31 Mar 2005

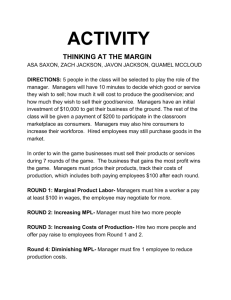

advertisement

Vp plc Preliminary Results Year Ended 31 March 2005 Jeremy Pilkington Chairman Neil Stothard Group Managing Director Mike Holt Group Finance Director Vp – an introduction • Specialist equipment rental • Breadth of sector exposure – earnings resilience • Market leading businesses • Core expertise in asset management • Excellent cash flow and strong balance sheet • Significant growth opportunities identified Highlights • 5 years of >10% earnings growth • PBT increased by 14%* to £9.4m • EPS increased by 14%* to 15.04 pence • Return on capital employed increased to 17% • Dividend increased 15% to 5.75 pence * Excluding prior year exceptional property profit Financial Review Mike Holt Group Finance Director Financial Highlights Turnover PBT (pre-goodwill) PBT (post-goodwill) Operating Margin EPS Dividend ROCE Net Debt Year Ended 31 March 2005 £m £90.0m £9.8m £9.4m 10.8% 15.04p 5.75p Year Ended 31 March 2004 £m £83.5m £8.6m* £8.2m* 10.3% 13.19p* 5.00p 17% £2.4m 16%** £7.5m +8% +14% +14% +5% +14% +15% * Excluding prior year exceptional property profit ** Restated for UITF 38 Balance Sheet 31 March 2005 £m 7.0 48.7 55.7 7.0 (4.0) 58.7 (2.4) 56.3 31 March 2004* £m 7.1 49.9 57.0 6.6 (4.3) 59.3 (7.5) 51.8 Gearing 4% 14% Net Assets Per Share (Pence) 122 112 Intangible Fixed Assets Tangible Fixed Assets Net Working Capital Provisions Capital Employed Net Debt Net Assets * Restated for UITF 38 Operating Cash Flow Year Ended Year Ended 31 March 2005 31 March 2004 £m £m Operating Profit 9.7 8.7 Depreciation 11.5 11.6 Profit on Sale of Fixed Assets (1.2) (1.2) Change in Net Working Capital 0.1 (2.3) Net Cash Inflow 20.1 16.8 Cash to Profit Ratio 208% 194% Cash Flow per Share 46.5p 38.7p +12% +20% +20% Cash Flow Year Ended Year Ended 31 March 2005 31 March 2004 £m £m Operating Cash Flow 20.1 16.8 Net Capital Expenditure (9.0) (6.5) Net Interest (0.3) (0.4) Tax (3.3) (2.4) Free Cash Flow 7.5 7.5 Acquisitions and Disposals (0.2) (6.5) Equity Dividends Paid (2.2) (2.0) Cash Inflow (Outflow) 5.1 (1.0) Acquired Net Debt (0.3) Movement in Net Debt 5.1 (1.3) International Financial Reporting Standards Impact P&L B/S Pensions Low Med Share Schemes Med Med Deferred Tax Low Low Goodwill impairment Financial Instruments Low Low Low Low Impact through reserves of circa £4m on net assets of £56m Operational Review Neil Stothard Group Managing Director Segmental Analysis Sales Operating Profit 31 Mar 05 31 Mar 04 31 Mar 05 31 Mar 04 £m £m £m £m Groundforce 24.6 19.3 5.7 5.3 +7% UK Forks 12.8 12.4 1.4 1.3 +11% Airpac Oilfield Services 4.5 3.7 1.1 0.5 +114% Hire Station 34.8 36.5 (0.7) (0.4) Torrent Trackside 13.3 11.6 2.5 2.3 +8% TOTAL 90.0 83.5 10.1 9.0 +12% - Breadth of Markets – Earnings Resilience 12% 19% 24% 15% 5% 25% Residential Non-residential Water and Civils Oil and Gas Rail RMI Groundforce Excavation support systems and specialist products for the water, civil engineering and construction industries Groundforce 31 March 2005 31 March 2004 £m £m Sales 24.6 19.3 +27% Profit 5.7 5.3 +7% 23.2% 27.5% 2.6 1.8 Margin Fleet Capex Groundforce • Market Leader in ground support systems • Good demand from AMP3/major projects • Successful integration of 03/04 acquisitions • Shoring hire fleet rationalisation • Improved national coverage – Piletec, Stoppers, Survey • Product extension opportunities • Well positioned for future AMP4 activity when commenced UK Forks Rough terrain material handling equipment for industry, residential and general construction UK Forks 31 March 2005 31 March 2004 £m £m Sales 12.8 12.4 +3% Profit 1.4 1.3 +11% 11.0% 10.5% 3.1 2.5 Margin Fleet Capex UK Forks • Profit and return on capital growth • Focused product investment – 10% ‘net’ growth in fleet • Further progress with major house-builders • Customer appetite for unique offering to the market • Housebuilding/Construction markets relatively supportive Airpac Oilfield Services Equipment and service providers to the international oil and gas exploration and development markets Airpac Oilfield Services 31 March 2005 31 March 2004 £m £m Sales 4.5 3.7 +22% Profit 1.1 0.5 +114% 24.4% 13.5% 0.5 0.5 