Evaluating a Firm's Internal Capabilities

advertisement

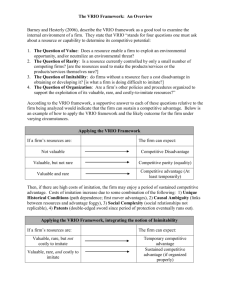

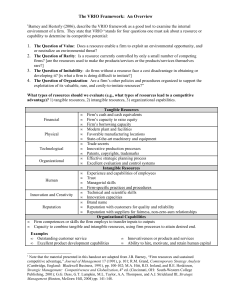

Evaluating a Firm’s Internal Capabilities Chapter 3 Learning Objectives • Be able to describe the critical assumptions of the resource-base view. • Describe resources & capabilities. • Understand how to use SWOT analysis. • Understand how value chain analysis is used to improve a firm’s operations & identify valuable resources & capabilities. • Understand how to apply the VIRO framework. What Does Internal Analysis Tell Us? • Internal analysis provides a comparative look at a firm’s capabilities – what are the firm’s strengths? – what are the firm’s weaknesses? – how do these strengths & weaknesses compare – to competitors? Why Does Internal Analysis Matter? Internal analysis helps a firm: • Determine if its resources and capabilities are likely sources of competitive advantage. • Establish strategies that will exploit any sources of competitive advantage. SWOT Analysis Internal Strengths Weaknesses External Opportunities Threats SWOT • Strengths (Internal Focus) – What does the firm do well? • Weaknesses (Internal Focus) – Where is the firm vulnerable? • Opportunities (External Focus) – What opportunities can the firm take advantage of given its resource bundle. • Threats (External Focus) – What does the company have to monitor and/or address. Focus: Opportunities/Threats • Companies scan their external environment looking for valuable information, e.g., new factors and trends. • What is happening in the general environment that may affect the company in the short- and/or long-term? SWOT Example: • Strengths – First mover advantage – Low labor cost – Creative employees • Weaknesses – Inexperienced new company – No proprietary information • Opportunities – Demand for electronic phone books – Sudden growth in use of digital technology • Threats – Easily duplicated product – Market power of incumbent firms Limitations of SWOT Analysis • SWOT Analysis is a starting point for discussion and cannot show how to achieve a competitive advantage. • Strengths may not lead to a competitive advantage. Limitations of SWOT Analysis • SWOT Analysis’ focus on the external environment is too narrow. • SWOT Analysis is a snapshot of a dynamic environment. • SWOT Analysis overemphasizes a single dimension of strategy. Dess, Lumpkin, & Taylor (2007) p. 78 The Theory Behind Internal Analysis The Resource-Based View: • Developed to answer the question: Why do some firms achieve better economic performance than others? • Used to help firms achieve competitive advantage and superior economic performance. • Assumes that a firm’s resources and capabilities are the primary drivers of competitive advantage and economic performance. The Resource-Based View • Resources: • Tangible and intangible assets of a firm used to conceive of and implement strategies. Capabilities: • A subset of resources that enable a firm to take full advantage of other resources. The Resource-Based View Four Categories of Resources • Financial (cash, retained earnings) • Physical (plant & equipment, geographic location) • Human (skills & abilities of individuals) • Organizational (reporting structures, relationships) The Resource-Based View Two Critical Assumptions of the RBV • Resource Heterogeneity • Resource Immobility The Resource-Based View Resource Heterogeneity • Heterogeneity of resources typically occurs as the result of ‘bundling’ the resources and capabilities of a firm. • Managers of a firm could take resources that seem homogeneous and ‘bundle’ them to create heterogeneous combinations. • Competitive advantage typically stems from several resources and capabilities ‘bundled’ together. Support Activities The Chain of Value Inbound Logistics General Administration Human Resource Management Technology Development Procurement Marketing Outbound Operations & Logistics Sales Primary Activities (Dess, Lumpkin, & Eisner p. 77). Service Inbound Logistics • Receiving, Storing, & Distributing Inputs, e.g., material handling, warehousing, inventory control, scheduling, & returns. • Just-in-Time Inventory Control saves companies money. Operations • Includes the activities that transform raw materials into the finished product. This includes processing, machining, packaging, assembly, equipment, testing, printing, and facility operations. Outbound Logistics • Activities that handle the finished product including collecting, storing, and distributing the product/service to the customer. Marketing & Sales • These departments are responsible for activities associated with making the market aware of the product/ service and turning potential customers into customers. • When channel customers are involved the marketing and sales force must convince them that their product should be carried. Service • Primarily responsible for handling customer problems associated with enhancing or maintain the product/ service. This may include installing, repairing, training, supplying parts, and adjusting the product. Support Activities • General Administration – Responsible for firm’s overall welfare. • Human Resources Management – Responsible for providing the best employees possible as well as managing those important resources. Support Activities • Technology