OBI EE - dbmanagement.info

advertisement

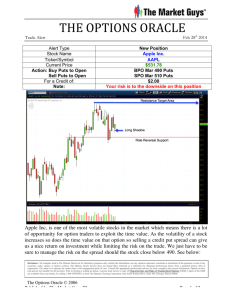

<Insert Picture Here> Integrating with Oracle Business Intelligence Enterprise Edition (OBI EE) Business Justification: Tools Integration • By implementing business intelligence objects, Warehouse Builder can be integrated with reporting environments seamlessly. © 2008 Oracle Corporation – Proprietary and Confidential 2 Integrating with OBI EE Oracle Data sources Warehouse Builder Data Siebel CRM Data Data Warehouse Oracle EBS ETL Data objects Data quality Other sources SAP/R3 Oracle BI Metadata Database Repository OBI EE Enterprise Semantic Layer (RPD) OBI EE Server Dashboards Distribute metadata Data OBI SE End user layer Ad hoc reports PeopleSoft © 2008 Oracle Corporation – Proprietary and Confidential 3 Integration with OBI SE (Discoverer) • Deploy objects directly into Oracle Business Intelligence Standard Edition (OBI SE) End User Layer (EUL). • Benefits: • Completeness: BI design in Warehouse Builder • Productivity: Direct building of reports based on Warehouse Builder design by end users Oracle Discoverer module contains: – Item Folders (module level) – Business Areas –Item Folders (business area level) –Drill Paths –Lists of Values –Alternative Sort Orders –Drills to Detail –Registered Functions © 2008 Oracle Corporation – Proprietary and Confidential 4 Lesson Agenda • Integrating with Business Intelligence Tools • OBI SE • OBI EE • Steps to derive, deploy, and transfer BI Metadata into OBI EE Server © 2008 Oracle Corporation – Proprietary and Confidential 5 Transfer BI Metadata to OBI EE Server Typical Steps to Transfer BI Metadata to the OBI EE Server Deploy BI metadata Derive BI metadata in Warehouse Builder Generate the UDML file © 2008 Oracle Corporation – Proprietary and Confidential Transport the UDML file to the OBI EE Server Convert the UDML file to the OBI EE repository file 6 Setting Up the UDML File Location 1 2 Transport Type determines how you want to transfer the UDML file to the file system where OBI EE is installed. If the Warehouse Builder repository and the OBI EE are on a single machine, select FILE. This prompts for a directory (rootpath) and file name. The UDML file will be saved to that directory upon deployment. © 2008 Oracle Corporation – Proprietary and Confidential 7 Creating a New Catalog Folder Select the source objects for the Catalog folder © 2008 Oracle Corporation – Proprietary and Confidential 8 Deriving the BI Metadata (OBI EE) Design Type Derived OBISE Object Deployed OBI SE Object Collection Catalog Folder Catalog Folder Dimension (star) + Dimension Role to such dimensions Logical Table; Items; Joins; Dimension Drill Path Logical Table; Items; Joins; Cube Logical Table; Items; Joins Logical Table; Items; Joins; Presentation Table Table, View, External Table Logical Table; Items; Joins Logical Table; Items; Joins; Presentation Table © 2008 Oracle Corporation – Proprietary and Confidential Dimension; Presentation Table 9 Deriving the BI Metadata 1 Right-click the module that contains the objects and select Derive. 2 Select the source objects for derivation. © 2008 Oracle Corporation – Proprietary and Confidential 10 Deriving the BI Metadata 3 4 Select the target catalog folder to derive the metadata into. Set the Rules for derivation. © 2008 Oracle Corporation – Proprietary and Confidential 11 Deriving the BI Metadata Dimensions derive into Logical Tables and Dimension Drill Paths nodes. Cubes derive into Logical tables. © 2008 Oracle Corporation – Proprietary and Confidential 12 Deploying the BI Module View Script A UDML file for each object is generated. A master SALES_EE.udml file is generated in the root path you specified while creating the BI location. © 2008 Oracle Corporation – Proprietary and Confidential 13 Converting the UDML File for OBI EE • The UDML file is converted into an RPD file and then opened in the OBI EE Admin tool. 1. Convert the UDML file to an .rpd file by using the following command: • <OBIEE_INSTALL>\OracleBI\server\Bin\nQUDMLExec -I source.udml -O tgt.rpd 2. Move this .rpd file into the OBI EE repository directory by using the following command: • copy tgt.rpd <OBIEE_INSTALL>\OracleBI\server\Repository 3. Configure the OBI EE initialization files. Edit <OBIEE_INSTALL>\OracleBI\server\Config\NQSConfig.INI to change the entry under [REPOSITORY]. This is required so that the repository can be used in reporting tools such as Answers or Dashboards. © 2008 Oracle Corporation – Proprietary and Confidential 14 Oracle BI Admin and Answers Tool Open the .rpd file in the BI Admin tool. It shows the Presentation, Business, and Physical layers. Log in to Oracle BI Answers tool and create reports. © 2008 Oracle Corporation – Proprietary and Confidential 15 •OBIEE is a Business Intelligence (BI) tool set that will make data mining and analysis possible. It’s a framework for leveraging data for tactical and strategic use. “Without data, we just went on opinion. There was no data to back up instructional needs of kids. It takes what in education was often driven by intuition into showing quantitative proof.” “Data without analysis doesn’t teach you anything, and analysis without action doesn’t change anything.” Cindy Goldsworthy Assistant Superintendent Derry Township School District •BI Administrator Tool •Oracle Analysis •Oracle Interactive Dashboards •Oracle BI Publisher •The administrator tool is used to manage the business logic, physical connections, security, and how available data sources are presented to the end users. •These areas are all managed through a single file – RPD. • Physical Layer • Business Layer • Presentation Layer •Dashboards are the standard interface for the majority of users. •It allows multiple reports to be displayed in a tabbed interface. •The reports are interactive and can be clicked on to interact with the data. © 2008 Oracle Corporation – Proprietary and Confidential 20 General Overview • You can publish for Report ,document or other paper based something. • The system can simple analysis about company. • Support for supply chain. • Easily integration [3] © 2008 Oracle Corporation – Proprietary and Confidential 21 First looking[8] © 2008 Oracle Corporation – Proprietary and Confidential 22 Interactive Dashboard • Why is this important? • Answer • Everything is not install and working ,We must see that developing and understandable. 