AlbrechtFinancialAcc..

advertisement

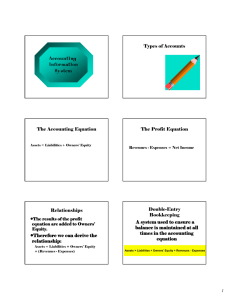

Chapter 2 Financial Statements: An Overview Albrecht, Stice, Stice, Swain COPYRIGHT © 2008 Thomson South-Western, a part of The Thomson Corporation. Thomson, the Star logo, and South-Western are trademarks used herein under license. 1 Primary Financial Statements • The Balance Sheet (Statement of Financial Position) • Income Statement (Statement of Earnings) • Statement of Cash Flows 2 Components of a Balance Sheet • Assets – Cash, inventory, accounts receivable, buildings • Liabilities – Accounts payable, taxes payable, mortgage payable • Owners’ Equity – Paid-in capital, retained earnings 3 Accounting Equation Assets = Liabilities + Owners’ Equity Sources of Financing Resources Resources to use to generate revenues = Creditors’ claims against resources + Owners’ claims against resources 4 Sample Balance Sheet Assets Liabilities Cash $ 40 Accounts payable Accounts receivable 100 Notes payable Land 200 Total assets Must Equal $340 Owners’ Equity Paid-in Capital Retained earnings Total liabilities and owners’ equity $ 50 150 $200 $100 40 $140 $340 5 Classified and Comparative Balance Sheets • Classified balance sheet – Distinguishes between current and long-term assets and liabilities. – Listed in decreasing order of liquidity. • Comparative balance sheet – Presents two years of balance sheet information. – Helps users identify significant changes. 6 Limitations of the Balance Sheet • Book value vs. market value. – Which is better? • Only records assets/liabilities that can be quantified. – Reputation • Wal-Mart’s name • Great CEO 7 The Income Statement Revenues Increase in a company’s resources from the sale of goods or services. Expenses Costs incurred in the normal course of business to generate revenues. Net Income or (Net Loss) Revenues - Expenses 8 Other Items on the Income Statement • Earnings per share Net Income (Net Loss) # of Shares of Stock Outstanding – The amount of earnings related to each share of stock. • Gains (losses) – Money made or lost on activities outside the normal operation of a business. 9 Statement of Retained Earnings • Shows the change in retained earnings over the period of time. Beginning retained earnings + Net income – Dividends Ending retained earnings • The total amount invested by the owners through the retention of profits 10 Statement of Cash Flows • Reports categorized cash inflows and outflows Operating Activities Day-to-day activities Investing Activities Buying and selling long-term assets Financing Activities Cash obtained or repaid to owners or creditors 11 Financial Statement Articulation Balance Sheet 12/31/08 Cash Other Total $ 80,000 4,550,000 $4,630,000 Liabilities $2,970,000 Cap. stock 900,000 R/E 760,000 Total $4,630,000 Cash--Op. Act. $ 973,000 Cash--Inv. Act. (1,188,000) Cash--Fin. Act. 245,000 Net increase $ 30,000 Beg. cash 80,000 End. cash $ 110,000 Income Statement Revenues $12,443,000 Expenses 11,578,400 Net income $ 864,600 Stmt of Retained Earnings R/E 12/31/08 $ 760,000 Net income 864,600 Dividends (400,000) R/E 12/31/09 $1,224,600 Cash Flow Statement Balance Sheet 12/31/09 Cash Other Total $ 110,000 4,975,000 $5,085,000 Liabilities $2,860,400 Cap. stock 1,000,000 R/E 1,224,600 Total $5,085,000 12 Notes to Financial Statements 1. Summary of significant accounting policies. 2. Additional information about the summary totals found in the financial statements. 3. Disclosure of important information that is not recognized in the financial statements. 4. Supplementary information required by the Financial Accounting Standards Board (FASB) or the Securities and Exchange Commission (SEC). 13 External Audits Audit Report – Issued by an independent CPA firm. – Verifies financial statements have been prepared according to GAAP. 14 External Auditor vs. Management Owners and managers want the most favorable results possible. • Bank credit • Bonuses • Public stock price CPA firms have economic incentives to perform credible audits. • Reputation • Lawsuits 15 What Are the Fundamental Concepts and Assumptions? • Going Concern Assumption • Monetary Measurement Concept • Arm’s-Length Transactions • Cost Principle • Separate Entity Concept 16