View Extended Abstract - United States Association for Energy

advertisement

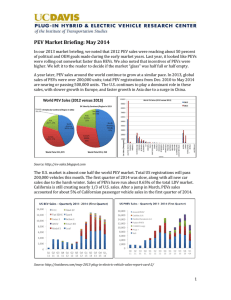

HOW THE INTERACTION OF SUPPLY AND DEMAND SHAPES PATTERNS OF NEW TECHNOLOGY ADOPTION: PLUG-IN ELECTRIC VEHICLES IN CALIFORNIA Varun Rai, The University of Texas at Austin, 512-471-5057, raivarun@utexas.edu Vivek Nath, The University of Texas at Austin, 484-226-6287, vivek.nath@utexas.edu Overview Depending on the details of the fuel source and other locational context, plug-in electric vehicles (PEVs) may offer one or more benefits, including reductions in greenhouse gas emissions and tailpipe emissions, reduced dependence on foreign sources of oil [1], and opportunities for new ways of using the electric grid [2]. Anticipating these benefits several government programs have been put in place across the world to encourage the adoption of PEVs. In the U.S. the most notable programs include the $7,500 federal tax incentive and the California Clean Vehicle Rebate Project (CVRP), which offers up to $2,500 in additional rebates. Additional indirect, yet substantial, incentives such as access to High Occupancy Vehicle (HOV) lanes are also often employed. PEVs represent a unique mix of the old and the new, both from the supply and demand perspectives. On the supply side: (i) there are new vehicle manufacturers such as Tesla along with most of the established manufacturers, (ii) there are vehicle models that are very close in technology/branding compared to some existing established models (for example, the Toyota Prius PEV); while there are also the full battery EVs, such as the Nissan Leaf and Tesla Model S, which are technologically quite different from the conventional internal combustion engine (ICE) based vehicles (iii) most sales of PEVs follow the conventional route of the dealership model, (iv) a mix of old (conventional electric sockets) and new (Level 2 chargers) charging infrastructure and electricity rate products are available and applicable to serve PEV customers, and (v) as before, conventional financing mechanisms, loans and leasing in particular, are levers that suppliers can pull to drive sales. How do these supply-side features of the PEV supply chain impact the rate of adoption of PEVs and how does it vary by different makes/models, which embody variations along key aspects of pricing and technology? On the demand side: (i) fuelling options are a mixed bag (varying from full electric models like the Nissan Leaf to largely gasoline-based like the Toyota Prius Plug-in Hybrid), (ii) maintenance is expected to be quite different from conventional ICE vehicles, (iii) electricity consumption timing and rate structures become more salient for the customer, (iv) performance and safety features also are a blend of established characteristics of the existing fleet, while also adding new uncertainty. Within this context, what drives consumers to adopt PEVs? How effective are various incentive types in addressing the financial and non-financial barriers that consumers face in adopting PEVs? In this paper we study how incentive policies, supply-side characteristics, and demand drivers interact to shape the rate and pattern of adoption of PEVs. In particular, we examine the influence of factors such as decision-making criteria, state and manufacturer incentives, information channels used, social influences, behavioral characteristics, and socio-economic and demographic data that impact consumer choice to adopt PEVs. Data and Methodology For our analysis we use a unique and rich data set collected as part of the California Plug-In Electric Vehicle Owner Survey.1 This longitudinal survey was administered to vehicle owners across California who had received a rebate through the state’s Clean Vehicle Rebate Project (CVRP). Surveys were administered via an email campaign and collected detailed information on purchasing motivations, demographic background, information sources, marketing media received, and financial aspects of the decision to adopt a PEV. In addition to the survey results, purchase details including purchase price and whether the vehicle was procured through a buy or lease were also used. Our analysis focused on data collected in the third round of surveys which were administered in May 2013. This round included a total population of 8,771 PEV owners from across California. 3,881 PEV owners responded to the survey, representing a response rate of 44%. 1 The Plug-in Electric Vehicle (PEV) Owner Survey is a long-term collaborative research project managed by California Center for Sustainable Energy's (CCSE), in coordination with the California Air Resources Board (ARB) and researchers at UT Austin's Lyndon B. Johnson School of Public Affairs and the UC Davis Institute of Transportation Studies. Together, the project team is analysing data from Clean Vehicle Project (CVRP) participants in order to understand trends in the PEV market, including the drivers of adoption, vehicle use, as well as vehicle charging infrastructure use and satisfaction. 