1.Great GUI support 2.Changing some item for each user 3.Ease of use for user[1] © 2008 Oracle Corporation – Proprietary and Confidential 23 •Makes the creation of high fidelity reports possible. •BI Publisher templates can be designed using Word, Excel, Adobe Acrobat. • Share Reports • Share Development Efforts • Share Business Rules • Administrative Efficiency • Licensing Efficiency • Hardware Efficiency Oracle’s EPM Vision: Extend Operational Excellence to Management Excellence Competitive Advantage MANAGEMENT EXCELLENCE OPERATIONAL EXCELLENCE Time © 2008 Oracle Corporation – Proprietary and Confidential 25 Enabling Management Excellence Traditional Performance Management SMART AGILE ALIGNED © 2008 Oracle Corporation – Proprietary and Confidential 26 Oracle’s EPM System EPM Workspace Performance Management Applications BI Applications Business Intelligence Foundation Fusion Middleware OLTP & ODS Systems Data Warehouse Data Mart © 2008 Oracle Corporation – Proprietary and Confidential OLAP SAP, Oracle, Siebel, PeopleSoft, Custom Excel XML Business Process 27 What Gartner Is Saying “The majority of customers are purchasing and implementing BI and CPM as disparate point solutions, which weaken their ability to achieve pervasive BI or to link BI platform and CPM suites capabilities into an integrated continuum to drive business transformation from the strategic level to the process level” Source: Employ a Coordinated Approach to BI and CPM, April 2007 © 2008 Oracle Corporation – Proprietary and Confidential 28 Comprehensive BI Applications EPM Workspace Performance Management Applications BI APPLICATIONS Sales Service Contact Center Marketing Procurement & Spend Supply Chain & Order Mgmt Finance HR Business Intelligence Foundation Fusion Middleware OLTP & ODS Systems Data Warehouse Data Mart © 2008 Oracle Corporation – Proprietary and Confidential OLAP SAP, Oracle, Siebel, PeopleSoft, Custom Excel XML Business Process 29 Enabling the Insight-Driven Enterprise 1. Empower Everyone – Every person is provided with relevant, complete and consistent information tailored to their function and role. 2. Provide Real-time Intelligence – Deliver insight that predicts the best next step, and deliver it in time to influence the business outcome 3. Use Insight to Guide Actions – lead people to take action based on facts to optimize decisions, actions and customer interactions Becoming an insight-driven enterprise will drive the next level of value creation and competitive advantage for organizations. © 2008 Oracle Corporation – Proprietary and Confidential 30 Oracle BI Applications Complete, Pre-built, Best Practice Analytics Auto Comms & Media Complex Mfg Consumer Sector Energy Financial Services High Tech Insurance & Health Life Sciences Public Sector Travel & Trans Sales Service & Contact Center Marketing Procurement & Spend Supply Chain & Order Management Financials Human Resources Pipeline Analysis Service Effectiveness Campaign Effectiveness Direct / Indirect Spend Revenue and Backlog General Ledger Employee Productivity Forecast Accuracy Customer Satisfaction Customer Insight Buyer Productivity Inventory Accounts Receivable Compensation Sales Team Effectiveness Resolution Rates Product Propensity Off Contract Purchases Fulfillment Status Accounts Payable Compliance Reporting Up-sell/ Cross-sell Service Rep Efficiency Loyalty & Attrition Supplier Performance Customer Status Cash Flow Workforce Profile Cycle Times Service Cost Market Basket Analysis Purchase Cycle Time Order Cycle Time Profitability Retention Analysis Lead Conversion Churn & Service Trends Campaign ROI Employee Expenses BOM Analysis Expense Management Return on Human Capital and Other Operational & Analytic Sources Source adapters: Oracle BI Suite Enterprise Edition Plus © 2008 Oracle Corporation – Proprietary and Confidential 31 Marketing Organizations Struggle to Use Data and Intelligence to Increase Performance KEY CHALLENGES EXAMPLES Lack of Campaign Insight for Successful Lead Generation • Unable to link vehicle, target list, offer and message mix with campaign success • Lack of complete visibility into campaign effectiveness and downstream sales conversion rates • Limited understanding on campaign response rates Limited Visibility into Marketing Performance & Accountability • Unable to determine campaign ROI • No means to assess segment penetration effectiveness and perform cross sell analysis • No knowledge of effectiveness of marketing funds in generating sales Lack of Customer Insight into Buying Behavior • Lack of visibility into common customer-preferred product and service bundles • Inability to establish correlation between customer buying patterns and behavioral attributes Unable to Control and Manage Marketing Spend • Limited information to effectively control marketing expenses • No means to know marketing cost distribution across customer profiles • Inability to make fact based resource allocations © 2008 Oracle Corporation – Proprietary and Confidential 32 Oracle Marketing Analytics Provides Insight to Optimize Spending and Drive Demand ANALYSIS & METRICS BENEFITS Marketing Planning • Sales alignment • Competitor pipeline • Forecast & Actual expenses by time • Executive scorecard report • Expense analysis by time • Financial information on marketing tactics Marketing Performance • Monitor campaign performance to take timely corrective action to improve efficiencies Customer Insight (B2B) • Make intelligent resource allocations based on effectiveness of tactics • Campaign scorecard • Campaign trends • Campaign pipeline • Cross sell analysis • Account revenue • Revenue growth • Account status • # of new accounts • Cumulative revenue trend • Oppty revenue by product • Demographics profile of responders • Market basket analysis • Account attrition • Next product purchased • Over promoted customers • Track expenses and reduce wasted spend Customer Insight (B2C) • Increase customer profitability with better buyer behavior insight Events • Improve cross-selling • Income/Age range • Customer counts • Top events ranking • Event expenses • Event scorecard • # of customer interactions • # of new contacts • Contact attrition • Events by region/type • Events lead generation • Opportunity revenue © 2008 Oracle Corporation – Proprietary and Confidential 33 Oracle Marketing Analytics Complete solution for entire marketing organization Marketing Planning Provides Marketing Planning related information. The information is organized for different roles like Marketing Executive, Director, Finance Director. The dashboard also has a Sales Alignment page to allow Sales and Marketing Executives to co-ordinate activities Campaign Performance Provides Campaign Results data by Offer, Segment, Agent performance. Manager can monitor a campaign scorecard and identify root causes for shortfalls in meeting predicted goals Customer Insight Provides product affinity, market basket and next product purchased analysis. Provides demographic information and information on impact of customer behavior due to marketing activities. Marketing Events Analytics Provides Analytics related to management of trade shows, customer events etc. Marketing Events Analytics can show analysis of Event registrations, expenses on supplies by vendor, region, event etc., Event ROI analysis that is fully integrated with Marketing Planning Analytics. © 2008 Oracle Corporation – Proprietary and Confidential 34 Complementary BI Applications Complete Solution for entire Campaign-to-Cash Process Sales Analysis • Analyze pipeline opportunities and forecasts to determine actions required to meet sales targets. • Determine which products and customer segments generate the most revenue and how to effectively cross-sell and up-sell. • Understand which competitors are faced most often and how to win against them. Supply Chain & Order Management Analytics • Provides insight into critical Order Management