Template Notes

advertisement

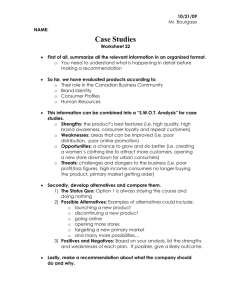

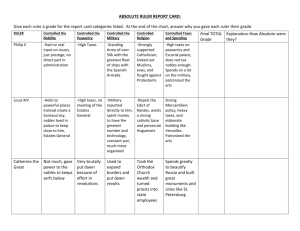

.XYZ Consulting .Name of case/firm How to develop a new area of the Rotterdam Port (Area A) to ◦ Attract new activities/companies ◦ collect sufficient revenue within the “Business Ecosystem” framework ● Population • 50.6 Million • Black Africans – 40.2M • White Africans – 4.6M • Other – 4.6M • Target age group: 15-50 Most important in red .Less important in black .allows to emphasize – and perhaps not go through every one ● Economic • Fastest growing economies in Africa carry highest macroeconomic risk • 8 of top 10 global vehicle makers • 3 of world’s largest manufacturers • More than 200 automotive component manufacturers ● Social • Brand conscious • Black: 49% of middle income, higher disposable income, new vehicles, features are important, suspicious • Buyer power is rising • White: Earn higher income, spend more, less disposable income, used cars, functional is important ● Legal • Motor industry development program • Automotive production and development program • Import duty rates/discounts Keep a running placeholder on ALL slides, to let them know where you are ... See next slide Strengths • • • • Weaknesses Worldwide brand awareness Quality yet affordable products Strong growth in the Chinese Market Ranked number two in global sales for sports retailers • • • Inexperienced in e-commerce and social media Weak online presence Weak virtual storefront Opportunities • • Threats Large target market Growing popularity of online/mobile shopping Analysis Alternatives • Transition of traditional instore shopping to internet shopping • Competive Industry with entrenched competitiors • Low margins in retail industry Recommendation Implementation General administration Margin Human resource management Procurement Inbound logistics Operations Outbound logistics Service Strength • brick-and-mortar Weakness • virtual presence Internal Analysis Product • Sporting goods • Table tennis balls • Treadmills • Sports aparel Price • Moderately priced • “A good bargain” Placement • Retail stores • 33 in China • 400 in 15 countries • Online •Taobao •Decathlon store Promotion • Outdoor billboards • Local newspapers • Flyers • Memberships • Sporting events • Contests Internal Analysis . • . • . • . . • . . . . . Supplier Power -Moderate -Moderate imput on price -High differentation of inputs -High presence of substitute inputs -Moderate supplier concentration Buyer Power -High -High price sensitivity -High level of company alternatives -Low switching costs -High buyer volume -High impact on quality Competitive Rivalry -High -High level of Competitors -High concentration of competitors -High globalization of industry Threat of Substitution -High -Many Alternatives -Lowcosts of substitutes -Moderate feasibility based on geographical location Threat of New Entry -Low -High cost barrier -High cost barrier -High brand identity -High Government policy External Analysis • Improve Ecosystem • Value (niche creation) • Critical mass (robustness) • Continous Performance Improvement (productivity) • Co-evolution or joint learning and optimization effects • Keystone Strategy • Create value within ecosystem • Share the value with other participants in the ecosystem • Mission Statement/Core Values • To become the most efficient, safe and sustainable port in the world • Passion, collaboration, continuous improvement, reliable • Attracting New Companies/Worldwide expansion • Strengthen the relationships between businesses, governments, and educational institutions • Invest in high quality technological knowledge • Sufficient Revenue Analyis . • . . • . . • . . • . . . • . . Opportunities Turnaraound Aggresive Weaknesses Strengths Defensive Diversify Threats Internal / External Analysis. . Strategic Group Mapping (p. 100 Thompson) .. X X X X .. •. •. •. . . . . •. . .. .. • . •• .. • . • . • . .. . • . • . • . • . • . • . • . • . . . x Product life cycle x (p. 326 marketing book) x x Introduction Early Growth Growth Late Maturity Growth Saturation Decline . . ● ● ● ● Internal Positive ● ● ● ● . ● . ● ● ● ● ● ● ● . BCG – Matrix “Question Marks” High (Pearce – 264) “Star” ... Invest, invest Select a few Remainder divested Market Growth Rate Dog - Liquidate or Divest “Cash Cow” ... Milked use for “star” and “?” Low Low High Cash Generation (Market Share) Alternative #1 Alternative #2 Construction site for offshore wind turbines Storage facility Alternative #3 New energy plant Alternative #4 Alternative #5 Lease to outside client Research & testing facility Alternatives . . . . . . . . . Construction site for offshore wind turbines Advantages Disadvantages Established market Does little to add to business ecosystem Aligned wth sustainability goals Logistically complicated Close to public areas Alternatives . . . . . . . . Alternatives Advantages