This Lesson Plan

advertisement

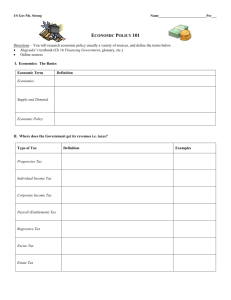

Lesson Plan _401(2) GOVERNMENT SPENDING: WHY DO WE SPEND THE WAY WE DO? The following link is to the student version of this lesson for students to follow online: http://econedlink.org/547 LESSON DETAILS Grades: 9-12 Author: Council for Economic Education Technology Staff Posted: March 15, 2004 Updated: January 4, 2007 Students look at definitions for the three categories of federal spending and using the internet locate examples of each. They then categorize a list of expenditures as government purchases or transfer payments. Given federal budget data, students analyze the pattern of change that has occurred over the last 40 years. Working in groups, they use the internet to ascertain what events altered government spending decisions. KEY CONCEPTS Interest STUDENTS WILL Differentiate among the three categories of government spending: purchases, transfer payments, and interest payments. List examples of government purchases and government transfer payments. Identify some government programs that have grown significantly in recent years and some that have declined in importance during that time. Explain what caused these trends in government spending. INTRODUCTION Income after taxes is used for two purposes: spending and saving. Choosing between consuming things today versus saving today in order to consume some things later through savings reflects the economic problem of scarcity. As result, choices must be made. This holds true not only for individuals but for the U.S. federal government, too. Historically, the founders of our country favored a limited role for government and a strong protections for individual freedom and by 1900, federal government spending amounted to less than three percent of our economy's production of goods and services. The percent of government spending relative to GDP increased during the 20th century reaching more than 45 percent during World War II. Today federal spending equals about 20 percent of GDP. This growth in government spending has been accompanied by a significant change in the types of programs being funded. Only one-fourth of federal government spending is now used for the more traditional government purchase programs such as defense, transportation, physical resources, commerce, and international affairs. More than 60 percent is now used for transfer payments, including direct payments to individuals, and grants to state and local governments. When the payment of interest on the national debt is added to the amount spent on transfer payments, non-purchase spending equals three-fourths of total federal government spending. RESOURCES Activity 1: This is a worksheet where students will review the definitions of government purchases, government transfer payments, and government interest rates. Activity 1 The Federal Budget 2004-2009: This site provides students with examples of different types of expenditures. www.infoplease.com/ipa/A0873746.html Activity 2: In this activity students will identify each expenditure by clicking on either Purchase or Transfer. Activity 2: Interactive Activity 2a: Printable Activity 3: Provides information on types of U.S. Federal Government Spending from 1960-2005. Activity 3: Worksheet Activity 3a: Interactive Activity 4: During this activity students will answer the questions for their time period in a group and present their findings to the class. Activity 4a: 1960-1975 Activity 4b: 1970-1975 Activity 4c: 1978-1988 Defense Spending Activity 4d: 1978-1988 Transfer Payments Activity 4e: 1988-2000 Defense Spending Activity 4f: 1988-2000 Transfer Payments Activity 5: This is a retrieval chart for students to record the findings from each group in activity 4. Activity 5 PROCESS Part I 1. Display a copy of Activity 1. Tell students to print a copy of Activity 1. Review the definitions of government purchases, government transfer payments, and government interest rates. 2. Direct students to the Federal Budget 2004-2009 Here they can locate examples of the different types of expenditures, which they will record on Activity 1. Review their answers. 3. Instruct students to complete Activity 2.They are to correctly identify each expenditure by clicking on either Purchase or Transfer. If you want students to record their answers for class discussion, have them print a copy of Activity 2a. 1) Early childhood education a) Purchase [CORRECT] b) Transfer 2) Food stamps a) Purchase b) Transfer [CORRECT] 3) Missile defense system a) Purchase [CORRECT] b) Transfer 4) Housing subsidies a) Purchase b) Transfer [CORRECT] 5) Space station a) Purchase [CORRECT] b) Transfer 6) Interstate highway system a) Purchase [CORRECT] b) Transfer 7) Medicare a) Purchase b) Transfer [CORRECT] 8) School technology equipment a) Purchase [CORRECT] b) Transfer 9) Air traffic control technology updates a) Purchase [CORRECT] b) Transfer 10) Aid to families with dependent children a) Purchase b) Transfer [CORRECT] 11) Federal Bureau of Investigation a) Purchase [CORRECT] b) Transfer 12) Medical research a) Purchase [CORRECT] b) Transfer 13) Repair and maintain national parks a) Purchase [CORRECT] b) Transfer 14) Unemployment compensation a) Purchase b) Transfer [CORRECT] 15) Social Security a) Purchase b) Transfer [CORRECT] 16) Foreign aid a) Purchase [CORRECT] b) Transfer 4. Instruct students to look at Activity 3. 