Micro_Class19_Externalities - Econ101-s13-Horn

advertisement

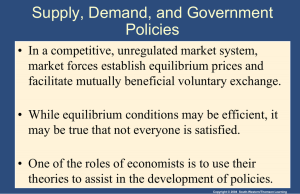

© 2007 Thomson South-Western Pollution • Think about air pollution from a factory. • The firm does not have to pay the costs associated with pollution • The firm will produce more than the socially efficient quantity. • This is an example of a negative externality © 2007 Thomson South-Western Education • Private benefits of education • Median income of college graduates $46,285 • $20,000 more than those with only high school diploma • External benefits of education • lower crime rates: educated people have more opportunities, so less likely to rob and steal • better government: educated people make better-informed voters • Result: Market equilibrium quantity of education will be too low • This is an example of a positive externality © 2007 Thomson South-Western EXTERNALITIES AND MARKET INEFFICIENCY • An externality refers to the uncompensated impact of one person’s actions on the wellbeing of a bystander. • Externalities cause markets to be inefficient, and thus fail to maximize total surplus. © 2007 Thomson South-Western EXTERNALITIES AND MARKET INEFFICIENCY • When the impact on the bystander is adverse, the externality is called a negative externality. • When the impact on the bystander is beneficial, the externality is called a positive externality. © 2007 Thomson South-Western NEGATIVE EXTERNALITIES • Examples: – Automobile exhaust – Barking dogs (loud pets) – Loud stereos in an apartment building © 2007 Thomson South-Western POSITIVE EXTERNALITIES • Examples: – Immunizations – Restored historic buildings – Research into new technologies © 2007 Thomson South-Western Recap of Welfare Economics The market for aluminum P $5 4 3 $2.50 2 1 0 0 10 20 25 30 Q (tons) Demand Curve reflects the value of that product to those consuming it, measured by price that consumers are willing (and able) to pay Assumed it captures all the benefits associated with consuming the next unit of a good. (Private Value) Supply Curve reflects the cost to producers of making the good Assumed it captures all costs associated with creating the next unit of the good (Private Costs) © 2007 Thomson South-Western Recap of Welfare Economics The market for aluminum P $5 The market eq’m maximizes consumer + producer surplus (or total surplus) 4 3 $2.50 all units for which the value placed on production is greater than the cost of creating are produced 2 1 0 0 10 20 25 30 Q (tons) © 2007 Thomson South-Western Application to Externalities • The Market for Production of Aluminum • Since the production of aluminum results in pollution (a negative externality), the cost to society of making aluminum is larger than the cost to aluminum producers. • For each unit of aluminum consumed, the social cost includes the private costs of the producers plus the cost to people/environment adversely affected by the pollution (external costs). © 2007 Thomson South-Western Analysis of a Negative Externality in Production The market for aluminum P $5 Social cost = private + external cost 4 External cost Supply (private cost) 3 External cost = value of the negative impact on bystanders 2 1 0 0 10 20 30 Q (tons) = $1 per ton (value of harm from pollution) © 2007 Thomson South-Western Analysis of a Negative Externality in Production The market for aluminum P $5 DWL 4 Social cost The socially optimal quantity is 20 gallons. S At any Q < 20, value of additional ton exceeds social cost 3 2 D 1 0 0 10 At any Q > 20, social cost of the last ton is greater than its value Dead Weight Loss as 20 25 30 Q a result of externality? (tons) © 2007 Thomson South-Western Negative Externalities • The intersection of the demand curve and the social-cost curve determines the optimal output level. • The socially optimal output level is less than the market equilibrium quantity. © 2007 Thomson South-Western Analysis of a Negative Externality The market for aluminum P $5 Social cost 4 S 3 2 D 1 0 0 10 20 25 30 Q (tons) Market eq’m (Q = 25) is greater than social optimum (Q = 20) One solution: tax sellers $1/ton, would shift supply curve up $1. © 2007 Thomson South-Western Negative Externalities • Internalizing an externality involves altering incentives so that people take account of the external effects of their actions. • To achieve the socially optimal output… • the government can internalize an externality by imposing a tax on the producer to reduce the equilibrium quantity to the socially desirable quantity. © 2007 Thomson South-Western Negative Externalities • In the previous example, the $1/ton tax on sellers makes sellers’ costs equal to social costs. • When market participants must pay both the private and external costs (social costs), the market eq’m