IRS Tangible Property Regs (Oct 22 2015 MACE)

advertisement

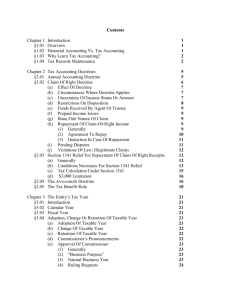

Final Tangible Property Regulations: Overview Richard G. Furlong, Jr. Main Line Association for Continuing Education Penn State Great Valley Conference Center October 22, 2015 Internal Revenue Code - General Rules Section 162 allows a deduction for ordinary and necessary business expenses, including amounts paid for incidental repairs and maintenance. Section 263(a) requires taxpayers to capitalize, rather than deduct, amounts paid to acquire, produce, or improve tangible and intangible property. Capitalized costs generally are recovered through depreciation (for tangible property) or amortization (for intangible property). 2 Purpose of Final Regulations The final regulations combine the case law and other authorities into a useful framework to assist taxpayers in distinguishing currently deductible tangible property costs from capital expenditures. In addition, the final regulations simplify the deduction and capitalization rules for tangible property through- Safe harbors Conventions Elections 3 Overview of Final Tangible Property Regulations under Sections 162 & 263(a) § 1.162-3 – Material and Supplies § 1.162-4 – Repairs and Maintenance § 1.263(a)-1 – Capital Expenditures; in general § 1.263(a)-1(f) – De Minimis Safe Harbor Election § 1.263(a)-2 – Acquisition and Production of Tangible Property § 1.263(a)-3 – Improvements to Tangible Property 4 Acquisition and Production Costs – § 1.263(a)-2 Requirement to Capitalize – A taxpayer must capitalize amounts paid to acquire or produce a unit of real or personal property (UOP), including- Invoice price; Transaction costs; Costs for work performed prior to the date the UOP is placed in service by the taxpayer; and Amounts paid to defend or perfect title to a UOP Important Exceptions: De Minimis Safe Harbor Election -- § 1.263(a)-1(f) Materials and Supplies -- § 1.162-3 5 De Minimis Safe Harbor Election Purpose The de minimis safe harbor election is intended to eliminate the burden of determining whether every small-dollar expenditure for the acquisition or production of property is properly deductible or capitalizable. If a taxpayer elects to use the de minimis safe harbor, the taxpayer does not have to capitalize the cost of certain de minimis acquisitions. 6 De Minimis Safe Harbor Election Effect A safe harbor; Not a limitation! An otherwise deductible amount is still deductible, even if the amount does not qualify under the de minimis safe harbor: Incidental materials and supplies, Non-incidental materials and supplies, or Repair and maintenance costs. The de minimis safe harbor election does not impose any additional capitalization requirements beyond the requirements that were already in place prior to the final regulations. 7 Applicable Financial Statement (AFS) A financial statement required to be filed with the Securities and Exchange Commission (SEC) (the 10-K or the Annual Statement to Shareholders); A certified audited financial statement that is accompanied by the report of an independent certified public accountant (or in the case of a foreign entity, by the report of a similarly qualified independent professional) that is used for— Credit purposes; Reporting to shareholders, partners, or similar persons; or Any other substantial non-tax purpose; or A financial statement (other than a tax return) required to be provided to the federal or a state government or any federal or state agency (other than the SEC or the Internal Revenue Service). 8 De Minimis Safe Harbor Taxpayers with Applicable Financial Statements A taxpayer electing the de minimis safe harbor may deduct and not capitalize or treat as materials or supplies amounts paid to acquire or produce a unit of tangible property, and if— The taxpayer has an AFS; The taxpayer has, at the beginning of the taxable year, written accounting procedures treating as an expense for non-tax purposes— o Amounts paid for property costing less than a certain dollar amount; or o Amounts paid for property with an economic useful life of 12 months or less; The taxpayer treats the amounts paid during the taxable year as an expense on its AFS in accordance with its written accounting procedures; and The amount paid for the property does not exceed $5,000 per invoice (or per item substantiated by invoice). 9 De Minimis Safe Harbor Taxpayer without Applicable Financial Statement A taxpayer electing the de minimis safe harbor may deduct and not capitalize or treat as materials or supplies amounts paid to acquire or produce a unit of tangible property, and if— The taxpayer does not have an AFS; The taxpayer has, at the beginning of the taxable year, accounting procedures treating as an expense for non-tax purposes— o Amounts paid for property costing less than a certain dollar amount; or o Amounts paid for property with an economic useful life of 12 months or less; The taxpayer treats the amounts paid for the property as an expense on its books and records in accordance with its accounting procedures; and The amount paid for the property does not exceed $500 per invoice (or per item substantiated by invoice). 