Chapter 7 - Holy Family University

advertisement

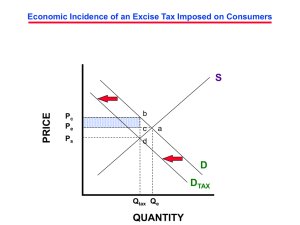

Chapter 7 The Government Sector Introduction: The Growing Economic Role of Government • Most of the growth over the past seven decades was due to the Depression and World War II • Since 1945 the roles of government at the federal, state, and local levels have expanded – The seeds of that expansion were sown during the Roosevelt administration • The government exerts four basic influences – – – – It spends more than $3.0 trillion It levies even more in taxes It redistributes hundreds of billions of dollars It regulates the economy State and Local Government Spending • Main expenditures – Education – Health – Welfare • Spending is a little more than half the level of federal spending • Police protection and prisons are now straining state and local budgets Government Purchases versus Transfer Payments • The federal, state, and local governments spends over $3.0 trillion a year – GDP = C + I + G + Xn – Approximately half are “transfer payments” • The largest transfer payment is social security • These payments end up in the “C” part GDP – Approximately half are “government purchases” • The largest government purchase is defense • These end up in the “G” part of GDP The Average Tax Rate and the Marginal Tax Rate This is a hypothetical illustration Income Level Marginal Tax Rate Tax 0 - $100 0 % $0 $101 - $200 10 % $10 Total Taxes $0 Additional Taxes Paid MTR = Average Tax Rate 0.0 % ( $10) -------------------------------- ---------- Additional Taxable Income ($100) The Marginal Tax Rate (MTR) is the rate you pay on the last dollars you earned The Average Tax Rate and the Marginal Tax Rate This is a hypothetical illustration Income Level Marginal Tax Rate Tax Total Taxes Average Tax Rate 0 - $100 0 % $0 $0 0.0 % $101 - $200 10 % $10 $10 5.0 % Total Taxes Paid ATR = ( $10) -------------------------------- ---------Entire Income ($200) The Average Tax Rate (ATR) is the overall rate you pay on your entire income Types of Taxes • Direct tax – A tax with your name on it • Indirect tax – A tax on things Types of Taxes • Progressive taxes – Places a greater burden on those best able to pay and little or no burden on the poor • Proportional taxes – Places an equal burden on the rich, the middle class, and the poor • Regressive taxes – Places a heavier burden on the poor than on the rich Sources of Federal Revenue • Personal Income Tax – The personal income tax is the largest source of federal revenue – Accounts for 44 percent of all federal tax revenue – Low income people pay little or no federal income tax Sources of Federal Revenue • The Social Security and Medicare taxes are the Payroll Tax • What you pay is matched by your employer • The social security tax by law is set at 6.2% with a wage based limitation of $87,000 • The inflation rate of the previous year raises the wage base • The Medicare tax of 1.45% applies to wages and salaries only. Income such as rental income, interest, dividends, and profit is exempt Sources of Federal Revenue • You pay 6.2% in payroll tax on wages up to $87,000 and 1.45% on all wages and salaries • The Payroll Tax is the fastest growing source of federal revenue The Corporate Income Tax • The corporate income tax is a tax on a corporation’s profits – The maximum rate is 35% • All corporations earning profits of at least $335,000 pay an average tax rate of 35% – Loopholes in the tax law allow many corporations to pay much lower taxes Excise Taxes • An excise tax is a sales tax aimed at specific goods and services • Accounts for about 4 percent of federal revenue • Most excise taxes are levied by the federal government – State and local governments often levy taxes on the same items Excise Taxes • Excise taxes tend to reduce consumption of certain products of which the federal government takes a dim view • Excise taxes are usually regressive The Estate Tax • The estate tax is a tax on the estates of people when they die – It is a graduated tax that rises to 55% • It is levied only on estates valued at $675,000 or more – More than 90% of estate taxes are paid by people with incomes above $200,000 a year Sources of State and Local Tax Revenue • Personal income tax – Accounts for about half of all state revenue • Sales Tax – Is a source of almost half of all taxes collected by the states – Is a highly regressive tax • Property taxes – Provides 80 percent of all local tax revenue – Can influence business decisions about where to locate Economic Role of Government • Provision of Public Goods and Services • Redistribution of Income • Stabilization • Economic Regulation Provision of Public Goods and Services • Some examples – – – – – – – Defense of the country Maintenance of internal order A nationwide highway network Provision of a money supply Public education Running the criminal justice system Environmental protection Redistribution of Income • The government does redistribute hundreds of billions of dollars every year – Social security redistributes money from those currently working to those who have retired – Welfare for the poor • Examples are food stamps, Medicaid, disability payments, and unemployment benefits – Welfare for the rich • Examples are subsidies to corporate farmers and tax breaks for defense contractors, oil companies, and other large corporations Stabilization • Two basic goals of the federal government – Stable prices with little or no inflation – Low unemployment • An economic rate of growth high enough to keep the unemployment rate to a minimum Economic Regulation • The government provides the economic rules of the game – This must be done within the social and political context in which the economy operates • The government must allow individuals and business firms to operate with the maximum degree of freedom • There is little agreement as to how far economic freedom may be extended without interfering with society as a whole or the economic rights of specific individuals or business firms Adam Smith’s Dos and Don’ts • Do – Protect society from the violence and invasion of other countries – Establish an exact administration of justice – Erect and maintain certain public works and institutions where private enterprise could not profit from doing so • Don’t do anything else