More useful tools for public finance

advertisement

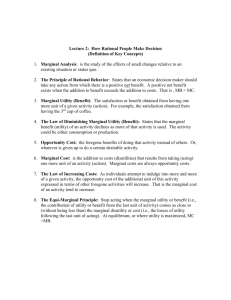

More useful tools for public finance Today: Size of government Expected value Marginal analysis Empirical tools Crashers? I should receive the waitlist from the Undergraduate Office on Monday Go through list of people from here on Monday No add codes given until next week Please let me know if you are now enrolled in the class New crashers? Check with me after class Last time Ground rules of this class If you were not here Mon., look at class website http://econ.ucsb.edu/~hartman/ You can find syllabus and lecture slides on-line Introduction to Econ 130 Introduction to public finance The role of government in public finance Today: Four topics Size of government Expected value Useful in topics like health care Marginal analysis How big is it, and how has it changed? Useful in many topics in economics Empirical tools Regression analysis is the most common statistical tool used Size of government The constitution gives the federal government the right to collect taxes, in order to fund projects State and local governments can do a broad range of activities, subject to provisions in the Constitution 10th Amendment: Limited power in the federal government Local governments derive power to tax and spend from the states Size of government How to measure the size of government Number of workers Annual expenditures Types of government expenditure Purchases of goods and services Transfers of income Interest payments (on national debt) Budget documents Unified budget (itemizes government’s expenditures and revenues) Regulatory budget (includes costs due to regulations) Government expenditures, select years 1 2 3 4 Total Expenditures (billions) 2005 Dollars (billions)* 2005 Dollars per capita Percent of GDP 1960 123 655 3,627 24.3% 1970 295 1,201 5,858 28.4% 1980 843 1,749 7,679 30.2% 1990 1,873 2,574 10,289 32.2% 2000 2,887 3,237 11,461 29.4% 2005 3,876 3,876 13,066 31.1% *Conversion to 2005 dollars done using the GDP deflator Source: Calculations based on Economic Report of the President, 2006 (Washington, DC: US Government Printing Office, 2006), pp. 280, 284, 323, 379 Gov’t expenditures, selected countries Figure 1.1: Government expenditures as a percentage of Gross Domestic Product (2005, selected countries) 0.6 0.5 0.4 0.3 0.2 0.1 United States 0 Sweden France Germany United Kingdom Canada Japan Australia Source: Organization for Economic Cooperation and Development [2006]. Figures are for 2005. Federal expenditures Figure 1.2: Composition of federal expenditures (1965 and 2005) 100% 90% Note increase in Social Security, Medicare and Income Security 80% 70% Other Net interest 60% Note Social security decline in Defense Income security 50% Medicare Health 40% Defense 30% 20% 10% 0% 1965 2005 Source: Economic Report of the President [2006, p. 377]. State and local expenditures Figure 1.3 Composition of state and local expenditures (1965 and 2002) 100% 90% 80% Increase in public welfare Decline in highways 70% 60% Other Public welfare 50% Highways Education 40% 30% 20% 10% 0% 1965 2002 Source: Economic Report of the President [2006, p. 383]. Figure 1.4: Composition of federal taxes (1965 and 2005) Federal taxes Social insurance and individual income tax have become more important Corporate and other taxes have become less important 100% 90% 80% 70% 60% Other Social insurance 50% Corporate tax 40% Individual income tax 30% 20% 10% 0% 1965 2005 Source: Economic Report of the President [2006, p. 377]. State and local taxes Figure 1.5: Composition of state and local taxes (1965 and 2002) 100% 90% Individual tax more important 80% Other 70% Grants from federal government Corporation tax 60% 50% Inidividual income tax 40% Sales tax 30% Property tax 20% 10% Property tax less important 0% 1965 2002 Source: Economic Report of the President [2006, p. 383]. Summary: Size of government Government spending in the US, as a percentage of GDP, has increased in the last 50 years Other industrialized countries spend more than the US (as a percentage of GDP) Composition of taxing and spending has changed in the last 50 years Mathematical tools Two mathematical tools will be important throughout the quarter Expected value Marginal analysis Think of marginal and derivative in the same way Expected value Expected value is an average of all possible outcomes Weights are determined by probabilities Formula for two possible outcomes EV = (Probability of outcome 1) (Payout 1) + (Probability of outcome 2) (Payout 2) Expected value example Draw cards from deck of cards Draw heart and receive $12 Draw spade, diamond or club and lose $4 Probability of drawing heart is 13/52 = ¼ Probability of drawing spade, diamond or club is 39/52 = ¾ EV = (1/4)($12) + (3/4)(-$4) = $0 No expected gain or loss from this game Another example Insurance buying People are usually risk averse This type of person will accept a lower expected value in return for less risk Numerical example Income of $100,000 with probability 0.8 Income of $40,000 with probability 0.2 Expected income