10 De Minimis Safe Harbor – Election and Coordination with Section 263A The De Minimis Safe Harbor is an annual election. It is not a change of accounting method. How to Make the Election will be discussed later. Even if the taxpayer elects the de minimis safe harbor, amounts paid for tangible property qualifying under the safe harbor may be subject to capitalization under section 263A if the amounts paid for property comprise the direct or allocable indirect costs of other property produced by the taxpayer or property acquired for resale. 11 Effect of Final Tangible Property Regulations on Materials and Supplies Rules In most cases, the final regulations do not change the general rules for deducting materials and supplies. Merely incorporate pre-existing precedents regarding the definition and treatment of materials and supplies Add safe harbors to provide additional certainty for taxpayers. 12 Materials & Supplies – § 1.162-3 Definition: A material or supply is tangible property that is used or consumed in the taxpayer’s operations, that is not inventory, and that— Components - Is a component acquired to maintain, repair, or improve a unit of property (UOP) owned, leased, or serviced by the taxpayer and that is not acquired as part of any single unit of tangible property; or Consumables - Consists of fuel, lubricants, water, and similar items that are reasonably expected to be consumed in 12 months or less, beginning when used in operations; or 12 Month Property - Is a UOP that has an economic useful life of 12 months or less, beginning when the property is used or consumed in the taxpayer’s operations; or $200 Property - Is a UOP that has an acquisition cost or production cost of $200 or less; or Other Identified Property - Is identified in published guidance. 13 Materials and Supplies – Treatment Incidental Materials & Supplies – Amounts paid to acquire or produce incidental materials and supplies that are carried on hand and for which no record of consumption is kept or of which physical inventories at the beginning and end of the year are not taken, are deductible in the taxable year in which these amounts are paid or incurred, provided taxable income is clearly reflected Non-Incidental Materials & Supplies – Deductible in year in which the materials and supplies are first used in the taxpayer’s operations or are consumed in the taxpayer’s operations. 14 Materials and Supplies – Treatment Continued Rotable & Temporary Spare Parts – Three Options: Deductible in the taxable year in which the taxpayer disposes of the part; Elect to Capitalize and Depreciate (also Standby Emergency Spare Parts); or Optional Method of Accounting for Rotable and Temporary Spare Parts; De minimis Safe Harbor – Taxpayer must apply the de minimis safe harbor, if elected, to materials and supplies that qualify under the safe harbor. 15 Applying the Final Regulations to Materials and Supplies Because the final regulations governing the treatment of materials and supplies are based primarily on prior law, many taxpayers who were previously in compliance with the rules generally will still be in compliance. Generally no action will be required to continue to apply these rules on a prospective basis. Taxpayers who are not in compliance or who want to change one or more accounting methods to begin using certain beneficial aspects of the materials and supplies rules generally would change their method of accounting. How the change is made will be discussed 16 later. Effect of Final Regulations on Improvements v. Repairs – Simplifying Alternatives If the amounts are not for an improvement to tangible property, then the amounts are generally deductible as repairs and maintenance expenses. Tax law has always required an evaluation of the taxpayer’s facts and circumstances (facts and circumstances analysis). The final regulations provide several safe harbors and simplifying elections to ease taxpayers’ compliance with these rules: • Safe Harbor Election for Small Taxpayers • Safe Harbor for Routine Maintenance • Election of Capitalize Repair and Maintenance Costs 17 Improvements to Units of Property (UOP) Improvements to tangible property must be capitalized under IRC 263(a) Was an improvement made? Ask yourself the following questions: 1. What is the unit of property to be analyzed for determining whether there is an improvement? 2. Does the work performed constitute an improvement to the relevant unit of property? 18 Question 1. Unit of Property – § 1.263(a)3(e) Analytical Framework Categories of Property– Buildings (including Condos, Coops, and Leased Buildings or Leased Parts of Buildings) Non-Buildings (all components that are functionally interdependent) o Plant Property (e.g., manufacturing plant) o Network Assets (e.g., railroad track) o Leased Property other than Buildings Additional Rule – Different MACRS class or method 19 Unit of Property – Buildings § 1.263(a)-3(e)(2) The unit of property is the building and its structural components. However, an amount is paid to improve a building if the amount is paid for an improvement to— Building Structure (building and structural components except for designated building systems); or Any Building System-o HVAC o Plumbing o Electrical o Escalators o Elevators o o o o Fire Protection and Alarm Security Gas Distribution Systems identified in guidance 20 Unit of Property –Non-Buildings § 1.263(a)-3(e)(3) General Rule - Functional Interdependence All components that are functionally interdependent comprise a single unit of property. Components are functionally interdependent if the placing in service of one component is dependent on the placing in service of the other component. 