Future Value

advertisement

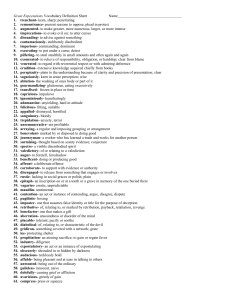

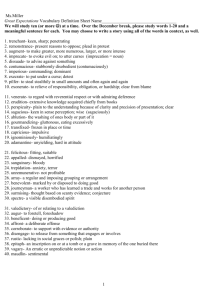

Time Value of Money Introduction TVM Preferences • More vs. Less • Sooner vs. Later • More Now vs. Less Later • Less Now vs. More Later ???? TVM Questions • What will my investment grow to? • How much do I need today? • How fast must my investment grow? • How long will it take? Compare and Contrast 1970 2011 TVM Cost of a first-class stamp: $ 0.06 $ 0.44 4.98% Cost of a gallon of gas: $ 0.36 $ 2.98 5.29% Cost of a dozen eggs: $ 0.62 $ 2.20 3.14% Cost of a gallon of Milk: $ 1.15 $ 3.69 2.88% TVM Basic Concepts • Simple vs. Compound Interest Simple Interest = interest earned only on principal (amount loaned) Compound Interest = interest earned on principal and any unpaid interest earned in an earlier time period Simple Interest Calculation Future Value Principal x Interest Rate x Periods Principal FV PV * i * n PV Interest Example • Principal $1,000 • Interest Rate 10% • Term 5 years Interest Example FV = (1,000 x .10 x 5) + 1,000 FV = 500 +1,000 FV = 1,500 Simple Interest Example • Principal • Total Interest • Ending Balance $1,000 500 $1,500 Compound Interest Calculation n Future Value Principal * Interest Rate Periods1 n -1 Interesti * Interest Rate Periods 1 Principal FV PV * (1 i) n Compound Interest Example 5 FV 1,000 x (1 .10) 5 FV 1000 x (1.10) FV 1,000 x 1.611 FV 1,611 Compound Interest Example • Principal • Total Interest Rate • Ending Balance $1,000 611 $1,611 Time Value of Money Calculator Tips • Set Calculator to 4 decimal points • Set P/Yr to 1 and do not change • Clear calculator before calculation • Use recommended format • Learn to use special features • Read carefully • Know the concepts of TVM TVM Concepts • Use a time line • Use + or - to indicate cash flow • Periodic Cash flows can be at Beginning or End of Period • Calculators use Percentages • Excel uses decimals Lump Sum vs. Periodic Pmts • Lump Sum – Single Payment – At time zero – Present Value OR – Single Payment – At end of time – Future Value • Periodic Payment – Ordinary Annuity • Pmt at end of periods • For life of investment – Annuity Due • Pmt at beg. of periods • For life of investment – PMT Annuities • Must be – Equal Amounts – Occurring in every compounding period – Ordinary Annuity – End of Period – Annuity Due – Beginning of Period Annuity? 0 1 2 3 4 5 100 100 100 100 100 Annuity? 0 1 2 3 4 5 100 100 100 100 100 Annuity? 0 1 2 3 4 5 100 100 100 Annuity? 0 1 2 3 4 5 100 200 300 400 500 Lump Sum & Periodic Payment • Combination – Single Payment – With periodic payments for life of investment – PV & PMT Recommended Structure Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods Future Value of Lump Sum If you invest $1,000 in a savings account earning 10% compounded annually, how much will you have after 5 years? Future Value of Lump Sum Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods ? (1,000.00) 10.00% 5 Future Value of Lump Sum Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods 1,610.51 (1,000.00) 10.00% 5 Future Value of Lump Sum If you invest $10,000 in a mutual fund that is expected to earn a 12% compound after-tax return, how much will you have at the end of 50 years? Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods Future Value of Lump Sum Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods ? (10,000.00) 12.00% 50 Future Value Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods 2,890,021.90 (10,000.00) 12.00% 50 Future Value of an Annuity If you invest $10,000 at the end of each year in a mutual fund that is expected to earn a 12% compound after-tax return, how much will you have at the end of 5 years? Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods Future Value of an Annuity Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods ? (10,000.00) 12.00% 5 End Future Value of an Annuity Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods 63,528.47 (10,000.00) 12.00% 5 End Future Value of an Annuity If you invest $10,000 at the beginning of each year in a mutual fund that is expected to earn a 12% compound after-tax return, how much will you have at the end of 5 years? Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods Future Value of an Annuity Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods ? (10,000.00) 12.00% 5 Beg Future Value of an Annuity Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods 71,151.89 (10,000.00) 12.00% 5 Beg Ordinary Annuity Time Payment Return FV 0 1 10,000 12% / 4 yrs 15,735.19 2 10,000 12% / 3 yrs 14,049.28 3 10,000 12% / 2 yrs 12,544.00 4 10,000 12% / 1 yr 5 10,000 12% / 0 yrs 10,000.00 Total 11,200.00 63,528.47 Annuity Due Time Payment Return FV 0 10,000 12% / 5 yrs 17623.42 1 10,000 12% / 4 yrs 15,735.19 2 10,000 12% / 3 yrs 14,049.28 3 10,000 12% / 2 yrs 12,544.00 4 10,000 12% / 1 yr 11,200.00 5 Total 71,151.89 Future Value of a Combination If you invest $10,000 today and $1,000 at the end of each year in a mutual fund that is expected to earn a 12% compound after-tax return, how much will you have at the end of 5 years? Future Value of a Combination Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods Future Value Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods ? (10,000.00) (1,000.00) 12.00% 5 End Future Value Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods 23,976.26 (10,000.00) (1,000.00) 12.00% 5 End Combination Investment Time Payment Return FV 0 10,000 12% / 5 yrs 17,623.42 1 1,000 12% / 4 yrs 1,573.52 2 1,000 12% / 3 yrs 1,404.93 3 1,000 12% / 2 yrs 1,254.40 4 1,000 12% / 1 yr 1,120.00 5 1,000 12% / 0 yrs 1,000.00 Total 23,976.26 Annual Rate of Return TVM can also solve for the rate of return required for a PV to reach a FV in n years. Annual Rate of Return What rate of return is required for $10,000 to grow to $16,000 in 5 years? Annual Rate of Return Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods Annual Rate of Return Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period 16,000.00 (10,000.00) ? 5 Annual Rate of Return Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period 16,000.00 (10,000.00) 9.86% 5 Annual Rate of Return If you invest $2,000 at the end of each year for 5 years, what rate of return must your investment earn for you to have $16,000 at the end of that period? Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods Annual Rate of Return Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods 16,000.00 (2,000.00) ? 5 End Annual Rate of Return Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods 16,000.00 (2,000.00) 23.69% 5 End Annual Rate of Return If you invest $10,000 today and $500 at the end of each year for the next 5 years, what rate of return must you earn to have $16,000 at the end of that period? Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods Annual Rate of Return Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods 16,000.00 (10,000.00) (500.00) ? 5 End Annual Rate of Return Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods 16,000.00 (10,000.00) (500.00) 5.71% 5 End Number of Periods TVM can also solve for the holding period required for a PV, a series of Payments or a combination of PV and Payments to reach a FV given a specific rate of return Number of Periods How long will it take for a $10,000 investment to grow to $24,000 if it earns 11.25% compounded annually? Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods Number of Periods Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods 24,000.00 (10,000.00) 11.25% ? Number of Periods Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods 24,000.00 (10,000.00) 8.21 Number of Periods If you deposit $3,000 at the beginning of each year in a savings account earning 9.75%, how long will it take for you to save for a $20,000 down payment for a house? Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods Number of Periods Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods 20,000.00 (3,000.00) 9.75% ? Beg Number of Periods Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods 20,000.00 (3,000.00) 9.75% 5 Beg Present Value TVM can also solve for the price you would pay for a FV, a series of Payments, or a combination of a series of Payments and a FV given a specific rate of return and holding period. Present Value of a Future Amount What would you pay for the right to collect $8,000 in 7 years, if your required return is 8.75%? Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods Present Value of a Future Amount Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods 8,000.00 ? 