Slides for Part 4 - Rose

advertisement

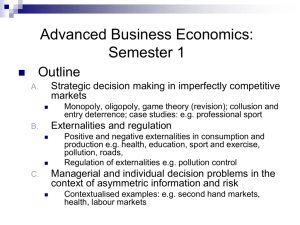

IA 350, Intermediate Microeconomics Part IV – Behavioral Economics A Methodological Approach … Individual Choices Observed Aggregate Outcomes Are the individuals “humans” or are they “econs”?* * This distinction between the way psychologists and economists model the agents in their models was originally suggested by Richard Thaler (see Kahneman, 2011, p269). Strategic Interaction and Social Norms Simple Ultimatum Games Mean offer: ~.37x Modal offer: .50x Offers < .20x often rejected Ultimatum Games and Rationality Consider a two-stage ultimatum game in which player 1 allocates $100 in round 1. If player 2 accepts player 1’s offer, the game ends with the players keeping the respective amounts. If player 2 refuses player 1’s offer in round 1, the game moves to round 2 with the player’s switching roles, and player 2 allocates $25. The same rules apply as in round 1. What is player 1’s optimal offer in round 1? ($75, $25) x = $25 ($1, $24) ($76, $24) x = $24 ($1, $24) x = $23 ($77, $23) ($1, $24) Uncertainty and Loss Aversion “Most respondents in a sample of undergraduates refused to stake $10 on the toss of a coin if they stood to win less than $30.” Value = V($) +v - $10 + (Loss) + $30 -v + (Gain) Uncertainty and Loss Aversion You respondents are offered in thea sample following bet: A fair coin will to bestake tossed. If “Most of undergraduates refused $10 on is heads, youif will x,towhile if itthan is tails theit toss of a coin theywin stood win less $30.”you will lose y. If y is $1, what value of x = would Value V($)you require to accept the $1.63 bet? ______________ If y is $100, what value of x would you require to accept the +v $931 bet? ______________ If y is $1,000, what- value $10 of x would you require to accept $3,212 bet? ______________ + the (Loss) + (Gain) + $30 If y is $10,000, what value of x would you require to accept $100,647 the bet? ______________ -v If y is $100,000, what value of x would you require to $463,824 accept the bet? ______________ A Mean Reverting Walk Down Wall Street What implications do the concepts of “endowment effects” and “loss aversion” have for our understanding of investor behavior and stock market performance? Loss aversion also explains one of the most common investing mistakes: investors evaluating their stock portfolio are most likely to sell stocks that have increased in value or, during a week like this (September 2008), have gone down the least amount. Why? Because it hurts to take a loss. Unfortunately, this means that people end up holding on to their depreciating stocks. Over the long term, this strategy is exceedingly foolish, since it ultimately leads to a portfolio composed entirely of shares that are losing money. (A study by Terrance Odean, an economist at UC-Berkeley, found that the stocks investors sold outperformed the stocks they didn't sell by 3.4 percent). Even professional money managers are vulnerable to this bias, and tend to hold losing stocks twice as long as winning stocks. Because selling shares that have decreased in value makes the loss tangible and losing sucks - we try to postpone the pain for as long as possible. Jonah Lehrer, author of How We Decide http://scienceblogs.com/cortex/2008/09/loss_aversion_and_the_stock_ma.php Time Inconsistency Discounting as a Function of Time Delay and Money Amount Three strong patterns: 1. Discount rates decline with the length of time to be waited. 2. Discount rates decline with the size of reward. 3. Discount rates for gains are higher than for losses. 