21 Non-Buildings Exception to Functional Interdependence Plant Property - § 1.263(a)-3(e)(3)(ii) Definition: Machinery or equipment used to perform an industrial process, such as manufacturing, generation, warehousing, distribution, automated materials handling in service industries, or other similar activities. Rule: The unit of property is comprised of each component (or group of components) within the plant that performs a discrete and major function or operation within the functionally interdependent machinery or equipment. 22 Unit of Property—Depreciation Conformity Exception – § 1.263(a)-3(e)(5) Depreciation Conformity – Separate Unit of Property If at the time the UOP is initially placed in service and the taxpayer has properly treated the component as being within a different MACRS class than the class of the UOP of which the component is a part or, the component was properly depreciated using a different depreciation method than the depreciation method of the Unit of Property of which the component is a part, then it must be treated as a separate unit of property. Subsequent Change in Classification– Consistent Change in Treatment In any taxable year after the UOP is initially placed in service by the taxpayer, if taxpayer or IRS changes the treatment of that property to a proper MACRS class or a proper depreciation method (for example, as a result of a cost segregation study or a change in the use of the property), then the taxpayer must change the UOP determination for that property under this section to be consistent with the change in treatment for depreciation purposes. 23 Question 2. Determining an Improvement to the Unit of Property General Rule - § 1.263(a)-3(d) An improvement is defined as amounts that: Are for a betterment to the unit of property; Restore the unit of property; or Adapt the unit of property to a new or different use. 24 Betterments - § 1.263(a)-3(j) An UOP is improved as a betterment only if the amount paid— Fixes a material condition or material defect that existed prior to the acquisition or that arose during the production of the property; or Is for a material addition (including a physical enlargement, expansion, extension, or addition of a major component) to the UOP or a material increase in capacity (including additional cubic or linear space) of the UOP; or Is reasonably expected to materially increase the productivity, efficiency, strength, quality, or output of the UOP. Appropriate Comparison - Normal wear and tear or damage during the use of the property 25 Restorations - § 1.263(a)-3(k) An amount restores a unit of property (or in the case of a building, the building structure or a building system) only if it meets one of the following 6 criteria— 1. The amounts paid is for the replacement of a component of the UOP and the taxpayer has properly deducted a loss for that component (other than a casualty loss); or 2. The amounts paid for the replacement or a component of the UOP and the taxpayer has properly taken into account the adjusted basis of the component in realizing gain or loss resulting from the sale or exchange of the component; or 26 Restorations - § 1.263(a)-3(k) - Continued 3. The amounts paid is for the restoration of damage to the property for which the taxpayer is required to take a basis adjustment as a result of a casualty loss under section 165, or relating to a casualty event described in section 165, but limited to the basis in the UOP; or 4. The amounts paid returns the property to its ordinarily efficient operating condition if the UOP has deteriorated to a state of disrepair and is no longer functional for its intended use; or 5. The amounts paid results in the rebuilding of the UOP to a like-new condition after the end of its class life; or 6. The amounts paid is for the replacement of a part or combination of parts that comprise a major component or a substantial structural part of the UOP. 27 Replacement of a Major Component or Substantial Structural Part - § 1.263(a)-3(k)(6) Major Component - performs a discrete and critical function, except “incidental components” Special Rule for Buildings – a major component can also include a significant portion of a major component of the building structure or a building system o Example: Taxpayer replaces 60% of the pipes in its plumbing system - Pipes would be a major component, and 60% would be a significant portion of that major component. Substantial Structural Part - a part or combination of parts that make up a large portion of the physical structure of the unit of property (or in the case of a building, the building structure or a building system) 28 Amounts that Adapt Property to a New or Different Use - § 1.263(a)-3(l) An amount is paid to adapt a UOP (or in the case of a building, the building structure or a building system) to a new or different use if the adaptation is not consistent with the taxpayer’s ordinary use of the property at the time originally placed in service by the taxpayer Example: Amounts paid to convert a manufacturing