Atlantic Grupa

advertisement

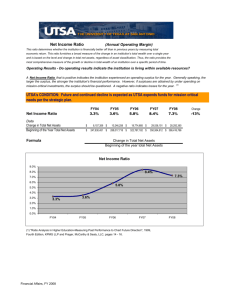

Atlantic Grupa Company of Added Value Belgrade, May 2009 1 CONTENT General overview of Atlantic Grupa Overview of the FY08 financial figures FY09 Guidance Cedevita GO! 2 VERTICALLY INTEGRATED COMPANY IN CONSUMER HEALTHCARE BUSINESS Key brands: The leading European company in the sports nutrition MULTIPOWER Leader in the vitamin instant drinks in the SEE region CEDEVITA Producer of the No1 Croatian brands in the VMS and the OTC DIETPHARM The largest private pharmacy chain in Croatia FARMACIA The leading FMCG distributer in the SEE region Distinguished International Brands (Ferrero, Wigley, Duracell, Johnson & Johnson) FY08 sales EUR280m (+20% yoy) Employees 1,670 Markets Expected FY09 sales 30 EUR290m 3 VERTICALLY INTEGRATED COMPANY IN THE CONSUMER HEALTHCARE BUSINESS FMCG DISTRIBUTION Distribution Division CONSUMER HEALTHCARE Consumer Health Care Sports and Functional Division Food Division Pharma Division VMS Own brands Vitamin drinks and teas Principal brands Cosmetics and personal Sports and functional food OTC Pharmacy chain care 38% of sales 24% of sales 24% of sales 14% of sales SYNERGIES 4 DEVELOPMENT CYCLE 5 GEOGRAPHICAL PRESENCES – Companies and Representative Offices across Europe Presence on 30 markets 6 SALES GROWTH 1993-2008 300 278 In EURm 247 250 CAGR 1993-2008: +35.2% 201 200 150 150 86 100 92 104 64 50 3 6 13 19 29 35 36 41 0 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 CROATIAN COMPANY REGIONAL COMPANY EUROPEAN COMPANY 7 SHAREHOLDER STRUCTURE Stable ownership structure Shareholder structure on March 31, 2009 52,72% E. Tedeschi 7,76% L. Tedeschi Fiorio 6,96% DEG 31,01% Free float 1,74% Management 0,28% Treasury shares 8 ATLANTIC GRUPA AND THE CAPITAL MARKETS Stable ownership structure All domestic pension funds among top 10 shareholders East Capital - the leading asset manager specialising in Eastern Europe Road show in 2008 in the US East Capital award for the Discovery of the Year in 2008 Pace of the ATGR-R-A share decline slower than the drop pace in the local benchmark Crobex 9 OVERVIEW OF THE FY08 FINANCIAL FIGURES In HRKm 2008 2007 2008/2007 Revenues 2.024,5 1.699,1 19,1% Sales 2.002,9 1.670,0 19,9% Strong business results In line with the management guidance Double-digit growth rates: Sales +20% EBITDA +28% EBITDA EBITDA margin EBIT EBIT margin Net profit after MI 169,3 132,3 27,9% 8,45% 7,92% 129,4 95,1 36,0% 6,46% 5,70% +77bps 68,6 46,4 47,9% +53 bps EBIT +36% Net profit +48% Acquisition of pharmacies contributed to the top-line growth with +13% - HRK221m Strong organic growth: Sales +6% EBIT +19% 10 SALES PROFILE Geographic sales profile in FY08 63,1% Croatia 11,6% Germany 4,9% Serbia 2,5% Slovenia 3,3% BiH 2,1% UK 2,2% Italy 10,1% Other FY08 44,2% Own brands 37,7% Principal brands 7,1% Private label 11,0% Farmacia 11 PROFITABILITY EBITDA Organic growth 180 169,3 EBIT EBITDA Net profit +27.9% 160 (in HRKm) 8,5% + 18.5% + 14.2% + 23.7% 132,3 140 Strong focus and commitment to: 120 Cost optimisation Business process improvements Exploring synergies among divisions 7,9% 100 80 2008 2007 NET PROFIT EBIT 80 140 120 129,4 70 +36.0% 6,5% 110 100 95,1 90 5,7% (in HRKm) (in HRKm) 130 60 68,6 +47.9% 3,4% 46,4 50 2,8% 40 30 80 2008 2007 2008 2007 12 DISTRIBUTION DIVISION The leading regional distributer of FMCGs with top global and regional brands in their categories 38% of sales Sales growth drivers Sales (HRKm) 800 760 752,8 +11.9% 720 672,5 680 640 600 FY08 New distribution deals focus on diversification of distribution portfolio Growth across all distribution channels retail HoReCa Extensive know-how key account management category management trade marketing FY07 Profitability growth drivers 24 Economies of scale lower marginal costs in distribution Developed network of distribution centres in the SEE Bargaining power Exploring brand synergies EBIT (HRKm) 25 23,7 +12.0% 23 22 21,2 21 20 19 FY08 FY07 13 CONSUMER HEALTHCARE DIVISION Integrates R&D, manufacturing, packaging, marketing and sales of: 24% of sales Cedevita vitamin instant drinks → No1 producer in the SEE region Personal care products: Plidenta toothpaste, Rosal lip balm Growth drivers Sales (HRKm) 500 487,5 Strength of the Cedevita brand Atlantic’s best selling brand New distribution channel – HoReCa (hotels, restaurants, cafes) Markets with high consumption potential: Serbia, Slovenia +4.3% 480 467,5 460 Cedevita entering new distribution channel Consumption on the GO → Cedevita GO! 440 FY08 FY07 65 63,2 EBIT (HRKm) +14.5% 60 55,2 55 50 FY08 14 FY07 SPORTS AND FUNCTIONAL FOOD DIVISION Integrates R&D, manufacturing, packaging, marketing 24% of sales Key brand: Multipower for sports and functional nutrition Sales (HRKm) 500 480,4 480 +1.8% Growth drivers 471,7 460 440 420 400 FY08 FY07 Strength of the Multipower brand Atlantic’s second best selling brand The leading market position in Germany, Norway, Sweden, Croatia