Stock Market Game Classroom Presentation

The Stock Market Game Program

A classroom activity for students grades 4 - 12

Stock Market

Game Basics

SMG Basics

Real-time stock market simulation

Played on the internet from any computer

The game runs for ten weeks in the fall, spring, and late spring. A new whole year game is also available.

SMG Rules

Transactions are made at the SMG

WorldWide site at: www.smgww.org

Trades are processed in 5 – 20 minutes

SMG Basics

Each team begins with a hypothetical $100,000

Teams should have one to five players

SMG Basics

Teams may buy, sell, short sell , or short cover their stocks

Invest in common stocks, mutual funds and ETFs traded on the three major exchanges: American , New

York , and NASDAQ Stock Exchanges

SMG Basics

A 2% brokers fee is charged for each buy or sell – limits day trading issue

Stocks valued at less than $5.00

per share may not be bought

Teams may borrow up to $100,000 to purchase stocks on margin -- interest is charged

SMG Rules

Stock and cash dividends and splits are automatically computed into team portfolios

Portfolios are updated and available on a daily basis

Rankings are updated every weekend

Teams will not appear in the rankings until a trade is made

SMG Rules

2% annual rate of interest is earned on cash balance

7% annual rate of interest is paid on negative cash balances (borrowed money)

Trades are made based on prices at time of order (market order).

Trades entered after 4:00 p.m. will are made at the next day’s opening price .

You may trade only stocks and mutual funds that have traded within the last 7 days.

SMG Basics

Portfolios are not liquidated at the end of the game and should not be liquidated at the end of the game

The team with the highest portfolio equity at the end of the game wins

Portfolio equity in the tenth week is used for final rankings

How Does the

Competition

Work?

Teams compete within a geographic region and on six levels

Grades 4-6

Grades 7-8

Grades 9-12

Post-Secondary

Youth Groups

Adult

SMG Levels

General

Information

General Information

Buying:

Ticker symbols are available online

Must be for a minimum of 100 shares

May set a maximum purchase price limit

Called a “Long” position

General Information

Buying:

Must have closing price of at least

$5.00 per share

No “penny” stocks

Most brokers will not allow margin purchases of stocks below $5.00

General Information

Selling:

Must already own the stock

Must be for a minimum of 100 shares (unless selling the only remaining shares) ex: If you bought 120 shares, then sold 100, you may then sell the remaining 20.

May set a minimum selling price limit

Setting a “limit” price

A limit order is an order that sets the maximum or minimum at which you are willing to buy or sell a particular stock.

you want to buy stock ABC, which is trading at $12, you can set a limit order for $12.50. This guarantees that you will pay no more than $12.50 to buy this stock.

you own stock ABC and it is trading at $15, you could place a limit order to sell it at $14.50. This guarantees that the stock will be sold at a price greater than or equal to $14.50 but not below.

Best for overnight or weekend trades. The limit trade is executed only once.

General Information

Please Note:

For real time trading price limits are generally not needed except for trades entered after the market close.

General Information

Short Selling:

Short selling starts with borrowing a stock from your broker

You sell the borrowed stock hoping to buy it back at a lower price and return (short cover) it to your broker for a profit

All rules for buying still apply

General Information

Short Covering:

Must have already short sold the stock

May set a maximum price limit

All other rules for selling apply

General Information

Example: Short Selling and Covering

I feel that IBM stock is going to go down and want to short sell the stock.

I am borrowing the stock from the broker (2% brokerage fee) and selling it. Now I’ve got cash.

General Information

Example: Short Selling and Covering

When stock price is at its lowest, I short cover by buying the stock back in the stock exchange at the low price and returning it to the broker (2% brokerage fee). I keep what I didn’t spend.

I get the difference between the high price and the low price minus the brokerage fees.

General Information

Long Positions:

A Long Position is a stock you own.

Ex: If a team owns 100 shares of

McDonalds, their long position

is 100 shares.