1 We develop regression models for explaining the factors determining the choice to lease the vehicle and for factors that influence the decision period—the duration that consumers spend deciding to get a PEV before arriving at a final choice. The variables considered include: incentives, purchase motivations, medium of marketing received, trusted sources of information, demographics, purchase price, and factors relating to the owners communicating with peers and other PEV owners. Results and Conclusion The three primary motivators behind PEV purchase were environmental value, financial benefits (saving money), and HOV lane access; but these motivations vary significantly for the different vehicle models. The degree of priority placed on HOV lane access was found to be region dependent and vehicle model dependent. The decision period of PEV owners surveyed was found to be influenced by a variety of factors. A higher degree of importance placed on HOV lane access and saving money on fuel costs were found to reduce the decision period. A higher degree of importance placed on reducing environmental damage, on the other hand, was found to increase the decision period. The lowering effect on the decision period from highly prioritizing HOV lane access and saving money on fuel costs suggests a different approach to deciding on a vehicle purchase from those who prioritize environmental benefits. Leasing as a percentage of total sales was found to be more prevalent for PEVs (overall average 28.8%) than for new cars in the U.S. (overall average ~20-24% in 2012). Among the top three makes in the survey, Chevy Volt owners have the highest proportion of lessees (38%) followed by owners of Nissan Leaf (31.2%), and Toyota Prius Plug-in Hybrid (17.2%). Two factors help explain the higher proportion of leases for PEVs: (i) the lower than expected sales of some of the PEV models, leading some manufactures to offer attractive leasing terms; and (ii) the technological uncertainty that consumers face with PEVs, as the long term operational and maintenance features of PEVs are not yet established. The value of the leasing option when deciding to procure a PEV was influenced by vehicle make adopted, income level, stated motivational factors, social effects, and the type of medium through which marketing/information was received. The Toyota Prius was associated with a lowering effect on the priority of leasing in the purchasing decision as compared to the Chevrolet Volt. Higher income groups were found to value the leasing option less than lower income groups, implying that leases were more valuable to those with higher financial constraints. A higher importance placed on HOV lane access, saving money on fuel costs and vehicle performance were factors that had a positive impact on the prioritization of the leasing option. Having co-workers who owned PEVs increase the likelihood of prioritizing leasing. Marketing received through referral by a friend also positively influenced the value placed on leasing. These two findings suggest that word of mouth and/or other social influences increase the value of leasing to a prospective PEV owner. We further discuss these findings and their implications in the context of the broader consumer behavior and vehicle choice literature (among others, see references [3 - 9]). References 1. 2. 3. 4. 5. 6. 7. 8. 9. Michalek, J. J. et al. (2011). Valuation of plug-in vehicle life-cycle air emissions and oil displacement benefits. Proceedings of the National Academy of Sciences 108.40 (2011): 16554-16558. Tuttle, D. P. & Baldick, R. (2010). The Evolution of plug-in electric vehicle-grid interactions. Smart Grid, IEEE Transactions on, 3.1 (2010): 500-505. Ozaki, R. & Sevastyanova , K. (2011). Going hybrid: An analysis of consumer purchase motivations. Energy Policy, 39 (2011): 2217-2227. Kavalec, C. (1999). Vehicle Choice in an Aging Population: Some Insights from a Stated Preference Survey for California. The Energy Journal, 20.3 (1999): 123-138. Ewing, G. & Sarigollu, E. (2000), Assessing Consumer Preferences for Clean-Fuel Vehicles: A Discrete Choice Experiment. Journal of Public Policy & Marketing 19.1 (2000): 106-118. Potoglou, D. & Kanaroglu, P. S. (2007), Household demand and willingness to pay for clean vehicles. Transporation Research Part D 12 (2007): 267-274. Dasgupta, S., Siddarth, S., & Silva-Risso, J. (2007). To lease or to buy? A structural model of a consumer's vehicle and contract choice decisions. Journal of Marketing Research 44.3 (2007): 490-502. Mueller, M. G. & de Haan, P. (2009). How much do incentives affect car purchase? Agent-based microsimulation of consumer choice of new cars—Part I: Model structure, simulation of bounded rationality, and model validation. Energy Policy 37.3 (2009): 1072-1082. Furse, D. H., Punj, G. N., & Stewart, D. W. (1984). A typology of individual search strategies among purchasers of new automobiles. Journal of Consumer Research 10.4 (1984): 417-431. 2