Teal_MBA617_USAA Final

advertisement

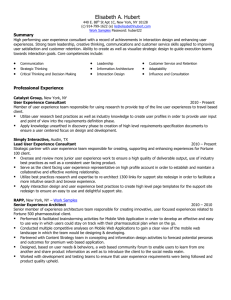

INCREASE USAA MEMBERSHIP Increase in USAA Membership The End Of Great Rates? Sheila Teal MBA 617 University of Alaska Fairbanks 1 INCREASE USAA MEMBERSHIP 2 Abstract United Services Automobile Association (USAA) is a financial institution with limited membership. They have evolved since they were created to increase their customer base by lessening restrictions on membership, making advances in technologies, and increasing their physical presence throughout the world. USAA needs to continue with innovative behaviors to remain competitive in their current environment and continue to increase their financial strength by growing their net worth. Key Words: USAA INCREASE USAA MEMBERSHIP 3 Increase in USAA Membership The End Of Great Rates? United Services Automobile Association (USAA) offers personal banking, personal insurance, personal investment, personal retirement, and money management services to its customers. Although USAA has limited membership, they have 10.3 million members worldwide. Customers of USAA have United States military affiliation in the following categories: active, retired, and honorably discharged officers and enlisted personnel; cadets and midshipmen at military academies advanced ROTC or ROTC scholarships, officer candidates within 24 months of commissioning; individuals whose parents had USAA auto or property insurance; former USAA members who had auto or property insurance; and widows, widowers, un-remarried former spouse of USAA members who had USAA auto or property insurance while married (“Who Can Join”, 2015). The main USAA campus is on 280 acres in San Antonio, Texas. Additional USAA campuses and offices are located in Phoenix, Arizona, Colorado Springs, Colorado, Tampa, Florida, London England, Frankfurt Germany, Highland Falls, New York, and Annapolis, Maryland. In addition to the offices, financial centers are open throughout the United States in California, Colorado, Washington DC, Georgia, Kansas, New York, North Carolina, Maryland, Tennessee, Texas, and Virginia. USAA also has a variety of bank-owned properties that were repossessed from members (“Locations”, 2015). USAA has approximately 26,000 people employed worldwide. More than 16,000 people are employed for USAA in San Antonio, Texas, making it one of the city’s largest private employers. USAA plans to add 3,500 positions in San Antonio, Phoenix, Tampa, and Dallas markets by the end of 2015 (Business Wire, 2015). In addition to regular full time employees, INCREASE USAA MEMBERSHIP 4 USAA plans to hire 300 college interns and 300 new college graduates in 2015 (“University Recruiting”, 2015). USAA was founded in 1922 by 25 Army officers who decided to insure each other’s vehicles. By 1928 membership had increased to 8000 people. Despite the Great Depression, membership doubled from 15,000 to 30,000 and USAA closed out the 1920s with net profit of $144,000. The first office outside of San Antonio was opened in Frankfurt, Germany in 1952 and the London office was opened 10 years after that. Automation of operations began five years later, which continues to grow even today. Initial membership was only open to Active Duty military officers. Allowing officers to continue their membership after their commission was resigned or after they left the military was enacted in 1961. The 1960’s brought about changes in employment opportunities. Women were offered employment and were required to finish school at night. Persons with disabilities were also hired by USAA and they were awarded the President's Employer Merit Award. The 1970 brought the opening of the mutual fund branch, insurance membership benefits extended to ex-dependents, a toll free phone number for members to conduct business using a method other than mail or telegraph, and assets reached $1 billion. USAA Federal Savings Bank opened in 1983 as the company continued expansion. The 1990’s brought with it the two-millionth member to USAA. Membership was extended to enlisted personnel in 1996. Finishing out the 1990’s, USAA owned and managed assets were at $58.9 billion. By 2003 96% of active duty officers and 44% of active duty enlisted personnel were USAA members. Membership was expanded again in 2008 allowing retired military personnel, those with an Honorable discharge after 1996, and their spouses and children. They continued to make access to services easier for their members by being the first mobile deposit capability and continuous updates to their website for ease of member access (“History”, 2015). INCREASE USAA MEMBERSHIP 5 Despite wars, natural disasters, and economic downturns, USAA continued to grow their membership and services and pay dividends to their members. Today USAA offers many services to its members. The services USAA provides customers with the following services: banking, insurance, investment, retirement, and financial planning (“Our Products”, 2015). They also assist their members by taking advantage of new technologies and trends in information technology to enhance their customers’ experiences. Some of these technologies are: video chat between members and USAA financial centers; mobile check deposit; phone, web, and mobile device banking; and a low bandwidth website, used by military personnel in remote areas where high bandwidth connection is not available. They are also expanding the network of financial centers located mostly near military bases that rely on remote-access technology and new video capabilities