# of shares

X current price per share

= Value of Long Position

General Information

Short Positions:

A Short Position is a stock you borrowed from the broker and sold

# of shares

X current price per share

= Value of Short Position

General Information

Equity:

Total Value of Long and

Short Positions

+ Cash Balance

=

Equity

General Information

Buying on Margin:

You may borrow funds using the stock in your portfolio as collateral for the loan

Interest charged at 7%

Borrowing on Margin

At the beginning of the game, teams have $200,000 of purchasing power, 50% of which is collateralized by your initial cash portfolio of $100,000

50% of value of long and short position is required as collateral (margin requirement)

Initial Margin Requirement = 50%

Margin requirement is subtracted from Equity

Remainder is matched dollar for dollar for total buying power

Margin Call:

If the Total Equity in your portfolio falls below

30% of the value of your long + short positions, your team will receive a “margin call”.

SMG will automatically liquidate a portfolio that falls below the 30% rule until the minimum margin requirement of 30% is met.

Investment

Basics

Investment Basics

Different Types of Investments:

Insured Savings Accounts

Savings Bonds

Certificates of Deposit

Treasury Bonds

Corporate Bonds

Mutual Funds

Stocks

ETFs

Collectibles

Commodities

The RISK to RETURN

Relationship:

Investment Basics

The RISKIER the

Investment -

The HIGHER the

Return

Investment Basics

The Difference Between Stocks, Bonds, and

Mutual Funds

Stocks:

You own a piece of the company

You make money if the company does well

Bonds:

You loan money to a corporation or government

You earn the interest

Mutual Funds & ETFs:

You own one portion of a collection of stocks, bonds, or other securities

Investment Basics

The Three Main Markets:

NYSE:

N ew Y ork S tock E xchange Oldest, largest, best-known stocks

NASDAQ: ( N ational A ssociation of sized, and small growth companies

S ecurities

D ealers A utomated Q uotations) Large, mid-

AMEX:

A merican S tock Ex change Mid-sized growth companies

Investment Basics

The Difference Between Large and

Small Companies:

Large:

Often have high prices

Low risk of failure

Some pay regular dividends

Small:

Potential for growth is greater

Generally prices are lower

Investment Basics

Common Stocks:

Pay dividends based on performance of the company

Have higher risk but may have higher reward

Preferred Stocks:

Dividend amount is preset

Dividends are paid on preferred stocks before common stocks

Have lower risk but may limit reward

Over-The-Counter Stocks

A security which is not traded on an exchange, usually due to an inability to meet listing requirements. For such securities, brokers/dealers negotiate directly with one another over computer networks and by phone. The NASD carefully monitors their activities.

Be very wary of some OTC stocks, the OTC:BB

(Bulletin Board) stocks are either penny stocks or may hold bad credit records.

Investment Basics

Stock Splits:

More shares are created at a lower price per share

Stockholders profit if stocks go up

Indicated with an (s) in the paper

Ex: Dell $109 $54

Mutual funds

Closed-ended funds may be traded just like the stocks traded on the

NYSE, NASDAQ and American Stock

Exchanges.

Open-ended mutual funds can also be traded but cannot be short sold or short covered.

Other Terminology:

Blue Chips the largest and most profitable stocks

Bull Market a market that is rising

Bear Market a market that is falling

Investment Basics

Why long term investing is the best route?

Investment Basics

Investment Basics

DJIA over last 33+ years:

Investment Basics

What stocks should I buy?

PE Ratio

Price-to-earnings ratio.

Earnings = earnings per share or firm profit divided by number of shares.

More earnings per share given stock price results in a lower PE ratio and a better buy.

Find PE ratios in the newspaper.

Where to get more information

American Stock Exchangewww.amex.com

NASDAQwww.nasdaq.com

NYSEwww.nyse.com

CNNfnwww.cnnfn.com

CNBCwww.cnbc.com

EDGAR Database of Corporate Informationwww.sec.gov/edgarhp.htm

Yahoo! Financehttp://finance.yahoo.com

Google Finance http://finance.google.com/finance

Playing the

Stock Market Game

Online Demo

Inside SMG WORLDWIDE (Team Pages)

The blue Trading tab contains all the functions necessary to compile research and make trades.

