Depreciation and Taxes

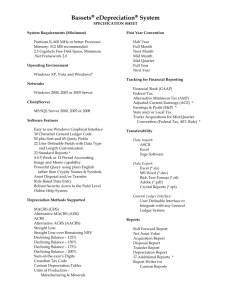

advertisement

ENGM 661 Engineering Economics Depreciation & Taxes Taxable Income + Gross Income - Depreciation Allowance - Interest on Borrowed Money - Other Tax Exemptions = Taxable Income Corporate Tax Rate Taxable Income Tax Rate Income Tax 0 < TI < 50,000 50,000 < TI < 75,000 75,000 < TI < 100,000 100,000 < TI < 335,000 335,000 < TI < 10,000,000 10,000,000 < TI < 15,000,000 15,000,000 < TI < 18,333,333 TI > 18,333,333 0.15 0.25 0.34 0.39 0.34 0.35 0.38 0.35 .15(TI) 7,500 + .25(TI - 50,000) 13,750 + .34(TI - 75,000) 22.250 + .39(TI - 100,000) 113,900 + .35(TI - 335,000) 3,400,000 + .35(TI - 10,000,000) 5,150,000 + .38(TI - 15,000,000) .35(TI) Corporate Tax Ex: Suppose K-Corp earns $5,000,000 in revenue above manufacturing and operations cost. Suppose further that depreciation costs total $800,000 and interest paid on short and long term debt totals $1,500,000. Compute the tax paid. Corporate Tax Gross Income Depreciation Interest Taxable Income $ 5,000,000 - 800,000 - 1,500,000 $ 2,700,000 Corporate Tax Gross Income Depreciation Interest Taxable Income $ 5,000,000 - 800,000 - 1,500,000 $ 2,700,000 Tax = $ 113,900 + .35(2,700,000 - 335,000) = $ 941,650 After Tax Cash Flow + Gross Income - Interest = Before Tax Cash Flow After Tax Cash Flow + Gross Income - Interest = Before Tax Cash Flow - Tax = After Tax Cash Flow After Tax Cash Flow Ex: Suppose K-Corp earns $5,000,000 in revenue above manufacturing and operations cost. Suppose further that depreciation costs total $800,000 and interest paid on short and long term debt totals $1,500,000. Compute the after tax cash flow. After Tax Cash Flow Gross Income $ 5,000,000 Depreciation 800,000 Interest - 1,500,000 Before Tax Cash Flow $ 2,700,000 After Tax Cash Flow Gross Income Interest Before Tax Cash Flow Less Tax After Tax Cash Flow $ 5,000,000 - 1,500,000 $3,500,000 941,650 $ 2,558,350 Methods of Depreciation Straight Line (SL) Sum-of-Years Digits (SYD) Declining Balance (DB) Prior to 1981 Accelerated Cost Recovery System (ACRS) 1981-86 Modified Accelerated Cost Recovery (MACRS) 1986 on Straight Line (SLD) Let P = Initial Cost n = Useful Life s = Salvage Value year n Dt = Depreciation Allowance in year t Bt = Unrecovered Investment (Book Value) in year t Then Dt = (P - S) / n Bt = P - [ (P - S) / n ] t Ex: Straight Line Depr. Let P = $100,000 n = 5 years s = $ 20,000 Then Dt = (P - S) / n = $ 16,000 B5 = P - [ (P - S) / n ] 5 = $ 20,000 Declining Balance In declining balance, we write off a constant % , p, of remaining book value D1 = pP , P = initial cost B1 = P - D1 = P - pP = P(1-p) D2 = pB1 = pP(1-p) Declining Balance In declining balance, we write off a constant % , p, of remaining book value B2 = B1 - D2 = P(1-p) - pB1 Declining Balance In declining balance, we write off a constant % , p, of remaining book value B2 = B1 - D2 = P(1-p) - pB1 = P(1-p) - pP(1-p) Declining Balance In declining balance, we write off a constant % , p, of remaining book value B2 = B1 - D2 = P(1-p) - pB1 = P(1-p) - pP(1-p) = P(1-p)[1 - p] Declining Balance In declining balance, we write off a constant % , p, of remaining book value B2 = B1 - D2 = P(1-p) - pB1 = P(1-p) - pP(1-p) = P(1-p)[1 - p] = P(1-p)2 Declining Balance In declining balance, we write off a constant % , p, of remaining book value B2 = B1 - D2 = P(1-p) - pB1 = P(1-p) - pP(1-p) = P(1-p)2 Dt = p [ P (1 - p) t - 1] Bt = P (1 - p) t Ex: Declining Balance P = $100,000 n = 5 years S = $20,000 p = 2/5 (200% declining balance) Then D1 = (2/5)(100,000) = $40,000 D5 = ? , B5 = ? Ex: Declining Balance P = $100,000 n = 5 years S = $20,000 p = 2/5 (200% declining balance) Then D1 = (2/5)(100,000) = $40,000 B1 = 100,000 - 40,000 = $ 60,000 D5 = ? , B5 = ? Ex: Declining Balance P = $100,000 n = 5 years S = $20,000 p = 2/5 (200% declining balance) Then D1 = (2/5)(100,000) = $ 40,000 B1 = 100,000 - 40,000 = $ 60,000 D2 = (2/5)(60,000) = $ 24,000 D5 = ? , B5 = ? Ex: Declining Balance (cont) = p [ P (1 - p) t - 1] D5 = .4(100,000)(.6) 4 = $ 5,184 Dt Bt = P (1 - p) t B5 = 100,000(.6) 5 = $ 7,776 Ex: Declining Balance (cont) = p [ P (1 - p) t - 1] D5 = .4(100,000)(.6) 4 = $ 5,184 Dt Bt = P (1 - p) t B5 = 100,000(.6) 5 = $ 7,776 Note that Declining Balance will never depreciate book value to $0. It will, however, depreciate past the salvage value Time Value of Tax Savings (Tax Rate = 40%) Time Value of Tax Savings (40%) SL Tax t Dt Save 0 1 20,000 2 20,000 3 20,000 4 20,000 5 20,000 6 0 Sum = 100,000 Present Value = 8,000 8,000 8,000 8,000 8,000 0 40,000 30,326 DDB Dt Tax Save 40,000 24,000 14,400 8,640 4,320 8,640 100,000 16,000 9,600 5,760 3,456 1,728 3456 40,000 32,191 DDB/SL Conversion (Salvage = $0) DDB/Straight Line Conversion SL Bt-1 Dt t 0 1 100,000 20,000 2 3 4 5 6 DDB Dt Bt 40,000 100,000 60,000 DDB/SL Conversion (Salvage = $0) DDB/Straight Line Conversion SL Bt-1 Dt t 0 1 100,000 20,000 2 60,000 15,000 3 4 5 6 DDB Dt Bt 40,000 24,000 100,000 60,000 36,000 DDB/SL Conversion (Salvage = $0) DDB/Straight Line Conversion SL Bt-1 Dt t 0 1 100,000 20,000 2 60,000 15,000 3 36,000 12,000 4 5 6 DDB Dt Bt 40,000 24,000 14,400 100,000 60,000 36,000 21,600 DDB/SL Conversion (Salvage = $0) DDB/Straight Line Conversion SL Bt-1 Dt t 0 1 100,000 20,000 2 60,000 15,000 3 36,000 12,000 4 21,600 10,800 5 6 DDB Dt Bt 40,000 24,000 14,400 8,640 100,000 60,000 36,000 21,600 10,800 DDB/SL Conversion (Salvage = $0) DDB/Straight Line Conversion SL Bt-1 Dt t 0 1 100,000 20,000 2 60,000 15,000 3 36,000 12,000 4 21,600 10,800 5 10,800 10,800 6 0 DDB Dt Bt 40,000 24,000 14,400 8,640 4,320 100,000 60,000 36,000 21,600 10,800 0 Class Problem Ex: Suppose K-Corp is interested in purchasing a new conveyor system. The cost of the conveyor is $180,000 and may be depreciated over a 5 year period. K-Corp uses 150% declining balance method with a conversion to straight line. Compute the depreciation schedule over the 5 year period. Class Problem DDB/Straight Line Conversion SL Bt-1 Dt t 0 1 180,000 2 3 4 5 6 DDB Dt Bt 180,000 Class Problem (p = 1.5/5 = .3) DDB/Straight Line Conversion SL Bt-1 Dt t 0 1 180,000 36,000 2 3 4 5 6 DDB Dt Bt 54,000 180,000 126,000 Class Problem DDB/Straight Line Conversion SL Bt-1 Dt t 0 1 180,000 36,000 2 126,000 31,500 3 88,200 29,400 4 58,800 29,400 5 29,400 29,400 6 0 DDB Dt Bt 54,000 37,800 26,460 17,640 8,820 180,000 126,000 88,200 58,800 29,400 0 DDB/SL Conversion (Half-Year Convention) DDB/Straight Line Conversion/Half-Year SL DDB Bt-1 Dt Dt t 0 1 100,000 10,000 20,000 2 3 4 5 6 Bt 100,000 80,000 DDB/SL Conversion (Half-Year Convention) DDB/Straight Line Conversion/Half-Year SL DDB Bt-1 Dt Dt t 0 1 100,000 10,000 20,000 2 80,000 17,778 32,000 3 48,000 13,714 19,200 4 28,800 11,520 11,520 5 17,280 11,520 6,912 6 Bt 100,000 80,000 48,000 28,800 17,280 5,760 DDB/SL Conversion (Half-Year Convention) DDB/Straight