8.75% 7 Present Value of a Future Amount Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods 8,000.00 (4,447.18) 8.75% 7 Stop Present Value of Periodic Payments What would you pay for the right to collect $8,000 at the beginning of each year for 7 years, if your required return is 8.75%? Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods Present Value of Periodic Payment Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods ? 8,000.00 8.75% 7 Beg Present Value of Periodic Payment Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods (44,156.42) 8,000.00 8.75% 7 Beg Present Value of a Combination What would you pay for the right to collect $800 at the end of each year for 7 years and an additional $10,000 at the end of the period, if your required return is 7.25%? Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods Present Value of a Combination Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods 10,000.00 ? 800.00 7.25% 7 End Present Value of a Combination Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods 10,000.00 (10,400.70) 800.00 7.25% 7 End Time Value of Money Compounding Periods Shorter than One Year Compounding Periods • Cash Flows are often more frequent than annually – Monthly, quarterly, semi-annually • If Compound periods < annual – Effective Interest Rate is higher – FV is higher and PV is lower Compound Interest Formula with Compounding Periods less than 1 Year i FV PV * 1 m n*m Where m = the number of compounding periods within the year. Adjustments for Compounding Periods < Annual • Compounding Periods = m • Divide Annual rate by m i/m • Multiply Years by m nxm • Input i/m for I/Y • Input (n x m) for N Future Value of Lump Sum If you invest $6,000 in a savings account earning 10% compounded quarterly, how much will you have after 5 years? Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods Future Value of Lump Sum Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods ? (6,000.00) 10.00% 5 4 2.50% 20 Future Value of Lump Sum Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods $9,831.70 (6,000.00) 10.00% 5 4 2.50% 20 Future Value of Lump Sum If you invest $1,000 in a savings account earning 10% compounded daily, how much will you have after 5 years? Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods Future Value of Lump Sum Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods ? (1,000.00) 10.00% 5 365 0.0274% 1,825 Future Value of Lump Sum Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods $1,648.61 (1,000.00) 10.00% 5 365 0.0274% 1,825 Future Value of an Annuity If you invest $1,000 at the end of each month in a mutual fund that is expected to earn a 12% aftertax return, how much will you have at the end of 5 years? Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods Future Value of an Annuity Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods ? (1,000.00) 12.00% 5 End 12 1.00% 60 Future Value of an Annuity Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods $81,669.67 (1,000.00) 12.00% 5 End 12 1.00% 60 Future Value of an Annuity If you invest $1,000 at the beginning of each month in a mutual fund that is expected to earn a 12% after-tax return, how much will you have at the end of 5 years? Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods Future Value of an Annuity Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods ? (1,000.00) 12.00% 5 Beg 12 1.00% 60 Future Value of an Annuity Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods $82,486.37 (1,000.00) 12.00% 5 Beg 12 1.00% 60 Annual Rate of Return If you invest $2,000 at the end of each quarter for 5 years, what rate of return must your investment earn for you to have $60,000 at the end of that period? Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods Annual Rate of Return Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods 60,000.00 (2,000.00) ? 5 End 4 ? 20 Annual Rate of Return Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods 60,000.00 (2,000.00) ? 5 End 4 4.07% 20 Annual Rate of Return Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods 60,000.00 (2,000.00) 16.29% 5 End 4 4.07% 20 Annual Rate of Return If you invest $10,000 today and $500 at the end of each month for the next 5 years, what rate of return must you earn to have $60,000 at the end of that period? Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods Annual Rate of Return Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods 60,000.00 (10,000.00) (500.00) ? 