1) Which category of federal government spending has grown the most in importance since 1960? a) Transfer payments [CORRECT] b) Purchases 2) Which category has declined the most? a) Transfer payments b) Purchases [CORRECT] Part II 1. Divide the students into six groups. Assign each group one of the following time periods for activity 4: o 1960-1975 o 1970-1975 o 1978-1988 (2 groups, one defense spending, one transfer payments) o 1988-2000 (2 groups, one defense spending, one transfer payments) 2. Have students print a copy of Activity 4 for their assigned group. Explain that each group is to use the websites listed and a copy of Activity 3 to answer the questions. 3. Have groups report their findings. Print a copy of Activity 5 for each student. Tell students to record information from other groups 4. Ask students to analyze the information they have recorded on Activity 5. Ask them what factors have caused the shift in priorities for government spending. Have them cite specific examples. [Depending on what world events were occurring from the 15 year war in Vietnam to the Arab-Israeli conflicts which impacted the oil supply to the fall of the Iron Curtain and the end of the Cold War, defense spending has fluctuated but has generally declined. Transfer payments have increased from the inception of the War on Poverty in the mid-60s. The development of Medicare, increased aging of the population and several severe recessions continued to put upward pressure on the transfer payment portions of the federal budget.] CONCLUSION Students will answer the following interactive questions below. They can then use the answers to have a in class discussion. 1. What are the three categories of government spending? 2. Give an example of each type of spending. 3. What government programs have grown significantly in recent years? What ones have declined in recent years? 4. What are the causes for changes in priorities in government spending over the last 40 years? Site examples for both purchases and transfers. Discuss: 1. What are the three categories of government spending? [The three categories of government spending are: government purchases, transfer payments, and interest payments on debt.] 2. Give an example of each type of spending. [An example of each type of spending is: Purchases-national parks, interstates, space, etc., Transfers-food stamps, Medicare, Social Security, welfare, etc., Interest payments- interest on the national debt.] 3. What government programs have grown significantly in recent years? What ones have declined in recent years? [Over the past forty years, defense as a percentage of government spending has been declining while transfer payments have steadily increased.] 4. What are the causes for changes in priorities in government spending over the last 40 years? Site examples for both purchases and transfers. (Refer to Activity 5 and the discussion above for answer.) [Defense spending may once again account for a larger portion of federal government spending. The federal deficit may increase if there is not enough tax revenue to pay for new defense technology. However, increased defense spending can create new jobs in areas where defense contractors are located, and new jobs can generate new tax revenue. Another possible outcome is that cuts would have to be made to transfers to maintain a balanced budget. Decreasing transfers is difficult because many are needs based, funded automatically by law, and not dependent on legislation year to year. The baby boomers will also be reaching retirement age and the Social Security system will have even more demands placed on it. More people will become eligible for Medicare, and medical costs will continue to rise as new technology comes into use. Some students may have other valid hypotheses.] ASSESSMENT ACTIVITY The President of the United States is suggesting increased spending for a missile defense system. He is also proposing a major long- term tax cut. Predict some possible outcomes for the federal budget categories and the relative importance of each outcome during the next 10 years. [Defense spending may once again account for a larger portion of federal government spending than before. The federal deficit may increase if there is not enough revenue to pay for the new defense technology, but new defense spending can also create new jobs in areas where defense contractors are located, and new jobs would generate new tax revenue. The baby boomers will hit retirement age and the social security system will have even more demands placed on it. More people will become eligible for Medicare, and medical costs will continue to rise as new technology comes into use. Some students may have other hypotheses that might be valid.]