International Accounting

advertisement

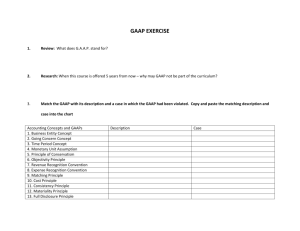

15 CHAPTER 15 GOING INTERNATIONAL AND INTERNATIONAL ACCOUNTING STANDARDS Slide 15-1 15 FOCUS OF CHAPTER 15 Globalization of Business: Ways to Export Ways to Manufacture Overseas Reasons for Manufacturing Overseas International Accounting Standards: The Diversity of Worldwide GAAP Efforts to Harmonize Worldwide GAAP Slide 15-2 15 Going International: Ways to Export (Choices Galore) Independent distributor: Foreign commission agent. Foreign marketing branch. Foreign marketing subsidiary. Export trade vehicle (FSC or IC-DISC). Slide 15-3 Ways to Export: The Concept of Physical Presence 15 Defined: Having an “operation” overseas. Examples: SALES OFFICE, WAREHOUSE, FACTORY, EMPLOYING FOREIGN CITIZENS AS SALES PERSONNEL. To make a determination: Review foreign tax laws. Review tax treaty. Significance: Subject to taxation tax laws in the foreign country. File a foreign income tax return. Slide 15-4 15 Foreign Earnings: DOUBLE Corporate Taxation??? Income of foreign units are taxed overseas and in the U.S--BUT DON’T PANIC. U.S. tax laws allow a “foreign tax credit.” Tax Calculation for Brazil U.S. Pretax income of foreign unit... 100,000 100,000 Applicable tax rate....................... 20% 35% Income taxes owed.................. 20,000 35,000 Less--Allowable tax credits........ (20,000) U.S. taxes owed........................ 15,000 Slide 15-5 15 Foreign Earnings: When Are U.S. Taxes Actually Paid? 3 possibilities exist: Foreign branches: IRS When INCOME is earned. Foreign subsidiaries: When DIVIDENDS are paid. When INCOME is earned (applies to “Subpart F” income) Slide 15-6 15 Reasons for Manufacturing Overseas: The List is Long The lure of cheap labor . Tax holidays. Taxes To establish a visible presence. Lax environmental laws. Dumping allowed Slide 15-7 15 Reasons for Manufacturing Overseas: The List is Long High literacy rates & safe environments. A Strong work ethic. Loan guarantees, grants, subsidies. The fluctuating exchange rate problem. Slide 15-8 15 Risks of Investing Overseas: All That Glitters Is Not Gold Expropriation--the seizure of assets by the foreign government. Devaluations/weakening of the foreign currency. Currency transfer restrictions Wouldn’t it be nice to be able to bring the profits home? Wars and civil disorders. Government mandated changes in the investment climate. Slide 15-9 15 The Diversity of Worldwide GAAP: An Almost Unbelievable Cornucopia Everything from soup to nuts. The United States is part of the problem-many U.S. standards are either rarely used or not used at all overseas: LIFO inventory method. Deferred income taxes. Goodwill capitalization. Slide 15-10 15 Internationalize Accounting Standards: The Grand Dream World GAAP--so many hurdles. All are for it--BUT few countries are willing to change their own GAAP. Slide 15-11 15 International Accounting Standards: World GAAP’s Advantages Having a Uniform World GAAP: Would greatly streamline the quarterly and year-end consolidation process for the accountants of publicly-owned companies. Slide 15-12 15 Efforts To Internationalize Accounting Standards: Progress Has Been Slow The International Accounting Standards Board [“Committee” prior to 2001] (created in 1973--London based) IASB Standards to date: Minimal impact-still fairly easy to comply with virtually all IASB Standards. Slide 15-13 Efforts To Internationalize 15 Accounting Standards: Capital Market Forces The Capital Markets-A much-needed injection: Relatively recent trend of raising capital in world markets has given greatly added emphasis to the desirability of having a world GAAP. The BIG advantage: Would greatly streamline the process by eliminating the need to comply with multiple GAAPs in offering securities. Slide 15-14 15 Efforts To Internationalize Accounting Standards: The FASB Hops Aboard 2/97: FASB issues FAS 128 “Earnings Per Share” conforming U.S. GAAP with world GAAP. 6/01: FASB abolished the pooling of interests method conforming U.S. GAAP with world GAAP. Slide 15-15 15 End of Chapter 15 Time to Clear Things Up-Any Questions? Slide 15-16