Slide 1 - Kellogg School of Management

advertisement

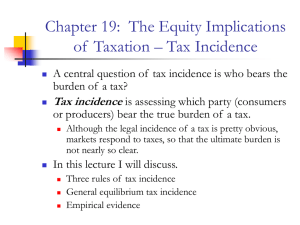

Principles of Taxation MGMT 932 Local Public Economics and Business Strategy Session 3: April 3, 2006 Professor Therese McGuire These slides are for exclusive use in MGMT 932 at the Kellogg School of Management, Northwestern University. No other use is allowed without permission of Professor Therese McGuire. Three Principles of Taxation Equity Horizontal equity. Vertical equity. Economic versus statutory incidence of a tax. Fairness is in the eyes of the beholder. Efficiency Minimize distortions to economic behavior. Minimize excess burden of taxation. Simplicity Minimize costs of administration. Minimize costs of compliance. Other principles: Stability, Competitiveness, Predictability 2 Some basic facts and concepts Two basic models/forms of taxation Ability-to-pay taxation: relate tax liability to some measure of well-being. Benefit taxation: relate tax liability to associated benefits received. More efficient, but not always (often) feasible. Average versus marginal tax rates ATR = Liability/Income MTR = change in liability per unit increase in income Example: T = .10 (Y – 5,000) where T is tax liability and Y is income Statutory versus economic incidence Is the tax burden shifted through price changes? Example: Corporation income tax borne by share holders, workers, consumers? Only people pay taxes. 3 Some basic facts and concepts (continued) Individual (personal) income tax Primary source of revenue for the federal government and ____ states. General sales tax Employed by ____ states. Property tax Primary source of revenue for local governments across the country. Under attack in recent years as a source of revenue for school districts, which have relied heavily on the property tax historically. Corporation income tax Minor source of revenue for the federal government and 40+ states. Selective (excise) taxes Employed by the federal government and all states as well as many local governments. Examples: gasoline at the pump, hotel rooms, alcohol and tobacco products. Charges and fees Rising in importance in recent decades for states and local governments. 4 Who bears the burden of the tax? The study of tax incidence. Example: impose a per-unit gasoline tax (t) on sellers of $0.50 per gallon. Equilibrium before the tax at P = $2.00 and Q = 3,000 gallons (per month). Tax causes the supply curve to shift up (parallel) by the amount of the tax. Why? At the new equilibrium there are two relevant prices. Pg price paid by consumers (gross price) $2.40 Pn price received by producers (net price) $1.90 Pg – Pn = t Equilibrium quantity falls. Why? New quantity is 2,800 gallons. Side bar: is demand elastic or inelastic? Amount raised in tax revenues? The burden of the tax is shared between consumers and producers. 4/5 of the tax is paid by consumers, 1/5 by producers. Consumers face a higher price, producers receive a lower price. 5 Who bears the burden of the tax? The study of tax incidence. (continued) The economic incidence of the tax does not depend on the statutory incidence of the tax. Place the statutory incidence on the buyers. Demand curve (as perceived by the sellers) shifts down by the amount of the tax. The split of the tax burden is the same. The incidence depends on the price elasticity of demand and supply. Suppose demand is perfectly inelastic (or supply perfectly elastic). The economic incidence falls on (all tax revenues are paid by) consumers. Suppose supply is perfectly inelastic (or demand perfectly elastic). The economic incidence falls on (all tax revenues are paid by) producers. If mobile enough (elastic demand for consumers, elastic supply for producers), then can avoid the tax. Elasticities tend to be greater in the long run than in the short run. Why? 6 The asset price incidence of capital gains taxes: evidence from the Taxpayer Relief Act of 1997 and publicly-traded real estate firms Todd Sinai and Joseph Gyourko Journal of Public Economics, 2004 What is the effect of the tax treatment of the return on an asset on the asset’s price? A question of tax incidence that depends on the relative supply and demand elasticities for the asset. An important question. Why? A difficult question to answer because there often is not much variation across corporations in corporate tax rates, or the variation is endogenously driven. This paper uses an “experiment” – the TRA97 and its differential treatment of REITs and UPREITs – to provide an answer. TRA97 lowered the personal capital gains tax rate, thereby potentially raising the price of investment for certain types of publicly-traded companies. Umbrella real estate partnership trusts (UPREITs) have a corporate structure that allows entities that sell properties to the firms to defer or avoid capital gains taxes – like an investment tax credit, with the statutory incidence on the sellers of the investment good rather than the buyers. To the extent that UPREITs capture some of the benefit of the tax deferral by paying lower prices for properties, TRA97 reduced a subsidy to investment for these companies. Regular real estate investment trusts (REITs) do not have this corporate structure. Relative price of investment is unaffected by the tax change for these firms. 