for members (Adams, 2012). The top competitors of USAA are Geico Corporation, Metlife, Inc., and State Farm Mutual Automobile Insurance Company (“United…”, 2015). Insurance companies who provide the same auto, home, and life insurance policies are also competitors. In addition, any financial institution which provides banking, retirement, and investment services can also be considered a competitor to USAA. As with any large company, the employer reviews are varied. One person sees working there as a “fun and productive place to work” while another sees it as a “great job, uneasy workplace” (Indeed, 2015). There are no common themes among unhappy employees that would point to a single problem internal to the company. Whether people ranked working for USAA high or low, many of them commented on the great benefits and heavy workload. Indeed.com ranks companies based on individual inputs, with 1 star being the lowest and 5 stars being the highest. USAA ranked just under 4 stars for Job Work/Life Balance; over 4 stars for INCREASE USAA MEMBERSHIP 6 Compensation/Benefits; three and a half stars for Job Security/Advancement; slightly under three and a half stars for Management; and four stars for Job Culture (Indeed, 2015). For a company in the financial world, a fast paced environment does not seem out of place. USAA’s organizational chart (Appendix A) can be considered symmetric. The work of the organization is broken down by specialty (Cogmap, n.d.). Each division is able to work independently of each other. The insurance division can sustain operations without relying on the banking division. Likewise, each portion of the insurance division such as property, auto, and life are also able to work independently of each other. USAA operates in a constantly changing environment based on market actions. Individual accounts are subject to market and employment fluctuations as are USAA managed investment accounts. Competition, inflation risks, and market trends affect USAA accounts and members directly. USAA has remained stable in economic upturn and downturn cycles. Competitors will continue to be a threat to USAA, but the established niche market and historically better insurance rates allows USAA a benefit others cannot match. They are both efficient and effective in getting the best rates for customers in all aspects of banking, insurance, investment, retirement, and money management accounts. USAA would like to continue to award their members Subscriber Savings Account dividends annually and maintain or increase their rank of 57 among Fortune 500 companies and net worth ranked at 141 (Financial.., 2015). The SWOT Analysis shown below identifies four opportunities for USAA to better serve existing customers or increase its standing in the current market in which it operates. The identified items are: restricted membership availability could be increased to allow more members; increase brick and mortar banks throughout the US to better serve customers; increase ATMs, partner with bank with large ATM network, or remove INCREASE USAA MEMBERSHIP 7 ATM fee for customers not near a USAA financial center; open Innovation Lab exists to allow engineers to try any wild ideas they may have. USAA should focus on innovation to become the leader in the insurance and banking industry. Strengths Weaknesses What do you do well? What unique resources can you draw on? What do others see as your strengths? What could you improve? Where do you have fewer resources than others? What are others likely to see as weaknesses? - Low cost insurance premiums - Restricted membership - Complete online services allow for members to handle banking/insurance/investment needs regardless of their location and time zone - Lifetime membership availability regardless of change in life situation (i.e. a spouse of a military person and a USAA member is now a former spouse, they retain their eligibility for all USAA services) - Reliance on technology for members to complete transactions is not always effective and at times a person-to-person conversation is needed. With members spanning across the globe, the changes in time zones can sometimes make this difficult. - Technological innovations have not progressed since mobile check deposit system. Opportunities Threats What opportunities are open to you? What trends could you take advantage of? How can you turn your strengths into opportunities? What threats could harm you? What is your competition doing? What threats do your weaknesses expose you to? - Restricted membership availability could be increased to allow more members. - Increase brick and mortar banks throughout the US to better serve customers - Increase ATMs, partner with bank with large ATM network, or remove ATM fee for customers not near a USAA financial center - Open Innovation Lab exists to allow engineers to try any wild ideas they may have - Poor market trends could hurt banking business overall, which includes USAA - Hackers and identity theft are inherent threats to companies conducting business over the Internet - Technological advances of other companies over USAA could leave them behind USAA is continuing to work towards innovative ways to make their services more accessible to their customers. They pioneered the mobile check deposit system that has since been adopted by many banks. However, they have not come up with new ideas to revolutionize INCREASE USAA MEMBERSHIP 8 the banking or insurance industries since then. This is one area where their Open Innovation Lab could be