tribtwa m 04 Streitz 2-21

advertisement

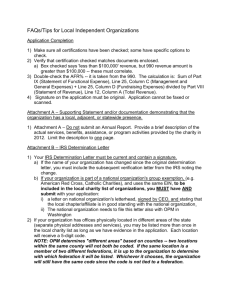

Law Seminars International: Tax Management for Tribes February 21-22, 2008 Seattle, WA The New Era of Increasing IRS Audits of Tribal Governments: Procedural Matters and Hot Issues Mary J. Streitz Dorsey & Whitney LLP IRS Has Multiple Functions 2 • Education and outreach • Enforcement – Compliance checks – Audits – IRS often refers to these as “examinations” – Collection activities Increasing IRS Emphasis on Enforcement • Emphasis is system wide, not just in Indian country • IRS Office of Indian Tribal Governments (“ITG”) has informed tribes in the Pacific Northwest that it currently has over 120 open audits 3 Compliance Check • A review to determine whether the Tribe is adhering to various tax return, information reporting, and recordkeeping requirements • Not an examination of books and records to determine the correct tax liability for a past period • Participation is optional • Tribes can perform a self-compliance check through ITG’s “TEFAC” program 4 Audit • An examination of the Tribe’s books and records to determine the correct tax liability for a past period • I.R.C. § 7605(b) – no taxpayer shall be subject to “unnecessary examination or investigations” – “only one inspection of a taxpayer’s books of account shall be made for each taxable year” unless appropriate IRS personnel notifies the taxpayer in writing that an additional inspection is necessary • ITG specialists conduct these audits, except Bank Secrecy Act audits and tax-exempt bond audits 5 Preparing for an Audit • Locate relevant records – Retain copies of returns and backup documents for at least 4 years after due date • Identify sensitive factual issues • Identify and evaluate exposure items 6 Managing the Audit • Time and place of audit – Tribe is entitled to reasonable notice – IRS is likely to want to commence audit at Tribe’s facilities – It may be helpful to discuss the scope and timetable for the audit at the initial meeting at the Tribe’s facilities 7 Managing the Audit (cont’d) • Ground rules – Specify personnel authorized to deal with IRS • Limited group desirable • IRS must make special arrangements to speak with other Tribal personnel 8 Managing the Audit (cont’d) • Ground rules (cont’d) – Ask that all IRS requests for information and documents be made in writing • These requests are known as Information Document Requests (“IDRs”) • Respond to IDRs in writing • Keep records of correspondence and documents provided 9 Managing the Audit (cont’d) • Role of counsel – Assist in preparation – Draft or review responses to IDRs – The team member who says “no” – Review notices of proposed adjustment and draft responses 10 Scope of the Audit • Information and documents requested should be relevant to some proper investigative purpose relating to determining the correct federal tax liability of the Tribe or a third party dealing with the Tribe • Personal interviews – ITG generally wishes to commence the audit with an interview of a knowledgeable Tribal employee – Tribe’s counsel may be present for interviews of employees and agents of the Tribe 11 Scope of the Audit (cont’d) • Documents – Financial records – Tribal government records – Attorney/client and other privileges protect certain documents from disclosure 12 The Audit Process • IDRs • Notice of proposed adjustments • Request for technical advice from IRS National Office • Settlement – IRS examining agents generally have no ability to compromise issues based on hazards of litigation – Issues may be eliminated, however, if parties agree on the merits • 30-day letter and report on unagreed issues 13 Contesting Unagreed Issues After the Audit • IRS Appeals Office – File protest within 30 days after date of 30-day letter – Informal process with one or more face to face conferences, lasting up to a year or more – Appeals Office mission is to settle cases on a fair and impartial basis by taking into account hazards of litigation • Litigation in U.S. Tax Court, U.S. District Court, or U.S. Court of Federal Claims 14 Impact of Audit on Tax Liability of Tribal Members • Proposed adjustments for Tribe may lead to proposed adjustments for tribal members • Tribe may wish to coordinate resolution of tribal members’ cases through a group-wide audit and appeals process, with common legal representation if appropriate – Assists tribal members with difficult process – Ensures strong and consistent arguments will be made – Efficient use of resources 15 Audit Issues: Employee v. Independent Contractor • Who is an employee? – IRC § 3121(d)(2) – “any individual who, under the usual common law rules applicable to determining the employer/employee relationship, has the status of an employee” – Common law test: whether employer has right to control and direct the individual regarding the job s/he is to do and how s/he is to do it – ITG focuses on factors related to (1) behavioral control, (2) financial control, and (3) relationship of the parties 16 Audit Issues: Employee v. Independent Contractor • ITG takes the position that in general, members of tribal boards and committees are employees, not independent contractors – See Example 3 from ITG’s Employment Tax Desk Guide, p. 12: Ms. Fran is a tribal member but not a council member. Ms. Fran is on the Beautification Committee. She is required to attend the Ms. Indian Pageant Committee and is paid $50. Ms. Fran is considered an employee and is subject to withholding of federal income taxes, FICA, and Medicare tax. Ms. Fran will also be issued a Form W-2. 