Document

Payroll Accounting 2011

Bernard J. Bieg and Judith A. Toland

CHAPTER 3

SOCIAL SECURITY TAXES

Developed by Lisa Swallow, CPA CMA MS

Learning Objectives

Identify which persons are covered under social security law

Identify types of compensation that are defined as wages

Apply current tax rates and wage base for

FICA/SECA purposes

Describe different requirements/procedures for depositing FICA/FIT taxes

Complete Forms 941 and 8109

Coverage under FICA

FICA (1935)

Federal Insurance Contributions Act

Tax paid both by employees and employers

6.2% OASDI plus 1.45% HI

SECA (1951)

Self-Employment Contributions Act

Tax upon net earnings of self-employed

(6.2% + 6.2%) = 12.4% OASDI plus (1.45% + 1.45%) = 2.9% HI

3 issues

Are you an EE or an independent contractor?

Is service rendered considered employment?

Is compensation considered taxable wages?

http://www.ssa.gov/employer

Independent Contractor (SECA) vs. Employee (FICA)

Employer “employs one or more individuals for performance of services in U.S.”

IRS uses common-law test to determine status

See Figure 3-2 on p. 3-5 to determine status

Certain occupations specifically covered

Agent- and commission-drivers of food/beverages or dry cleaning

Full-time life insurance salespersons

Full-time traveling salespersons

Individual working at home on products that employer supplies and are returned to furnished specifications

More Specific Situations

Government employees – certain exemptions from OASDI/HI depending upon date of hire

Military personnel - certain types of pay exempt from FICA

In-patriates - may be exempt from FICA (20 countries)

Family employees – in certain situations, children may be exempt from FICA

Household employees

If they make cash wages of $1,700 or more per year

Must pay if domestic employee, like a nanny, is under your control

Additional exemptions - inmates, medical interns, student nurses and workers serving temporarily in case of emergency

Independent Contractor

Persons may be classified as independent contractors if they conduct an independent trade or business

See Figure 3-2 (page 3-5) for characteristics of independent contractors

Hiring agent does not pay/withhold FICA on worker classified as independent

Independent contractor liable for his/her own social security taxes on net earnings

If ER misclassifies EE, penalties will accrue to the ER

If EE did report the earnings on his/her federal tax return, the penalty is voided

What are Taxable Wages?

Cash

Wages and salaries

Bonuses and commissions

Cash value of meals/lodging provided (but only if for

employee’s convenience)

Fair market value of noncash compensation, examples include:

Gifts (over certain amounts)

Stock options

Fringe benefits like personal use of corporate car

Prizes

Premiums on group term life insurance > $50,000

Other types of taxable wages found in Figure 3-3 (page 3-6)

What are Taxable Wages?

Tips greater than $20 or more per month

EE can report tips to ER using Form 4070

ER calculates FICA on tips and withholds from regular paycheck on these reported tips

Must withhold on first paycheck after tips are reported

ER must match FICA on reported tips

“Large employers” (11+ employees) must allocate

[(Gross receipts x .08) – reported tips]

Don’t have to withhold FICA on allocated tips, only reported tips

Have to show allocated tip income on W-2

ER files Form 8027 at year-end with IRS showing food/beverage receipts and reported tips

ER can claim a credit for SS/Medicare taxes paid on employees’ tips on Form 8846

Specifically Exempt Wages

Meals/lodging for employer’s convenience

Sick pay

After 6 consecutive months off (personal injury)

Sick pay by 3 rd party (insurance company/trustee) with specific stipulations for ER match

Pay for difference between employees’ salary and military pay for soldiers/reservists activated more than 30 days

Employer contribution to pension plan

Employer-provided nondiscriminatory education assistance

Job-related educational expenses not subject to FICA

Payments for non-job related expenses up to $5,250

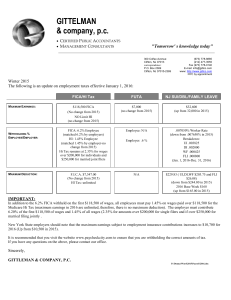

FICA Taxable Wage Base

OASDI wages cap at $106,800 for 2010

HI wages never cap

The Patient Protection & Affordable Care Act of 2010 created additional .9% HI tax on taxpayers receiving wages in excess of $200,000 ($250,000 if married filing jointly) beginning in 2013.

Facts: Tamara earn $132,000/year; paid semimonthly on the

15 th and 30 th ; determine FICA for October 30th payroll

First must find prior payroll YTD gross $132,000/24 =$ 5,500.00

$5,500.00 x 19 payrolls (before today)= $104,500.00

How much will be taxed for OASDI?

$106,800.00 – $104,500.00 = $2,300.00

OASDI tax is $2,300.00 x 6.2% = $142.60

HI tax is $5,500.00 x 1.45% =$ 79.75

Total FICA is $142.60 + $79.75 =$ 222.35

Another Example -

Calculating FICA

Facts: Ahmed earns $175,000/year; paid first of every month; determine FICA for August 1 payroll

What do we calculate first?

$175,000/12 = $14,583.33 per paycheck

YTD gross prior to current payroll =$14,583.33 x 7 = $102,083.31

$106,800.00 – $102,083.31 = $4,716.69 taxed for OASDI

$4,716.69 x 6.2% = $292.43 OASDI tax

$14,583.33 x 1.45% = $211.46 HI tax (remember - no cap!)