business processes and key information, including Orders, Order Fulfillment, Invoices, G/L Revenue, sales effectiveness and customer scorecards. • The delivered analysis of every step in the back-office sales processes from Order to Cash, enables companies to respond more quickly to customer issues and resolve them before they become problems. © 2008 Oracle Corporation – Proprietary and Confidential 35 Complementary Oracle Application Marketing Segmentation • Highly Interactive Interface • Drag and drop criteria definition and grouping, across multiple customer levels • Simplified query terminology (‘Start with’, ‘Keep’, ‘Add’, ‘Exclude’ customers) • “Waterfall” style display of counts • Sample counts for large data sets • Personal and shared subject areas • Fully Integrated on Analytics Platform • Queries across many different stars and subject areas, allowing complex queries • Shields the marketer from underlying data complexity and performance optimization • Uses same meta data as reporting tools; leverages all available calculations and metrics, plus data mining models • Enforcement of Global Rules • Consistently apply governance rules (such as profiling, privacy, contact frequency) © 2008 Oracle Corporation – Proprietary and Confidential 36 <Insert Picture Here> Value of Prebuilt Oracle BI Applications © 2008 Oracle Corporation – Proprietary and Confidential 37 Key Benefits of Oracle BI Applications • Insight • Alignment Gain visibility and insight into business performance, processes, and customers Better decisions, actions, control at all levels Respond faster to opportunities and threats Identify and replicate best practices • Leverage © 2008 Oracle Corporation – Proprietary and Confidential 38 Role-Based Best Practices Provide Relevant and Actionable Insight for Everyone Marketing Analytics – Key Objectives and Questions by Role Optimizing Marketing Performance for Competitive Advantage VP Marketing / CMO • • How is the marketing budget being consumed? What areas / programs are trending to go over budget? • • How should I allocate the marketing budget to generate the best results? What areas historically have yielded the best results? Deeper Insights for Marketing Strategy • Marketing Director • • Which customers segments are unprofitable and why? What is our most profitable acquisition method? What trade shows generated a positive ROI? • • • How can we increase revenue through more effective a cross-sell/up-selling? What can we do to increase customer satisfaction and loyalty? What types of promotions deliver the most revenue lift? Better Manage Acquisition & Campaign Performance MARCOM / DM Manager • • Do purchased lists perform better than our house list and why? Is the sales organization picking up the Leads in a timely manner? © 2008 Oracle Corporation – Proprietary and Confidential • • Which marketing campaigns generated the most qualified leads? Which programs / campaigns yield the highest take rate? 39 Marketing Process Relationship Map Core Processes Marketing Campaign Management Sales Sales Execution Management Processes Planning & Budgeting Support Processes Event Management Needs Analysis © 2008 Oracle Corporation – Proprietary and Confidential 40 Example Response and Lead Management Process Marketing Plan, budget Execute campaigns Nurture prospects Track, measure results Marketing/Sales Operations Capture, load responses Sales Development Call Center Cleanse, enrich, score responses Assign leads Assign oppty, notify rep Qualify leads, create opptys Field Sales and Channel Sales Set objectives, define “lead” © 2008 Oracle Corporation – Proprietary and Confidential Accept or reject opptys Work opptys 41 End-to-End Campaign to Cash Flow Key Questions Business Process Quality Information Is Needed During All Stages Plan Design Target How do I set some realistic goals for this campaign? What should campaign flow look like? Any related events? Who is target audience? How much shall I spend? How to allocate the budget? Which Product offer and through which channel? Who are more likely to respond? How to segment them? Launch When should the campaign be launched? Shall I launch it in waves? Track Are the responses, leads, opportunities, orders etc. matching the plan? Analyze How was campaign performance? How much did I spend? What is the revenue? ROI? Maximizing Campaign Effectiveness Will Enable High Return on Marketing Investment and Drive Sales Revenues © 2008 Oracle Corporation – Proprietary and Confidential 42 Campaign to Cash Flow Example Decision Flow Marketing Executive Role Business Objective Marketing Planning & Execution Are we on target to meet our goals? What campaigns are under / over performing? Gain Insights Are we generating quality leads from these campaigns? How are these leads converting to orders Take Action Drill to Campaign to modify © 2008 Oracle Corporation – Proprietary and Confidential 43 Campaign to Cash Flow Example, MARCOM Manager Plan Business Objective Design Target Launch Track Analyze Set campaign goals What is historical campaign performance for similar tactics? Gain Insights What was the plan for those campaigns? Was the actual in line with the goal for various measures? Take Action © 2008 Oracle Corporation – Proprietary and Confidential Did they get anticipated response? How was the lead generation? How many orders? How was the revenue? What was the plan on spending ? Did the expense stay within planned budget ? Are there any patterns with large variance? Analyze variance by Time, Region, Organization etc. Plan the campaign with these data points 44 Campaign to Cash Flow Example, MARCOM Manager Plan Business Objective Design Take Action Launch Track Analyze Design the Campaign / program Analyze similar campaigns / programs which provided strong ROI Gain Insights Target If the campaign flow was phased, would it be more effective? When is best time to launch marketing events? How was the response rate in the past for similar product launch / offers? For this product and target, which channel works best? What is inferred leads generated? Design the flow © 2008 Oracle Corporation – Proprietary and Confidential Build program flow 45 Campaign to Cash Flow Example, MARCOM Manager Plan Business Objective Gain Insights Take Action Design Target Identify the target audience Identify similar tactics. Which customers did I target in those campaigns? Conduct campaign history analysis to identify potential contact lists © 2008 Oracle Corporation – Proprietary and Confidential Launch Track What is purchasing behavior of those potential targets? Have they been contacted through other campaigns in the recent past? What is the demographic profile of those customers / prospects? Exclude people from the list based on the contact frequency and their preferences Identify target market segments using past purchase behavior and likelihood of responding Finalize the target Analyze 46 Campaign to Cash Flow Example, MARCOM Manager Plan Business Objective Design Take Action Launch Track Analyze Start campaign When is last campaign completing? Gain Insights Target Are there other ongoing campaigns? Are all channels capable of