7 The asset price incidence of capital gains taxes: evidence from the Taxpayer Relief Act of 1997 and publicly-traded real estate firms (continued) Todd Sinai and Joseph Gyourko Journal of Public Economics, 2004 The authors examine the share prices of UPREITs, “acquisitive” UPREITs, and REITS before and after the tax change. What are they looking for? The authors find that “the capital gains tax rate changes in TRA97 led to an 8 percent decline in the share price of acquisitive UPREITs relative to REITs and non-acquisitive UPREITs, all relative to the same period in 1996.” “Thus it appears that acquisitive UPREITs, not building sellers, reaped most of the benefit of the gains tax deferral and that the investment subsidy was substantially capitalized into UPREIT share prices.” Was the investment subsidy (the capital gains tax deferral) effective at spurring investment? Who reaped the benefit of the capital gains tax deferral, the suppliers of properties or the buyers? 8 Horizontal and Vertical Equity Horizontal equity. Do tax burdens vary across equally-situated taxpayers? Many forms of deductions and exemptions treat “equals” unequally. Retired couple v. young couple with equal incomes. Person whose income is in the form of capital gains versus person whose income is in the form of earnings. Senior-citizen homeowner v. working-aged homeowner. Defining “equals” can be problematic. Vertical equity. How do tax burdens vary as economic well-being varies across taxpayers? Our measure of tax burden is the Average Tax Rate. Recall ATR = tax liability/income. Progressive (ATR rises as income rises) v. proportional (no change in ATR as income rises) v. regressive (ATR falls as income rises). Examples: sales tax on food; flat rate income tax with a standard deduction; tax on property value. 9 Efficiency in taxation. Minimize excess burden. Taxes drive a wedge between the price paid by consumers and the price received by sellers. Recall that the efficiency of the perfectly competitive market rested on everyone facing the same prices. Prices signaled resource costs (firms) and value (consumers). The tax wedge results in welfare losses. Illustrate with a unit tax imposed in a market with constant MC (perfectly elastic supply). Consumer Surplus before the tax? CS after the tax? Difference between the two? Part is transferred to the government in the form of tax revenues. Necessary loss (evil) associated with funding government. But, part of the loss in CS is simply lost to society. It represents a loss in net benefits. The loss in CS above and beyond the taxes paid is the deadweight loss or the Excess Burden of the tax. 10 Efficiency in taxation. Minimize excess burden. (continued) Illustrate with a unit tax imposed in a market with upward-sloping supply. Now the DWL triangle (the Excess Burden triangle) reflects loss in Consumer Surplus and Producer Surplus. Why do we care about a loss in CS and PS? Why do we want to minimize the size of Excess Burden triangles? CS and PS represents value to society of the resources employed in the market. The EB triangles represent lost value to society. Excess Burden is akin to a loss in income, a decrease in the size of the economic pie. To minimize welfare losses, design taxes to minimize excess burden. The excess burden is greater the greater the distortion to (change in) behavior. The distortion to behavior is greater the greater the elasticities of demand and supply. Illustrate with example of two goods that differ only in their demand elasticities. 11 Efficiency in taxation. Minimize excess burden. (continued) Rule: Tax goods in inelastic demand (and inelastic supply). For any given per unit tax, revenue raised is greater and excess burden is less with inelastic demand. Tax rate should vary inversely with elasticity of demand. What types of goods have inelastic demand? Cigarettes (bonus: tax justified because of negative externality). Gasoline (bonus: tax justified as a benefit tax/user charge). Insulin (equity-efficient tradeoff). Elasticity of supply also relevant consideration. Example: labor supply. A tax on earned income (labor) should be imposed on inelastically supplied labor (historically, the labor supply of married men). Example: land. Land, an immobile factor, is inelastically supplied. 12 Simplicity Minimize the costs of administration and compliance. An equitable and efficient tax system is not a good one if it is too complex to administer and comply with. What are the real resource costs associated with: Complying with tax systems; Administering tax systems (collecting taxes, audits to prevent evasion); Efforts to avoid taxes? There are psychic and political costs as well to having an overly complex tax system. Loss of confidence and trust in government. Final word on the three criteria: they are often in conflict with one another. Tradeoffs must be faced when designing an “optimal” tax system. 13 Preview of next class meeting The “big three” state and local taxes. General sales tax. Individual income tax. Property tax. State tax reform – what are the issues around the country? Education finance reform. Other spending pressures – Medicaid. Avoiding the “T” word. State budget deficit/surplus dynamics. The fiscal crisis of 2001 and beyond. Can the ride be smoothed? Rainy day funds. 14