Advisor Name

Firm

Address

City, St Zip

(555) 333-8888

Company website

Financial Market Update

—February 28, 2015

The summary below is provided for educational purposes only. If you have any thoughts or would like to

talk about any other matters, please feel free to contact me.

Fundamentals Reassert, Yellen on Rates, and Gasoline Prices Drive off Lows

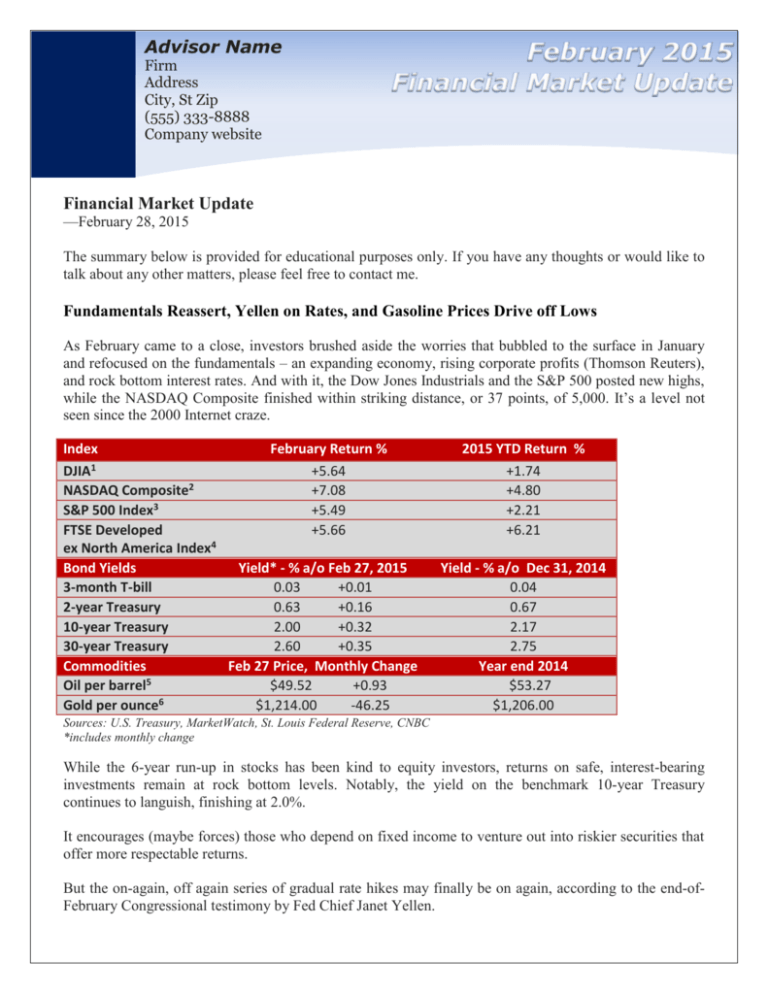

As February came to a close, investors brushed aside the worries that bubbled to the surface in January

and refocused on the fundamentals – an expanding economy, rising corporate profits (Thomson Reuters),

and rock bottom interest rates. And with it, the Dow Jones Industrials and the S&P 500 posted new highs,

while the NASDAQ Composite finished within striking distance, or 37 points, of 5,000. It’s a level not

seen since the 2000 Internet craze.

Index

February Return %

1

DJIA

+5.64

2

NASDAQ Composite

+7.08

3

S&P 500 Index

+5.49

FTSE Developed

+5.66

4

ex North America Index

Bond Yields

Yield* - % a/o Feb 27, 2015

3-month T-bill

0.03

+0.01

2-year Treasury

0.63

+0.16

10-year Treasury

2.00

+0.32

30-year Treasury

2.60

+0.35

Commodities

Feb 27 Price, Monthly Change

5

Oil per barrel

$49.52

+0.93

6

Gold per ounce

$1,214.00

-46.25

2015 YTD Return %

+1.74

+4.80

+2.21

+6.21

Yield - % a/o Dec 31, 2014

0.04

0.67

2.17

2.75

Year end 2014

$53.27

$1,206.00

Sources: U.S. Treasury, MarketWatch, St. Louis Federal Reserve, CNBC

*includes monthly change

While the 6-year run-up in stocks has been kind to equity investors, returns on safe, interest-bearing

investments remain at rock bottom levels. Notably, the yield on the benchmark 10-year Treasury

continues to languish, finishing at 2.0%.

It encourages (maybe forces) those who depend on fixed income to venture out into riskier securities that

offer more respectable returns.

But the on-again, off again series of gradual rate hikes may finally be on again, according to the end-ofFebruary Congressional testimony by Fed Chief Janet Yellen.

In her semi-annual Monetary Policy Report to Congress, Yellen conceded that more needs to be done on

the job front, but she acknowledged there has been “important progress” toward one of the Federal

Reserve’s key objectives – full employment.