handling increased volume of interactions? © 2008 Oracle Corporation – Proprietary and Confidential Have all treatment / media been approved? Have response assignments rules been prepared? Execute launch of campaign across all channels 47 Campaign to Cash Flow Example, MARCOM Manager Plan Business Objective Design Track campaign / program results Are the actual in line with the goal for each metric? Gain Insights Take Action How was the campaign response? What are the number of bounced interactions? Review response accuracy © 2008 Oracle Corporation – Proprietary and Confidential Target Launch Track Analyze Is the marketing generating enough quality leads for the sales force? Is the sales force converting those leads to opportunities in a timely manner ? Are these Opportunities leading to Quotes ? What is Actual Order Revenue from the campaigns? Review response to lead to order conversion rates and cycle times 48 Campaign to Cash Flow Example, MARCOM Manager Plan Business Objective Design Analyze campaign execution Did marketing message get successfully delivered? Gain Insights Take Action Target Launch Track Analyze campaign performance Have we updated contact information based on success/failure of delivery? What is response rate? Which channel generated more responses? What percentage of the people I contacted responded ? How quick was response qualification? What is lead generation rate? Analyze leads by geography, marketing source, time etc. Campaign delivery metrics Review campaign execution cycle times Campaign response and lead metrics © 2008 Oracle Corporation – Proprietary and Confidential Analyze What is the actual expense and cost involved? How is the ROI ? How does it compare against other campaigns ? Develop Campaign ROI Analysis 49 Key Benefits of Oracle BI Applications • Insight • Alignment Gain a single, consistent view of enterprise information across functions & data sources Align strategy and execution across functions Use guided analytics and best practice analytic workflows to drive the best actions • Leverage © 2008 Oracle Corporation – Proprietary and Confidential 50 Typical Operational Challenges Analyses, Reports Executives Sales Marketing Operations Sales Data Marketing Data Operations Operations Data 1 Data N IT Finance Data 1 Finance Data N Data Warehouse • Delayed, inaccurate reporting • Conflicting, departmentally-biased results © 2008 Oracle Corporation – Proprietary and Confidential Finance • Cross-functional analysis only by IT • Sub-optimal enterprise performance 51 Procurement Operations Finance HR/Workforce Customers Marketing Sales Customers Service Customers Distribution Valuable Insights Often Require Data from Multiple Departments and Sources Suppliers Suppliers Suppliers How does lead quality affect conversion rates, pipeline build up and revenue ? How does sales performance of sales reps relate to their tenure in the team/organization? Does on- time shipment relate positively to repeat purchases? © 2008 Oracle Corporation – Proprietary and Confidential 52 Maximizing Customer Value Key Objectives in Sales, Marketing, Customer Service FRONT OFFICE BACK OFFICE • Primary role: identify, acquire & support customers • Key objective: grow revenues and profit by maximizing customer value • Primary functions: Sales, Marketing, Service, Contact Center • Primary role: buy, make, and deliver products, support the workforce, and manage finances • Key objective: maximize operational efficiency, quality & accuracy while controlling costs • Primary functions: Finance, HR, Supply Chain Operations, Procurement, Order Management Customers Front Office © 2008 Oracle Corporation – Proprietary and Confidential Back Office Suppliers 53 Typical Business Challenges SALES MARKETING • How are actual sales tracking against forecast and plan by region? • What are the best products to cross and up-sell? • Why are sales opportunities being lost? • Which campaign tactics are most effective? • Which offers are succeeding with different customer segments? • What is the product mix compared to plan? CONTACT CENTER • What are average handle times and abandonment rates? • Which are the most productive and efficient CSR’s and why? • What are the best cross-sell and up-sell offers for each segment? SERVICE • How do I reduce costs while maintaining high customer satisfaction? • What are quality levels and component failure rates by product? • How long is it taking to resolve new service requests? © 2008 Oracle Corporation – Proprietary and Confidential 54 Deeper Insight within Business Functions SALES ANALYTICS CONTACT CENTER ANALYTICS • • • • • • • • Improve pipeline visibility Forecast with confidence Increase cross & up-selling Quickly spot opportunities/threats Understand service cost drivers Optimize staffing for call volumes Monitor CSR performance & drivers Detect defects early MARKETING ANALYTICS SERVICE ANALYTICS • Identify high potential segments • Maximize return on marketing spend • Track campaign results & impact • Improve customer service • Drive efficiency, lower costs • Provide single view of customer © 2008 Oracle Corporation – Proprietary and Confidential 55 Alignment across Functions SALES ANALYTICS • Improve lead follow-up and conversion • Understand campaign impact on revenue • Improve customer product and service offerings MARKETING ANALYTICS © 2008 Oracle Corporation – Proprietary and Confidential • Best align switch workflows to increase customer satisfaction • Convert inbound service calls to sales Understand customer profitability and tailor customer experience • Devise marketing programs to deflect product availability or quality issues • Understand how marketing promotions impact service centers CONTACT CENTER ANALYTICS • Monitor and manage service channel usage/mix • Understand compliance of call handling to SLA’s • Monitor customer satisfaction vs. service cost SERVICE ANALYTICS 56 Alignment across the Enterprise Front Office Sales Analytics Marketing Analytics Contact Center Analytics Service Analytics Back Office • Impact of product mix and discounts on revenue and margins • Correlation between training & compensation and worker productivity • Visibility into supply chain enabling delivery of the perfect order • Complete visibility across value chain to better manage supply and demand fluctuations © 2008 Oracle Corporation – Proprietary and Confidential Financial Analytics HR Analytics Supply Chain & Order Mgmt Analytics Procurement & Spend Analytics 57 Oracle BI Applications Provide a Single Integrated View of Enterprise Information INTEGRATED DATA WAREHOUSE • Integrated enterprise-wide intelligence • Summary level to lowest level of detail • Data warehousing best practices – conformed dimensions, lowest level of granularity, full change histories for time comparisons, built for speed, extensible DATA INTEGRATION FROM MULTIPLE SOURCES • Call center telephony (IVR, ACD, CTI) • Syndicated data • Universal Adapters © 2008 Oracle Corporation – Proprietary and Confidential 58 Key Benefits of Oracle BI Applications • Insight • Alignment • Leverage © 2008 Oracle Corporation – Proprietary and Confidential Do more with less - deploy