plant into a retail showroom adapts the building structure to a new or different use. 29 Safe Harbor for Small Taxpayers § 1.263(a)-3(h) – General Rule The requirements of the safe harbor election for small taxpayers are: Average annual gross receipts less than $10 million; and Owns or leases building property with an unadjusted basis of less than $1 million; and The total amount paid during the taxable year for repairs, maintenance, improvements, or similar activities performed on such building property doesn't exceed the lesser of: 2% of the unadjusted basis of the eligible building property; or $10,000 If amounts paid by the taxpayer during the taxable year for an eligible building exceed this limitation, then the taxpayer must apply the general rules of the final regulation to all its amounts paid in connection with that building to determine the proper treatment. 30 Safe Harbor for Routine Maintenance § 1.263(a)-3(i) – General Rule General Rule: An amount paid for routine maintenance on a Unit of Property does not improve the property. What is Routine Maintenance? Amounts that meet all of the following criteria: Amounts paid for recurring activities that it expects to perform; and As a result of use of the property in its trade or business; and To keep the property in its ordinarily efficient operating condition; and The taxpayer reasonably expects, at the time the property is placed in service, to perform the activities: For building structures and building systems, more than once during the 10-year period beginning when placed in service, or For property other than buildings, more than once during the class life of the unit of property. 31 Safe Harbor for Routine Maintenance Application Rules Exception and Inclusion: Betterments - doesn't apply Restorations – does apply in certain cases If all of the requirements for the routine maintenance safe harbor are not met, the amounts may be deductible under the facts and circumstances analysis. Generally, no action is required for taxpayers who were in compliance with prior rules. Taxpayers that are not in compliance or that want to use the safe harbor method generally would change their method of accounting. How to make the election will be discussed later. 32 Election to Capitalize Repair and Maintenance Costs - § 1.263(a)-3(n) General Rule - A taxpayer may elect to treat repair and maintenance costs paid during the taxable year as improvements subject to the allowance for depreciation if: The taxpayer pays these amounts in carrying on a trade or business; and The taxpayer treats these amounts as capital expenditures on its books and records regularly used in computing its income. 33 Applicability Dates Generally, the final regulations apply to taxable years beginning on or after January 1, 2014. In certain circumstances (such as the de minimis safe harbor & the materials and supplies rules) the final regulations apply to amounts paid or incurred in taxable years beginning on or after January 1, 2014. 34 Making an Election An election is made annually and it is not a change of accounting method. You do not file a Form 3115, Application for Change in Method of Accounting, to make an election or to stop applying an election for a subsequent tax year. You make an election by attaching a statement for each election to your timely filed original federal tax return including any extensions for the taxable year in which the amounts subject to the election are paid. For each of the Elective Provisions the statement should be titled as follows: “Section 1.263(a)-1(f) De Minimis Safe Harbor Election” “Section 1.263(a)-3(h) Safe Harbor Election for Small Taxpayers” “Section 1.263(a)-3(n) Election” for the Election to Capitalize Repair and Maintenance Costs 35 Making an Election – Continued The statement should include the following: The taxpayer’s name Address Tax Identification Number, and A statement indicating that the taxpayer is making (specify the election) For the Safe Harbor Election for Small Taxpayers the statement requires you to include a description of each eligible building property to which you are applying the election 36 Method Changes to Comply with the Final Regulations In general, many taxpayers will be required to change their methods of accounting to utilize certain provisions in the final regulations. A change in method of accounting includes a change in the treatment of an item affecting the timing for including the item in income or the timing for taking the item as a deduction. For example, a taxpayer that has been capitalizing certain amounts that it characterized as improvements and that would like to currently deduct the amounts as repairs and maintenance costs pursuant to the final regulations is changing its method of accounting. 37 Method Changes to Comply with the Final Regulations - Continued To change a current accounting method to a new accounting method, a taxpayer is required to obtain the Commissioner’s consent. The Treasury Department and the IRS have provided automatic consent procedures for taxpayers that want to change to a method of accounting permitted under the final regulations. The detailed rules are provided in Rev. Proc. 2015-13 and Rev. Proc. 2015-14 (Sections 6.37-6.40 and 10.11). 