ICON plc Goldman Sachs Mid-Cap Conference March 11 th 2005

advertisement

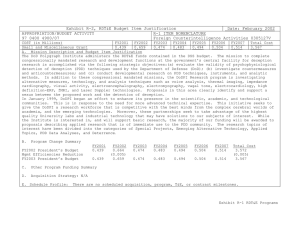

ICON plc Goldman Sachs Mid-Cap Conference March 11th 2005 www.iconclinical.com Overview Forward Looking Statements Certain statements contained herein including, without limitation, statements containing the words “believes,” “anticipates,” “intends,” “expects” and words of similar import, constitute forward-looking statements concerning the Company's operations, performance, financial condition and prospects. Because such statements involve known and unknown risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Given these uncertainties, prospective investors are cautioned not to place undue reliance on such forward-looking statements. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. www.iconclinical.com Snapshot Fourth largest Clinical CRO in the world Quintiles PPD Parexel ICON Dedicated team model and quality ethos differentiates ICON from competitors Over $300m in Net Revenues and approx 2700 staff 37 offices in 23 countries on five continents www.iconclinical.com Offices: US Chicago Doylestown San Francisco New York City Irvine Long Island Houston Philadelphia Delaware Nashville Baltimore Tampa Raleigh-Durham www.iconclinical.com Offices: Europe and Middle East Marlow Stockholm Amsterdam Manchester Riga Dublin Eastleigh Moscow Barcelona Tel Aviv Paris Budapest Frankfurt www.iconclinical.com Offices: ROW Montreal Seoul Sydney Hong Kong Bangkok Tokyo Taiwan Chennai Buenos Aires Singapore Johannesburg www.iconclinical.com Current Services in Drug Development Pre-clinical 6% Phase I Phase II Phase III Launch Phase IV Strategic Drug Development and Regulatory Consulting (US & EU) 5% Phase I 8% 16% Central lab (Global) Data Management & Statistical Consulting (Global) 57% Trial Management & Monitoring (Global) 3% 2.5% IVRS (Global) Central Imaging Lab (US & EU) 2.5% Contract Staffing (US) www.iconclinical.com ICON plc Market Dynamics www.iconclinical.com Three Elements Supporting Growth Growth in Underlying spending (1) Total 2005 R&D spend estimated at > $82bn; 10% growth forecast to continue Total 2005 Development Spend estimated at >$54bn; 11% growth forecast Continued growth in outsourcing(1) Industry estimated to outsource approximately 27% of development and growing by 1% per annum. Market growth estimated at 14% Pharma reducing supplier numbers Fewer CROs servicing Large Pharma = Market share gains for Global and multi-service CROs (1) Source Jeffries & Co. www.iconclinical.com Strong Market Environment Preferred Providers Improving Pipelines Biotech / Specialty Companies Regulatory Environment www.iconclinical.com RFP Volume / Value Trends – US Last 4 Quarters RFP Volume Growth 75.0% RFP Value Growth 65.0% 66% 65.0% 55.0% 43% 45.0% 45.0% 39% 35.0% -04 04 Nov - Aug -23% -04 Ma y -25.0% Q3 -15.0% 4 04 Nov- -5.0% -04 Aug -5% -0 May -25.0% 14% 5.0% Q3 -15.0% 35.0% 15.0% 15.0% -5.0% 36% 25.0% 25.0% 5.0% 53.0% 55.0% www.iconclinical.com Bio-Tech, Mid-Sized and Japanese companies are now significant outsourcers Biotech and specialty companies account for a growing percentage of projects in development: 55% of 2002 Clinical trials are derived from biotech companies. Currently estimated to be more compounds in development in biotech/specialty than in all of Top 20 Pharma % of ICON revenues ICON’s sales to non Top 20 pharma companies have been rising strongly: 50% 40% 30% 35% 20% 21% 5% 10% 16% 26% 12% 39% 17% 40% 42% 27% 31% 13% 11% 12% 14% 23% 22% Scope for Growth 0% FY2000 FY2001 FY2002 FY2003 FY2004 FY2005 YTD Non-Bio / Non-Big Pharma Biotech www.iconclinical.com $ millions ICON Gross Business Wins Last 9 Quarters $150 $140 $130 $120 $110 $100 $90 $80 $70 $60 $50 $40 $30 $20 $10 $0 $136 $129 $101 $93 $99 $93 $84 $72 $73 Q2 Nov Feb-03 May-03 Aug-03 Nov-03 Feb-04 May-04 Aug-04 Nov-04 02 www.iconclinical.com Total Backlog $Millions $500 $488 $450 $464 $453 $450 $422 $427 $400 $ millions $350 $336 $327 $300 $276 $282 $250 $200 $352 $241 $246 $223 $235 $150 $100 $50 $0 May-01 Aug-01 Nov-01 Feb-02 May-02 Aug-02 Nov-02 Feb-03 May-03 Aug-03 Nov-03 Feb-04 May-04 01-Aug Nov-04 ICON plc Financial Performance (Fiscal Years ending May 31) www.iconclinical.com Net Revenue CAGR of 38% over last 5 Years $297 $300 Millions $226 $200 $157 $116 $100 $81 $60 $0 FY1999 FY2000 FY2001 FY2002 FY2003 FY2004 www.iconclinical.com 7 Years of Earnings Per Share Growth…. $2.00 $1.88 $1.80 $1.50 $1.60 Millions $1.40 $1.16 $1.20 $0.92 $1.00 $0.66 $0.70 $0.80 $0.60 $0.40 $0.48 $0.23 $0.20 $0.00 FY1997 FY1998 FY1999 FY2000 FY2001 FY2002 FY2003 FY2004 www.iconclinical.com …However, ICON Has Traditionally Experienced Low Cancellation Rates but in Q1 05…… Cancellations as % of Opening Backlog 10% 10.00% $46m cancellations inc. 2 major projects 9% 8% 7% 6% 5% 4.30% 4% 3.60% 3.60% 3.60% 3.00% 3% 2% 1.80% 1% 3.00% 1.80% 1.30% 0.80% 2.30% 1.70% 1.40% 0.60% 0.40% 0% Q3 01 Q4 01 Q1 02 Q2 02 Q3 02 Q4 02 Q1 03 Q2 03 Q3 03 Q4 03 Q1 04 Q2 04 Q3 04 Q4 04 Q1 05 Q2 05 www.iconclinical.com Quarterly Revenue and Operating Profit $12.0 $76.9 $73.2 $66.0 $10.0 $68.9 $59.3 $8.4 $53.5 $ Millions $8.0 $39.6 $36.2 $37.8 $6.0 $4.1 $4.4 $4.6 $43.0 $5.1 $46.9 $7.2 $77.9 $9.6 $8.8 $78.3 $79.5 $9.5 $7.6 $7.0 $6.3 $6.2 $5.2 $4.0 $2.0 $0.0 Q1 Q2 Q3 Q4 02 02 02 02 Q1 Q2 Q3 Q4 03 03 03 03 Q1 Q2 Q3 Q4 04 04 04 04 Q1 Q2 05 05 www.iconclinical.com Quarterly EPS $0.55 51c 43c $0.45 36c $0.35 $0.25 15c 17c 19c 20c 21c 22c 23c 25c 29c 27c 28c 31c 44c 45c 52c 47c 41c 38c 33c $0.15 $0.05 -$0.05 Q1 Q2 Q3 Q4 FY2000 Q1 Q2 Q3 Q4 FY2001 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 FY2002 FY2003 Q1 Q2 Q3 Q4 FY2004 Q1 Q2 FY2005 www.iconclinical.com Summary Balance Sheet and Cashflow ($ millions) Nov 30, 2004 (Half Year) May 31, 2004 (Year) $71.0 $78.8 $370.4 $335.3 $10.0 $0.0 $236.3 $216.8 ($2.0) $43.6 Capital expenditures $7.5 $13.1 Fully diluted shares outstanding 14.1 13.7 Cash and cash equivalents Total assets Total debt Shareholder’s equity Cashflow from operations www.iconclinical.com Current Issues / Strategic Development www.iconclinical.com Current Tactical Issues Recovery from Exceptional Cancellation Quarter to Restore Growth Net Wins $120m in Nov Qtr Good net wins again expected for Feb quarter Capitalise on Lab Investments and Sales Success to Eliminate Losses Continue Sales Success Add more major clients Develop technological base www.iconclinical.com ICON LABS Net New Business Wins Average Net Business Wins Book to Bill Ratio $20 1.8 Book-to-Bill 1.35 1.9 1.5 1.4 1.4 1.1 0.97 $ millions $15 0.7 $10.8 $10 $12.0 $11.3 $9.3 $8.8 $6.9 $6.6 $5 $4.9 $0 Q3 03 Q4 03 Q1 04 Q2 04 Q3 04 Q4 04 Q1 05 Q2 05 www.iconclinical.com Strategic Mission To continue to develop our business as a global, full service, clinically focused CRO, and to leverage the synergies between our multiple services. Use “Full Service” to Leverage Client Relationships and Capture more of the Spend Strategic Product Development / Consulting 6% Central Laboratory 8% Clinical Trial Management Phase II – IV 57% Phase I 5% Central Imaging Lab 2.5% Data Management & Biostatistics 16% IVRS 2.5% Contract Staff 3% Current Strategic Initiatives Investing in Operations in Japan Creation of Data Management Operation in India Partnership with Medidata Solutions in EDC Developing specialised Phase IV Division New IT in 2005 to enhance efficiency New Trial Management and Project Collaboration Systems New Document Management System New eLearning System Current Acquisition / Investment Focus Central Labs to increase scale Additional Central Imaging Expertise to broaden offering Phase I in US to compliment EU facility Analytical Labs to compliment EU facility New Expertise in any of core areas to add scale / unique expertise Future Development Get more business from current clients Add new clients Organic Sell more new services - IVRS/Lab/Consulting/Phase I Expand global presence Increase therapeutic experience Acquisitions Goal Add new services and broaden existing ones To be the best www.iconclinical.com