matches the social optimum. (Imposing the tax on buyers would achieve the same outcome; market Q would equal optimal Q.) © 2007 Thomson South-Western Analysis of a positive externality in consumption P The market for flu shots External benefit = $10/shot • Draw the social value curve. • Find the socially optimal Q. • What is the DWL? • What policy would internalize this externality? $50 40 S 30 20 10 D 0 Q 0 10 20 30 © 2007 Thomson South-Western Answers Socially optimal Q = 25 shots DWL = ½(10*5)=25 To internalize the externality, use subsidy = $10/shot. P The market for flu shots $50 external benefit 40 DWL 30 S Social value = private value + external benefit 20 10 D 0 Q 0 10 20 25 30 © 2007 Thomson South-Western PRIVATE SOLUTIONS TO EXTERNALITIES • Can people solve these problems on their own (without government involvement)? • Types of Private Solutions – Moral codes and social sanctions (ex/littering) – Charitable organizations (Sierra Club to protect environment) – Integrating different types of businesses (ex/Bees and Orchard) © 2007 Thomson South-Western The Coase Theorem • The Coase theorem is a proposition that • if private parties can bargain without cost over the allocation of resources, they can solve the problem of externalities on their own. © 2007 Thomson South-Western The Coase Theorem: An Example Dick owns a dog named Spot. Negative externality: Spot’s barking disturbs Jane, Dick’s neighbor. The socially efficient outcome maximizes Dick’s + Jane’s well-being. • If Dick values having Spot more than Jane values peace & quiet, the dog should stay. See Spot bark. Coase theorem: The private market will reach the efficient outcome on its own… © 2007 Thomson South-Western The Coase Theorem: An Example • CASE 1: Dick has the right to keep Spot. Benefit to Dick of having Spot = $500 Cost to Jane of Spot’s barking = $800 • Socially efficient outcome: Spot goes bye-bye. • Private outcome: Jane pays Dick $600 to get rid of Spot, both Jane and Dick are better off. • Private outcome = Efficient outcome. © 2007 Thomson South-Western The Coase Theorem: An Example • CASE 2: Dick has the right to keep Spot. Benefit to Dick of having Spot = $1000 Cost to Jane of Spot’s barking = $800 • Socially efficient outcome: See Spot stay. • Private outcome: Jane not willing to pay more than $800, Dick not willing to accept less than $1000, so Spot stays. • Private outcome = Efficient outcome. © 2007 Thomson South-Western The Coase Theorem: An Example • CASE 3: Benefit to Dick of having Spot = $800 Cost to Jane of Spot’s barking = $500 But Jane has the legal right to peace & quiet. • Socially efficient outcome: Dick keeps Spot. • Private outcome: Dick pays Jane $600 to put up with Spot’s barking. • Private outcome = Efficient outcome. The private market achieves the efficient outcome regardless of the initial distribution of rights. © 2007 Thomson South-Western ACTIVE LEARNING 2: Brainstorming Collectively, the 1000 residents of Green Valley value swimming in Blue Lake at $100,000. A nearby factory pollutes the lake water, and would have to pay $50,000 for non-polluting equipment. A. Describe a Coase-like private solution. B. Can you think of any reasons why this solution might not work in the real world? © 2007 Thomson South-Western ACTIVE LEARNING 2: Brainstorming A. Describe a Coase-like private solution. A good Coasian solution would be for each of the 1000 residents to chip in $75, so the town can offer $75,000 to the factory to stop polluting. © 2007 Thomson South-Western ACTIVE LEARNING 2: Brainstorming B. Can you think of any reasons why this solution might not work in the real world? 1. Transaction costs (cost of hiring lawyers) 2. Bargaining breakdown 3. Difficult to get so many people to agree on something © 2007 Thomson South-Western Why Private Solutions Do Not Always Work • Transaction costs are the costs that parties incur in the process of agreeing to and following through on a bargain. • Holdouts occur when a beneficial agreement is possible but some parties hold out for a better deal. • Coordination costs when the number of parties is very large. © 2007 Thomson South-Western PUBLIC POLICIES TOWARD EXTERNALITIES • When externalities are significant and private solutions are not found, government may attempt to solve the problem through . . . – command-and-control policies. • limits on quantity of pollution emitted • requirements that firms adopt a particular technology to reduce emissions – market-based policies. • provide incentives so that private decision-makers will choose to solve the problem on their own. © 2007 Thomson South-Western Command-and-Control Policies: Regulation • Usually take the form of regulations: • Forbid certain behaviors. • Require certain behaviors. • Examples: • Requirements that all students be immunized. • Stipulations on pollution emission levels set by the Environmental Protection Agency (EPA). • Regulations are often used when the costs are so high that the optimal quantity is zero (ex/dumping poisonous chemicals into the water supply) © 2007 Thomson South-Western Market-Based Policy 1: Corrective Taxes and Subsidies • Corrective taxes are taxes enacted to correct the effects of a negative externality. • The ideal corrective tax = external cost • Also known as Pigouvian Taxes after Arthur Pigou (18771959) • Corrective subsidies are subsidies enacted to adjust for the effects of a positive externality. • The ideal corrective subsidy = external benefit © 2007 Thomson South-Western Regulation vs. Corrective Tax • If the EPA decides it wants to reduce the amount of pollution coming from a specific plant. The EPA could… • tell the firm to reduce its pollution by a specific amount (i.e. regulation). • levy a tax of a given amount for each unit of pollution the firm emits (i.e. corrective tax). • Lets compare the costs associated with these two approaches © 2007 Thomson South-Western Regulation vs. Corrective Tax • Example Two Firms: Acme and US Electric run coal-burning power plants. Each emits 40 tons of sulfur dioxide per month. SO2 causes acid rain & other health issues. • Policy goal: reducing SO2 emissions 25% (from 80-60) • Policy options: (1) Regulation require each plant to cut emissions by 25% (2) Corrective Tax Make each plant pay a tax on each ton of SO2 emissions. Set tax at level that achieves goal. © 2007 Thomson South-Western Regulation vs. Corrective Tax • Firms have different costs for reducing emissions: • Acme – cost of reducing emissions is $100/ton • US Electric – cost of reducing emissions is $200/ton • Socially efficient outcome: Acme reduces emissions more than US Electric. (1) Regulation: Both firms will reduce missions by the same amount. (2) Taxation: Tax allocates this “good” to the firms who value it most highly (ex/Tax of $150) • US Electric will continue polluting and pay tax • Acme will choose to reduce pollution rather than pay tax © 2007 Thomson South-Western Regulation vs. Corrective Tax • Under regulation, firms have no incentive to reduce emissions beyond the 25% target. • A tax on emissions gives firms incentive to continue reducing emissions as long as the cost of doing so is less than the tax. • If a cleaner technology becomes available, the tax gives firms an incentive to adopt it. © 2007 Thomson South-Western Challenges associated with corrective tax A lot of information is needed to get the tax right If tax is too high will restrict production too much, causing inefficiency If tax is too low will not adequately reduce pollution. Is there a way that we can set the quantity and let the market choose the price? Yes! Tradable Permits © 2007 Thomson South-Western Market-Based Policy 2: Tradable Pollution Permits • Tradable pollution permits allow the voluntary transfer of the right to pollute from one firm to another. • A market for these permits will eventually develop. • A firm that can reduce pollution at a low cost may prefer to sell its permit to a firm that can reduce pollution only at a high cost. © 2007 Thomson South-Western Market-Based Policy #2: Tradable Pollution Permits • Alternative: • issue 60 permits, each allows its bearer one ton of SO2 emissions (so total emissions = 60 tons) • give 30 permits to each firm • establish market for trading permits • Each firm can choose among these options: • emit 30 tons of SO2, using all its permits • emit < 30 tons, sell unused permits • buy additional permits so it can emit > 30 tons © 2007 Thomson South-Western Market-Based Policy #2: Tradable Pollution Permits Suppose market price of permit = $150 US Electric • buys 10 permits from Acme for $1,500 • emissions remain at 40 tons • net cost to USE: $1,500 Acme • sells 10 permits to US Electric for $1,500 • spends $2,000 to cut emissions by 20 tons • net cost to Acme: $500 Total cost of achieving goal: $2,000 Total cost through regulation: $3,000 © 2007 Thomson South-Western Market-Based Policy #2: Tradable Pollution Permits • A system of tradable pollution permits achieves goal at lower cost than regulation. • Firms with low cost of reducing pollution sell whatever permits they can. • Firms with high cost of reducing pollution buy permits. • Result: Pollution reduction is concentrated among those firms with lowest costs. © 2007 Thomson South-Western Tradable Pollution Permits in the Real World • SO2 permits traded in the U.S. since 1995. • Nitrogen oxide permits traded in the northeastern U.S. since 1999. • Carbon emissions permits traded in Europe since January 1, 2005. © 2007 Thomson South-Western