notes - Anne Sibert

advertisement

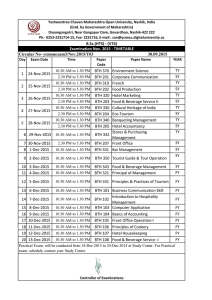

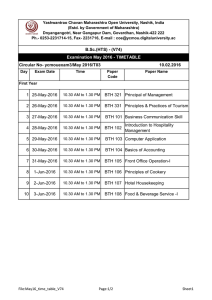

BSc Financial Economics International Finance Autumn 2013 Speculative Attacks: The First Generation In the discrete-time monetary approach model equilibrium is given by mt - et = y* - a ( et+1 - et ) . (1) Suppose that the government wants to peg the exchange rate at et = e. Substituting this into equation (1) yields mt = e + y* . This is the same result as in the MF model: the money supply is now endogenous. A country cannot have internationally mobile capital, a fixed exchange rate and an independent monetary policy. This note presents a first-generation model of a speculative attack on the exchange rate of a country with mobile capital and a pegged exchange rate that attempts to follow an independent monetary policy. This model differs from the model of the last lecture in that it is convenient to assume that time is continuous, rather than discrete. In continuous time, the uncovered interest parity condition is that the difference between the home and foreign interest rates is equal to the rate of depreciation of the home currency. This has two implications. First, equation (1) is rewritten as mt - et = y* - a et , (2) where a dot over a variable is its derivative with respect to time. That is et = det dt. Since its derivative et is always equal to the finite interest rate differential, the exchange rate cannot jump. If a function “jumps”, that is if it is not continuous, then its derivative does not exist at that point. The money supply (given in level terms, rather as a logarithm) is given by M t = Bth + Btf , (3) where Bth is the central bank’s holdings of home government bonds at time t and Btf is the central bank’s holdings of foreign government bonds at time t. At some time, say time zero, the central bank pegs the exchange rate at e and it becomes known that central bank intends to run an expansionary monetary policy to monetize a fiscal deficit and so Bh (4) bth = th = m > 0. Bt 1 Since maintaining the pegged exchange rate requires a constant money supply it must be that Btf = -Bth . That is, if the government buys home government bonds, it must intervene in the foreign exchange market and sell foreign exchange reserves. Thus, its foreign exchange reserves are falling over time. Clearly, this is not sustainable as the available reserves are finite. It is assumed that when reserves hit zero ( Btf = 0 ) that the central bank is forced to abandon its pegged exchange rate. The result is a speculate attack at some time T. To keep things simple it is assumed that once the peg is abandoned, the exchange rate floats forever after. It is demonstrated that reserves decline slowly until time T and then the remainder of the stock of reserves suddenly jumps down to zero. The intuition for this result is seen from looking at the equilibrium condition (2). Prior to the abandonment of the peg the exchange rate does not change, hence the derivative of the exchange rate is equal to zero up until the peg collapses. As soon as the peg collapses, the exchange rate begins to depreciate as the government pursues an expansionary monetary policy. Thus, the derivative of the exchange rate is strictly positive after the collapse occurs. Thus, the derivative of the exchange rate jumps up at the moment of collapse. Hence, demand for home money, given by the right-hand side of equation (2) jumps down when the collapse occurs. For equilibrium in the money market to be maintained, the real value of the money supply, given by the left-hand side of equation (2), must jump down as well. As previously noted, the exchange rate cannot jump; hence, the nominal value of the money supply must jump down at the moment of collapse. The nominal value of the money supply is the sum of home bonds and foreign bonds held by the central bank. By hypothesis the central bank’s holdings of home bonds do not jump; they grow as specified in equation (4). Thus, it must be that reserves jump down. This note finds the time of the attack T and demonstrates that, indeed, reserves jump. To find the time of the attack it is noted that the exchange rate cannot jump. Thus, at the time the attack occurs, the market (floating) rate is equal to the pegged rate. Thus, the