0.50 Implied Discount Rate 0.45 $40 0.40 0.35 $200 0.30 .025 .020 0.15 $1,000 $5,000 0.10 0.05 0 0 1 2 3 4 Delay in Years Adapted from Thaler, The Winner’s Curse (1992), Figure 8 – 1. Original source given as Benzion et al. (1989), “Discount Rates Inferred from Decisions: An Experimental Study,” Management Science 35: 270 – 284. Time Inconsistency 6. You are working at a job and are currently earning $10,000 a month. You receive a memo that says a new payment plan is under consideration for next year. Instead of receiving monthly paychecks, you can start the new year by receiving your annual salary in a lump sum. (If you quit during the year, you will have to pay back an amount equal to the percentage of the year that you will not be working there, plus interest.) There is a catch, however: if you choose this new plan, your salary will be deduced. What annual salary would you be willing to accept to receive the your entire year's salary in a lump sum at the beginning of the year? Average Minimum Maximum 7. $120,000 $68,136 $200,000 Implied d ~ 0% 120% - 85% You are working at a job and are currently earning $10,000 a month. You receive a memo that says a new payment plan is under consideration for next year. Instead of receiving monthly paychecks, you can receive your annual salary in a lump sum at the end of the year. (If you quit during the year, you will be paid a lump sum equivalent to an amount equal to the percentage of the year that you worked there.) To induce you to sign up for this plan, your salary will be increased. What annual salary would you require to sign up for this end-of-year lump sum payment plan? Average Minimum Maximum $143,000 $100,000 $200,000 Implied d 32% - 34% 92% Time Inconsistency – One Implication The psychology of intertemporal choice complicates the already complicated question of selecting the proper social rate of discount (the rate at which the government should discount future costs and benefits). The standard view is that the market rate of interest, corrected for tax distortions, represents an aggregation of individual time preferences, and is the appropriate social rate of time discounting … But, if individuals do not discount everything at a single rate, then which rate is the one that is appropriate for social discounting? Rhichard Thaler, The Winner’s Curse,1992, pp. 105 – 106. Some observations about the “correctness” of risk assessments: Risk analysis and the assumption of normality S&P 500 – Frequency Distribution of Daily Returns 7% Properties of Distribution Median Mean Standard Deviation Skewness Kurtosis 6% 5% 0.05% 0.03% 0.96% -0.6778 23.0759 4% October 21, 1987 Daily Change: 9.10% Probability: 1.716 X 1021 3% October 19, 1987 Daily Change: -20.47% Probability: 2.038 X 10101 2% October 13, 2008 Daily Change: 11.58% Probability: 1.195 X 1033 1% 0.25 0.20 0.15 0.10 0.05 0.00 -0.05 -0.10 -0.15 -0.20 -0.25 0% Risk Analysis and the Assumption of Normality Mean: Std. Dev.: 0.0323% 0.9653% Range October 19, 1987 +/- s 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 Low -0.9329% -1.8982% -2.8634% -3.8287% -4.7939% -5.7592% -6.7244% -7.6897% -8.6550% -9.6202% -10.5855% -11.5507% -12.5160% -13.4812% -14.4465% -15.4117% -16.3770% -17.3423% -18.3075% -19.2728% -20.2380% -21.2033% -22.1685% -23.1338% -24.0990% High 0.9976% 1.9629% 2.9281% 3.8934% 4.8586% 5.8239% 6.7891% 7.7544% 8.7196% 9.6849% 10.6501% 11.6154% 12.5807% 13.5459% 14.5112% 15.4764% 16.4417% 17.4069% 18.3722% 19.3374% 20.3027% 21.2680% 22.2332% 23.1985% 24.1637% Probailbity 68.2689492% 95.4499736% 99.9487524% 99.9936658% 99.9999427% 99.9999998% 1-Probability 31.7310508% 4.5500264% 0.0512476% 0.0063342% 0.0000573% 0.0000002% October 21, 1987 October 13, 2008 IA 350, Intermediate Microeconomics Part IV – Externalities Externalities Market prices reflect only private valuations and private costs of production. S’ P [= Private + Social Cost] The “Dead Weight Loss” associated With a negative externality. S [= Private Cost] D [= Private Value] P’ P* MSC Q’ Q* Optimal Output -- Society’s View [Social Cost] Q Optimal Output -- Private Market’s View Externalities The Problem of Social Cost (1960) “It is strange that a doctrine as faulty as that developed by Pigou should have been so influential …” Ronald Coase 1910 - “The traditional approach [to the externality problem, the ‘Pigovian’ approach] has tended to obscure the nature of the choice that has to be made. The question is commonly thought of as one in which A inflicts harm on B. But this is wrong. We are dealing with a problem of a reciprocal nature. To avoid the harm to B would be to inflict harm on A … The problem is to avoid the