Relational Data Base Fundamentals

advertisement

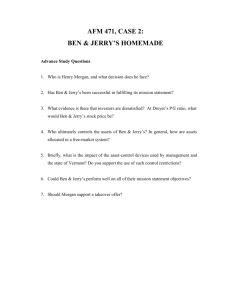

Chapter 7: Public Goods Outline Optimal provision of public goods. Under-provision generally characterizes markets with public goods, absent government intervention. Private sector provision. Crowd out Problems OPTIMAL PROVISION OF PUBLIC GOODS Pure public goods have two traits: They are non-rival in consumption: The marginal cost of another person consuming the good is zero, and does not affect your opportunity to consume the good. They are non-excludable: There is no way to deny someone the opportunity to consume the good. Table 1 gives some examples. If a Ice good Icecream cream is both isisrival, rival also and because excludable, excludable, This my Cable Some It is table excludable, TV goods shows is non-rival, are examples since “impure” because theof public cable pure my consumption because aofprivate simply it precludes good. not share you public company goods from myconsumption goods, because canimpure simply they of itpublic refuse are in no non-rival, way goods, to hook Table 1 it Iiscan Yet For Other itexample, is non-excludable goods asame are crowded “impure” because sidewalk public Finally, It The itis National is isalso pure non-excludable, defense public goods is a classic because are both consuming icethe cream with iceyou. cream. diminishes but they and upare private the your (to system. some consumption. goods. extent) goods rival clearly because because very difficult they your are enjoyment torival, prohibit but once not an area It is and isnon-rival protected, non-excludable. because everyone my Defining and public goods only way for you topure consume itexample. isisnon-rival toimpure excludable. pedestrians reduced asfrom excludable. moreusing pedestrians the sidewalk. also consumption “consumes”ofthat national protection. defense make ice cream. use the same sidewalk. protection doesgood not diminish yourin Is the rival consumption of it. consumption? Yes Is the No good excludable ? Yes No Ice cream Cable tv Crowded city sidewalk National defense Optimal Provision of Private Goods Consider a private good, like ice cream. Figure 1 shows the market for ice cream cones, assuming that the alternative use of the money is buying cookies at $1 each. This makes cookies the numeraire good. Adding up Ben’s and Jerry’s At a price Ben ofhas $3, an neither individual, person Adding up Ben’s and Jerry’s S=SMC individual demands at each demands downward-sloping ice cream. demand individual demands give Jerry alsomuch has an individual, price givesforsociety’s demand. curve ice cream. society’s demand at $3. downward-sloping demand curve for ice cream. At a price of Adding $2, Leading bothup people to Ben’s a competitive and Jerry’s demand more equilibrium individual ice cream. atdemands $2. Ben give & Jerry consume society’s different demand quantities. at $2. There is a market supply curve Price of ice cream $3 associated with producing ice cream. $2 DJERRY 0 Figure 1 QJERRY QBEN QTOTAL Demand for a private good DBEN SMB =DBEN+JERRY Quantity of ice cream Optimal Provision of Private Goods In this figure, as price adjusted, each person changed his quantity consumed. For a private good, consumers demand different quantities at the same market price. We can also represent this relationship mathematically. Ben has preferences over cookies (C) and ice cream (IC): U B C, IC As does Jerry: U J C, IC Optimal Provision of Private Goods Utility maximization requires that each of their indifference curves is tangent to the budget constraint. Moreover, suppliers set P=MC. For Ben, we have: B MU IC MU CB B MRS IC ,C PIC MCIC PC MCC For Jerry we have: J MU IC MU CJ J MRS IC ,C PIC MCIC PC MCC Optimal Provision of Private Goods The private market equilibrium in this case is socially efficient. The MRS for any quantity of ice cream equals the SMB of that quantity–the marginal value to society equals the marginal value to any individual in the perfectly competitive market. Optimal Provision of Public Goods Now consider the tradeoff between a public good, like missiles, and a private good like cookies. Figure 2 shows the market for missiles, assuming that the alternative use of the money is buying cookies at $1 each. Price of missiles $6 $4 $3 Adding Adding up Ben’s up Ben’s andand Jerry’s Jerry’s willingness willingnesstoto pay paygives for each society’s quantitydemand gives society’s for 1 missile. demand. As does Jerry. There is a market supply curve Leading to a competitive associated with and producing Adding up Ben’s Jerry’s equilibrium at 5 missiles. Ben & tomissiles willingness pay gives society’s Ben hasJerry a downward consumesloping the same Q. demand While Ben’s Jerry’s willingness willingness to pay for to pay the for the 5th missile. S=SMC demand curve for missiles. DJERRY for the firstfirst missile missile is $2. is $4. While Ben’s Jerry’s willingness willingness to pay for to pay the for the fifthfifth missile missile is $1. is $2. SMB=DBEN+JERRY $2 $2 DBEN $1 0 Figure 2 1 5 Demand for a public good Quantity of missiles Optimal Provision of Public Goods Unlike the case of private goods, where aggregate demand is found by summing the individual demands horizontally, with public goods, aggregate demand is found by summing vertically. That is, holding quantity fixed, what is each person’s willingness to pay? Optimal Provision of Public Goods We can also represent this relationship mathematically. Ben has preferences over cookies (C) and missiles (M): U B C, M To Ben, the marginal missile is worth MU MB B MRS M ,C MU CB Jerry’s preferences are U J C, M To Jerry, the marginal missile is worth MU MJ J MRS M ,C MU CJ Optimal Provision of Public Goods The social marginal benefit (SMB) of the next missile is the sum of Ben and Jerry’s i MRS marginal rates of substitution: M ,C i where “i” represents each person in society. Efficiency requires i i MRSM ,C MCM MCC Optimal Provision of Public Goods That is, social efficiency is maximized when the marginal costs are set equal to the sum of the marginal rates of substitution (rather than each individual’s MRS). This is