and Serbia Markets with the highest growth: Russia, Sweden, Spain New trends toward healthier lifestyle Successfully completed restructuring the highest EBIT growth among divisions 20 18,4 EBIT (HRKm) +81.0% 16 12 10,1 8 FY08 15 FY07 PHARMA DIVISION R&D, manufacturing, packaging, marketing and sales of VMS and OTC Key brand in the VMS and OTC - Dietpharm 14% of sales The largest private pharmacy chain in Croatia - Atlantic Farmacia 300 282,2 Growth drivers Sales (HRKm) Acquisition of pharmacies/launch of specialised stores new distribution channel for the Group synergies across the Group’s distribution portfolio 250 +383.6% 200 Strategic focus on increasing participation of nonprescription drugs New product launches in the VMS and the OTC segment 150 100 58,4 50 FY08 Dietpharm VMS and OTC Pharmacy business – margin-accretive for Atlantic FY07 Market share Rang in in Croatia category 22% 1 EBIT (HRKm) 24 23,4 +154.9% 20 16 32 Pharmacies and 5 specialized stores 5.5% 12 9,2 8 FY08 16 FY07 KEY PERFORMANCE INDICATORS (In HRK '000) 2008 2007 Turnover Sales EBITDA EBITDA margin EBIT EBIT margin Net income 2.024.459 2.002.926 169.306 8,45% 129.400 6,46% 68.629 1.699.103 1.670.045 132.330 7,92% 95.118 5,70% 46.405 Net debt Total assets Equity Interest coverage ratio Current ratio Gearing ratio CAPEX 291.192 1.655.766 710.976 6,69 1,76 40,96% 58.700 90.492 1.464.426 651.529 5,59 1,83 13,89% 54.349 Market capitalization * 1.138.668 2.166.210 EV 1.479.060 2.302.671 EV/EBITDA 8,74 17,40 EV/EBIT 11,43 24,21 EV/sales 0,74 1,38 EPS 27,84 21,96 P/E * 16,56 39,94 * Calculated based on shaer price of HRK 461.00 as at 31 December 2008 and HRK 877.01 as at 31 December 2007 17 FY09 GUIDANCE In HRKm 2008 2009 Plan 2009/2008 Revenues 2.024,5 2.166 7,0% Sales 2.002,9 2.143 7,0% EBITDA 169,3 194 14,3% EBIT 129,4 147 13,4% 18 FY09 GUIDANCE Even though Atlantic Grupa operates in stable industry, the management is well aware of challenges created by the economic and financing environments Strict focus on: (i) Liquidity maintenance (ii) Cost management (iii) Business processes improvements (iii) Implementation of new projects 19 FY09 GUIDANCE New programs set to create opportunities even in challenging economic times: Consumer Healthcare division Launch of Cedevita GO! – Cedevita in the new distribution channel Distribution division New distribution agreements signed at the end of 2008/beginning of 2009: Distribution of Karolina products – estimated annual turnover of HRK125m Distribution of the Ferrero program in Slovenia – estimated annual turnover of EUR16m Nestle’s NESCAFE assortment in the HoReCa channel – estimated annual turnover of HRK15m 20 FY09 GUIDANCE New programs set to create opportunities even in challenging economic times: Pharma division 5 new pharmacies from the previously acquired licenses 1 specialised store within the scope of strategic cooperation with Agrokor Sports and Functional Food division Redesign of Multipower Regulatory approvals for the Multipower product line in Russia Launching new ENDURANCE product line for cycling and jogging Taking Multipower outside of gyms and fitness centres 21 FY09 GUIDANCE No refinancing requirements, with only minor portion maturing in 2009 Favourable gearing ratio of 29.1% in FY08 Screening potential acquisition targets that would secure value-creative IRR Atlantic Grupa has substantial know-how and experience in due diligence and acquisition activities EUR20m from DEG at disposal Targeting: (i) Pharmacies in Croatia and the region (ii) Companies, brands and market shares in the food supplements segment in the EU market (CEE, Germany, Scandinavia) (iii) Companies, brands and market shares in the sports nutrition in the EU market 22 Cedevita BRAND Cedevita has the strongest household presence and is the second favourite Soft drink brand in Croatia. Favourite* brand (%) Have in* household (%) Jamnica 33 Coca-ColaTM Jana Cedevita 28 9 44 Volume in 2007 (In MM liters) 8 178 20 92 3 61 13 55 Source: Canadean 2007 industry report; Centum istrazivanja: Croatia AFB Study Ferbuary 2009, *Total sample, Open end question 23 Cedevita GO! New distribution channel for Cedevita – consumption on the go Cedevita covers all consumption channels Exploring synergies potential among divisions: R&D, production and packaging Consumer Healthcare division integrated in the Own distribution infrastructure Synergies opportunities in the Sports and Functional Food division’s portfolio Development project worth of HRK75m Payback period of 5-6 years The value-creating IRR Region-wise Macedonia, BiH) distribution (Croatia, Serbia, Slovenia, Favourable impact on the Group’s profit margins 24 Contacts Lada Tedeschi Fiorio, Vice President for the Business Development lada.tedeschi.fiorio@atlantic.hr Zoran Stankovic, CFO zoran.stankovic@atlantic.hr Maja Barac, Head of Investor Relations maja.barac@atlantic.hr +385 1 24 13 908 25 Q&A Thank you for your attention! 26