“As long as employment keeps growing, Yellen said, the Fed “anticipates that it will be appropriate to

raise the fed funds rate when, on the basis of incoming data, the committee (that determines the fed funds

rate) is reasonably confident that inflation will move back over the medium term toward our 2%

objective.”

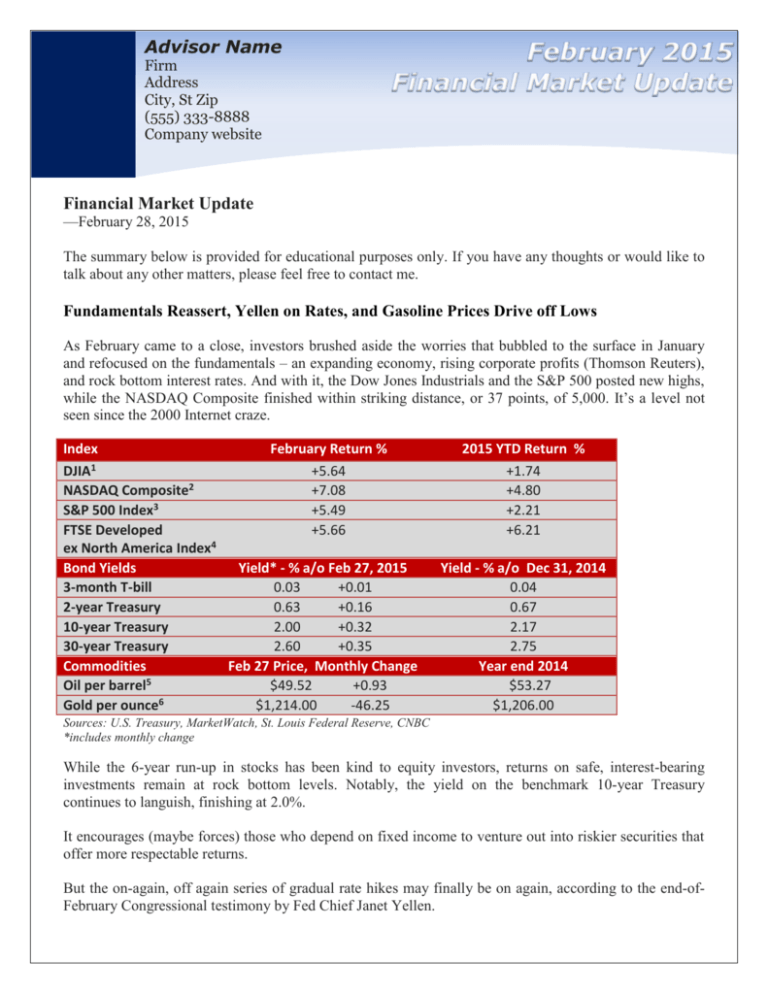

Bureau of Labor Statistics data reveal the steep decline in oil prices is largely responsible for the

downturn in overall inflation. In January, the broad-based PCE Price Index fell 0.5% from the prior month

and is up a scant 0.2% from the prior year (Bureau of Economic Analysis).

But if you look at what economists call core inflation, which removes food and energy, price increases

have been fairly stable and benign – less the 2% annually for almost three years (Figure 1). For the Fed,

that is too benign, as it remains below its annual goal of 2%.

PCE Price Index and Core PCE Price Index

Fig. 1

Percent

3.0

2.5

Fed 2% inflation target

2.0

1.5

1.0

0.5

PCE Price Index

Core PCE Price Index

0.0

Jan-10

Jan-11

Jan-12

Jan-13

Data Source: St. Louis Federal Reserve, Bureau of Economic Analysis

Jan-14

Jan-15

Last Date: Jan 2015; Note: Like the Consumer Price Index, the PCE Price Index is a broad-based measure of prices

What’s noteworthy is that we haven’t seen the drop in oil prices bleed through to the broader price level.

That’s not too surprising since an expanding economy doesn’t incent businesses to cut prices. Think of

the airlines, which have barely reduced airfares per BLS pricing data. And oil prices won’t fall forever.

While Yellen didn’t get overly specific, much of her language was designed to lay the groundwork for a

rate hike later in the year.

Her goal: telegraph to investors that the Fed wants the flexibility to act when it believes the data warrants

a rate hike. But as the Fed prepares for a likely liftoff in rates, Yellen is quite cognizant of the scars left by

the Great Recession.

“We will want to feel confident that the recovery will continue and that inflation is moving up over time.

There are also, of course, risks of waiting too long to remove accommodation,” she noted in the Q&A

session with Congressional committee members (Bloomberg).

Those risks include economic distortions caused by low interest rates and the potential for whipping up

unwanted inflation. It’s a delicate balancing act.

Seasonal ritual – gasoline prices rebound

If you’ve filled up your tank lately, you’re not alone if you’ve noticed an uptick in gasoline prices. Our

friends in California have been hammered, with an average price of $3.31 per gallon for regular gasoline

as of February 28.