strategy is to find the path of the exchange rate after the attack and then find the value of T such that the value of the floating rate is equal to the fixed rate at T. To find the path of the floating rate after the collapse, recall from the last section of the last lecture that when the money supply grew at a constant proportional rate the exchange rate was given by et = c0 + c1mt , where c0 = -y* and c1 = 1 (1+ a - am ). The idea is to guess that the exchange rate has the same functional form here, although the values of the coefficients may be different. Then, calculate the derivative of the conjectured exchange rate and substitute the conjectured exchange 2 rate and its derivative into the equilibrium condition (2) and see if there are any values of the coefficients that it works for. So, suppose that et = c0 + c1mt . Since reserves equal zero once the attack occurs, mt = bth after the attack. The conjectured exchange rate and equation (2) can be rewritten as et = c0 + c1bth and bth - et = y* - a et , respectively. Differentiating the conjectured exchange rate and using equation (4) yields et = c1bth = c1m. Substituting the conjectured guess and its derivative into the rewritten equilibrium condition yields bth - c0 - c1bth = y* - c1am. Gathering terms yields (1- c1 ) bth = c0 + y* - c1am. This has to be true no matter what bth is. In particular, it has to be true when it is equal to zero. Thus, c0 + y* - c1am = 0. It also has to be true when bth is not equal to zero. Thus, (1- c1 ) bth = c0 + y* - c1am = 0 Þ c1 = 1. Thus, c0 + y* - am = 0 Þ c0 = am - y* . The floating exchange rate is given by et = am - y* + bth . (5) This exchange rate is called the shadow floating exchange rate. The next step is to set eT = e , using equation (5), and to solve for T. First, however, bTh must be expressed in terms of T. By equation (4) dbth / dt = m. Thus, dbth = mdt. Integrating yields ò T 0 T dbth = m ò dt . Calculating the integrals implies bTh = b0h + mT . 0 Thus, using equation (5) eT = am - y* + b0h + mT = e . Solving yields T= e + y* - am - b0h m . (6) Equation (6) is sensible. The less ambitious the pegged exchange rate (that is, the greater is e ) the longer the peg will last. The smaller the fiscal deficit, the longer the peg will last. The less sensitive money demand is to the interest rate, the longer the peg will last. The smaller the initial money supply, the longer the peg will last. Note that nothing ensures that T is strictly positive. The interpretation of a negative T is that at date 0 it becomes known that the central bank has pegged the exchange rate and is embarking on monetizing the fiscal deficit. At time zero, the public is surprised: it has perfect foresight, except that it did not anticipate becoming aware of the policy at time zero. If the pegged exchange rate is too ambitious ( e is too small) or the deficit is too large, then the exchange rate will collapse immediately at time zero. A graphical representation of this formal argument is seen in the following figure. 3 shadow float pegged exchange rate time T Time is on the horizontal axis and both the shadow float and the pegged exchange rate are graphed. The shadow float, the path the exchange would take if reserves had fallen to zero and the peg had collapsed, is rising over time because the money supply is growing over time. Since the exchange rate cannot jump, the time of the collapse occurs when the floating rate that would prevail if the collapse occurred is equal to the pegged exchange rate. It is now shown that reserves jump down at T. To maintain the peg, the central bank must set mt = e + y* . By equation (3) this requires ln Bth + Btf = e + y* . Taking the ( ) exponents of both sides (and using exp to denote the exponential function since e is already being used to denote the exchange rate) gives Bth + Btf = exp e + y* .1 Thus, ( ) Btf = exp ( e + y* ) - exp ( bth ) . As time goes to T, lim Btf = exp ( e + y* ) - exp ( b0h + mT ) . By ( ) t®T * ( ) equation (6), lim Bt = exp e + y - exp e + y - am . This is strictly positive if f t®T * exp ( e + y* ) éë1- exp ( -am ) ùû > 0. This is true if exp (am ) > 1. This is true because am > 0. Thus, reserves jump down at time T. This is seen in the figure below. reserves time T 1 Recall that if x > 0, then exp(ln(x)) = x. 4