Total FICA = $292.43 + $211.46 =$ 503.89

Tax Holiday

Hiring Incentives to Restore Employment

Act of 2010 provides relief for employer’s share of OASDI tax

On wages paid 3/19/10 - 12/31/10

For qualified employees only

Full-time or part-time

Retention credit also available if remain employed for 52 consecutive weeks

SECA and Independent

Contractors

EE and ER portion of FICA if net earnings exceed $400

Net Earnings = Net income + distributive share of partnership income

If you own more than one business - offset losses and income and calculate FICA based on combined net income

Can have W-2 and self employment income

Count both towards calculating cap of $106,800 for OASDI

Report on Schedule C “Profit or Loss from Business”

Also file Schedule SE “Self-Employment Tax”

Must include SECA taxes in quarterly estimated payments

Calculating FICA with W-2 and

Self-Employed Earnings

Facts: Celia’s W-2 = $107,768 and her selfemployment income = $14,500; how much is

FICA on $14,500?

No OASDI because capped on W-2

HI = $14,500 x 2.9% = $420.50

Total FICA = $420.50

Calculating FICA with W-2 and

Self-Employed Earnings

Facts: Felipe’s W-2 = $78,000 and his selfemployment income = $36,000; how much is

FICA on $36,000?

OASDI ($106,800 - 78,000) = $28,800 taxable

OASDI wages x 12.4% = $3,571.20

HI = $36,000 taxable HI wages x 2.9% =

$1,044.00

Total FICA $3,571.20 + 1,044.00 = $4,615.20

How to Get Set Up with SSA

One employer identification number (EIN) per employer

Obtain directly from http://www.irs.gov

with no preregistration necessary

TELE-TIN to obtain (EIN) immediately at 1-800-829-4933

Can still fax/mail Form SS-4

If purchasing an existing business, new owner needs own EIN

SSN required for everyone that is employed or self-employed

To apply for social security number file SS-5

W-7 for ITIN (aliens who must file a tax return, but are ineligible for SS #)

Required for children age one or over who are claimed as dependents on federal income tax return

Three ways available for employers to verify SSNs – via internet, telephone or paper request

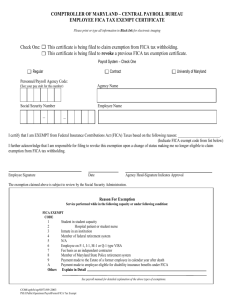

Depositing FIT & FICA

FICA & FIT always deposited together

Each November, IRS notifies ER whether they will be a monthly or semiweekly depositor for next calendar year

Monthly - pay FICA and FIT by 15th of following month

Semiweekly

If payroll was W-F, deposit by next Wednesday

If payroll was S-T, deposit by next Friday or

Amount deposited may be affected by safe harbor rule (see p. 3-19)

One day - $100,000 or more of federal payroll tax liability, taxpayer has until close of next banking day

or

No deposit required - owe less than $2,500 in entire quarter, wait and pay when 941 report is filed

Different requirements for agricultural and household employees

*New employers are monthly depositors unless $100,000+ of liability triggers one-day rule

Credit Against Required

941 Deposits

Consolidated Omnibus Budget Reconciliation Act

(COBRA) gives involuntarily terminated employees option to continued coverage under company’s group health insurance

Can continue coverage up to 15 months

Government subsidizes 65% of this cost

Company is ‘reimbursed’ its 65% by taking a deduction on

Form 941

Employee pays 35%

How to Deposit FIT/FICA

Electronically

EFTPS (Electronic Federal Tax Payment System)

Most employers must use EFTPS – major exception is for businesses owing $2500 or loss in quarterly tax liabilities

Enroll in EFTPS Online at http://www.eftps.gov

All new employers automatically pre-enrolled

Two methods

ACH debit method – withdraw funds from employer’s bank account and route to Treasury

ACH credit method – employer instructs his/her bank to send payment directly to Treasury

How to Deposit FIT/FICA by Coupon

Federal Tax Deposit Coupons, Form 8109

Will most likely not be used beginning 1/1/11

Take to Treasury Tax & Loan institution or mail to

Financial Agent at Federal Tax Deposit Processing in St.

Louis, MO

Timely deposits requires postmarking two days before due date

Federal depository stamps date on coupon and forwards to IRS

Coupon has stub that ER keeps as payment record

How to Report and

Reconcile FIT/FICA

File Form 941 (Employer’s Quarterly Federal Tax Return)

Download at www.irs.gov/formspubs/ or call 1-800-829-3676

Due on last day of month following close of quarter

January 31, April 30, July 30, October 31

If that falls on weekend or legal holiday, file next business day

Payments made with 941if taxes for quarter are less than

$2,500 or making monthly deposit (attach 941-V)

Electronic filing options available for employers who meet requirements

Complete an e-file application & then electronically submit 941 or apply for a PIN on IRS website and file electronically through third-party transmitter

Employer’s Annual Federal

Tax Return

Employers who owe $1,000 or less per year may file

Form 944

Employer must have made timely deposits for prior two years

Can also be used by new employers paying wages of $4,000 or less per year

Employer should contact IRS and express interest

Employer may chose to file Form 941 quarterly instead – need to notify IRS

Can correct errors on previously filed Form 941 by filing Form 941-X

Types of Penalties

Failure-to-comply penalties will be added to tax and interest charges; negligence can also result in fines/imprisonment

Interest set quarterly, based on short-term Treasury bill rate

Penalties imposed for following:

Not filing employment tax returns on time

Not paying full taxes when due

Not making timely deposits

Not furnishing W-2s to employees on timely basis

Not filing information returns with IRS on time

Writing bad checks

Note: IRS estimates a full 30% of all employers incur penalties for insufficient/late deposits of payroll taxes!!