Case 8-2 Palmerstown Company

advertisement

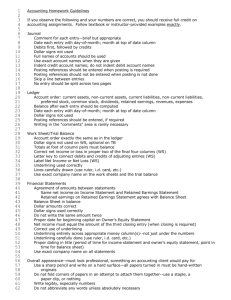

Case 8-2 Palmerstown Company Exchange Rates January 1, Year 1 January 1-31, Year 1 Average Year 1 When inventory purchases made When ending inventory acquired December 31, Year 1 $/pound 1.00 1.00 0.90 0.86 0.83 0.80 1. Pound is the functional currency – Current rate method Sales Cost of goods sold Gross profit Selling and administrative expense Depreciation expense Income before tax Income taxes Net income Plus: Retained earnings, 1/1/Y1 Retained earnings, 12/31/Y1 Exchange Pounds Rate 15,000 0.900 (9,000) 0.900 6,000 (3,000) 0.900 (1,000) 0.900 2,000 (600) 0.900 1,400 1,400 U.S. $ 13,500 (8,100) 5,400 (2,700) (900) 1,800 (540) 1,260 1,260 Cash Inventory Fixed assets Less: accumulated depreciation Total assets 2,400 4,000 10,000 (1,000) 15,400 0.800 0.800 0.800 0.800 1,920 3,200 8,000 (800) 12,320 Current liabilities Long-term debt Contributed capital Retained earnings Translation adjustment Total 2,000 4,000 8,000 1,400 15,400 0.800 0.800 1.000 from above from below 1,600 3,200 8,000 1,260 (1,740) 12,320 Case 8-2 Palmerstown Company (continued) Calculation of Cumulative Translation Adjustment Net assets, 1/1/Y1 Net income, Year 1 Net assets, 12/31/Y1 Net assets, 12/31/Y1 at current exchange rate Translation adjustment, Year 1 (negative) Pounds 8,000 1,400 9,400 Exchange Rate 1.000 0.900 9,400 0.800 U.S. $ 8,000 1,260 9,260 7,520 1,740 2. U.S. dollar is the functional currency – Temporal method Sales Cost of goods sold Gross profit Selling and administrative expense Depreciation expense Remeasurement gain (loss) Income before tax Income taxes Net income Plus: Retained earnings, 1/1/Y1 Retained earnings, 12/31/Y1 Pounds 15,000 (9,000) 6,000 (3,000) (1,000) 2,000 (600) 1,400 1,400 Exchange Rate 0.900 Sched. A 0.900 1.000 from below 0.900 U.S. $ 13,500 (8,000) 5,500 (2,700) (1,000) 180 1,980 (540) 1,440 1,440 Cash Inventory Fixed assets Less: accumulated depreciation Total assets 2,400 4,000 10,000 (1,000) 15,400 0.800 0.830 1.000 1.000 1,920 3,320 10,000 (1,000) 14,240 Current liabilities Long-term debt Contributed capital Retained earnings Total 2,000 4,000 8,000 1,400 15,400 0.800 0.800 1.000 to balance 1,600 3,200 8,000 1,440 14,240 Case 8-2 Palmerstown Company (continued) Schedule A - Cost of goods sold Purchase, January 10 Additional purchases Ending inventory Cost of goods sold Pounds 1,000 12,000 (4,000) 9,000 Exchange Rate 1.000 0.860 0.830 U.S. $ 1,000 10,320 (3,320) 8,000 Calculation of Remeasurement Gain Net monetary assets, 1/1/Y1 Increase in monetary assets: Sales Decrease in monetary assets: Acquisition of beginning inventory Purchase of inventory during year Selling and administrative expenses Income taxes Purchase of fixed assets Net monetary liabilities, 12/31/Y1 Net monetary liabilities, 12/31/Y1 at current exchange rate Remeasurement gain - Year 1 Pounds 8,000 Exchange Rate 1.000 U.S. $ 8,000 15,000 0.900 13,500 (1,000) (12,000) (3,000) (600) (10,000) (3,600) 1.000 0.860 0.900 0.900 1.000 (1,000) (10,320) (2,700) (540) (10,000) (3,060) (3,600) 0.800 (2,880) (180) 3. With the pound as functional currency, the U.S. dollar net income reflected in the consolidated income statement is $1,260. If the U.S. dollar were the functional currency, the amount reflected in consolidated net income would be $1,560, 24% higher. The amount of total assets reported on the consolidated balance sheet is 17% smaller than if the U.S. dollar were functional currency [($14,360 – $12,320)/$12,320]. The relations between the current ratio, the debt to equity ratio, and profit margin calculated from the FC financial statements and from the translated U.S. dollar financial statements are shown below. Pounds Current ratio: Current assets Current liabilities Debt to equity ratio: Total liabilities Total stockholders' equity Profit margin: Net income Sales U.S. $ Current Rate U.S $ Temporal 6,400 2,000 3.2 5,120 1,600 3.2 5,240 1,600 3.275 6,000 9,400 0.638 4,800 7,520 0.638 4,800 9,440 0.508 1,400 15,000 0.093 1,260 13,500 0.093 1,440 13,500 0.107 A comparison of the ratios calculated using pounds and using U.S.$ translated amounts shows that the temporal method distorts all ratios as calculated from the original foreign currency financial statements. The current rate method maintains all ratios that use numbers in the numerator and denominator from the balance sheet only (current ratio, debt-to-equity ratio) or the income statement only (profit margin). Note: For ratios that combine numbers from the income statement and balance sheet (return on equity, inventory turnover), even the current rate method creates distortions. The U.S. dollar amounts reported under the temporal method for inventory and fixed assets reflect the equivalent U.S. dollar cost of those assets as if the parent had sent dollars to the subsidiary to purchase the assets. For example, to purchase 10,000 pounds worth of fixed assets when the exchange rate was $1.00/pound, the parent would have had to provide the subsidiary with $10,000. The U.S. dollar amounts reported under the current rate method for inventory and fixed assets reflect neither the equivalent U.S. dollar cost of those assets nor their U.S. dollar current value. By multiplying the pound historical cost amounts by the current exchange rate, these assets are reported at what they would have cost in U.S. dollars if the current exchange rate had been in effect when they were purchased. This is a hypothetical number with little, if any, meaning.