Expected income is the weighted sum of the two possible outcomes $100,000 0.8 + $40,000 0.2 = $88,000 A risk averse person would be willing to take some amount below $88,000 with certainty How much below $88,000? Wait until Chapter 8 Marginal analysis Quick look at marginal analysis Important in many tools we will use this quarter We look at “typical” cases Marginal means “for one more unit” or “for a small change” Mathematically, marginal analysis uses derivatives Marginal analysis We will look at four topics related to marginal analysis Marginal utility and diminishing marginal utility The rational spending rule Marginal rate of substitution and utility maximization Marginal cost, using calculus Example: Marginal utility Marginal utility (MU) tells us how much additional utility gained when we consume one more unit of the good For this class, typically assume that marginal benefit of a good is always positive Example: Diminishing marginal utility Banana quantity (bananas) Total utility (utils) 0 0 Marginal utility (utils/banana) 70 1 70 50 2 120 30 3 150 10 4 160 5 5 165 Diminishing marginal utility Notice that marginal utility is decreasing as the number of bananas increases Economists typically assume diminishing marginal utility, since this is consistent with actual behavior The rational spending rule If diminishing marginal utility is true, we can derive a rational spending rule The rational spending rule: The marginal utility of the last dollar spent for each good is equal Goods A and B: MUA / pA = MUB / pB Exceptions exist when goods are indivisible or when no money is spent on some goods (we will usually ignore this) The rational spending rule Why is the rational spending rule true with diminishing marginal utility? Suppose that the rational spending rule is not true We will show that utility can be increased when the rational spending rule does not hold true The rational spending rule Suppose the MU per dollar spent was higher for good A than for good B I can spend one more dollar on good A and one less dollar on good B Since MU per dollar spent is higher for good A than for good B, total utility must increase Thus, with diminishing MU, any total purchases that are not consistent with the rational spending rule cannot maximize utility The rational spending rule The rational spending rule helps us derive an individual’s demand for a good Example: Apples Suppose the price of apples goes up Without changing spending, this person’s MU per dollar spent for apples goes down To re-optimize, the number of apples purchased must go down Thus, as price goes up, quantity demanded decreases MRS and utility maximization Utility maximization Necessary condition is that marginal rate of substitution of two goods is equal to the slope of the indifference curve (at the same point) At point E1, the necessary condition holds Utility is maximized here Marginal cost, using calculus Suppose that a firm has a cost function denoted by TC = x2 + 3x + 500, with x denoting quantity produced Variable costs are x2 + 3x Fixed costs are 500 Marginal cost is the derivative of TC with respect to quantity MC = dTC / dx = 2x + 3 Notice MC is increasing in x in this example Summary: Mathematical tools Expected value is the weighted average of all possible outcomes Marginal means “for one more unit” or “for a small change” We can use derivatives for smooth functions Marginal analysis is important in many economic tools, such as utility, the rational spending rule, MRS, and cost functions Empirical tools Economic models are as good as their assumptions Empirical tests are needed to show consistency with good theories Empirical tests can also show that real life is unlike the theory Causation Economists use mathematical and statistical tools to try to find the effect of causation between two events For example, eating unsafe food leads you to get sick How many days of work are lost by sickness due to unsafe food? The causation is not the other direction Causation Sometimes, causation is unclear Stock prices in the United States and temperature in Antarctica No clear causation Number of police officers in a city and number of crimes Do more police officers lead to less crime? Does more crime lead to more police officers? Probably some of both Empirical tools There are many types of empirical tools Randomized study Observational study Relies on econometric tools Important that bias is removed Quasi-experimental study Not easy for economists to do Mimics random assignment of randomized study Simulations Often done when the above tools cannot be used Randomized study Subjects are randomly assigned to one of two groups Control group Treatment group Item or action in question not done to this group Item or action in question done to this group Randomization usually eliminates bias Some pitfalls of randomized studies Ethical issues Is it ethical to run experiments when only some people are eligible to receive the treatment? Example: New treatment for AIDS Technical problems Will people do as told? Some pitfalls of randomized studies Impact of