better utilized. They have partnered with Progressive Insurance to license their “usage based pricing technology” which is used to collect driving data to calculate coverage (Aldridge, 2013). Using technologies developed by other companies is allowing USAA to remain competitive in the environment in which they operate, but they need to lead the technology innovations for customers. They will continue to lag the industry and have to rely on leasing the technologies of other companies, which can come at a hefty cost. The first company to the market with a new innovation has the advantage of being able to be the sole user until other companies develop the same technologies, or lease it to their competitors at a profit. Although USAA has an Open Innovation Lab for any type of innovation to be fostered, they should look into expanding their structure to include employees who are not engineers. This may allow a broader range of ideas that are brainstormed without any biases as to whether or not they can feasibly be expanded upon and implemented. USAA membership is limited to a select group of customers. One way they may be better poised to increase their net worth is to lessen the restricted membership availability beyond what is currently is today. The restriction on the year of discharge could be lifted, as well as the conduct of the discharge from service to be more than just members with an Honorable discharge. The requirement to have military affiliation altogether could be lifted as well. USAA is the only company among its competitors that has a restricted customer requirement. GEICO, which used to be known as Government Employees Insurance Company, expanded their membership to allow more than federal government employees and enlisted INCREASE USAA MEMBERSHIP 9 military members. They still offer rate discounts to these groups, but were able to increase their customer base and overall company success by opening their doors to other customers (A.M. Best, 2011). Taking the lead from GEICO, USAA could expand its membership by removing the limitation of who can become a member, but continuing to offer the same great rates members now have as a discount. They could move out of their current institutional environment into a broader operating arena. This would actually increase rates overall, but then discounts would be applied to previously qualified members. Continuing to operate in the same niche market they currently are in is also a viable option to increase their standing among other Fortune 500 companies. The membership requirements will remain the same and USAA should look into creating an agreement with military installations to put a small financial center branch on the installation. To keep costs down from building new structures and increasing employees, installing ATMs on the installations and Naval Vessels may be a viable alternative. A company that caters to the military should have a greater physical presence for military members to take advantage of their services. As a manager making the decision of which of the above mentioned suggestions to implement, I feel the most viable solution to increase standing in the list of Fortune 500 companies would be to open membership to a larger customer base while maintaining discounts for currently qualified members. This would allow additional revenue to come into the company in terms of assets managed, insurance policies written, and bank account balances. USAA has already created a switched structure with the Open Innovation Lab. This lab can be utilized as a place to develop new ideas to make the company more successful overall, beyond technological advances. INCREASE USAA MEMBERSHIP 10 References A.M. Best Market Report. (2011). GEICO’s story from the beginning. Retrieved from https://www.geico.com/about/corporate/history-the-full-story/ Adams, J. (2012). Bank Technology News. How USAA innovates online banking. Retrieved from http://www.americanbanker.com/btn/25_9/usaa-innovates-online-banking-withvoice-recognition-and-customer-analytics-1052161-1.html Aldridge, J. (2013). San Antonio Business Journal. USAA licenses pricing technology from Progressive Insurance. http://www.bizjournals.com/sanantonio/news/2013/07/08/usaalicenses-pricing-technology-from.html Business Wire. (2015). USAA adding as many as 3,500 new positions through 2015. Retrieved from http://www.businesswire.com/news/home/20130305006540/en/USAA-Adding3500-Positions-2015#.VQOQ0-G2KT8 Cogmap USAA. (n.d.) Retrieved from http://www.cogmap.com/chart/usaa?ver=9&vt=0 Financial Strength. (2015). Retrieved from https://www.usaa.com/inet/pages/about_usaa_corporate_overview_financial_strength?akr edirect=true History. 2015). Retrieved from https://www.usaa.com/inet/pages/about_usaa_corporate_overview_history Indeed. (2015). Retrieved from http://www.indeed.com/cmp/Usaa/reviews?fcountry=US&start=40 Locations. (2015). Retrieved from https://www.usaa.com/inet/pages/about_usaa_corporate_overview_locations Our Products. (2015). Retrieved from https://www.usaa.com/inet/pages/our-products-main United Services Automobile Association competition. (2015). Retrieved from http://www.hoovers.com/companyinformation/cs/competition.UNITED_SERVICES_AUTOMOBILE_ASSOCIATION.b5 45524fb6f4a0e5.html University Recruiting. (2015). Retrieved from https://www.usaajobs.com/campus/index.html Who Can Join. (2015). Retrieved from https://www.usaa.com/inet/pages/why_choose_usaa_main?showtab=legacyPassDown&a kredirect=true INCREASE USAA MEMBERSHIP 11 Appendix A USAA Organizational Chart