Chapter 11 & 12

advertisement

Chapter 11

Reducing Transactions Costs and

Information Costs

Banks vs. Bonds

1000000

900000

800000

700000

600000

500000

400000

300000

200000

100000

0

Bank Loans

Bonds

External

6/1/2002

PE Ratios

Average PE Ratio 1985-2001

21

20

19

18

17

16

15

14

13

US PE Ratio

HK PE Ratio

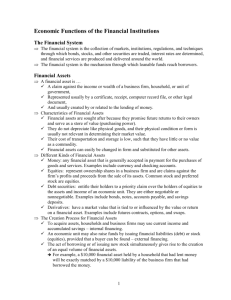

Objectives

1. Differentiate Adverse Selection and Moral

Hazard

2. Identify 5 different types of financial

institutions.

Unit Overview

Securities

Market

Institutions

Transactions

Costs

Asymmetric

Information

Costs

Investment

Institutions

Adverse

Selection

Moral

Hazard

Contractual

Savings

Institutions

Depository

Institutions

Government

Financial

Institutions

Facts of Finance

• Issuing marketable debt and securities is not the

primary source of finance for businesses. (In G-7,

less than 20% of all finance).

– Internal finance (retained profits) is an important source

of funds for business.

– Securities markets play a small (but growing) role in

external finance in all markets outside North America.

Banks are the source of half of external finance in

North America and 75-80% outside NA.

– Only most well known companies issue debt securities.

– Direct sale of securities from issuers to savers play a

tiny role in finance. Most securities held by financial

institutions.

Transactions Costs

• Debt serves a useful purpose in matching those

who currently have greater income than

consumption to those with greater consumption

than income.

• However, matching buyers and sellers involves

some costs. Institutions develop to reduce these

costs.

– Economies of scale

– Specialization

Information Costs

• As noted, all debt involves some risk that

the borrower will be unable to repay.

• Part of transactions costs involve acquiring

information about this likelihood.

• Information asymmetry between borrowers

and lenders. Borrowers always know more

about their chances than lenders.

Asymmetric Information

•

Asymmetric Information A condition that occurs when

borrowers have some information about their

opportunities or activities that they do not disclose to

lenders, creditors or insurers.

•

Two categories of imbalanced information

1. Borrower has more information about their own

prospects before the loan was made.

2. Borrower has more information about and control

over the way funds are used after the loan has been

made.

Costs of Asymmetric Information

• Two types of problems

1.Adverse Selection – A lender’s problem of

distinguishing the good-risk applicants from the

bad-risk applicants before making an

investment.

2.Moral Hazard – Borrowers incentives will not

align with lenders and will behave in ways that

are not conducive to repaying debt.

Lemon Problem: Used Cars

• Two indistinguishable (to buyers) types of cars:

lemons (often breaking down) and creampuffs

(never breaking down).

• If buyers are willing to pay a price equal to the

average value of lemon and creampuffs, they will

offer a price higher than the value of a lemon, but

less than the value of the creampuff.

• Only sellers would be lemon owners.

Lemon Problem: Bond Market

• Some firms have risky prospects (lemons) and

some firms have safe prospects (creampuffs).

• Bond buyers cannot distinguish between them.

They offer bond prices which are an average of the

price of creampuff bonds and lemon bonds.

[Another way of putting this is that interest rates

are an average of creampuff and lemon rates].

• Potential borrowers with creampuff prospects may

finance their own projects.

• Only borrowers with lemon prospects will join

bond markets.

Reducing Adverse Selection

Through Information Gathering

1.

2.

3.

Information Gathering – Bond rating agencies perform

the function of analyzing possibility of repayment.

Free Rider Problem – Gathering information about firms

is costly, but once gathered it can be shared very cheaply.

Information firms do not receive funds from all who

benefit from their services. Information may be

underprovided by markets.

Government Regulation – One solution to the free rider

problem is for the government to issue rules requiring

sellers of securities to provide honest information about

their firms.

Collateral/Net Worth

•

•

Most debt is backed by some sort of

collateral. In the case of default, lender

takes possession of some physical or

financial asset of relatively clear value.

Lenders will only lend to firms with a high

net worth. This means lenders can make

claims on the outstanding assets of

companies in the case of debt default.

Moral Hazard

• Once funds have been lent, borrowers have

control.

• If borrowers take risky actions and lose,

they share the losses with their debtors by

defaulting.

• If borrowers take risky actions and win,

they keep all the extra winnings themselves.

Moral Hazard Example

•

Lender lends $100 to borrower at 5% interest. Borrower can choose

between two investment projects each of which require an upfront

pay-off of $100.

•

Project A is a risky project but potentially lucrative. With an 80%

probability, project A will generate 0 payoff. With a 20% probability

project A will generate a $205 payoff.

