File

advertisement

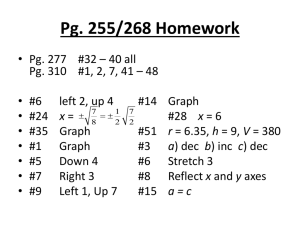

ENTRANCE TICKET You take out a loan for $20,000 to finance your college education. In your research of loans and loan interest rates, you find that: •Federal government offers you an interest rate of 4.6%. •PNC Bank offers you an interest rate of 7.8%. If it takes you 10 years to pay off your loan, how much more will you pay if you take the PNC loan? 1. Federal government offers you an interest rate of 4.6%. Simple interest = P= r= t= I= (20,000)(.046)(10) I= $9200 2. PNC Bank offers you an interest rate of 7.8%. Simple Interest = P= I = (20,000)(.078)(10) I = $15,600 r= t= 15,600 - 9,200 $6,400 more Agenda 1) Announcements 2) Go Over HW 3) Notes on Compound Interest 4) Practice Problems Announcements • Final PEETs due by 11/30/15 • Wednesday’s lesson will be about Black Friday --- you are still responsible to complete the lesson if you do not have me on Wednesday (do it by 11/30/15) Go Over HW • Simple Interest Problems Compound interest: •interest is added back into the principal, thus earning more interest Compound (v) = to increase or add to Ex) Julio’s frustration with his class was compounded by his student’s poor quiz grades SIMPLE INTEREST vs. COMPOUND INTEREST • Simple interest makes $$ grow at a consistent rate • Compound Interest makes $$ grow at an increasing rate • How do I calculate how much interest I earn/pay if interest is compounded? • Compound Interest Formula: Compound = P[(1 + Interest Principal Rate of Amount of $$ earn/pay at the end of the time period starting $$ amount Interest Change % to decimal 25% .25 t r) -1] Time in years EXAMPLE • Brett deposits $725 into savings account that pays 2.3% interest compounded annually. How much will he pay in interest? T = 8 years Compound Interest = ___ P = = P[(1 + r)t -1] = $725[(1 + .023)8-1] = $144.65 r= t= Formula for different rates of time • P[(1+r)t -1] = for annually • P[(1+r/2)t*2 -1] = for semi-annually • P[(1+r/4)t*4 -1] = for quarterly • P[(1+r/12)t*12 -1] = for monthly Compound Interest Problems •Start now (finish at home) Exit Ticket • What do “annually,” “semi-annually,” “quarterly,” and “monthly” mean in terms of compound interest?