GENERAL INVESTMENT ANALYSIS

advertisement

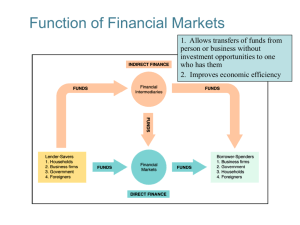

GENERAL INVESTMENT ANALYSIS INVESTORS NEED TO •gather (info services) • process (computer) • and interpret (models) information •then make logical investment decisions •fits many skilled job requirements - not just invest. STEPS TO SELECTING AMONG SICs and COMPANIES (STOCKS) IN YOUR SIC 1. Choose an SIC for which detailed knowledge of such financial group offers you some benefit - better performance in present job - potential for future employment - better personal financial success. 2. Among SIC’s that fit criterion (1) consider an SIC you expect to benefit from economic trends. 3. Gather information on general industry trends and important factors that determine what types of companies in your SIC will be most successful. 4. Gather information on all companies in the SIC select the stocks of the most promising companies. INFORMATION TYPES 1. Direct information from financial statements, • newspapers, internet etc. • financial position - ratios, etc. • differential strengths - patents, size, economies of scale, scientists, brand name • read brokerage reports - especially those that compare competing firms • consider past and potential future growth of total market and firm’s market share 2. Indirect information • stock ownership of management • level and incentives in management pay • ownership of institutional investors • management credentials and experience • suppliers and partners - call and question • customers - call and question • customer service and product distribution • test products yourself - ask others their opinion of products - store sales people • watch for price cutting • check competitor’s products and potential competitors outside the industry • technical analysis - let the market lead you Financial Systems 1. Financial Systems not just Intermediaries • Financial intermediaries compete with financial markets in an innovation spiral. • Both facilitate financial trade with services/products. • Financial intermediaries often buy illiquid and risky financial claims (corporate loans) and transform (engineer, produce) them into less risky, more liquid claims (demand deposits) - best for custom, illiquid, low-volume, complex assets. • Financial markets provide a centralized place to trade financial claims - best for standardized, liquid, high-volume, simple products. Financial System Global Flow of Funds Full System MARKETS SURPLUS UNITS DEFICIT UNITS Intermediaries The lines trace the flow of funds. Not shown is the flow of securities, information, guarantees, etc., flowing in the opposite direction. Flow of Funds Simple System MARKTS SURPLUS UNITS DEFICIT UNITS Examples : Early history - lending to tribe, family, friends. Recently - Boston Market funds franchisees. - Firms sell stocks and bonds on web directly to investors, DRIPS. Question: What problems may occur in these examples? Question: How can intermediaries help solve the problems? Flow of Funds Intermediaries but no Markets Example: Insurance (exception, Llyods of London). SURPLUS UNITS Intermediaries DEFICIT UNITS Flow of Funds Markets but no Intermediaries Example: Stock exchanges, ECNs like Instinet. SURPLUS UNITS Markets DEFICIT UNITS Question: Salomon Brothers sold “Bowie” bonds which pay investors coupons from the future royalties from David Bowie’s record sales. Who are the surplus and deficit units and the market or intermediary? Functional Perspective on Financial Intermediaries Six Primary Financial Functions •Intermediaries come and go but their functions remain. • Banks originated in Italy as money changers “Banca” refers to money changers’ benches. • In the U.S. banks largely pool deposits and lend whereas in Europe they perform many functions. •Institutional form can be explained and changes predicted from competition within function. • The proper question to answer is how best to satisfy customer demand for a function rather than which particular institution usually handles the function. Example of Institutional Form Following Function Suppose you want a levered position in the S&P 500. • Buy the 500 individual stocks on margin (broker lending). • Borrow and buy an S&P 500 index fund/unit trust. • Buy an S&P 500 futures contract. • Buy an S&P 500 forward contract. • Enter into an S&P 500 for LIBOR swap contract. • Buy S&P 500 call options and sell S&P 500 put options. • Buy a bond that pays a coupons based on the S&P 500. • Buy a CD that pays a return based on the S&P 500. • Buy a variable annuity linked to the S&P 500. Function 1 1. Clearing and settling transactions to facilitate trade in goods, services and financial products. • Barter makes trade time consuming and costly. • Using gold is cheaper and more convenient. • Currency is even better (flooz,beenz). • Checks, credit cards, travelers checks. Function 2 2. Provide information directly or implicitly in prices. • Interest rates encourage (discourage) savings/investment. • Stock prices signal business