•

Project B is a non-risky project which will generate a pay-off of

$110 with an 80% probability and a pay-off of $95 with an 20%

probability.

Three Questions

1.

Which project will A choose if he is risk-neutral.

2.

Which project would B choose if he is risk-neutral

3.

Which project is most advantageous to a risk-neutral society.

Expected Value

• We can use the statistical concept of

expected value to answer these questions.

• Expected payoff to a project with two

possible outcomes

PayoffE = Prob(Outcome1)*Payoff1 +Prob(Outcome2)*Payoff2

Which project is socially beneficial?

• Expected payoff to project A is

.8∙$0 +.2·$205 = $41

Since cost is $100, the expected payoff to project

A is less than the cost. To a risk neutral or risk

averse society this project will be bad.

• Expected payoff to project B is

.8∙$110 +.2·$95 = $107

Since cost is $100, the expected payoff to pro ject

B is more than cost. To a risk neutral society this

project is good (though the risk might be to large

for a suffiiciently risk-averse society).

Pay-off to Borrower and Lender

• Project A. With 80% probability, the payoff to the project will be $0 so

both the borrower and lender get $0. With 20% probability, the pay-off

to the project will be $205, so the lender will be repaid $105 and the

borrower will keep $205-$105 = $100. The expected payoff to the

project for the lender will be .2∙$105+.8∙0=$21. The expected payoff to

project A for the borrower is .2∙$100+.8∙0=$20.

• Project B. With 20% probability, the payoff to the project will be $95,

so the lender will only be repaid $95 and the borrower keeps $0. With

80% probability, the payoff to the project will be $110, so the lender is

repaid $105 and the borrower keeps $5. The expected payoff to the

project for the lender will be .2∙$95+.8∙$105 =$103. The expected

payoff to project A for the borrower is .2∙$0+.8∙$5=$4

Which project will be undertaken?

• If the borrower has control of the funds, then he will

choose project A. The expected value of the payment to

him is higher for the riskier project. This is because the

lender bears all of the upside of a risky investment and

none of the downside.

• The lender of course prefers the reverse. He would choose

the socially beneficial project B.

• This example demonstrates the problem of moral hazard in

debt markets. Because he shares none of the downside, the

borrower will choose inefficiently risky projects once he

has control of the funds.

Restrictive Covenants

•

Debt agreements place restrictions on

activities of borrowers.

–

–

–

Restrict spending of funds

Require maintenance of minimum net worth

Require maintenance of value of collateral

Financial Intermediaries

• Most funds raised internally through owners

savings or retaining earnings.

• Banks specialize in acquiring information

and reducing monitoring costs.

• Typically, they do not share information so

do not face the free rider problem as

severely.

Adverse Selection

Moral Hazard

Debt Market

Problems

Credit Rationing – High

Interest Rates Attract Bad

Risks

Assumption of Greater

Risk by Borrowers

Solutions

1.

2.

Collateral

Net Worth

Requirements

Restrictive Covenants

1.

Restrict Activities

2.

Require Net Worth

Equity Market

Problems

High Growth Companies

Do Not List Shares

Principal Agent Problem

Managers Serve

Themselves

Solutions

?

Leveraged Buyouts

Chapter 12

Financial Institutions

Investment &

Contractual Savings

Mutual Funds

Hedge Funds

Pension Funds

Insurance

Financial Markets

1. Primary: Investment Banks

2. Secondary: Exchanges

3. Secondary: Brokers &

Dealers

Investment

Finance

Companies

Government

Mortgage

Companies

Savers

Depository Institutions

1.

2.

Banks

RLB’s & DTC’s

Borrowers

Security

Market

Information Investment

Banks

Investment Contract

Savings

Depository Government

Finance

Companies

Commercial

Banks

Risk

Brokers

Dealers

Markets

OTC

Mutual

Funds

Insurance

Pension

Funds

Liquidity

Brokers

Dealers

Markets

OTC

Mutual

Funds

Pension

Funds

Commercial

Banks

Mortgage

Companies

Types of Financial Institutions

•

•

•

•

•

Security Market Institutions

Investment Institutions

Contractual Savings Institutions

Depository Institutions

Government and Quasi-Government

Institutions

Security Market Institutions:

Primary Markets

• Investment Banks – Advise and aid firms in

issuing bonds and stocks to primary markets.

• Underwriting – Underwriter guarantees a price for

bonds, makes profits if they can sell it for more.

• Syndicates – Groups of investment banks gathered

by a lead bank to share in underwriting.

Secondary Market Institutions:

Secondary Markets

• Exchanges – (Hong Kong Exchanges and Clearing Ltd.)

– Hong Kong Stock Exchange

• Main Board: Established Companies

• Growth Enterprise Market

• Bond Market

– Hong Kong Futures Exchange. Main Product: Hang

Seng Futures Indexes

• Brokers match buyers and sellers. Dealers own

stocks of assets

Stocks traded through a centralized clearing system Central Clearing and

Settlement System (CCASS) operated by HK Securities Clearing

Company Limited.

