Whiteboard - Federal Reserve Bank of St. Louis

advertisement

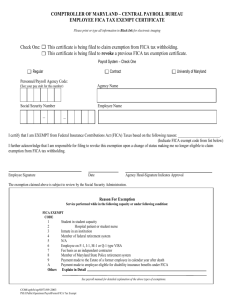

Teacher Instructions 1. Print the lesson, Know Your Dough, Lesson 2: "W" Is for Wages, W-4 and W-2. 2. Display slide 2 with Procedure step 2 in the lesson. 3. Display slide 3 with Procedure step 3-5. Click "Definitions" for definitions of taxes, gross pay, and net pay. 4. Display slides 4 and 5 with Procedure step 6. 5. Display slide 6 with Procedure step 8. 6. Display slide 7 with Procedure step 9. 7. Display slide 8 with Procedure step 10. 8. Display slide 9 with Procedure step 11. 9. Display slide 10 with Procedure step 12-14. 10. Display slide 11 with Procedure step 15. 11. Display slides 12, 13, and 14 with Procedure step 17. Use the “felt pen” tool to draw a line from each good or service offered by the entity noted. Answers Federal State Local National parks State parks Police protection National defense State roads Fire protection Interstate highways Public education Street lights State troopers Public education 12. Display slides 15-24 with Procedure step 18. Income – The payment people receive for providing resources in the market. Wages – The income for providing human resources (labor). John Dough is 16 years old and recently started his first job at ABC Mart. This is his first pay stub for his first two weeks of work. Income tax – A tax on the amount of income people earn. How much federal income tax was withheld from John's check? $24.74 What percentage of his income was withheld for federal income tax? $24.74 ÷ $240.00 = 0.10 = 10% John works in a state that has a state income tax. How much was withheld for state income taxes? $5.04 Why wasn’t money deducted from John’s check for medical insurance or retirement savings plans such as a 401(k)? John isn’t a full-time employee―he doesn’t receive a benefits package; so, money wasn’t deducted for insurance or retirement savings. How did John’s employer know what percentage of John’s income to deduct for federal income taxes and state income taxes? Employees must complete various forms that give the employer the information needed to determine this. FICA – Federal Income Contributions Act. The FICA tax is a U.S. payroll tax used to fund Social Security and Medicare. Social Security – A federal program that provides benefits for retirees, the disabled, and the minor children of deceased workers. Medicare – A federal program that provides health insurance for people 65 years of age and people under 65 with certain disabilities. Taxes are collected on a "pay as you go" principle. Many people, therefore, try to adjust the amount of money they have withheld so that they pay the correct amount of taxes for each paycheck. Some people, however, prefer to receive a refund each year; so, they purposely pay more than they need to pay per pay period. The government does not pay you interest on your overpayment. What are some goods and services the federal government provides for citizens? Police protection Public education National defense National parks Federal government provided goods and service Fire protection State roads State parks State troopers Street lights Interstate highways What are some goods and services state governments provide for citizens? Police protection Public education National defense National parks State government provided goods and service Fire protection State roads State parks State troopers Street lights Interstate highways What are some goods and services local governments provide for citizens? Police protection Public education National defense National parks Local government provided goods and service Fire protection State roads State parks State troopers Street lights Interstate highways What are wages? Wages are a form of income people receive for work they do. What income? Income is payment people receive for providing resources in the market. What are taxes? Taxes are government fees on business and individual income, activities, products, or property that people are required to pay. What is gross pay? Gross pay is the amount people earn in a pay period before any deductions or taxes are taken out. What is net pay? Net pay is take-home pay; it is the amount received after taxes and deductions have been taken out of gross pay. What is the FICA tax? The FICA tax is a tax resulting from the Federal Insurance Contributions Act. What does the FICA tax fund? The FICA tax funds Social Security and Medicare. Who pays the FICA tax? Both employees and employers pay the FICA tax. What is Form W-4 and for what is it used? Form W-4 is a form that must be completed by an employee before starting a job. It is used by the employer to determine the amount of income tax to withhold for the employee. What is Form W-2? Form W-2 is a form employers must provide to employees shortly after year-end to report annual income and withholding for the employee's tax return.