to expand - brand value. • Index options provide information on market risk (VIX). • Intermediaries sell investment information and advice. • You can hire a real estate appraiser or set the price of your house by using the price of recent sales. Function 3 3. Alleviating incentive problems. • Problems occur when one party to a trade has more information than another - reduces or stops trade. •Type 1: Moral Hazard - after insuring, risk-taking behavior changes - Boston Market. • Type 2: Adverse Selection - after setting a fixed premium, only poor risks find it attractive - “lemons”. • Type 3: Principal/Agent - delegating stock selection Merrill Lynch ad “What’s your motivation.” •Occurs often because public ownership implies a separation between owners and managers of firms. • Information gathering, convertible debt, collateral or compensation systems can alleviate the problems. • Solving the problems increases trade and leaves both parties better off. Function 4 4. Pooling funds and subdividing ownership • Pooling facilitates risk diversification and financing of large projects. • Subdividing facilitates risk transfer and ownership transfer - race horse syndicate on web. • Spreads information gathering and trading costs over many investors. • Berkshire Hathaway - $55,000 stock - facilitates pooling but not subdividing. Function 5 5. Transfer resources across time, place and industry. • The more developed and complex a country, the more important this is to an efficient financial system. • Asset allocation funds. • Old economy stocks versus new economy stocks. • In Europe - people are selling bonds and buying stocks. • Question: Does the U.S. Social Security System satisfy this function? Function 6 6. Risk management and transfer - the most important and fastest growing function. • Management includes hedging, diversifying and insuring. • Insurance transfers risk from policyholder to insurer. • Insurance companies spread risk among policies. • Bank transfers risk to loan co-signers - parents. • Jewelry maker fixes metal costs in the futures market. • Question: What happens in agriculture price supports? • Question: Why do few people by hurricane insurance? •Technology and communications advances reduce information and transactions costs, leading to more efficient responses to small changes in consumer tastes and economic events. • Better information reduces incentive problems leaving risk management as most important - more class time. • Firms shed risks they know little about and manage internally, risks in which they are expert. • Intermediaries help match risk sellers with buyers. • Securitization is exploding - markets match risk traders. • Manger self-interest, progressive taxes and bankruptcy costs increase the demand for risk management. The Changing Functions of Banks • In the past, banks primarily settled customer transactions, pooled customer deposits and loaned funds locally. • Now banks pool deposits and transfer funds nationally through securities such as mortgage-backed bonds. • Loan origination, servicing and funding are now often done by specialist institutions with local banks focussing on origination and perhaps funding. • Each institution focuses on its core competency - for a local bank- its competitive advantage is knowledge of local businesses and its proximity for monitoring. Their knowledge and monitoring generates valuable information and mitigates incentive problems. • The clearing and settling functions of banks is less significant as money market funds have grown. Money market funds’ operating costs are ten time lower than those of banks. • Given that money market funds invest in very highly rated securities, banks’ risk absorption function is less important. • Banks risk management function is becoming more sophisticated as they resell loans or securitize them instead of holding mortgages and commercial loans on their books. Future of Financial System • Information scale economies leads to larger institutions. • Large institutions reduce costs by netting transactions internally, cross-selling products, customize products. • Financial research important to support complex products. • With less risk kept internally, more firms remain privately held - less need for co-owner diversification. • Individuals shift from direct financial holdings to specialized intermediary products. • In 1966 (1995), individuals held 85% (52%) of stocks. • In 1966 (1995), individuals held 5% (25%) of their stocks as mutual funds. • Traditional strategies and technologies of intermediation are losing out to structured finance and market-making. • Structuring securities and making markets for them relies on proprietary knowledge and models. • Skill sets for doing this include, technological knowledge, analytic ability, customer and supplier networking as well as regulatory and political networking. Finance Careers Basic Job Groupings • Corporate Finance • Investments • CD-ROM - Careers in Finance • www.careers-in-finance.com