BI more broadly with fewer IT resources than custom-build Accelerate time-to-value, lower TCO and risk Increase the value of existing data and applications, including CRM and ERP 59 Building BI Solutions is Challenging Investment, Skills and Time Required Develop detailed understanding of operational data sources Design a data warehouse by subject area License an ETL tool to move data from operational systems to this DW Build ETL programs for every data source License interactive user access tools Research/understand analytic needs of each user community These steps require multiple different BI and DW technology INVESTMENTS These steps require IT or BI staff resources with specialized SKILLS Build analytics for each audience License/create information delivery tools Set up user security & visibility rules Perform QA & performance testing Manage on-going changes/upgrades © 2008 Oracle Corporation – Proprietary and Confidential These steps take TIME to understand and perfect as knowledge of best practices is learned 60 Marketing Analytics Components 1 Pre-built warehouse with 15 star-schemas designed for analysis and reporting on Marketing data 3 Pre-mapped metadata defining real-time access to analytical and operational sources, best practice calculations, and metrics for marketing. Presentation Layer Logical Business Model Physical Sources 2 Pre-built ETL to extract data from over 1,000 4 A “best practice” library of over 500 pre-built operational tables and load it into the DW, sourced from CRM systems and other sources metrics, Intelligence Dashboards, Reports and alerts for marketing analyst, managers and executives. © 2008 Oracle Corporation – Proprietary and Confidential 61 More than just dashboards and reports Value of BI Apps lies under the surface DASHBOARDS& REPORTS • Prebuilt best practice library • “One size does NOT fit all” SUBJECT AREAS • Many metrics and dimensional attributes not surfaced by prebuilt dashboards and reports • Possibilities are endless • Incremental work to build tons more content from this foundation © 2008 Oracle Corporation – Proprietary and Confidential 62 Unrivaled Integration with Oracle Apps Extends BI Value. Lowers TCO. ACTION LINKS – “INSIGHT TO ACTION” INTEGRATED SECURITY Seamless navigation from analytical information to transactional detail One login. Right content for each user. Data Security Object Security INTEGRATED WITH PLANNING AND EPMS INTEGRATED WORKFLOW Intelligence-driven business processes BPEL, ESB User Security View performance “in-context” with budgets and plans Oracle BI © 2008 Oracle Corporation – Proprietary and Confidential 63 Unrivaled Integration with Oracle Apps Deeply Integrated into Siebel CRM • Single user interface - essential for driving user adoption • Action Links - direct navigation from record to transactional while maintaining context • Take action immediately without navigating to a different screen © 2008 Oracle Corporation – Proprietary and Confidential 64 Unrivaled Integration with Oracle Apps Deeply Integrated into Siebel CRM • Integrated Data Security Visibility • One login. Right content for each user based on • Position • Owner • Organization Data Security © 2008 Oracle Corporation – Proprietary and Confidential 65 Align Actions with Best Practices Guided & Conditional Navigation Helps Novice Users GUIDED NAVIGATION • Enables users to quickly navigate a standard path of analytical discovery specific to their function and role • Enhances usability and lowers learning curve for new users CONDITIONAL NAVIGATION • Appears only when conditions are met and alerts users to potential out of ordinary conditions that require attention • Guides users to next logical step of analytical discovery © 2008 Oracle Corporation – Proprietary and Confidential 66 Speeds Time To Value and Lowers TCO Build from Scratch with Traditional BI Tools Oracle BI Applications Training / Roll-out Results Define Metrics & Dashboards • • • Faster time to value Lower TCO Assured business value DW Design Training / Rollout Back-end ETL and Mapping Define Metrics & Dashboards DW Design Back-end ETL and Mapping Months or Years Easy to use, easy to adapt Role-based dashboards and thousands of pre-defined metrics Prebuilt DW design, adapts to your EDW Prebuilt Business Adapters for Oracle, PeopleSoft, Siebel, SAP, others Weeks or Months Source: Patricia Seybold Research, Gartner, Merrill Lynch, Oracle Analysis © 2008 Oracle Corporation – Proprietary and Confidential 67 Typical Effort & Customization balance Dashboards & Reports OBIEE Metadata DW Schema ETL Degree of Customization © 2008 Oracle Corporation – Proprietary and Confidential Easy Moderate Intermediate Involved Additional dashboards and reports, guided and conditional navigations, iBots, etc. Additional derived metrics, custom drill paths, exposing extensions in physical, logical and presentation layer, etc. Extension of DW Schema for extension columns, additional tables, external sources, aggregates, indices, etc. Extension of ETL for extension columns, descriptive flexfields, additional tables, external sources, etc. Level of Effort 68 The Value is Below the Surface Oracle BI Applications • Dashboards • Pre-built ETL across multiple applications and sources • Pre-mapped metadata • Pre-built metrics • Pre-built data model © 2008 Oracle Corporation – Proprietary and Confidential 69 BI Applications - Business Content Over 5,000 pre-defined assets Application Dashboards Dashboard Pages Reports Metrics 14 33 620 555 Marketing 5 27 124 501 Service 8 15 102 465 Contact Center 5 17 72 448 Finance 4 30 205 360 HR 4 16 76 138 Supply Chain & Order Mgmt. 2 18 157 388 Procurement & Spend 2 14 103 161 All Industry Apps 44 147 1117 508 Total 88 317 2576 3524 Sales © 2008 Oracle Corporation – Proprietary and Confidential 70 Selected Key Entities of Business Analytics Warehouse Sales Opportunities Quotes Pipeline Order Management Sales Order Lines Sales Schedule Lines Bookings Pick Lines Billings Backlogs Marketing Campaigns Responses Marketing Costs Supply Chain Purchase Order Lines Purchase Requisition Lines Purchase Order Receipts Inventory Balance Inventory Transactions Finance Receivables Payables General Ledger COGS Call Center ACD Events Rep Activities Contact-Rep Snapshot Targets and Benchmark IVR Navigation History Service Service Requests Activities Agreements Workforce Compensation Employee Profile Employee Events Pharma Prescriptions Syndicated Market Data Financials Financial Assets Insurance Claims Public Sector © 2008 Oracle Corporation – Proprietary and Confidential Benefits Cases Incidents Leads Conformed Dimensions Customer Products Suppliers Internal Organizations Customer Locations Customer Contacts GL Accounts Employee Sales Reps Service Reps Partners Campaign Offers Cost Centers Profit Centers Modular DW Data Warehouse Data Model includes: ~350 Fact Tables ~550 Dimension Tables ~3,500 prebuilt Metrics (2,000+ are derived metrics) ~15,000 Data Elements 71 Rapid Deployments Oracle BI Applications 6 weeks 9 weeks 10 weeks 12 weeks 3 months 3½ months 100 days © 2008 Oracle Corporation – Proprietary and Confidential 72 Business Intelligence Customers