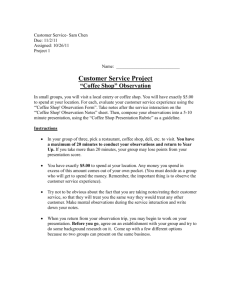

Product & Service

advertisement

PK FUN

Consulting Elites------Wang lingkai

Jiang yi

Liu wenwen

Yin xiaolin

Xu hua

From HSBC Business

School, Peking

University

Logical Line

Appropriate

Position

Strategy

Success

Factors

External

Factors

Customers

Position

Internal

Factors

Product

Raise

Price

Solutions

Profits=

Price*Quantity-Cost

Increase

Quantity

Control

Cost

Operation

Performance

Comparison

Overall

Value

Business Value

Evaluation

Product

Environment

Competitors

Current

Situation

Service

Implemen

-tation

Industry Trend

Identify

Strategy

Financial performance

before change

Financial performance

after change

FCF Model

KPI

External Factors

Current

Situation

Solutions

P&Q&C

Key Point

KPI

Industry

Trend

Internal

Position

External

Factors

Customers

Factors

Product

Competitors

Operation

Compared with 6% increase in the whole world

China’s coffee market increases by 30% per year,

and it will reach 50 billion dollars till 2020*.

There

Financial Ratios

is a huge gap between China’s drinking

coffee amount and the other countries, varying

from 140 to 1240.

There is great growth potential in China’s

coffee industry.

Reference: *China coffee industry development’ in Sina Finance

**Café ID of Australia

Overall

Value

External Factors

Current

Situation

Solutions

P&Q&C

Key Point

KPI

Industry

Trend

External

Factors

Customers

Competitors

Most people born after 70th are the only child in their families

and haven’t encountered any frustrations and barriers, resulting

in their fragile characteristics. These people are also the major

group who tolerate mortgage, so they have so much pressure

and negative emotions.

People aged from 21 to 40 are the major

customers for coffee shops.

Characteristics of people aged from21 to 40

According to the survey, although

female white-collar lack

communication with others, more

than 90% of them are eager to do

so.

Reference:

*Survey by Jing Newspaper

**Survey of white-collar women’s need,

Women federation of Jiangsu province

People born after 70th stand

much pressure and spiritual emptiness.

Overall

Value

External Factors

Current

Situation

Solutions

P&Q&C

Key Point

KPI

Industry

Trend

International

coffee chains

External

Factors

Customers

An Italian-style

restaurant

More attractive in

lunch & dinner

More attractive in Tea Break

& between-meal nibbles

Competitors

Direct

competitors

Indirect

competitors

Income Statement of Starbucks (part)

Locate at the same ground

floor of the apartment

An ice cream

cafe

Income Statement of Pudong (part)

Net earnings(loss)

31-Dec-09

31-Dec-08

% Change

(13,710)

32,300

- 42.4%

The two direct competitors have fulfilled customers’ daily need, which has

significant impact on the Pudong coffee shop in current period.

The international coffee chains will have more influence in the foreseeable future.

Overall

Value

Current Position

Current

Position

Competitors

Direct

competitors

Indirect

competitors

Current

Situation

They have Same customer

base but no significant

difference in positioning,

which results in less

competitive in main meals

& between-meal nibbles

Huge gap in competence

and similar position leads

to disadvantage

in

competition.

A place offering

casual and relax

feeling

Solutions

P&Q&C

Most aged from 21 to 40

Competitive price is not the

key factor of coffee industry,

and customer base will not

significantly increase by

decreasing price.

Key Point

KPI

Customers

Not Pricesensitive

Competitive price

Customers base:

Local expats,

professionals

A place for leisure can’t

fulfill customers’ need for

enriching spirit.

As Pudong’s current position can’t fulfill customers’ particular need, it can’t

achieve the core competency.