Line Conversion/Half-Year SL DDB Bt-1 Dt Dt t 0 1 100,000 10,000 20,000 2 80,000 17,778 32,000 3 48,000 13,714 19,200 4 28,800 11,520 11,520 5 17,280 11,520 6,912 6 5,760 5,760 2,304 Bt 100,000 80,000 48,000 28,800 17,280 5,760 0 Class Problem A $180,000 piece of machinery is installed and is to be depreciated over 5 years. You may assume that the salvage value at the end of 5 years is $ 0. The method of depreciation is to be double declining balance with conversion to straight line using the half-year convention (you may only deduct 1/2 year of depreciation in year 1). Establish a table showing the depreciation and the end of year book value for each year. Class Problem DDB/Straight Line Conversion/Half-Year SL DDB Bt-1 Dt Dt t 0 1 2 3 4 5 6 Bt 180,000 180,000 Solution DDB/Straight Line Conversion/Half-Year SL DDB Bt-1 Dt Dt t 0 1 2 3 4 5 6 180,000 144,000 86,400 51,840 31,104 10,368 18,000 32,000 24,686 20,736 20,736 10,368 36,000 57,600 34,560 20,736 12,442 4,147 Bt 180,000 144,000 86,400 51,840 31,104 10,368 0 MACRS Tables MACRS Percentages 3, 5, 7, & 10 are 200% DB/SL 15 & 20 are 150% DB/SL t 3-Yr. 5-Yr. 7-Yr. 10-Yr. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 33. 33% 44. 45% 14. 81% 74. 10% 20. 00% 32. 00% 19. 20% 11. 52% 11. 52% 5. 76% 14. 29% 24. 49% 17. 49% 12. 49% 8. 93% 8. 92% 8. 93% 4. 46% 10. 00% 18. 00% 14. 40% 11. 52% 9. 22% 7. 37% 6. 55% 6. 55% 6. 56% 6. 55% 3. 28% 15-Yr. 20-Yr. 5. 00% 9. 50% 8. 55% 7. 70% 6. 93% 6. 23% 5. 90% 5. 90% 5. 91% 5. 90% 5. 91% 5. 90% 5. 91% 5. 90% 5. 91% 2. 95% 3. 75% 7. 22% 6. 68% 6. 18% 5. 71% 5. 29% 4. 88% 4. 52% 4. 46% 4. 46% 4. 46% 4. 46% 4. 46% 4. 46% 4. 46% 4. 46% 4. 46% 4. 46% 4. 46% 4. 46% 2. 23% MACRS Percentages 3,5,7, & 10 are 200% DB/SL 15 & 20 are 150% DB/SL t 3-Yr. 5-Yr. 7-Yr. 10-Yr. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 33.33% 44.45% 14.81% 74.10% 20.00% 32.00% 19.20% 11.52% 11.52% 5.76% 14.29% 24.49% 17.49% 12.49% 8.93% 8.92% 8.93% 4.46% 10.00% 18.00% 14.40% 11.52% 9.22% 7.37% 6.55% 6.55% 6.56% 6.55% 3.28% 15-Yr. 20-Yr. 5.00% 9.50% 8.55% 7.70% 6.93% 6.23% 5.90% 5.90% 5.91% 5.90% 5.91% 5.90% 5.91% 5.90% 5.91% 2.95% 3.75% 7.22% 6.68% 6.18% 5.71% 5.29% 4.88% 4.52% 4.46% 4.46% 4.46% 4.46% 4.46% 4.46% 4.46% 4.46% 4.46% 4.46% 4.46% 4.46% 2.23% Modified Accelerated Cost Property Classes 3 yr. - useful life < 4 yrs. autos, tools 5 yr. - 4 yrs. < useful life < 10 yrs. office epuipment, computers, machinery 7 yr. - 10 < UL < 16 office furniture, fixtures, exploration 10 yr. - 16 < UL < 20 vessels, tugs, elevators (grain) 15 yr. - 20 < UL < 25 data communication, sewers, bridges, fencing MACRS (Cont.) 20 yr. - UL > 25 farm buildings, electric generation 27.5 - residential rental property 31.5 - non-residential real property Depreciation class (3, 5, 7, 10 yr.) uses 200% declining balance switching to straight-line @ optimal year class (15, 20) 150% DB switch to SLD class (27.5, 31.5) use straight-line After Tax Cash Flow Formulas BTCF = Before Tax Cash Flow = Revenues - Expenses After Tax Cash Flow Formulas BTCF = Before Tax Cash Flow = Revenues - Expenses TI = Taxable Income = Cash Flow - Interest - Depreciation After Tax Cash Flow Formulas BTCF = Before Tax Cash Flow = Revenues - Expenses TI = Taxable Income = Cash Flow - Interest - Depreciation Tax = TI * Tax Rate After Tax Cash Flow Formulas BTCF = Before Tax Cash Flow = Revenues - Expenses TI = Taxable Income = Cash Flow - Interest - Depreciation