limited duration of experiment Often difficult to determine long-run effect from short experiments Generalization of results to other populations, settings, and related treatments Example: Effects of giving surfboards to students UCSB students UC Merced students Observational study Observational studies rely on data that is not part of a randomized study Surveys Administrative records Governmental data Regression analysis is the main tool to analyze observational data Controls are included to try to reduce bias Conducting an observational study L = α0 + α1wn + α2X1 + … + αnXn + ε Dependent variable Independent variables Parameters Stochastic error term L Regression analysis Here, we assume changes in wn lead to changes in L Regression line Standard error Intercept is α0 Slope is α1 α0 wn Regression analysis More confidence in the data points in diagram B than in diagram C Less dispersion in diagram B Interpreting the parameters L = α0 + α1wn + α2X1 + … + αn+1Xn + ε ∂L / ∂wn = α1 ∂L / ∂X1 = α2 Etc. Types of data Cross-sectional data Time-series data “Data that contain information on individual entities at a given point in time” (R/G p. 25) “Data that contain information on an individual entity at different points in time” (R/G p. 25) Panel data Combines features of cross-sectional and time-series data “Data that contain information on individual entities at different points of time” (R/G p. 25) Note: Emphasis is mine in these definitions Pitfalls of observational studies Data collected in non-experimental setting Specification issues Data collected in non-experimental setting Could lead to bias if not careful Example: Education People with higher education levels tend to have higher levels of other kinds of human capital This can make returns to education look higher than they really are Additional controls may lower bias Education example: If we had human capital characteristics, we could include them in our regression analysis Specification issues Does the equation have the correct form? Incorrect specification could lead to biased results Example: The correct form is a quadratic equation, but you estimate a linear regression Quasi-experimental studies Quasi-experimental study Also known as a natural experiment Observational study relying on circumstances outside researcher’s control to mimic random assignment Example of quasi-experimental study A new college opens in a city Will this lead to more people in this city to go to college? Probably These additional people go to college by the opening of the new school We can see the earnings differences of these people in this city against similar people in another city with no college Conducting a quasi-experimental study Three methods Difference-in-difference quasi-experiments Instrumental variables quasi-experiments Regression-discontinuity quasi-experiments We will focus only on the first one These topics are covered more extensively in the econometrics sequence Difference-in-difference method Find two similar groups of people One group gets treatment; the other does not Compare the differences in the two groups Difference-in-difference example Example: Two groups of college freshmen Assume both groups have similar characteristics One group is induced to exercise more The other group is not induced to exercise more Exercise group: Average weight gain of 2 pounds in freshman year Non-exercise group: Average weight gain of 7 pounds in freshman year Difference-in-difference estimate: 2 – 7 = –5 Interpretation: Additional exercise leads to average of 5 fewer pounds gained per person in freshman year Pitfalls of quasi-experimental studies Assignment to control and treatment groups may not be random Not applicable to all research questions Researcher needs to justify why the quasiexperiment avoids bias Data not always available for a research question Generalization of results to other settings and treatments As before: Surfboards to UCSB students and UC Merced students Simulations Sometimes, there is no good data set to statistically analyze an economic problem Some economists use simulations to “do their best” to mimic real life in their models Example: Given a model of the economy, what will happen in my model if I change the federal minimum wage from $9 per hour to $10 per hour A computer will analyze the parameters of the model to estimate the impact Summary: Empirical tools Empirical tools can be useful to test economic theory Bias can be problematic in studies that are not randomized Controls in observational studies may lower bias Quasi-experimental studies can act like randomized experiments What have we learned today? How big government is Mathematical tools Composition of taxes and expenditures has changed since 1965 Expected value and marginal analysis Empirical tools When causation exists, regression analysis is a useful tool Next week Monday: Finish Unit 1 Welfare economics and market failure Cost-benefit analysis Pages 150-157 and 160-165 Certainty equivalent value Pages 33-39 and 45-47 Pages 175-177 Wednesday: Begin Unit 2 Public goods Have a good weekend