Account Summary

This team has used some of its “margin”

“Min Maintenance” is 30% of the team’s long + short value. If the teams total equity were to fall below this number, they would receive a margin call.

Check Account Summary and Transaction Notes for the status of your account balance and the trades you have entered.

The math…..

140,710 / (281,420 + 0) = 50%

146,560.56

– 140,710 = 5,850.56

84,426 / (281,420 + 0) = 30%

Account Holdings

“Short Sell” and “short cover” are the transactions used when taking a “short” position on a stock. A short position earns a positive return when the stock price falls.

Enter a Trade

How to Read the

Stock Market Page

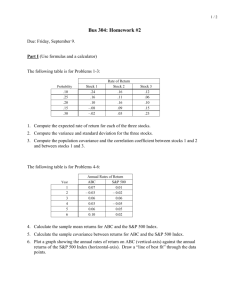

Stock Table

52 Week

High

49

80

66

18

13

52

Week

Low

39

49

38

13

8

Stock Div Yield % P/E

Ratio

ABC 1.30 3.25% 20

BBA .40

.53% 26

CCI

LLY

1.20 1.87%

1.78 11.12%

XYZ ---0%

9

7

62

Sales 100s High Low Close Net Change

3314

73016

77723

13101

6

40

77

66

16

10

39

75

63

16

10

40

76

64

16

10

----

+ 1

+ 1

----

- 1

52 Week High/Low

Highest and lowest price a share of the stock has sold for in the past 52 weeks.

Example ABC: High was 49

Example ABC: Low was 39

Stock

Varies by Newspaper

Either company abbreviation or ticker symbol

In A-Z order

Div

Annual Dividend per Share of

Stock

Based on the rate of the Last

Quarterly Payout

Annualized Data

Example ABC: $1.30 per share

Example: XYZ: $0 per share

Yield Percentage

Known as Dividend Yield

A Measure of the Income Produced by the Stock

Is the Amount of the Dividend divided by the Price of the Stock

Yield Percentage

Achieved by Dividing the Annual

Dividend by the Day’s Closing Price

Example: ABC 1.30/40 = .0325

or as a percentage: 3.25%

P/E Ratio

PRICE- EARNINGS RATIO

– Ratio: latest closing price of the stock to the latest available annual earnings per share of the firm

– Trailing P/E: is what is reported in the financial section of newspapers

– Forward P/E: based on forecasting net year’s future expected earnings

P/E Ratio

Example: ABC – 20 P/E Ratio

– Indicates that ABC is selling for 20 times the company’s earnings

Example: XYZ – P/E Ratio is 62

– Indicates that XYZ is selling for

62 times the company’s earnings

Sales 100s

This represents the volume of transactions on the trading day

Bought or Sold

Presented in hundreds, simply multiple by

100

Example: ABC – 3314

Indicates that 331,400 shares traded

High/Lows

This represents the highest and lowest selling price of the stock for the day.

Example: ABC – high of 40 low of 39

Close

This represents the price of the last stock sold for the day

Example: ABC – closed at 40

Net Change

This lists the net change between the closing price for the stock for the day and the closing price on the previous trading day

Example: BBA: Today’s Close: 76

Net Change: + 1

Previous Day: 75

Earnings per Share

A means of valuing common stock.

Part of a firm’s profit that is allocated to each outstanding share of common stock.

Can be a good indicator of fiscal health

Earnings per Share

Many investors carefully watch this number

In general, higher earnings per share means better dividend and overall stock performance.

Earnings per Share

Calculated by dividing the closing price on the day being consider by the P/E ratio.

Example: Today’s Close P/E Ratio

40.00

20

Earnings per Share:

ABC – $2.00