5 End 12 60 Annual Rate of Return Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods 60,000.00 (10,000.00) (500.00) ? 5 End 12 1.04% 60 Annual Rate of Return Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods 60,000.00 (10,000.00) (500.00) 12.50% 5 End 12 1.04% 60 Number of Periods If you deposit $300 at the beginning of each month in a savings account earning 9.75%, how long will it take for you to save for a $20,000 down payment for a house? Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods Number of Periods Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods 20,000.00 (300.00) 9.75% ? Beg 12 0.81% ? Number of Periods Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods 20,000.00 (300.00) 9.75% ? Beg 12 0.81% 53 Number of Periods Future Value Present Value Payment Annual Rate Years Beg / End Compounding Periods Rate / Period Years * Periods 20,000.00 (300.00) 9.75% 4.43 Beg 12 0.81% 53 Uneven Cash Flows • How do you calculate Present Value when your required return is 9.0% and you expect to receive the following cash flows: Year 1 2,000 Year 2 3,000 Year 5 1,000 Uneven Cash Flows • Alternative One – The Hard Way 1. Draw a Time Line 2. Calculate the PV of each cash flow 3. Total the Present Values Uneven Cash Flows FV I/Y N PV CF 1 2,000 9.00% 1 (1,834.86) Uneven Cash Flows FV I/Y N PV CF 1 CF 2 2,000 3,000 9.00% 9.00% 1 2 (1,834.86) (2,525.04) Uneven Cash Flows FV I/Y N PV Total PV CF 1 2,000 9.00% 1 (1,834.86) CF 2 3,000 9.00% 2 (2,525.04) (5,009.83) CF 3 1,000 9.00% 5 (649.93) Uneven Cash Flows • Alternative Two – Use the CF Register 1. Draw Time Line 2. Input Cash Flows into CF Register 3. Go to NPV Register 1. Input Rate of Return 2. Compute NPV Uneven Cash Flows Example 1 – Alternative Two 1. Draw Time Line 2. Push CF button 3. Clear CF register 2nd CLR Work 4. Input Cash Flows Cash Flow Register • Inputs – CF0 = Investment, Price, Cost at Time 0 We are solving for PV so CF0 should be 0 Since CF0 already = 0, – C01 = Cash Flow at the end of Period 1 – F01 = Frequency of C01 The number of times that C01 occurred consecutively Uneven Cash Flows Example 1 1. Draw Time Line 2. Clear the CF Register 3. Input Cash Flows a. b. c. d. e. CF0 = 0, C01 = 2,000; F01 = 1, C02 = 3,000; F02 =1, C03 = 0; F03 = 2, C04 = 1,000; F04 = 1, Uneven Cash Flows Example 1 1. Check Inputs 2. Go To NPV Register 3. Input I 9 ENTER, 4. CPT NPV = 5,009.83 Uneven Cash Flows Example 2 What would you be willing to pay for a real estate investment that has the following expected cash flows: Yr. 1 $500, Yrs. 2-6 $1,000, Yr. 7-10 $1,500, and Yr. 11 $30,000? Assume your required return for this type of investment is 17.0%. Uneven Cash Flows Example 2 1. Draw Time Line 2. Input Cash Flows a. CF0 = 0 b. C01 = 500; c. F01 = 1 C02 = 1,000; F02 = 5 d. C03 = 1,500; F03 = 4 e. C04 = 30,000; F04 = 1 Uneven Cash Flows Example 2 3. Check your Inputs 4. Go to “NPV” Register 1. Enter I = 17.0; 2. Press “CPT” NPV = ? Uneven Cash Flows Example 2 NPV = 10,100.25 Uneven Cash Flows • The CF Register can also be used to find the rate of return associated with uneven cash flows. • This cannot be done easily any other way. Uneven Cash Flows • Inputs – CF Register Steps are the same – Go to IRR Register CPT IRR IRR = the Internal Rate of Return IRR = the rate of return on the investment Effective Interest Rate Calculation Effective Interest Rate Calculation The annual rate of return actually earned when compounding or payment periods are less than 1 year. Effective Interest Rate • Nominal rate = i – The nominal rate is the rate “named” in the information. – “The credit card rate is for 18.0% compounded monthly.” • 18.0% is the nominal rate EIR Calculations What is the Effective Interest Rate for a credit card with an 18% nominal interest rate if the card is not paid off each month? Effective Interest Rate with Compounding Periods < 1 Year m i Eff. Int. Rate 1 1 * 100 m Where m = the number of compounding periods within the year. EIR Calculations 12 .18 EIR 1 1 * 100 12 EIR Calculations EIR 1.015 1 * 100 12 EIR Calculations EIR 1.1956 1* 100 EIR Calculations EIR 19.56% EIR CALCULATIONS Use “I Conv” Register for easy Effective Interest Rate calculations. I Conv Register • Steps 2nd I Conv Input Nominal Rate, ENTER Arrow Down Twice Input C/Y • (Compounding Periods per Year) 5. Arrow Up 6. CPT EFF (Effective Interest Rate) 1. 2. 3. 4.