38 Method Changes to Comply with the Final Regulations – Form 3115 Generally, a taxpayer makes an automatic change to an accounting method by completing and filing a Form 3115, Application for Change in Accounting Method, and including it with the taxpayer’s timely filed original federal tax return for the year of change. The taxpayer must also file a duplicate copy of its completed Form 3115 with the IRS at Internal Revenue Service 1973 Rulon White Blvd. Mail Stop 4917 Ogden, UT 84201-1000 This application identifies the taxpayer, describes the methods that are being changed, identifies the type of property involved, and includes a section 481(a) adjustment, if applicable. 39 Simplified Procedures for Small Business Taxpayers – Rev. Proc. 2015-20 To ease the administrative burden faced by small business taxpayers that want to prospectively apply the final regulations, and do not wish to compute a section 481(a) adjustment, the IRS has provided a simplified procedure that these taxpayers may use for their first taxable year beginning in 2014. Under this procedure, a taxpayer with a qualifying small business may choose to change to certain methods of accounting under the final regulations by taking into account only amounts paid or incurred in taxable years beginning on or after January 1, 2014. If a taxpayer chooses this procedure for its small business, then the small business will not have a section 481(a) adjustment for its first taxable year beginning 2014, and will not be required to file a Form 3115 to start using the final regulations for 2014. 40 Simplified Procedures for Small Business Taxpayers – Who Qualifies? A taxpayer may choose to apply this procedure to each separate trade and distinct trade or business that meets one or both of the following criteria: Total assets of less than $10 million; or Average annual gross receipts of $10 million or less for the prior three taxable years. If a taxpayer has more than one separate and distinct trade or business, the taxpayer can only choose the simplified procedure for the trades or business that meet at least one of the criteria specified above. A taxpayer may not choose the simplified procedure for any trade or business that does not meet at least one of the criteria above. 41 Simplified Procedures for Small Business Taxpayers – Definitions Separate and Distinct Trade or Business refers to each trade or business for which the taxpayer keeps a complete and separate set of books and records Total Assets are determined by the accounting method regularly used by the taxpayer in keeping the books and records of the trade or business at the end of the tax year Gross receipts are the trade or business’s receipts for the taxable year that are properly recognized under its method of accounting used for federal tax purposes. For more information, see § 1.263(a)-3(h)(3)(iv) of the regulations. 42 Simplified Procedures for Small Business Taxpayers – Effect of Election If a taxpayer chooses this procedure for a qualifying trade or business- For that business, the taxpayer may not take into account certain dispositions of tangible property occurring in taxable years beginning before January 1, 2014, or may not make a late partial disposition election for a disposition during that period; and The taxpayer does not receive audit protection for that trade or business for amounts paid or incurred in taxable years beginning before January 1, 2014, and subject to this procedure. The trade or business must utilize this procedure for all changes specified under the procedure, and may not pick and choose which final regulation methods apply prospectively. 43 Simplified Procedures for Small Taxpayers Other Considerations Generally, if a taxpayer has a separate trade or business that qualifies under these procedures, and does not file a Form 3115 and include a Section 481(a) adjustment for its first taxable year beginning Jan. 1, 2014, then the taxpayer will be presumed to have changed its method for amounts incurred under the final regulations under these procedures. Thus, if this taxpayer decides to change these accounting methods for the same business in later taxable year by filing a Form 3115 and calculating a section 481(a) adjustment in the later year, then the section 481(a) adjustment is calculated by taking into account only amounts paid or incurred, and dispositions, in taxable years beginning in 2014. 44 Summary Generally, Materials, Supplies, and Repairs and Maintenance are deductible expenses. An amount paid for the betterment, restoration, or adaptation to unit of tangible property must be capitalized. Elections (e.g., De Minimis) – No Form 3115 is needed. An annual election is NOT a change in method of accounting. Form 3115 is needed for method changes to comply with the Final Regulations. Qualifying Small Business Taxpayers may use the Simplified Procedures in Rev Proc 2015-20 45 IRS.gov Resources Final Tangible Regulations [Treasury Decision 9636] IRS.gov/Businesses/Small-Businesses-&-SelfEmployed/Tangible-Property-Final-Regulations (FAQs) Revenue Procedure 2015-20 for qualifying small business taxpayers Rev. Proc. 2015-13 Rev. Proc. 2015-14 (section 10.11) 46 Contact Information Richard G. Furlong, Jr. Senior Stakeholder Liaison IRS Small Business/Self-Employed Division 267-941-6343 richard.g.furlong@irs.gov 47