66-SEC A - St.Joseph's College

advertisement

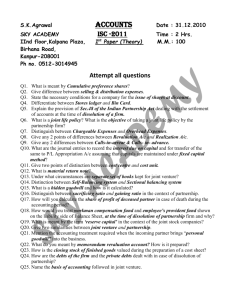

CLASS: B.Com. C.A. 15A/66 St. JOSEPH’S COLLEGE (AUTONOMOUS) TIRUCHIRAPPALLI – 620 002 SEMESTER EXAMINATIONS – APRIL 2015 TIME: 40 Minutes MAXIMUM MARKS: 30 SEM SET PAPER CODE TITLE OF THE PAPER II 2014 14UCC230204 FINANCIAL ACCOUNTING – II SECTION - A Answer all the questions: 30 1 = 30 Choose the correct answer: 1. 2. 3. 4. 5. A and B are sharing profits in the ratio of 2:5 C is admitted for ¼ share. The new ratio is _____. a) 6:15:7 b) 12:6:7 c) 2:5:4 d) 15:7:6 Revaluation a/c is a _____. a) Nominal a/c b) Real a/c c) Personal a/c d) Impersonal a/c Old profit ratio minus new profit ratio is equal to _____. a) Capital ratio b) Profit ratio c) Sacrificing ratio d) Gaining ratio When goodwill is brought in cash by the new partner it is called _____ method. a) Revaluation b) Premium c) Memorandum revaluation d) None of these Sec 37 of the partnership act provides interest on the account left by retiring or deceased partner at a) 5% b) 6% c) Bank rate d) None of these 6. 7. 8. 9. 10. 11. 12. 13. 14. A the time of Amalgamation, liabilities not taken over by new firm is transferred to _____. a) Capital a/c of partners b) New firm a/c c) Relationship a/c d) Revaluation a/c Garner Vs Murray rule is appolicable to a) Admission of a partner b) Retirement of a partner c) Dissolution of a partner d) Insolvency of a partner The expenses of realization are _____ to realization a/c a) Debited b) Credited c) Transferred d) None of these Proportionate capital method is otherwise called _____. a) Relative capital method b) Maximum loss method c) Balance method d) Capital method On dissolution cash in hand is transferred to _____. a) Realization a/c b) Capital a/c c) Cash a/c d) Revaluation a/c The sale of partnership firm to a company for a price called _____. b) Purchase consideration a) Selling price d) Cost price c) Market price Profit or loss on realization should be divided among partners in the _____ ratio. a) Profit sharing ratio b) Equal ratio c) Capital a/c d) None of these The difference between the hire purchase price and cash price is _____. a) Interest b) Down payment c) Advance payment d) Profit Hire purchase stock a/c is _____. a) Nominal a/c b) Real a/c c) Personal a/c d) Stock a/c 15. Under installment system, the ownership of goods passes on to the buyer on _____. a) Final payment b) Initial payment c) Down payment d) Cash payment 16. The cost of goods sold on hire purchase is transferred to _____. a) H.p trading a/c b) Sales a/c c) Purchase a/c d) Good a/c 17. In _____ repossession, the vendor takes away only a part of goods a) Complete b) Asset c) Default d) Patial 18. Repossessed stock a/c is opened in _____ books a) Hire purchaser b) Hire vendor c) Owner d) None of these 19. The objective of Branch accounting is to know _____. a) Profit / loss of head office b) Profit /loss of total business c) Profit or loss of branch d) None of these 20. Under stock and debtor system, branch stock a/c is usually maintained at _____. a) Cost price b) Selling price c) Purchase price d) Invoice price 21. In departmental a/c Rent and Rates paid are apportioned between departments on the basis of a) Sales b) Purchase c) Space occupied d) None of these 22. When goods are transferred from one department to another _____. a) Credit the receiving department b) Debit the giving department c) Both a and b d) None of above 23. In case of Independent Branch, Branch a/c is in the nature of _____. a) Real a/c b) Personal a/c c) Nominal a/c d) None of these 24. If the rate of G.P for dept A is 25% on cost and the sales is ` 1,00,000 the gross profit is ______. a) ` 25,000 b) ` 20,000 c) ` 33,333 d) ` 10,000 25. The average clause in a loss of profits policy protects the interest of the _____. a) Insured b) Insurer c) Workers d) None of the above 26. Consequential loss policy indemnifies _____. a) Loss of stock b) Loss of profit c) Loss of property d) None of these 27. The difference between standard turnover and actual turnover during the indemnity period is _____. a) Short sales b) Increased cost of working c) Claim d) Gross profit 28. A property of ` 40,00,000 is insured for ` 30,00,000. The property is completely lost in fire. The amount of claim is _____. a) ` 30,00,000 b) ` 20,00,000 c) ` 40,00,000 d) ` 10,00,000 29. ______ a/c is prepared to know the stock at the date of fire. a) Trading a/c b) Memorandum trading a/c c) Profit and loss a/c d) None of the above 30. Under loss of profit policy, insurance policy is taken for a maximum period of ______. a) 3 years b) 2 years c) 1 year d) none of the above *********************