because the good is non-rival. Since a unit can be consumed by all consumers, society would like the producer to take into account all consumers’ preferences. PRIVATE PROVISION OF PUBLIC GOODS: Private-sector Underprovision In general, the private sector underprovides public goods because of the free rider problem. Consider two people, Ben and Jerry, and two consumption goods, ice cream and fireworks. Set the prices of each good at $1, but fireworks are a public good. Assume that Ben and Jerry have identical preferences. Private-sector Underprovision Ben and Jerry benefit equally from a firework that is provided by either of them. What matters is the total amount of fireworks. Each person chooses combinations of ice cream and fireworks in which his own MRS equals the ratio of price. For both Ben and Jerry, they set: MRS F , IC 1, MU IC MU F Whereas optimal provision requires: MRS Fi , IC 1 i Private-sector Underprovision With identical preferences, the optimal condition is: MU F 2 MU IC MU IC 1, which implies MU F 2 Recall that marginal utilities diminish with increasing consumption of a good. In this example, optimal provision would require that fireworks are consumed until their utility equals half the marginal utility of ice cream. Thus, each individually buys too much ice cream privately. The Free Rider Problem in Practice There are some interesting examples of the freerider problem in practice. Only 7.5% of public radio listeners in New York contribute to the stations–that is, there is a lot of freeriding. In the United Kingdom, the BBC charges an annual licensing fee for all television owners. Many users of file sharing services never contribute uploaded files; they only download files. Some of these services, like Kazaa, give download priority to those who contribute. When Is Private Provision Likely to Overcome the Free Rider Problem? Under what circumstances are private market forces likely to solve the free rider problem? Intense preferences. Altruism. Utility from one’s own contribution to the public good. Some individuals care more than others When some individuals have especially high demand for a public good, private provision may emerge (but not necessarily provide efficiently – in particular, the public good is still likely to be underprovided). The key intuition is that the decision to provide a public good is a function of the enjoyment that the individual gets from the total amount of the public good, net of cost. If a person gets a lot of enjoyment, or has a lot of money, he will choose to purchase more of the public good even though it benefits others. Altruism and Warm Glow A second reason is that there is evidence that many individuals are altruistic, caring about the outcomes of others as well as themselves. A third reason is that that individuals may provide for a public good is due to warm glow. The warm glow model is a model of public good provision in which individuals care about both the total amount of the public good and their particular contributions as well. For example, they may get some psychological benefit from knowing they helped a worthy cause. In this case, the public good becomes more like a private good, though it also does not fully solve the underprovision problems. PUBLIC PROVISION OF PUBLIC GOODS In principle, the government could solve the optimal public goods provision problem and then either provide the good directly or mandate individuals to provide the amount. In practice, three problems emerge: Crowd-out. Measuring costs and benefits. Determining the public’s preferences. Private Responses to Public Provision: The Problem of Crowd-Out In some cases, the private market may already be providing a socially inefficient level of the private good. In this case, public provision may crowd-out some of the private provision–as the government provides more of the public good, the private sector provides less. Private Responses to Public Provision: The Problem of Crowd-Out For example, in the fireworks example with Ben and Jerry, if one assumes: Ben and Jerry care only about the total number of fireworks provided. Government provision will be financed by charging equal amounts to each of them. And the government provides no more fireworks than were being provided privately beforehand. Then each dollar of public provision will crowd out private provision one-for-one. Private Responses to Public Provision: The Problem of Crowd-Out The full crowd-out in the fireworks example is rare, though partial crowd-out is much more common and can occur when: People who don’t contribute to the public good are taxed to finance its provision. Or when individuals derive utility from their individual contributions as well as the total amount of the public good provided. Private Responses to Public Provision: The Problem of Crowd-Out If noncontributors are forced to help pay for the good (but it is still below the social optimum), then the contributors’ effective income levels are higher than before. As a result of this income effect, contributors buy more if the public good is a normal good, offsetting the crowd-out to some extent. Private Responses to Public Provision: The Problem of Crowd-Out Alternatively, as discussed previously, there may not be full crowd-out if an individual cares about his own contributions (the warm glow model). In this case, an increase in government contributions will not fully crowd out giving. Public Provision of Public Goods: Measuring the costs and benefits of public goods Another problem for government provision is measuring costs and benefits of the public good. This entails the field of cost-benefit analysis, discussed in the next lesson. For example, improving a highway involves valuations of commuting time saved as well reduced traffic fatalities. How Can We Measure Preferences for the Public Good? Finally, our model of optimal public good provision assumes the government knows each person’s preferences over public and private goods. In practice, this runs into problems with preference revelation, preference knowledge, and preference aggregation. These issues are addressed in the field of political economy.