Position is the beginning of analyzing

internal factors

Spiritual

Emptiness

Overall

Value

Internal Factors—Business process & product

Current

Situation

Drinks

Industry

Trend

Bottled Drinks

Brewed Coffee

Cappuccino

Position

Factors

Product

Competitors

Operation

Hot Breakfast

Muffin; Toast

Lunch

Financial Ratios

Salads; Sandwiches;

Wraps; Pies

Latte

Evening foods

Soft drinks

Overall

Value

Internal

Espresso

Mocha Teas

Key Point

KPI

Foods

External

Factors

Customers

Solutions

P&Q&C

Tiramisu; Chocolate;

Cakes

Free Fruit and Biscuits

Offer the necessary kinds of products and no

value-added services;

Not competitive, unique and attractive

enough.

Internal Factors—Business process & product

Current

Situation

Industry

Trend

Internal

Position

External

Factors

Customers

Solutions

P&Q&C

Factors

Product

Competitors

Operation

Financial Ratios

Operating with simple business process makes it less possible to expand.

Key Point

KPI

Overall

Value

Internal Factors---Operation management

Current

Situation

Solutions

P&Q&C

Key Point

KPI

Overall

Value

Cost control

Operating costs as % of total revenue in coffee shops

Expand in excess of 10%

Percentage of sales

31-Dec- 31-Dec31-Dec- 31-DecAverage

Change

09

08

09

08

100%

100%

915000 930000 100%

1.6%

Food and beverages(COGS)

389000 420000

40%

43%

45%

8.0%

Depreciation of tangible assets

82000

82000

5%

9%

9%

0

Wages and remuneration

110000 130000

20%

12%

14%

18.2%

Utilities(light and heat etc)

39000

48000

5%

4%

5%

23.1%

Advertising and promotions

25000

30000

5%

3%

3%

20%

Rental

200000 200000

20%

22%

22%

0

Gross profit

526000 510000

60%

57%

55%

-3.0%

Operating profit for year

70000

20000

5%

8%

2%

-71.4%

The speed of growth is extremely low

Should pay more attention to

COGS control, due to excess to

average and high increase.

Although these three expenses

have increased rapidly, they are all

below that of industry average, so

the rise is NORMAL.

Although rental expenses excess

that of industry average, there is

few room for improvement, due to

the fixed rent terms.

Notes: To compared with the average level, we subtract Garbage collection expense from operating expense.

The big loss results from extremely low growth of sales

rather than the increasing expense, which is still in the reasonable range.

Attendance

Current attendance per day=

Sales/365 days/per capita consumption= 930000/365/50=60

Capacity: 50 customers

Opening Hours: 13 hours

The space of coffee shop is not adequately used, and the quantity of customers is sufficient.

Financial Status

Activity Analysis

31-Dec-09

31-Dec-08

¥

¥

9.55

10.24

38

36

Long-term investment activities

Total Assets Turnover

Total Assets Turnover is below

the industry average 1.6 *, due

to inadequate investment in

assets.

Key Point

KPI

Overall

Value

Table2: Liquidity Analysis

Short-term operating activities

Average No. days Inventory in stock

Solutions

P&Q&C

Liquidity Analysis

Table 1: Activity Analysis

Inventory Turnover

Current

Situation

1.05

0.95

Inventory turnover in

2009 decreased by

6.7%. The coffee shop

should take measures

to improve sales

revenue.

*Reference: Wind Database,2009, industry financial indicators

31-Dec-09 31-Dec-08

Operating cycle

Avg. No. days

payables outstanding

Cash cycle

Working Capital

Current Ratio

Quick Ratio

Cash Ratio

¥

38

¥

36

171

(133)

35,000

1.17

0.96

0.49

43,000

1.23

1.03

1.55

The industry average cash ratio is 5.3 *,

extremely outweigh Pudong’s. Pudong’s weak

profitability limited by CFO (decreased 65.54%)

caused troubles of repaying current liabilities,

which may influenced the trade

credit

provided by suppliers.

