SWOT ANALYSIS

advertisement

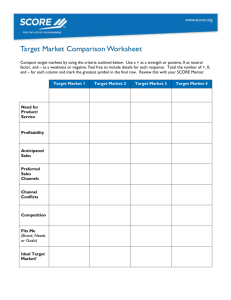

Second Presentation Group 6 Member:蘇冠穎 程弘棋 劉庭妤 Professor : 黃光渠 Contents SWOT Analysis CPM BCG Strength S1:Wide network coverage 3G [] [] [] [] Strength S2:Large customer base 404 million customers Strength S3:High brand visibility HEY! VODAFONE! Strength S4:Network infrastructure Ready Weakness W1:Negative growth rate of return on assets (ROA) ROA Weakness W2:Declined liquidity Weakness W3:Declined Revenue Revenue fell by 4.2% to £44.4 billion. Opportunities O1:Increasing demand for mobile services in emerging markets Opportunities O2:Growing demand for high speed data Data speed Threat T1:Market saturation in developed countries Threat T2:Global economic depression Threat T3:New competitors(low or no-capital operators) SWOT Strengths 1.Wide network coverage 2.Large customer base 3.High brand visibility 4.Network infrastructure Weakness 1.Negative return on assets (ROA) 2.Declined liquidity 3.Declined Revenue Opportunities 1.Increasing demand for mobile services in emerging markets 2.Growing demand for high speed data S3O1:With high brand visibility, We can promote 4G service in emerging market. W3O1:We can improve our 3G mobile service quality in emerging market, like India, Turkey …etc., to attract more customers for increasing revenue. Threat 1.Market saturation in developed countries 2.Global economic depression 3.New competitors (low or no-capital operators) S1S2T3:We can offer preferential plans, like free SMS and Unlimited calling to other wireless customers with Mobile to Mobile, to compete with new rivals. W1T2:We simplify our organization and eliminate old equipment to decrease the effect of global economic depression. Strategies S3 High brand visibility + O1 Increasing demand for mobile services in = emerging markets S1 Wide network coverage S2 + Large customer base S3O1 With high brand visibility, We can promote 4G service in emerging market. T3 New competitors (low or no-capital = operators) S1S2T3 We can offer preferential plans, like free SMS and Unlimited calling to other wireless customers with Mobile to Mobile, to compete with new rivals. IEM Vodafone EE O2 CSF WT (%) Rating W t ’d Score Rating W t ’d Score Rating W t ’d Score 3G Wide network coverage 0.35 4 1.4 4 1.4 4 1.4 Strong customer base 0.2 4 0.8 4 0.8 3 0.6 High brand visibility 0.15 3 0.45 4 0.6 3 0.45 0.30 1 0.3 1 0.3 1 0.3 Steady decline in average revenue per user (ARPU) Total 1 2.95 3.1 2.75 BCG Relative Market Share Position High 1.0 High 20 Industry Sales Growth Rate Low 0.0 Medium 0.5 Fixed line Data + Message Stars II Question Marks I Medium 0 Voice Cash Cow III Low -20 Dogs IV 3000 2500 Growth 2000 Vodafone Services’ Market services’ revenue revenue in UK share Voice 1500 1000 Voice 500 Adjusted Data+Message -7.09% 2559 £ml 26041.5 £ml 9.83% 0.6117 16.07% 1 0 2009 50 Data + Message 40 12.98% 2010 2011 1841 £ml 2012 11458.5 £ml 30 20 Fixed line 10 15.24% 32 £ml 3300 £ml 0 2009 2010 2011 2012 Fixed line 0.97% 0.0604 How could we do for these services • Fixed line: -Question Marks -Low market share in high growth industry • Strategy: 1. Increasing investment 2. Do market research How could we do for these services • Data + Message: -Stars -High market share and high growth rate • Strategy: 1. Sales promotion and Advertising How could we do for these services • Voice: -Cash Cow -High market share and low-growth industry Do survey about client's satisfaction Provide some preferential plan for old customer • Strategy: 1. Customer satisfaction programs & Loyalty programs 2. Generate cash to invest other services Thank you for tour listening !