Select References Communications Automotive Finance / Banking Consumer Goods High Tech Media / Energy Aero / Industrial Insurance / Health Life Sciences Other © 2008 Oracle Corporation – Proprietary and Confidential 73 Holistic View of Customer Information Enables Alignment of Marketing and Service World’s leading manufacturer and marketer of major home appliances. Deployed Oracle BI Suite EE and Oracle Marketing Analytics integrated with Siebel CRM Call Center Application. Before After No centralized customer view Multiple siloed customer data sources hampered marketing abilities Slow time-to-market with marketing campaigns despite millions spend on outside vendors Call center unable to effectively use customer data to enhance service or capitalize on sales opportunities Companywide, holistic view of information by customer, household and asset Consolidated 3 customer databases into 1 Accelerated marketing campaign introductions to capitalize on trends Provided call centers with information and tools to up-sell customers and establish “closed loop” marketing capabilities “With Oracle, Whirlpool business units are capitalizing on the integration between our business intelligence, call center, and marketing solutions to drive revenue creation and customer loyalty incentives.” - Thomas Mender, Whirlpool Corporation © 2008 Oracle Corporation – Proprietary and Confidential 74 Optimize CRM Processes and Performance 1,250 Users, 400 Reports, 3 Months, 1 IT Admin Pitney Bowes is the world’s largest producer of postage meters. Implemented Oracle BI Applications (Sales, Service, and Marketing Analytics) to over 1,250 employees. Before After Poor measurement of employee performance in sales and service Lack of customer insight - no consistent, real-time view Slow “Customer Inquiry Response Time” No single source of customer data for segmentation High reliance on IT for information “Turned the tides” in sales force with better insight into performance Enhanced sales productivity with 360o view of customer relationship Increased customer responsiveness, leading to greater satisfaction / retention Unified customer data for better marketing segmentation and targeting Customer-facing employees empowered with the information they need “One of the most important values of Oracle’s BI solution is its TCO. We created 400 reports used by 1,250 users with a staff of one within a few months—that is very cost effective.” – William Duffy, Data Warehousing Project Manager © 2008 Oracle Corporation – Proprietary and Confidential 75 Safe Harbor Statement The preceding is intended to outline our general product direction. It is intended for information purposes only, and may not be incorporated into any contract. It is not a commitment to deliver any material, code, or functionality, and should not be relied upon in making purchasing decisions. The development, release, and timing of any features or functionality described for Oracle’s products remains at the sole discretion of Oracle. © 2008 Oracle Corporation – Proprietary and Confidential 76 Some Terms • OBI EE: Oracle Business Intelligence Enterprise Edition • This is the “strategic” BI Platform for Oracle that was inherited from the Siebel acquisition. • OBI SE: Oracle Business Intelligence Standard Edition • This is the new packaging of Oracle Discoverer & other legacy Oracle BI technologies. • Pre-Packaged Oracle BI Applications • BI application solutions for EBS, PSFT, JDE, SEBL, and SAP, that generally include pre-built ETL, DW, Metrics, Reports & Dashboards. • These solutions are: • DBI: Daily Business Intelligence • EPM: Enterprise Performance Management BI Applications • Packaged, subject-specific warehouses and data marts • OBI Applications: Business Intelligence Applications (from Siebel) © 2008 Oracle Corporation – Proprietary and Confidential 77 Oracle Business Intelligence Applications Pre-Siebel Acquisition – Oracle Offerings User Interface (Performance Management Viewer) (Business Objects, Cognos, etc) EBS HCM Warehouse Data Sources Financial Warehouse DBI Apps SCM Warehouse Financials DBI Supply Chain DBI 3rd-Party HCM DBI… BI Platform DBI UI EPM BI Apps JDE Other PSFT Oracle DBI © 2008 Oracle Corporation – Proprietary and Confidential PeopleSoft EPM 78 Oracle Business Intelligence Applications Pre-Siebel Acquisition – Siebel Offerings SBA UI Financial Analytics Workforce Analytics… BI Platform Supply Chain Analytics (Dashboards, Answers, Alerts) User Interface SBA Apps Data Sources JDE Other EBS SAP PSFT SEBL Siebel Business Analytics © 2008 Oracle Corporation – Proprietary and Confidential 79 Oracle Business Intelligence Applications Oracle Offerings Today User Interface EPM BI Apps Financial Analytics Siebel SBA Renamed to: Oracle Business Intelligence Enterprise Edition (OBI EE) HCM Warehouse Financial Warehouse Data Sources SCM Warehouse… Financials DBI DBI Apps (Dashboards, Answers, Alerts) Supply Chain Analytics (Business Objects, Cognos, etc) OBI EE Workforce Analytics… (Performance Management Viewer) Supply Chain DBI 3rd-Party UI HCM DBI… BI Platform DBI UI SBA Apps JDE EBS JDE Other PSFT Oracle DBI © 2008 Oracle Corporation – Proprietary and Confidential PeopleSoft EPM Other EBS SAP PSFT SEBL Siebel Business Analytics 80 Oracle Business Intelligence Applications ‘Better Together’ Offerings – By End FY2007 DBI UI (Performance OBI EE Management 3rd-Party (Business OBI EE Objects, (Dashboards, Cognos, etc) OBI EE Financial Analytics EPM BI Apps Supply Chain Analytics Data Sources Workforce Analytics… DBI Apps (Dashboards, Answers, Alerts) HCM Warehouse CY200 6 Delive ry Financial Warehouse Financials DBI Supply Chain DBI HCM DBI… BI Platform SCM Warehouse … Viewer) (Dashboards, Answers, Alerts)“OBIAnswers, Alerts) EE” as the new UI User Interface SBA Apps JDE EBS JDE Other PSFT Oracle DBI © 2008 Oracle Corporation – Proprietary and Confidential PeopleSoft EPM Other EBS SAP PSFT SEBL Siebel Business Analytics 81 OBI Myths • Myth: Oracle’s BI Technology Strategy is still being debated • Truth: OBI EE technology is the centerpiece of Oracle’s BI Strategy. • Myth: Oracle’s EPM/DBI strategy is going away • Truth: OBI EE is the Business Intelligence platform on which the pre-built Siebel BI Applications are built, and OBI EE is also the new Business Intelligence platform for EPM & DBI. This gives us the ability to offer our customers the “BI application” solution that best meets their needs. • Myth: The Siebel BI Applications are for Siebel CRM only • Truth: These applications are ready to go today for Oracle EBS, PeopleSoft, and SAP, with JDE coming this fiscal year. • Myth: Oracle is going to buy Business Objects (or some other BI vendor…) • Truth: Who knows? A BOBJ (or other) purchase will always be on the radar. But such a purchase has nothing to do with product strategy – OBI EE is the strategic technology choice. • Myth: TSMs sell OBI EE; ASMs sell OBI Applications; BI sells both • Truth: We sell what best fits the customer’s needs. Pre-built BI Apps are a major differentiator, whether it’s EPM, DBI, or SBA. Application deals are 3-4x larger than pure Technology deals. • Message to TSM’s: Would you rather