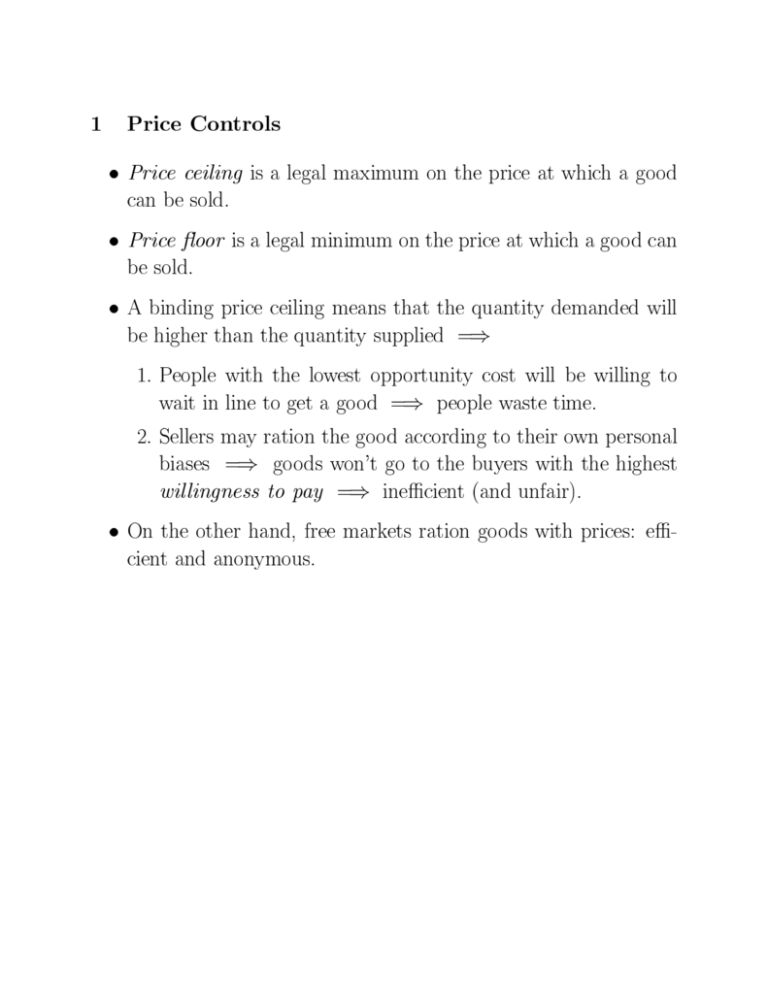

1 Price Controls

advertisement

1 Price Controls Price ceiling is a legal maximum on the price at which a good can be sold. Price oor is a legal minimum on the price at which a good can be sold. A binding price ceiling means that the quantity demanded will be higher than the quantity supplied =) 1. People with the lowest opportunity cost will be willing to wait in line to get a good =) people waste time. 2. Sellers may ration the good according to their own personal biases =) goods won't go to the buyers with the highest willingness to pay =) inecient (and unfair). On the other hand, free markets ration goods with prices: ecient and anonymous. Question: Should the students be able to buy their grades? Question: OPEC has raised oil prices many times. Why were there lines at gas stations in the 1970's, but in the 1980's and 1990's? Question: What are the eects of rent controls in the short-run and in the long-run? 1. Demand side: More people move into the city. 2. Supply side: less maintance and less new buildings. Discrimination and bribes. [Question: Suppose you get caught driving too fast. What's dierence between paying a ne or a bribe to the ocer?] 3. Government: More regulation. Laws against discrimination, minimum housing standards, and so on. Question: What is the eect of binding price oor? Question: Are there examples of price oors? Question: Is unemployment caused by minimum wages? Notice that the supply and demand analysis does not separate between extensive margin (whether people work) and intensive margin (how many hours they work). 2 Taxes Tax incidence: The study who bears the burden of taxation. Question: What happens if all icer-cream buyers must pay a tax of $0.50 for each cone they buy? Question: What happens if all icer-cream sellers must pay a tax of $0.50 for each cone they sell? Question: Who bears the tax burden if demand is inelastic? Question: Who bears the tax burden if supply is inelastic? Question: Should you tax goods that have elastic or inelastic demand? Question: What would be an optimal tax? Results: 1. With taxes, equilibrium quantity goes down. 2. Buyers and sellers share the tax burden. Buyers pay more and sellers received less. 3. Taxes on buyers and taxes on sellers are equivalent. 4. Tax burden falls more heavily on the side of the market that is less elastic. 5. Problem with taxes is that they change behavior. This eect is larger the more elastic is the demand/supply.