Disadvantages Alternative #1: Sample Maintain Normal Course of Business •Growing market •No increased risk •Little to no extra costs •Potential missed growth opportunities •Potential loss of competitive advantage and market share •Current decreased growth rates Alternative #2: Sample Aggressive expansion into intraregional/ international markets •Growing market •In line with company’s goals •Increase market share •Meet customer demands •Harmonized regulations •Knowledge of expansion markets •High associated costs •Higher risk •Little strategic implementation time •Few low-cost satellite airports in place •Negative government relations Alternative #3: Sample Expand intraregional with a strong focus on profit •Growing market •Cost benefits •Increase market share •In line with company’s goals •Meet customer demands •Harmonized regulations •Knowledge of expansion markets •Focus on profits means: -Increase Shareholder Value -Stimulated external investment -Increase capital expenditures -Growth within business operations •Few low-cost satellite airports in place •High associated costs •Higher risk •Little strategic implementation time •Negative government relations . . Contract Assembly • • • • • • • Build manufacturing facility • • • Improve margins - reduces cost of shipping by 25% No major upfront investment Option for companies with low volume Must assemble 50,000 vehicles per annum and export to be eligible for tradeable certificate Import duty for CKD components: 20% 3-months lead time to commence operations 10 day vehicle ordering cycle Standard for setting up own facility is annual sales of 6,000 units with a single brand selling 1,500 Must manufacture 50,000 vehicles per annum and prove content localization to be eligible for tradable certificate Have to maintan high production levels to break even • • Global automotive market has not fully recovered from recession Industry has just recovered from a sharp decline in new-vehicle sales in three consecutive years Import duty for CBUs: 25% Not eligible for tradeable certificate Use South Africa as a hub • • • Individual markets have to be developed over time None of the 54 African countries has a sizeable middle class Political turmoil Exit Strategy • • Sell assets Divert resources to SsangYong Wait-and-watch • • Alternatives . Contract Assembly Manufacturi ng Facility Wait-andWatch Re-Export Hub Exit Strategy Key Success Factor Weight Rank Weight Rank Weight Rank Weight Rank Weight Rank Weight Exposure to Risk ,35 3* 1,05 1* ,35 4* 1,4 1* ,35 5 1,75 Financial Feasability ,25 3 ,75 2 ,50 4 1,0 1* ,25 5* ,75 Alligned with Mission of Parent Company ,25 4 1,00 5 1,25 2 ,50 5 1,25 3 ,75 Competitive Advantage ,10 2 ,20 4 ,40 2 ,20 3 ,30 3 ,10 Presense in South Africa ,05 3 ,15 4 ,20 2 ,10 5 ,25 1 ,05 Total 1,00 3,15 2,70 3,20 2,40 3,35 Ranking Scale 1: 2: 3: 4: 5: The alternative does not effectively address this criterion The alternative may contribute to addressing this criterion The alternative provides an average solution to this criterion The alternative provides an above-average solution to this criterion The alternative effectively addresses this criterion Alternatives Decision Gate Approach (develop-step-by-step) Monsoon as is Amazon Yes Yes Self-made Remain the Same No Online Sales Monsoon Modified No Pricing Structure Change Alternative #5 Exit Strategy Recommendation . • . • . • . • . • . • . . . Financial Projections Pro Forma Projections Revenue growth Profit margin Lease expense Operating expenses Tax Benefit Pro Forma Income Statement (in RM millions) Revenue COGS Gross Profit Lease Expense Operating Expenses Pre-Tax Profit Tax Benefit Net Income Pro Forma EBITDAR EBITDAR margin EBITDAR (RM millions) (examples) What Who Develop strategy for transition of resources to SsangYong Board / CEO Develop PR/marketing strategy to mitigate negative brand reputation PR/Marketing Fulfill current obligations in South Africa M&M (SA) Prepare Egyptian facility to accomodate additional demand if necessary Management Create marketing plan to increase sales from other locations Marketing Sell assets Finance / Management Assist displaced workers Human Resources Transition Management Implementation . . . . . . . 1 month 3 months 6 months Develop strategy for transition of resources to SsangYong Develop PR/marketing strategy to mitigate negative brand reputation Fulfill current obligations in South Africa Create marketing plan to increase sales from other locations Prepare Egyptian facility to accomodate additional demand if necessary Sell assets Assist displaced workers Milestone Review Implementation . . . . . . . . . . . . . . Risk Probability Mitigation/ Contingency South Africa/Africa market grows faster than expected Low Generate sales through imports from India and Egypt Parent Company does not approve of exit plan Low Adopt a wait and watch approach Implementation . . M-E . .