Financial Status

Activity Analysis

Long-term debt and Solvency Analysis

Weak ability of generating CFO

Current

Situation

Solutions

P&Q&C

Key Point

KPI

Profitability Analysis

Table 4: Profitability Analysis

31-Dec-09

Table3: Long-term

¥

General

Analysisdebt

andand Solvency analysis

Return on sales

31-Dec-09

31-Dec-08

relationships

Gross margin ratio

0.55

¥

¥

Profitability

Operating margin ratio

0.01

Debt to total Capital

0.53

0.55

Analysis

Profit margin ratio

-0.01

Debt to Equity

0.63

0.78

Return on investments

Times interest earned

0.42

2.13

ROA(return on assets)

0.01

Long-term

ROE(return ondebt

equity)

-0.03

Liquidity

&

Operating leverage

0.55

solvency

Analysis

Analysis

Financial leverage

-0.73

Unsatisfied

performance

of

generating

controlling costs, the times interest earned and net

profits

income were threatened seriously.

Weak in repaying

current

As Pudong is weak

inliabilities

generating revenues and

Overall

Value

31-Dec-08

¥

0.57

0.07

0.04

0.06

0.07

0.57

1.89

Difficult

to pay interests

of long-term

liabilities

All the

ratios related

to

profitability decreased.

Deteriorated profitability must

be improved!

Bottleneck

Current

Situation

Solutions

P&Q&C

Key Point

KPI

Simple business process , normal products without value-added services

limit the profitability.

The big loss results from extremely low sales growth rather than the

increasing expense, which is still in the reasonable range..

Inadequate

Profits

Four types of financial ratios are all related to weak ability of generating CFO,

which is the most effective way to gain profits.

We use the basic mathematic equation of profit- Profits= P × Q — C - to analyze each factor thoroughly, and

get a comprehensive, convictive suggestion. By improving price, quantity and cost, profit will increase

involuntarily.

Cash Inflow

Price * Quantity

Cash Outflow

Cost

Returns

Profits

Overall

Value

Step 1: Increase Q

Current

Situation

Solutions

P&Q&C

Key Point

KPI

Overall

Value

How to increase Q?

1 Necessary

Management

• Product & Service

• Operation

2 Differentiation

management

• Theme

• Product & Service

• Operation

3

Promotion

• Stories & Cards

• Memory wall

• Experience Nobility &

Classicality

• Online Group buying

• Topic sharing salon

• Launch multi-level

membership card

Establish differentiation advantage among coffee shops by

taking necessary management and differentiation

management in product and service within Pudong coffee shop.

Adopt promotion to convey the differentiation advantage of

Pudong Coffee to target customers successfully.

4

5

6

Differentiation

Advantage

Customer

Increase in Q

• In order to establish

•

differentiation

advantage, Pudong

should create unique

theme and take

necessary and

differentiation

management.

• By popularizing

promotion, Pudong can

convey differentiation

advantage to

customers.

Touched by the

• Q can be increased by

differentiated

customers’

product and

recognition towards

service, customers

differentiation

become more

advantage.

willing to come to • With increase in Q,

Pudong, treat

consumption and

here a second

profit will also

home, go back to

increase.

themselves.

Step 1: Increase Q---Necessary Management

Current

Situation

Q

Necessary Management

• Standardize product quality

- Make integrated quailty standard to grantee that

customers can get highest-quality food and

beverage.

- Such as :serve hot coffee within 3 minutes , serve

fresh-made cakes.

• Extend opening hour

- 8 am to 9 pm now, not long enough.

- 50% of coffee shops in local region take this

measure to encourage business growth.*

50%

40%

40%

35%

Overall

Value

Operation Management

Example

Steps taken to Encourage/improve Business

60%

Key Point

KPI

• Random customer survey

-Get feedback of product and service in detail, such as

whether customers are satisfied with the sofa,

music and smile of waiter.

