Section 351 is a code of tax law, section 351 is a

advertisement

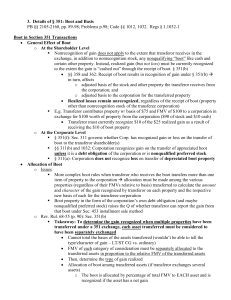

Running Head: Calculations 1 Tax Computations Section 351 is a code of tax law, section 351 is a part of the internal revenue code (IRC) of the taxation of United States of America. Internal revenue code is a domestic portion of federal statuary tax law in United States was established in 1986 in order to account for the income for tax purpose. Various taxes are fall under the category of internal revenue code such as income tax, excise tax, gift tax, payroll tax, estate tax and so on and all the taxes are further comprehensively described in section codes. Tax basis balance sheet is prepared as other ordinary balance sheet is prepared but the difference is that the tax basis balance sheet is prepared for tax purpose. Tax basis balance sheet provides the current deferred tax liability of a company and provides managers the overview that all the assets are sold at their current value and all liabilities could be paid off immediately. Transaction occurred due to the incorporation of John and Jill business venture is not treated under section 351 because no cash is transferred in exchange of Jill’s property and in order to compute tax for in accordance with section 351 exchanges of cash is necessary. Therefore transaction of Jill and john’s joint venture is not treated under section 351. Section 351 deals with the transferring of property into a corporation. General rule of section 351 states that while transferring a property in exchange for its stock is a taxable event therefore tax is charged according to an appropriate percentage. The transaction is taxed if a person sold property to the corporation in return of cash. Due to the transaction difference between the stock valued and the tax basis in the property transferred to the corporation will Running Head: Calculations 2 result in gain or loss. No gain or loss recognized if property is transferred in exchange of stock. (cornell.edu, 2016) Balance sheet Assets Cash 200000 Land 240000 Total assets 440000 Capital and liabilities Reserves 290000 Stock 80000 Equities 20000 Liabilities 50000 Total liabilities and equity 440000 Major benefit of the section is this no gain or loss will be recognized and no tax liability is booked if the exchange of property is made in contrast with stock. For sole proprietors who want to incorporate for liability protection purposes, this is the way through which tax free exchange is performed. After the section 351 if transfer of property to the corporation in exchange of stock , the transfer will loses control of the corporation by a taxable sale of all or Running Head: Calculations 3 part of that stock to a third party who does not also transfer property to the corporation in exchange of stock . Running Head: Calculations 4 References cornell.edu. (2016). U.S. Code § 351 - Transfer to corporation controlled by transferor. Retrieved 1 18, 2016, from cornell.edu: https://www.law.cornell.edu/uscode/text/26/351