This compares with Nevada at $2.73, which is the next highest (excluding Hawaii, GasBuddy.com). The

average price across the U.S. is $2.40. But that’s still below the average of a year ago of $3.45. If you’re

keeping score, Utah is the cheapest at $2.02.

Data published weekly by the Energy Information Administration (EIA) reveals that regular gasoline

prices peaked last year on April 28 at $3.71 and plummeted to $2.04 by January 26, 2015. By February

23, the price had rebounded to $2.33, but it’s still $1.11 per gallon below the average U.S. price from a

year ago.

While I’m mindful that sharp cutbacks in capital spending among the oil companies and oil-service

providers is creating pain in the energy patch, longer-term the savings is set to support economic activity.

In her Congressional testimony last month, Yellen acknowledged the negative impact on energy

producers, but noted, “It (falling gasoline prices) will likely be a significant overall plus, on net, for our

economy.”

Where prices might be headed in the short term? If seasonality continues to play a role, higher is the short

answer – see Figure 2.

Weekly Average Price Regular Gasoline: 2000-2014

25.0%

Fig. 2

Memorial Day

weekend

20.0%

15.0%

Labor Day

10.0%

5.0%

Average Price 2000-2014

0.0%

-5.0%

Price change 2015

-10.0%

1

5

9

13

17

Data Source: Energy Information Administartion

Last 2015 date: Feb. 23, 2015

21

25

Week#

29

33

37

41

45

49

Over the last 15 years, prices have risen by an average of 20% between January 1 and Memorial Day

weekend.

While gasoline continued to slide through much of January, seasonality has reasserted itself and we’re

back on track.

Factors that have played a role include an uptick in oil prices, but other variables are in play.

Scheduled maintenance to prepare for the transition from winter blends to the more expensive summer

blends of gasoline is impacting some parts of the country. And there is also the general expectation of the

upcoming summer driving season.

Then there are factors that are specific to the current situation.

Data from the EIA suggest that gasoline usage is up as lower prices encourage increased driving. The

largest refinery strike in 35 years is occurring at plants that account for 20% of U.S. gasoline production

(LA Times), and its coming at a time of very cold weather in the Northeast, which increases demand for

heating oil at the expense of gasoline production.

A recent explosion and fire at an Exxon refinery in California (Reuters) is creating havoc in the Golden

State. Finally, prices may have just overshot to the downside.

It’s important from an economic standpoint because we’re experiencing sharp cutbacks in capital

spending among oil producers. Yet, various surveys of consumer spending, including MasterCard (Wall

Street Journal) and retail sales data (U.S. Commerce Department) suggest that consumers have been slow

to recycle their gas savings into new spending.

Warmest Regards,

Advisors Name/Signature

Share!

It’s OK with us if you would like to share the Market Update with your friends,

family and neighbors. We love meeting new folks!

It is important that you do not use this e-mail to request or authorize the purchase or sale of any security or commodity, or

to request any other transactions. Any such request, orders or instructions will not be accepted and will not be processed.

All items discussed in this report are for informational purposes only, are not advice of any kind, and are not intended as a

solicitation to buy, hold, or sell any securities. Nothing contained herein constitutes tax, legal, insurance, or investment

advice.

Stocks and bonds and commodities are not FDIC insured and can fall in value, and any investment information, securities

and commodities mentioned in this report may not be suitable for everyone.

U.S. Treasury bonds and Treasury bills are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of

return and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of

principal and interest by the federal government. Treasury bills are certificates reflecting short-term (less than one year)

obligations of the U.S. government.

Past performance is not a guarantee of future performance. Different investments involve different degrees of risk, and

there can be no assurance that the future performance of any investment, security, commodity or investment strategy that is

referenced will be profitable or be suitable for your portfolio.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing

material is accurate or complete. The information contained in this report does not purport to be a complete description of

the securities, markets, or developments referred to in this material. Any information is not a complete summary or

statement of all available data necessary for making an investment decision and does not constitute a recommendation.

Before making any investments or making any type of investment decision, please consult with your financial advisor and

determine how a security may fit into your investment portfolio, how a decision may affect your financial position and how

it may impact your financial goals.

All opinions are subject to change without notice in response to changing market and/or economic conditions.

1

The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past

performance does not guarantee future results.

2 The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not

guarantee future results.

3 The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not

guarantee future results.

4 The FTSE Developed ex North America Index is an unmanaged index of large and mid-cap stocks providing coverage of developed markets,

excluding the US and Canada. It cannot be invested into directly. Past performance does not guarantee future results.

5 New York Mercantile Exchange front-month contract; Prices can and do vary; past performance does not guarantee future results.

6 London Bullion Market Association; gold fixing pricing at 3 p.m. London time; Prices can and do vary; past performance does not

guarantee future results.

Copyright © 2015 Financial Jumble, LLC All rights reserved.