Comparative Financial Systems

advertisement

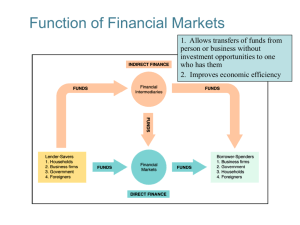

Comparative Financial Systems PROF. ELENA BECCALLI COURSE AIMS The course is designed to provide the student with a comparative analysis of the organisational and institutional frameworks of the main financial systems at an international level. For this purpose, the course will illustrate the distinctive aspects of financial systems oriented primarily to markets and those oriented toward intermediaries as well as the reasons that have historically led to such differences. A special emphasis is placed on the types of intermediaries operating within the different systems and the different operating models adopted by banks, as well as the structural and operational characteristics of the securities markets at an international level. The course ends with a review of financial crises in industrialised nations and emerging markets, and the role of those crises in delineating the current organisation of financial systems. COURSE CONTENT INSTRUCTIONAL OBJECTIVES THAT THE STUDENT SHOULD HAVE ACHIEVED BEFORE TAKING THE COURSE Before taking the course, the student should be familiar with: – the economic functions of financial intermediaries; – the types of intermediaries operating in a financial system; – how regulated markets work; – the structure of the financial statements of credit intermediaries. INSTRUCTIONAL OBJECTIVES OF THE COURSE Financial systems at an international level After having completed the study of the material, the student is expected to be capable of: – analysing from a comparative standpoint the nuances of market-based financial systems and bank-based systems in terms of the means of financing businesses, the mix of household financial portfolios, types of consumer financing; – understanding the structural development of the main financial systems (US, UK, France, Germany, Japan, and Italy) so as to understand the current differences. Financial intermediaries at an international level After having completed the study of the material, the student is expected to be capable of: – understanding the types of intermediaries operating in the international financial systems, as well as their importance in relation to the different systems; – understanding the distinctive aspects of the originate-and-distribute and the originate-and-hold banking intermediation models; – comparing European bank intermediaries in terms of earnings, capital and operating efficiency; – interpreting the mergers and acquisitions processes in banking markets. Securities markets at an international level After having completed the study of the material, the student is expected to be capable of: – understanding the structural and operational aspects of securities markets at an international level (London Stock Exchange, New York Stock Exchange and NASDAQ); – understanding and interpreting the empirical evidence in relation to the risk and return on financial instruments in international markets. Financial crises After having completed the study of the material, the student is expected to be capable of: – interpreting the dynamics of financial crisis (USA, Argentina and Southeast Asia), banking crises (Japan, Scandinavia, and Russia) and speculative bubbles (Internet stocks); – understanding the crisis originating from sub-prime mortgages in relation to issues regarding the financing of households and bank management models; – understanding the dynamics of the Northern Rock case. At the end of the course, the student is also expected to be able to interpret the financial statistics compiled by institutions such as the European Central Bank and the Federal Deposit Insurance Corporation. READING LIST Considering the course's particular structure and the analysis over time of certain subjects, it is not possible to identify specific textbooks for all topics covered in class. Reading references will thus be indicated in class. Various readings and supplemental instructional materials will be made available through the Blackboard platform on the site dedicated to the course. Recommended reading E. BECCALI, Principles of banking and finance, London University Press, 2008 (Chapters 2, 3 and 4). F. ALLEN-D. GALE, Comparing financial systems, MIT Press, 2001 (Chapters 2, 3 and 9). [ISBN 0262511258]. TEACHING METHOD The course will be taught through lectures (90% del course) and presentations by sector experts (10%). ASSESSMENT METHOD The examination consists of a written test with five questions; the test will run for 90 minutes. An interview is optional, but not integrative. NOTES Further information can be found on the lecturer's webpage at http://docenti.unicatt.it/web/searchByName.do?language=ENG or on the Faculty notice board.