Margin Fleet Capex Airpac Oilfield Services • Excellent performance • Strong demand from North Sea and South East Asia • International project activity good • New competences being developed • Geographic growth opportunities • Market remains busy, with supportive crude oil price Hire Station Tools and specialist products for industry and construction Hire Station 31 March 2005 31 March 2004 £m £m Sales 34.8 36.5 Loss (0.7) (0.4) - - 5.7 4.2 Margin Fleet Capex (5%) Hire Station • Disappointing results • Turnover reflects exit in prior year of surplus locations • Lifting Point responsible for majority of losses • Tool hire profitable after a difficult 1st Quarter • Repositioning year restoring stability Hire Station • Focus on core product lines and guaranteed availability • Launch of regional hire desk structure • Lower cost network supporting local, regional and national customers • Specialist Products Division created December 2004 • Hire Station commenced New Year in line with plan Torrent Trackside Portable rail infrastructure equipment, lighting and related services for the railway renewals and maintenance industry. Torrent Trackside 31 March 2005 31 March 2004 £m £m Sales 13.3 11.6 +15% Profit 2.5 2.3 +8% 18.8% 19.8% 1.5 1.8 Margin Fleet Capex Torrent Trackside • Strong performance in challenging year • Renewals business – further expansion • Maintenance business steady but in transition • Network Rail maintenance plant tender • London Underground – new area for growth • Prospects positive overall in competitive market Summary • A further year of excellent progress • Profitability underpinned by cash generation and strong balance sheet • Hire Station well positioned to deliver recovery in coming year • Management appetite for growth and incentivised accordingly • Top quality teams across all divisions • Opportunities to accelerate pace of growth within core expertise of asset management Overview and Outlook Jeremy Pilkington Chairman Turnover (£m) 100 95 90 85 80 75 70 65 60 55 50 83.5 90.0 75.5 59.8 2001 66.8 2002 2003 2004 2005 Profit Before Tax (pre goodwill) (£m) 10 9 8 7 6 5 4 3 2 1 0 6.5 7.8 * 8.6 9.8 2004 2005 3.3 2001 2002 2003 *excluding prior year exceptional property profit Return on Capital Employed (%) % 18 16 14 12 10 8 6 4 2 0 12.4 14.8 15.7 16.5 2003 2004 2005 7.4 2001 2002 Restated UITF38 Dividend (pence per share) 6 5.5 5 4.5 5.75 4 3.5 5.0 4.05 4.2 2001 2002 4.5 3 2003 2004 2005 Earnings per share (pence) 16 14 12 10 8 6 10.23 4 2 * 15.04 12.36 13.19 2003 2004 2005 5.03 0 2001 2002 *excluding prior year exceptional property profit Total Shareholder Return Groundforce • Market leader position strengthened • Excellent acquisition identification and integration track record • AMP4 – expect delays but very positive UK Forks • Market leader - unique service offering • Converting larger users • Housebuilding remains firm; prospects good • Operational efficiency consistently driving up ROCE - 2002 : 10.5% 2005 : 14.4% Airpac Oilfield Services • Market Leader • Excellent year – strategy bearing fruit • Oil industry activity strong • International growth opportunities • Small but vital role in oilfield supply chain Hire Station • Very disappointing year, behind management expectation • Improving trend established within tools • Reorganisation and refocus at Specialist Products • Recovery plan back on track but behind schedule Torrent Trackside • Clear market leader • Another excellent year against background of industry change • Challenge to replace NR maintenance plant volumes • Renewals programme workload strong • Significant opportunities within LUL but will take time Group Outlook • Overall outlook for the Group very positive - UK infrastructure spend set to continue - Safety and regulatory regimes supporting growth • Breadth of markets gives earnings resilience • Strength of balance sheet and cash flow gives significant investment capacity • Growth opportunities, organic and acquisition, identified in all markets Group Outlook • Board committed to leveraging up • All levels of management strongly incentivised to deliver earnings growth in their business • Strengthened senior management team