Development – Responsible for providing the firm with state of art future products/services as well as ensuring the company has the resources to support this environment. • Procurement – Responsible for procuring raw material inputs and creating systems that ensure the firm has access to best resources. The Internal Analysis Tool • If a firm’s resources are: – Valuable – Rare – Costly to Imitate – Organized to Exploit these Resources … • Then the firm can expect to gain a sustained competitive advantage. Applying the VRIO Framework The Question of Value: • In theory: Does the resource enable the firm to exploit an external opportunity or neutralize an external threat? • The practical: Does the resource result in an increase in revenues, a decrease in costs, or some combination of the two? (Levi’s reputation allows it to charge a premium for its Docker’s pants) Applying the VRIO Framework The Question of Rarity • If a resource is not rare, then perfect competition dynamics are likely to be observed (i.e., no competitive advantage, no above normal profits). • A resource must be rare enough that perfect competition has not set in. Applying the VRIO Framework The Question of Imitability • The temporary competitive advantage of valuable and rare resources can be sustained only if competitors face a cost disadvantage in imitating the resource. • If there are high costs of imitation, then the firm may enjoy a period of sustained competitive advantage. Applying the VRIO Framework The Question of Organization • A firm’s structure and control mechanisms must be aligned so as to give people ability and incentive to exploit the firm’s resources. • These structure and control mechanisms complement other firm resources—taken together, they can help a firm achieve competitive advantage. (3M Company) The VRIO Framework Costly to Exploited by Competitive Valuable? Rare? Imitate? Organization? Implications No No Disadvantage No Parity Yes Yes No Temporary Advantage Yes Yes Yes Yes Yes Sustained Advantage The VRIO Framework Costly to Valuable? Rare? Imitate? No Exploited By Org? No Competitive Implics. Economic Implics. Disadvantage Below Normal No Parity Yes Yes No Temporary Advantage Above Normal Yes Yes Yes Sustained Advantage Above Normal Yes Yes Normal Entrepreneurial Application of the VRIO Framework The Logic Remains the Same: • Small firms and start-ups can apply the VRIO framework to their resources and capabilities. – Competitive advantage vis-à-vis larger firms can often be identified. – Recognizing if and why larger firms face high costs of imitation can be critical to small firm success. International Application of the VRIO Framework Two Reasons for International Expansion: 1. Exploit current resource and capability advantages in a new market. 2. Develop new resources and capabilities in a foreign market Competitive Dynamics of Resource Imitation Competitive Dynamics: • The strategic decisions and actions of firms in response to the strategic decisions and actions of other firms. Firm B’s Possible Responses Firm A (strategy decisions lead to competitive advantage) No Response Change Tactics Change Strategy Competitive Dynamics • A firm may decide to take no action because: • the other firm is serving a different market. • A response may hurt its own competitive advantage. • It does not have the resources and capabilities to mount an effective response. • It wants to reduce or manage rivalry in the market through tacit collusion. “No Action” Response (Rolex Casio) Competitive Dynamics “Change” Responses Tactics (Tide) • specific actions »tweaking product characteristics • usually imitated so quickly that there is no advantage • a ‘leap frog’ move may create advantage Strategy (Monsanto) • a fundamental change in a firm’s theory • may be necessary if current strategy becomes obsolete • a mimetic change may achieve parity, but not advantage Competitive Dynamics • Imitation will seldom lead to competitive advantage. • Firms should use resources and capabilities to fill unique competitive space. Price Focal Firm Offering Competitor Offerings Customer Needs Quality Competitive Dynamics • Similar strategies may lead to competitive advantage. • Some firms can achieve competitive advantage even if they are second movers Price Focal Firm Offering » higher quality/ lower cost offering may lead to advantage Competitor Offerings Customer Needs Quality Wrapping it Up Internal Analysis Assumes: • Determinates of economic performance are firm-level characteristics (resources & capabilities). – firms may be different (heterogeneity) – differences may be enduring (immobility) • competitive advantage stems from resources and capabilities that meet the VRIO criteria Wrapping it Up: The Resource-Based View Resources & Capabilities Competitive Advantage • Valuable CA will be sustained if: • Rare 1.Other firms’ costs of • Costly to Imitate imitation are greater • Organized to Exploit than benefit of imitation. 2.The firm is organized to exploit advantages The Resource-Based View What do these assumptions really mean? • If one firm has resources that are valuable and other firms don’t, and… • If other firms can’t imitate these resources without incurring high costs, then… • The firm possessing the valuable resources will likely gain a sustained competitive advantage.