get 100% of a 200K deal, or 50% of a 800K deal (our average sales prices over the past 5 years). © 2008 Oracle Corporation – Proprietary and Confidential 82 BI Challenges Today …not easy to achieve! • • • • • Fragmented In-consistent Report-centric Restricted Non-Intuitive Hasn’t the promise of BI been there for the past decade? © 2008 Oracle Corporation – Proprietary and Confidential 83 The Business Intelligence Marketplace $12B Market Size $10B $8B $6B $4B $2B 0 100 80 60 $7.5B $3.7 B $3.8 B 2003 59 Million CRM 20 $11.1B $6.2 B BI Applications BI Tools $4.0 B 2004 2005E BI Tools $4.7 B $4.5 B $4.2 B 2006E 2007E $4.9 B Source: IDC, 2004 2008E 80% Current % User Penetration 70% 60% 50% SCM 40 $5.6 B $5.1 B $4.6 B $4.1 B 98 Million Estimated User Potential $9.6B $8.8B $8.1B $10.3B 40% BI Apps ERP 0 30% 51% 20% 33% 10% 0 2010 Seat Estimates © 2008 Oracle Corporation – Proprietary and Confidential 66% Sources: Goldman Sachs Estimates & Department of Labor ERP SCM CRM 30% BI Tools 10% BI 84 Apps Insight-Driven Business Processes “Business intelligence (BI) is moving into the context of the business process, not just to make users’ information experience more effective, but also to allow for business process optimization.” Software Macro-Trends: Reshaping Enterprise Software - Sep 2005 © 2008 Oracle Corporation – Proprietary and Confidential 85 Oracle History in the Market • 80-85% of COGN, BOBJ & HYSL’s revenue come from selling their “Tools” on top of an Oracle DW. • SAP sells SAP/BW with every deal – it looks and feels like a clean, integrated story (even if it’s not true). • At Oracle, in Commercial for FY06: • ~18M in total revenue for CPM/EPM • Avg deal size ~$64K • 3rd Largest EPM Deal in Q4: 700K for EPM/Scorecard • And yet $1.4M went to BOBJ for the BI piece • Oracle dominates in the DW market share, but is largely not visible in the BI tools market…not yet at least. © 2008 Oracle Corporation – Proprietary and Confidential 86 Siebel Business Analytics History • In November 2001, Siebel bought nQuire Software – 55 employees, not much revenue, revolutionary BI Platform that is now OBI EE. • In FY2005, 27% of Siebel’s Revenue came from Siebel Business Analytics – both technology & applications. • There are now over 800 SBA (OBI EE) customers • 20% ONLY use the BI Technology (OBI EE ONLY) • 5% ONLY use restricted “application-only” version of OBI EE • 75% use BOTH the pre-packaged BI applications and the BI Technology for custom-built BI applications on existing data warehouses & other sources © 2008 Oracle Corporation – Proprietary and Confidential 87 Siebel Business Analytics History Market Leader in Analytic Applications for Sales, Service, and Marketing Fastest Growing in BI Market 110 Rank 1 2 3 Vendor Siebel Systems SAS Institute NetIQ % Share 15.4% 12.7% 6.0% 100 90 80 70 4 Epiphany 5.8% 60 5 SAP AG 4.1% 50 6 SPSS 3.6% 40 7 Fair Isaac 3.5% 30 8 Business Objects 3.1% 9 Coremetrics 10 NCR Teradata 2.1% 1.9% Sources: IDC Vendor Rankings, Worldwide Customer Analytics Applications (2003), July 2004 © 2008 Oracle Corporation – Proprietary and Confidential 20 10 0 2003 2004 Siebel BI License Rev (U.S. $ Millions) 2005 Revenue $120.3M 88 Oracle & Siebel in the BI “Tools” Marketplace GARTNER COMMENTS ON THE SBA BI Platform “Unlike other mega software vendors, Siebel's BI platform is application source independent and is, arguably, the best front end to a Teradata data warehouse.” “Siebel Business Analytics is one of the more innovative and comprehensive sets of BI Platform acquired from functionality among the BI nQuire Software in Nov platform vendors, including some 2001 advanced analysis and datamining functionality and packaged industry-specific analytical applications.” © 2008 Oracle Corporation – Proprietary and Confidential 89 Siebel Business Analytics History Aerospace & Defense 5 of the top 6 Commercial Banks 4 of the top 5 Pharmaceutical 8 of the top 9 Computer Office Equip 6 of the top 9 Diversified Financials 3 of the top 4 Railroad 3 of the top 4 Medical Products & Equip 3 of the top 6 © 2008 Oracle Corporation – Proprietary and Confidential Telecommunications 5 of the top 6 Securities 3 of the top 6 Network & Comms Equip 2 of the top 4 Life & Health Insurance 3 of the top 5 90 So, the Opportunity for Us • Get in front of Cognos, Business Objects & Hyperion opportunities • Become #1 in the Business Intelligence marketplace in the next 18 months. • Expose SAP’s “black box” BI Applications story • The way we do it is by selling packaged BI Applications, built on the new Oracle BI Platform (SBA), for PeopleSoft, EBS, Siebel, & JDE customers. © 2008 Oracle Corporation – Proprietary and Confidential 91 Procurement Operations Finance HR / Workforce Customers Marketing Sales Customers Service Customers Distribution BI Applications are Almost Always Heterogeneous Suppliers Suppliers Suppliers In a Call Center, how does agent tenure, training, & compensation affect productivity & cross-selling? What impact does supplier performance have on customer satisfaction and revenue consistency? How do my campaigns impact call-handle time & cost to serve? © 2008 Oracle Corporation – Proprietary and Confidential 92 Oracle BI Tools & Packaged BI Applications Front Line Employees Partners Sales Analytics Interactive Dashboards Service Analytics Marketing Analytics Proactive Detection & Alerts Ad-Hoc Analytics Managers Supply Chain Analytics Intelligent Customer Interaction Senior Executives Finance Analytics Workforce Analytics Mobile Analytics Predictive Analytics PreBuilt Enterprise Business Model Oracle Enterprise Business Intelligence Platform Enterprise Data Warehouse (EPM and/or SBA) ETL & Business Adapters Sales & Mktg Fin/HR Service SCM Operational Systems © 2008 Oracle Corporation – Proprietary and Confidential IVR Web Help Desk Customer Interaction Systems Existing Data Warehouse & Data Mart Sources Oracle Business Intelligence Applications • Comprehensive suite of prebuilt analytic applications • For Siebel, SAP, PeopleSoft, Oracle, and other sources • Based on industry and analytic best practices • Enable rapid deployment, low TCO, & assured business value Oracle Enterprise Business Intelligence Platform (EE) • Next-generation, scalable enterprise BI platform • Relevant and actionable insight for all users • Complete, real-time intelligence across enterprise sources • One common, fully-integrated modern web architecture 93 Benefit from BI Applications while maintaining single BI architecture Build from Scratch with Traditional BI Tools BI Applications Training & Roll-out Define Metrics & Dashboards Faster deployment Lower TCO Assured business value DW Design Back-end ETL and Mapping Training & Rollout Specific Metrics & Dashboards DW Design Mod Pre-built ETL Tailoring Quarters or Years © 2008 Oracle Corporation – Proprietary and Confidential Role-based dashboards and alerts Thousands of pre-defined metrics Prebuilt DW design Adaptable to your enterprise DW Prebuilt ETL Business Adapters for Oracle, SAP, others Weeks or months 94 Leverage Prebuilt Oracle BI Applications Proven Rapid Time To Value Deployed to 800 users in under 90 days Finance, Service & Sales Analytics (SAP/SEBL) Live in 120 days Sales Analytics (SEBL) Deployed to 100+ users in 3 months Finance Analytics (Oracle EBS) 4 months from decision to live for 1200 users Pharma Analytics (SEBL) “ Live in 100 days, 9000+ users Finance, Sales, Help Desk and Marketing Analytics (MSFT, SEBL) ” Having had experience of Siebel Business Analytics, I can vouch that it can be deployed as rapidly as they claim...It is a product that really delivers. © 2008 Oracle Corporation – Proprietary and Confidential 95 Dedicated Sales Force for NA Adam Driver SC Director N. America BI Susan Cook GVP Sales N. America BI David Novak Duane Cologne Channels John Duda Sales VP Sales VP Oracle Direct SC Manager Commercial NASA & PS Sales Strategy Commercial BI ERP/CRM/Tech ERP/CRM/Tech 47 BI Sales Reps, 3 Channels, 15 OD, 2 Strategy/Comp Intell © 2008 Oracle Corporation – Proprietary and Confidential Scott Hilner SC Manager NASA & PS ROI Enablement 44 BI Sales Consultants 96 Where’s the Gold: Scenario 1 Oracle Apps, Custom DW, Incumbent BI Characteristics Oracle Apps Customer Custom Data Warehouse Some other BI tool on top Likely Issues Solution • Poor user adoption of operational applications • Integrated OBI apps drive adoption of EBS because and incumbent BI tools (which are separate UI’s) the users get informational value from using EBS • Not getting answers to key business questions; • OBI Apps likely deliver these answers and make it not exploiting the information in EBS much easier to answer new questions • Looking to upgrade the 3rd party BI tool = $$$ • It will likely cost the same or less to move to a more license costs and it’s a re-deployment complete total solution with the OBI Apps • Looking to upgrade EBS, may need to make • This is painful. OBI Apps are clearly the lowest TCO large investments in the BI/DW upgrade option. Easy upgrades are just part of the equation. • Don’t forget about the power of the tech stack • If it’s an Oracle tech stack, your value prop just integration when Oracle is the DW. about doubled. © 2008 Oracle Corporation – Proprietary and Confidential 97 Where’s the Gold: Scenario 2 Oracle Apps, No DW Characteristics Oracle Apps Customer NO Data Warehouse Operational Reporting Tools Only Likely Issues Solution • Do not have a true BI platform; operational • OBI Apps require OBI EE, arguably the most reporting tools only allow for stop-gap, static reporting with little to no flexibility. advanced BI platform on the market. • May have independent data marts that don’t • OBI EE can “glue together” these independent data allow cross-functional questions to be answered. marts, leveraging these investments and allowing the toughest questions to get answered. • Want a real Enterprise Data Warehouse but can’t • OBI Apps include Enterprise Data Warehouse afford to build it, or don’t have the time/knowledge/resources. schemas that often implement in 90-120 days and cost a fraction of the build approach. • Have user adoption and potentially data quality • Naturally, increasing the value of the information issues with EBS. delivered to the end user will drive adoption of the operational application. © 2008 Oracle Corporation – Proprietary and Confidential 98 Where’s The Gold: Scenario 3 New Prospect - Heavy Competition from SAP Characteristics Oracle Apps *Prospect* Heavy Competition from SAP Likely Issues Solution • Probably believe SAP’s approach is more • We need to turn the tide on this perspective – SAP’s scalable and more robust than Oracle’s approach. BI solution will simply NOT work in any environment other than SAP. Furthermore, it’s not cost effective except for a small number of users. • Probably believe SAP BI solution is more • The fact is, SAP BW is very limited in it’s usefulness seamlessly integrated into their ERP applications. They are very good at positioning this. to employees on the front-line. It provides solid information for financials, and is good for executives, but leaves all other employees wanting more. • If they are already an SAP shop, but understand • Oracle BI Applications are pre-packaged for SAP the limitations of BW, you can be sure they are looking at alternate BI vendors (not us). and are more robust than any others on the market due to the strength of the OBI EE platform. © 2008 Oracle Corporation – Proprietary and Confidential 99 Where’s The Gold: Scenario 4 SEBL CRM, SEBL Analytics, ORCL Apps Characteristics SEBL CRM SEBL Analytics (OBI EE) ORCL Apps Likely Issues Solution • Are leveraging the power of an integrated CRM • Easily extend their Siebel Analytics deployment by and BI solution with the Siebel deployment but have not yet realized those benefits with Oracle Applications. including the pre-packaged Oracle BI Applications for ERP – we can’t lose on the economics here. • Are likely custom building data marts or data • We need to find these immediately and convince warehouse for their Oracle Applications and planning on using another BI technology with it. them that the time-to-value on the build vs buy approach is a 5:1 ratio. © 2008 Oracle Corporation – Proprietary and Confidential 100 Where’s The Gold: Scenario 5 Oracle DW, Oracle Tech Shop, Incumbent BI Characteristics Oracle DW Customer Oracle Technology Shop Incumbent BI Technology on Top Likely Issues Solution • Have a maintenance nightmare w/ existing BI • These solutions do NOT manage change or technologies because of too many moving parts, un-integrated technologies, poor performance. upgrades well. They are “report-centric” architectures. Example: moving from BOBJ 6x to XI is a redeployment, not an upgrade. • Want a tighter, more scalable interface b/w BI • Simple question: which BI platform is more tightly tools and Oracle DW integrated with an Oracle DW – Oracle BI EE or anyone else? Same goes for the rest of the technology stack: Identity Mgmt, Portal, BPEL, etc. • Can’t answer questions across different data • OBI EE is the technology leader in the ability to join sources (Oracle, Teradata, SQL, etc.) across multiple data sources. It is also “arguably the best front end to a Teradata DW (Gartner)”. • Can’t integrate BI tools with operational systems • OBI EE is 100% SOA and can be seamlessly integrated into existing UI’s and business processes. © 2008 Oracle Corporation – Proprietary and Confidential 101 <Insert Picture Here> Okcan Yasin Saygili Oracle BI 11g new Features for BGOUG spring events Who am i? • Okcan Yasin Saygili • Free consultant and Instructor • Oracle ACE • Oracle RAC SIG Turkey Chair • Founding member of TROUG • Oracle CAB Membering © 2008 Oracle Corporation – Proprietary and Confidential 103 Agenda • • • • • • • • • • • • Starts with Introduction Key Feature Interactive Dashboard Scorecard feature Enterprise reporting and publishing Integration Another Trick points Olap Analysis System Management Detection and alert Conclusion… © 2008 Oracle Corporation – Proprietary and Confidential 104 <Insert Picture Here> Starts with … Starts with • • • • • • Since 1945 1945:First large scale computer 1950:need for feedback 1952:Computer prediction on TV … 2010.Oracle BIEE © 2008 Oracle Corporation – Proprietary and Confidential 106