Investment Institutions

•

Investment Institutions match retail

lenders/borrowers with security markets.

1. Mutual Funds raise funds in retail markets and

use the funds to invest in securities markets.

2. Finance Companies raise funds in securities

markets and make loans in retail markets.

3. Hedge Funds are partnerships of wealthy people

investing in financial markets.

Purpose: Direct participation in security markets

may involve too great transaction costs for some

borrowers/savers.

Mutual Funds

•

•

Mutual Funds – Intermediaries that raise funds from

investors and use the funds to buy securities. For savers,

a cheap way of acquiring a share of a diversified

portfolio. (AKA Unit Trusts)

Types of Funds

1.

2.

3.

4.

Closed End vs. Open End: Closed end funds are not redeemable

at will but shares are traded. Open end funds can be redeemed

from initial issuer. Value of shares are based on value of

portfolio assets.

Load vs. No Load – Purchasers of load funds pay commissions.

No load funds pay only management fees based on earnings.

Indexed vs. Managed Funds – Indexed Funds have portfolios

that proportionally matches a broad pre-determined set of assets

like the S&P 500 or the Hang Seng Index. Managed Funds try to

use strategy to maximize returns.

Money Market – MMMF’s hold short-term assets. Popular since

deposits are checkable.

Finance Companies

• Finance companies issue commercial paper or

securities to raise funds. The funds are then lent to

retail borrowers to finance purchases of assets.

• Types of finance companies

– Consumer: Make loans to households

– Business: Make short-term loans to businesses.

– Sales: Manufacturers own finance companies that lend

to people who purchase their products. (Toyota Motor

Credit).

Hong Kong Finance Companies

• Restricted License Banks – Can take

deposits of at least HK$500,000, no

maturity restrictions. {Merchant Banks,

Business Finance}

• Deposit Taking Companies Can take

deposits of HK$100,000 or more with three

month maturity. Typically consumer finance

arms of banks.

Maturity

Size

Requirements

Restricted None

License

Banks

Deposit

3 Months

Taking

Companies

Names

$500,000

GE Capital

Hang Seng

Finance

$100,000

Dao Heng

Finance

Wing Lung

Finance

Hedge Funds

• Hedge funds are partnerships which require large

contributions from their subscribers.

• Advantage of this structure is that the funds are

largely unregulated allowing them to use

innovative, unique, or arcane financial strategies.

Some hedge funds may keep strategies secret even

from partners.

• Some hedge funds often active in derivatives

markets.

• Some have criticized hedge funds as destabilizing

to the financial system.

Contractual Savings

•

•

Some institutions channel funds to

securities markets whose source is regular,

required payments.

Contractual Savings institutions includes:

1. Insurance Companies

2. Pension Funds

Insurance Companies

• Risks like accidental death or fire are

unpredictable at the individual level but are easily

quantifiable among large groups.

• Insurance companies get regular up front

payments (premiums) from group members

worried about some risk and make large payments

(claims) to unlucky victims.

• Premiums are invested in securities markets.

Returns are used to pay insurance companies costs

and generate profits for insurance companies.

Types of Insurance

• Property and Casualty – Insurance for fire, car

accidents, etc.

• Life Insurance

– Term life: Regular payments are made to the insurance

company. If you die while covered, your estate files a

claim. Otherwise, the insurer keeps the premium.

– Whole life: Regular payments are made to the company

for many years. If you do not die by some final date,

the insurance company makes a final payment to you or

sets up a series of annual payments until your death.

Pension Funds

• Employers set aside some of their compensation

as contributions to investment funds that will pay

retirement benefits to workers.

• In the United States, there are tax advantages to

paying wages through this channel. In Hong

Kong, less so and pension funds are less

important.

• Types of Pension Funds

– Defined Benefit: The employer promises to make certain payments

when employees retire.

– Defined Contribution: Employer makes a specific contribution to a

fund often invested by employees themselves.

Mandatory Provident Funds

• Since last years, employees without a retirement

plan must enroll in an investment fund.

• Both the employer and employee are required to

put 5% into a fund.

• Funds are invested in a set of essentially mutual

funds chosen by the employer and employee.

Savings can be shifted across funds at some costs.

Depository Institutions

• Depository Institutions collect potentially

small deposits in retail markets and make

direct loans to borrowers.

• Commercial banks play an important role in

evaluating risks and monitoring borrowers.

• Licensed Banks

Government Institutions

•

Hong Kong Mortgage Corporation set up

in 1997. Begin operating in secondary

mortgage market in two phases.

1. Issue securities and purchase mortgages

for its own portfolio.

2. Sell mortgage backed securities.