Tax = TI * Tax Rate ATCF = After Tax Cash Flow = BTCF - Tax Ex: After Tax Cash Flow Tax Rate = MARR = t 0 1 2 3 4 5 6 7 NPV = 34% 20% BTCF MACRS % Depr. (82,000) 23,500 20.0% 16,400 23,500 32.0% 26,240 23,500 19.2% 15,744 23,500 11.5% 9,446 23,500 11.5% 9,446 23,500 5.8% 4,723 28,500 0 $4,103 Taxable Income Tax 7,100 (2,740) 7,756 14,054 14,054 18,777 28,500 2,414 (932) 2,637 4,778 4,778 6,384 9,690 ATCF (82,000) 21,086 24,432 20,863 18,722 18,722 17,116 18,810 ($7,854) Borrowed Money Amt. Financed Interest Period of Loan Payment Tax rate 34% MARR 20% t 0 1 2 3 4 5 6 Project Cash Flow (500,000) 150,000 150,000 150,000 150,000 150,000 175,000 $210,000 16% 3 #NUM! Loan Payment 210,000 70,000 70,000 70,000 Year 0 1 2 3 Principle Interest 70000 70000 70000 33600 22400 11200 Loan Before Tax MACRS Interest Cash Flow % (290,000) 33,600 46,400 20.0% 22,400 57,600 32.0% 11,200 68,800 19.0% 150,000 12.0% 150,000 12.0% 175,000 6.0% Total Pmt. Loan Bal. $210,000 103600 $140,000 92400 $70,000 81200 $0 MACRS deduct Taxable Income 100,000 160,000 95,000 60,000 60,000 30,000 16,400 (32,400) 43,800 90,000 90,000 145,000 Tax 34% After Tax Cash Flow (290,000) 5,576 40,824 (11,016) 68,616 14,892 53,908 30,600 119,400 30,600 119,400 49,300 125,700 NPW = ($29,471) Class Problem A company plans to invest in a water purification system (5 year property) requiring $800,000 capital. The system will last 7 years with a salvage of $100,000. The before-tax cash flow for each of years 1 to 6 is $200,000. Regular MACRS depreciation is used; the applicable tax rate is 34%. Construct a table showing each of the following for each of the 7 years. Solution Solution Tax Rate = MARR = t 0 1 2 3 4 5 6 7 NPV = 34% 20% BTCF MACRS % (800,000) 200,000 200,000 200,000 200,000 200,000 200,000 300,000 ($51,173) Depr. Taxable Income Tax ATCF (800,000) Solution Tax Rate = MARR = t 0 1 2 3 4 5 6 7 NPV = 34% 20% BTCF MACRS % (800,000) 200,000 20.0% 200,000 32.0% 200,000 19.2% 200,000 11.5% 200,000 11.5% 200,000 5.8% 300,000 ($51,173) Depr. Taxable Income Tax 160,000 256,000 153,600 92,160 92,160 46,080 0 40,000 (56,000) 46,400 107,840 107,840 153,920 300,000 13,600 (19,040) 15,776 36,666 36,666 52,333 102,000 ATCF (800,000) 186,400 219,040 184,224 163,334 163,334 147,667 198,000 ($136,824) Residential Rental MACRS - ADS Election Straight Line with either a half-year or halfmonth convention. Required for property outside U.S. having tax-exempt status financed by tax-exempt bonds covered by executive order Example Ex: A press forming machine is purchased for the manufacture of steel beams for $300,000. The press is considered a 7 year property class (MACRS-GDS = 7). Compute the annual depreciation using the MACRS Alternative Depreciation Election. Example Soln: MACRS - ADS has a longer life than does MACRS - GDS. In this case 14 years. Dn = $300,000/14 = $21,428 = $21,428 / 2 = $10,714 n = 2, . . ., 14 n = 1, 15 Units of Production Method Allows for equal depreciation for each unit of output Ut Dt ( P F ) U where Ut = units produced during the year U = total units likely to be produced during life (P-F) = depreciable amount allowed Operating Day Method Allows for equal depreciation for each unit of output Qt Dt ( P F ) Q where Qt = total hours used during the year Q = total hours available during the year (P-F) = depreciable amount allowed Income Forecast Method Allows for equal depreciation for each unit of output Rt Dt ( P F ) R