17 Audit Issues: Section 530 Relief • Section 530 of 1978 Revenue Act, as amended, essentially overrides the common law rules regarding worker classification for federal employment tax purposes – This statute is not codified in the Internal Revenue Code – Section 530 provides retroactive and prospective relief from employment tax liability to employers who misclassified workers as independent contractors 18 Audit Issues: Section 530 Relief • Prerequisites for Section 530 relief (summarized in IRS Publication 1976): – Reasonable basis for not treating workers as employees • Reasonable reliance on court case or IRS ruling; • IRS did not reclassify workers in a previous audit; • Reliance on practice by a significant industry segment; or • Other reasonable basis 19 Audit Issues: Section 530 Relief • Prerequisites for Section 530 relief (cont’d): – Substantive consistency • Must have consistently treated workers, and any similar workers, as independent contractors – Reporting consistency • Must have filed all required tax returns (i.e., Forms 1099-MISC) consistent with treatment of workers as independent contractors 20 Audit Issues: Section 530 Relief • IRS should consider eligibility for Section 530 relief before examining the merits of the issue • Section 530 provides one potential basis for overriding ITG’s position regarding classification of tribal board and committee members 21 Audit Issues • Distributions to tribal members – Per capita payments – Deferred per capita payments • Programs for minors • Programs for adults – Nontaxable general welfare benefits 22 General Welfare Doctrine: General Tax Principles • Section 61 of the Internal Revenue Code: all income, from any source, is subject to taxation unless excluded by law. • Squire v. Capoeman, 351 U.S. 1, 6 (1956) & Rev. Rul. 67284: unless a treaty or law provides an exemption, all tribal member income is taxable income, including nongaming per capita payments received from tribe • IGRA: all gaming revenue per capita payments are subject to federal income tax, reporting and withholding • “General Welfare Doctrine”: certain benefits provided by a tribe to its members may be nontaxable if they satisfy the general welfare doctrine of federal tax law. 23 General Welfare Doctrine The IRS has broadly described the contours of its general welfare doctrine and applied it to tribal benefits: “[P]ayments made under legislatively provided social benefit programs for promotion of the general welfare are excludable from gross income. This general welfare doctrine applies only to governmental payments out of a welfare fund based upon the recipients’ need. . .” Tech. Adv. Mem. 9717007 (Jan. 13, 1997) 24 General Welfare Doctrine • Facts and circumstances test • Doctrine is driven by policy considerations 25 General Welfare Doctrine State/federal nontaxable general welfare benefit programs: – Benefits to the blind (Rev. Rul. 57-102) – Crime victim compensation awards (Rev. Rul. 74-74) – Grants to low income families for home ownership (Rev. Rul. 75-271) – Grants to help with basic needs in major disaster (Rev. Rul. 76-144) – Heating cost assistance for elderly and disabled (Rev. Rul. 78-170) 26 General Welfare Doctrine Favorable IRS rulings involving tribal programs: – Federal and tribal business development grants (Rev. Rul. 77-77 and Priv. Ltr. Rul. 199924026 (Mar 19, 1999)) – Education benefits, based on members’ education need, not financial needs (Tech. Adv. Mem. 200035007 (May 23, 2000)) – Education benefits, based on members’ financial needs (Priv. Ltr. Rul. 200409033 (Nov. 24, 2003)) 27 General Welfare Doctrine Favorable IRS rulings involving tribal programs: – Housing benefits similar to those provided under federal programs to low and moderate income persons (Chief Counsel Advice 200138007 (Sept. 21, 2001)) – Housing benefits provided based on “a consideration of financial as well as housing needs” (Priv. Ltr. Rul. 200336030 (Jun. 6, 2003)) – Housing benefits provided based on a needs-based priority system (Priv. Ltr. Rul. 200632005 (Apr. 13, 2006)) 28 Creating Nontaxable General Welfare Doctrine Programs General Characteristics: • Tribal legislative body authorizes the program – A written program document should explain need for program and define eligibility criteria – Tribal departments or committees with responsibility for program administration may adopt program procedures • Benefit program must be “need-based” – Income eligibility rules most defensible – Exceptions may include education, health-related benefits, benefits for the elderly, and certain types of housing benefits • Program open to every tribal member who qualifies 29 Creating Nontaxable General Welfare Doctrine Programs Program document also should include: Dollar limit or other limits on benefits Required use of benefits, with safeguards against 30 misuse Priority rules Application process Review of program operations Penalties for program violation Appeal process Program audit requirements Creating Nontaxable General Welfare Doctrine Programs Program must be followed as closely as possible • Adopt a program that the tribe can live with • Provide for regular internal audits, with prompt correction of problem areas, and external audits if necessary Program should be amended infrequently and then only if and to the extent necessary If there are multiple programs, conduct a program review to identify areas of overlap and inconsistency 31 Creating Nontaxable General Welfare Doctrine Programs Decide whether to seek a private letter ruling from the IRS National Office that the benefits paid under the program are nontaxable under the general welfare doctrine and not subject to reporting or withholding 32 Other Audit Issues • Compensation paid to Tribal Council members • Compensation paid to treaty fishery employees • Tax exempt bonds – “essential governmental function” test • Scope of Bank Secrecy Act audits • ITG has published its own “top 10” list of problems discovered during compliance checks – see attachment to materials 33 IRS Guidance Projects • Regulations establishing criteria for determining whether a corporation is an integral part of the federal, state, or tribal government • Implementation of tribal government provisions of Pension Protection Act of 2006 34