (52,500) 70,000 (30,000) $ 40,000 Units sold Revenue @ $28 Variable Expenses @ $12 Contribution Margin @$16 Fixed Expenses Net Income Income 6,000 $ 168,000 (72,000) 96,000 (42,000) $ 54,000 Change in Several Variables Management has been able to reduce variable costs to $8 per bottle and decides to reduce the selling price per bottle to $25 (so the contribution margin is now $17). Further, management believes that if advertising is cut to $22,000, the company can still expect sales volume to be 4,200 units. Should management adopt this plan? Change in Several Variables Profit = Contribution margin – Fixed cost Profit = (4,200 × $17) – $22,000 = $49,400 Proposed Situation Current Situation Units sold Revenue @ $28 Variable Expenses @ $12 Contribution Margin @$16 Fixed Expenses Net Income Income 4,375 $ 122,500 (52,500) 70,000 (30,000) $ 40,000 Units sold Revenue @ $25 Variable Expenses @ $8 Contribution Margin @$17 Fixed Expenses Net Income Income 4,200 $ 105,000 (33,600) 71,400 (22,000) $ 49,400 Contribution Margin Ratio The contribution margin ratio is the contribution margin divided by sales, computed using either total figures or per unit figures. Here is the total dollar, per unit and contribution margin (CM) ratio for Bright Day when sales volume is 5,000 bottles. Revenue Variable Expenses Contribution Margin Fixed Expenses Net Income Total $ 180,000 (120,000) 60,000 (60,000) $ - Per Unit $ 36 24 $ 12 CM Ratio 100.00% 66.67% 33.33% Contribution Margin Ratio Approach = Contribution Margin / Sales 1st – Identify Contribution Margin $60,000 2nd – Identify Sales $180,000 = $60,000 / $180,000 = 0.33 What does this Ratio mean? • Ratio means that every dollar of sales provides $0.33 to cover Fixed Costs • After Fixed Costs are covered – Each $1 provides $0.33 of profit Contribution Margin Ratio Bright Day is considering the introduction of a new product called Multi Minerals. Here is some per unit information about Multi Minerals: Sales revenue per unit Variable cost per unit Contribution margin per unit $ 20 12 $ 8 100% 60% 40% Bright Day expects to incur $24,000 in fixed marketing costs in connection with Multi Minerals. Let’s look at the calculation of the break-even point in units and dollars. Contribution Margin Ratio Break-even in Units Break-even in Dollars Fixed costs CM per unit Fixed costs CM ratio $24,000 = 3,000 units $8 $24,000 = $60,000 40% Contribution Margin Ratio Break-even in Units Break-even in Dollars Fixed costs + Desired profit CM per unit Fixed costs + Desired profit CM ratio Bright Day desires to earn a profit of $8,000 on the sale of Multi Minerals $24,000 + $8,000 = 4,000 units $8 $24,000 + $8,000 = $80,000 40% The Equation Method At the break-even point: Sales = Variable cost + Fixed cost We can look at the above equation like this: Selling price per unit × Number of units sold = Variable cost per unit × Unmber of units sold + Fixed cost The Equation Method Let’s use our information from Multi Minerals to solve the equation for the number of units sold. $ 20 × $ 8 × Units Units Units = = = $ 12 × Units $ 24,000 3,000 + $ 24,000 If we want to consider the desired profit of $8,000 the solution would be: $ 20 × $ 8 × Units Units Units = = = $ 12 × Units $ 32,000 4,000 + $ 32,000 Check Yourself Matrix, Inc. manufactures one model of lawnmower the sells for $175 each. Variable expenses to produce the lawnmower are $100 per unit. Total fixed costs are $225,000 per month, and management wants to earn a profit in the coming month of $37,500. Use the equation method to determine how many lawnmowers Matrix must sell next month: 1. 3,000. 2. 3,500. 3. 4,000. 4. 4,500. $ 175 × Units = $ 75 × Units = Units = $ 100 × Units + $ 262,500 $ 262,500 3,500 Weighted-Average Contribution Margin per Unit In the real world, a company is selling more than one product Unit Selling Price Unit Variable Cost Unit Fixed Cost Total Units Sold Product A $ 100 40 20 10,000 Product B $ 200 60 30 20,000 • Step 1: Find the CM for each – Product A = 100 – 40 = 60/unit – Product B = 200 – 60 = 140/unit • Step 2: Find the total # of units sold – 10,000 + 20,000 = 30,000 • Step 3: Find the % sold of each product – Product A = 10,000 / 30,000 = 33% – Product B = 20,000 / 30,000 = 67% • Step 4: Find the Weighted CM – Product A = $ 60 * 33% = $19.80 / unit – Product B = $ 140 * 67% = $93.80 / unit – Total CM = $19.80 + $93.80 = $113.60 / unit