where Rt = rent income earned during the year R = total likely rent to be earned during life (P-F) = depreciable amount allowed Depletion Method Allows for equal depreciation for each unit of output Vt Dt ( P F ) V where Vt = volume extracted during the year V = total volume available in reserve (P-F) = depreciable amount allowed Example Ex: NorCo Oil has a 10 year, $27,000,000 lease on a natural gas reservoir in western South Dakota. The reservoir is expected to produce 10 million cubic ft. of gas each year during the period of the lease. Compute the expected depletion allowance for each year. Example Ex: 10,000,000 Dt $27,000,000 10 x 10,000,000 $2,700,000 Percentage Depletion Depletion is taken as a constant percentage of gross income Allowable Percentages Oil/Gas 15% Natural Gas 22% Sulphur/Uranium 22% Gold, silver, … 15% Coal 10% Example Ex: NorCo Oil has a 10 year, $27,000,000 lease on a natural gas reservoir in western South Dakota. The reservoir is expected to produce 10 million cubic ft. of gas each year during the period of the lease at $1.50 per cubic ft. Gross Income Depletion = 1.5(10,000,000) = 15,000,000 = 15,000,000 (0.22) = $3,300,000 Depreciation Recapture Ex: K-Corp purchases a Loader for $250,000 which has a 7 year property class life. After 3 years, $140,675 has been depreciated and the book value is now $109,325. K-Corp now sells the loader for $150,000. Depreciation Recapture Ex: K-Corp purchases a Loader for $250,000 which has a 7 year property class life. After 3 years, $140,675 has been depreciated and the book value is now $109,325. K-Corp now sells the loader for $150,000. Recapture = 150,000 - 109,325 = $40,675 Depreciation Recapture Ex: K-Corp purchases a Loader for $250,000 which has a 7 year property class life. After 3 years, $140,675 has been depreciated and the book value is now $109,325. K-Corp now sells the loader for $150,000. Recapture = 150,000 - 109,325 = $40,675 $40,675 taxed as ordinary income Depreciation Recapture Ex: Suppose K-Corp were able to sell this same loader for $ 275,000. Capital Gain = 275,000 - 250,000 = $25,000 Depr. Recapture = 250,000 - 109,325 = $140,675 Depreciation Recapture Ex: Suppose K-Corp were able to sell this same loader for $ 275,000. Capital Gain = 275,000 - 250,000 = $25,000 Depr. Recapture = 250,000 - 109,325 = $140,675 $ 25,000 taxed at 28% $140,675 taxed at 35% Depreciation Recapture Non residential or commercial real property If Then Ft > P Bt < Ft < P Ft < Bt Ft - P is section 1231 capital gain Ft - Bt recaptured as ordinary income Bt - Ft is section 1231 loss Depreciation Recapture Non residential or commercial real property If Then Ft > P Bt < Ft < P Ft < Bt Ft - P is section 1231 capital gain Ft - Bt recaptured as ordinary income Bt - Ft is section 1231 loss Residential or Commercial real property If Then Bt < Ft Ft < Bt Ft - Bt is section 1231 gain Bt - Ft is section 1231 loss Investment Tax Credit Stimulate investment by providing reduced taxation in year in which asset is placed in service. On-again, off-again Repealed in 1985 with tax rate 46% 35% Investment Tax Credit K-Corp purchases a CNC machine for $100,000. ITC = 100,000(0.10) = 10,000 Initial Cost Basis (for depreciation) is reduced 5% Padj = 100,000(.95) = 95,000 Investment Tax Credit K-Corp purchases a CNC machine for $100,000. ITC = 100,000(0.10) = 10,000 Initial Cost Basis (for depreciation) is reduced 5% Padj = 100,000(.95) = 95,000