Simple and Compound Interest

advertisement

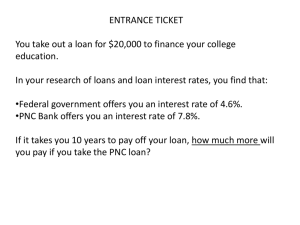

Simple and Compound Interest What is interest? Money earned/charged from an investment/loan Calculated with a rate (proportion of the principal amount) Banks pay you interest for your investment you pay banks interest for loans Simple Interest With simple interest, the interest is calculated at the end of the year (interest rates are given as an annual rate usually) on the original principal Next year the interest is calculated again on the principal Essentially the interest earned is the same each year In real life, simple interest is not practical as it results in a loss for businesses Calculating Simple Interest The formula to calculate simple interest is: I=Prt P= principal (original amount of loan or investment) I= Interest (the value of interest at the end of the time period) R= rate (the rate of the interest, on an annual basis, always convert from percent to decimal when calculating with formula) T= time (years usually, sometimes it will have to be converted according to the situation) Calculating Simple Interest The formula to calculate the total value “amount” of the interest and the principal value the formula is” A= P+I A= total amount P= principal value I= Interest value Example What would the value of a $4000 investment be after 7 years with interest at a rate of3%? I=Prt I=4000* 0.03* 7 I=840 A=P+I A=4000+840 A=4840 The value of the investment after 7 years will be 4840 Example What would the value of a $5000 investment be after 16 months with interest at a rate of 3.9% I=Prt I=5000* 0.039* (16/12) since a year is 12 months I= 260 A=P+I A=5000+260 A=5260 So the value of the investment after 16 months would be $5260 Practice! What would the value of a $500 investment be after 8 years if invested at a rate of 4.8% Remember to calculate the total amount, not just the interest Your answer should be $692 Practice! How much would you owe the bank if you took a loan of $7000 at a rate of 9% for 28 months? Remember to convert the “time” unit into years You should have an answer of $8470 Compound Interest Compound interest is when the interest calculated is calculated on the principal amount and the interest added from the previous term This is a more commonly seen form of interest in the real world It is also more profitable for investments as the interest value is calculated on a larger sum Calculating Compound Interest The formula to calculate the value of compound interest is: 𝒏 A= 𝑷 ∗ (𝟏 + 𝒓 ∗ 𝒕) I= Interest P=principal amount R= rate T= time for 1 compound period N= number of compound periods Calculating Compound Interest Compound interest can be calculated for different time period as well, not just annually Term Meaning Annually Once a year Semi-annually Twice a year Quarterly 4 times a year (3 months in each quarter) Monthly 12 times a year Weekly 52 times a year Daily 365 times a year Example What would the value of a $2000 bond be after 3 months at an interest rate of 5% I= 2000 (1+ 0.05* 1/12)^3 (the months are converted as 1/12 as there are 12 months in a year, but to calculate for three months the exponent value is raised to 3) A= 2025.10 Example How much would you owe the bank for a loan of $4000 compounded semi-annually for 4 years at an interest rate of 7%? A= 4000* (1+ 0.07* ½)^8 semi annually makes the denominator for “time” 2 as it is calculated twice a year, whereas the exponent becomes 8 since in 4 years, if calculated twice each year the interest would be compounded 8 time A= 5267.24 Practice! $2500 compounded quarterly for 5 years at a rate of 4.75% Remember to convert the “time” unit You should get $3165.76 as your answer Resources http://www.youtube.com/watch?v=B3IdfBcXrLA http://www.youtube.com/watch?v=GtaoP0skPWc