more serious harm.” The Coase Theorem: In the absence of transaction costs, all government allocations of property rights are equally efficient, because interested parties will bargain privately to correct any externality. Implication: Any market plagued by externalities can be made efficient if property rights are clearly defined and assigned (the “missing market” interpretation), and if transaction (bargaining) costs are negligible. Pure Exchange and Externalities B · X’ Good 2 (Externality) · X · A · Good 1 (Income) Pure Exchange and Externalities : The Coase Theorem B · X’ X Good 2 · A · · Good 1 IA 350, Intermediate Microeconomics Part IV – Asymmetric Information Markets with asymmetric information Varian’s “market for plums and lemons” P S plums : P 44Q ps Slemons : P 1100 44Qls 2200 Pplums 1925 P̂plums D plums : P 4400 44 Q pd 1375 P̂lemons Duncertainquality 1100 Plemons pr plums* D plums prlemons* Dlemons Dlemons : P 3300 44Qld Qˆ plums Q plums Qˆ lemons || 43.75 Qlemons || || 56.25 Duncertainquality Q pr plums* D plums prlemons* Dlemons || 50 Adapted from Varian, Intermediate Microeconomics, 8th ed., 719 – 720. His example is itself an adaptation from a famous paper by George Akerlof, “The Market for Lemons: Quality Uncertainty and the Market Mechanism.” Quarterly Journal of Economics 84 (1970): 485 – 500. Markets with asymmetric information Signaling in a Labor Market w cl(e) ch(e) wh b(e) wl e* e Adapted from Varian, Intermediate Microeconomics, 8th ed., 726 – 730. His example is itself an adaptation from a famous paper by Michael Spense, “Job Market Signaling.” Quarterly Journal of Economics 87 (1973): 355 – 374. Markets with asymmetric information General categories of problems of asymmetric information: Adverse Selection: A situation in which individuals possess hidden information, leading to a market selection process that results in a pool of individuals with economically undesirable characteristics. Moral Hazard: A situation in which one party to a contact takes a hidden action that creates benefits at the expense of another party to the contract. Social institutions that help solve these market inefficiencies: Private agent responses to problems of asymmetric information: Signaling – the party possessing private information takes action to generate a credible signal, such as warranties or guarantees. Screening – the party with imperfect information takes action to induce a advantageous sorting of the market, such as an incentive-driven menu of options. Public / Private sector responses to problems of asymmetric information: Compulsory purchase plans (insurance markets) Licensing and certification (note that this may also be done by private agents). Market regulation, including “truth” laws and “insider trading” laws. Agency costs What is the “agency problem” and what are agency costs? Efficiency costs which arise when there is a divergence of interests between parties to a transaction. When one party to a transaction cannot observe the effort of another party, upon whose effort the value of the transaction depends, we say there is a principal-agent problem. Examples: • Shareholders (principal) cannot perfectly monitor the efforts of a CEO (agent) • CEO (principal) cannot perfectly monitor the efforts of managers (agent) In such cases, the principal cannot determine whether a bad outcome was the result of the agent’s low effort or due to bad luck. Basic Principal-Agent Model Principal’s Share Uncertainty Observable Outcome Payoffs Agent’s Share Agent’s Actions Contract The Agency Challenge. To structure a contract that specifies division of payoffs in such a way that the agent’s actions will maximize those payoffs, given two complicating factors: Uncertainty Unobservability of effort Implications of Agency Theory Summary There is an implicit tradeoff between efficient risk bearing and creation of incentive effects. The difference in utility outcomes may be interpreted as the cost of inducing a risk-averse agent to accept some risk Inability to observe effort entails efficiency costs (in terms of lower utility or surplus generated from the transaction.