• Standardize service process, set it clear, professional and

fixed, such as:

-when customers come in or leave, waiters must say

“Welcome”;

-What one waiter should do daily in order.

Product & Service

70%

Solutions

P&Q&C

30%

•Open the door with the key

•Turn on the light and examine the abnormality

•Open the monitor, play the music according to

different time slot.

•Open the POS, check the imprest

•Check the sales record and financial data of previous

day

•Check the working logs of the previous group

•Check whether the Espresso can work or not by making a

cup of single Espresso

•Fill the Espresso grinding machine with the coffee bean

•Begin to prepare today’s fresh brewed coffee, hang the

tag on the heat-preserving container

•………………

*Reference: Table 2D-Steps taken to encourage/Improve Business in Coffee Shops %

Step 1: Increase Q---Differentiation

Current

Situation

Differentiation

Management

Q

• Redecoration

-To better express the theme, Pudong should

redecorate and redesign the whole atmosphere,

including visual, hearing, feeling and smelling.

- 70% coffee shops in local region take this measure to

encourage business growth. *

Operation

Steps taken to Encourage/improve Business

50%

40%

40%

35%

Overall

Value

Back to you!

---Coffee life, Your life.

An intimate space for you to sit down,

slow down, recall and think about who

you are and what you want .

• Theme Coffee shop- Back to You!

- Emphasize the theme that customers can enjoy the

most relaxed, natural themselves in Pudong.

60%

Key Point

KPI

Theme & culture

Product & Service

70%

Solutions

P&Q&C

30%

* Reference: Table 2D-Steps taken to encourage/Improve Business in Coffee Shops %

• Li should change his role from employee to manager

and entrepreneur, take more time to communicate

with customers, especially who come for the first

time, to get feedback of product and service.

• Only more monetary reward is not enough for

employees, Li should pay more attention to form

friendly, comfortable organizational culture and

enhance employee commitment.

• Employees with high commitment will care customers

more, thus enhance customer commitment.

• Li and all employees should take more efforts to

make friends with customers, make them feel free

and relaxed here.

Step 1: Increase Q---Promotion

Current

Situation

Online

Group

Buying

Topic

sharing bar

Make Different groups such

as musicals,

composers

Exhibit pure,

classical

andcoffee

singersmachines

to find to

confidant

and feast.

offer visual

themselves

Make your own coffee

Use Douban to

according to your

advertise.

flavor

Key Point

KPI

Overall

Value

Online Group

Purchase

Cards

Cooperate with

some&

infusive group buying

Memories

Website.

Topic sharing bar

Attract traveling lovers,

Hikers, Backpackers to get

together, Experience

sharing and

&

organizing Nobility

outing

activities. Classicality

Solutions

P&Q&C

Experience

Nobility &

Classicality

Multi-level

Membership

Card

Cards &

Memories

Customers write

Provide favorable combo

cards , Pudong will

from 2pm to 5pm during

help them to send

certain period.

cards to anyone at

a specific future

Multi-level

date.

Membership Card

Offer membership card with

offers

morePudong

discount to old

customers

memory

wall tofor

before

redecoration

collect

customers

to

write

advances from customers.

memories, feeling

Offer

ormembership

wishes.. card with less

discount to new customers to

attract customers.

Exchange stories

Step 2: Increase P

Current

Situation

Solutions

P&Q&C

Key Point

KPI

Overall

Value

The original

why could we charge more from the customs?

Economics

price is almost

rapid

economy

Better

The

original

decoration

price

the same

as the

growth in

outlets around

analysis:

elasticity

Pudong

New

Economy

the district.

with

is

almost

the the

Area

of

demand

is

Above200

condition:

According to the chart it is obvious that

escalation

same

as the

of rapid

Economy

economy

growth

Our target customs

are those majority of consumers prefer to pay ¥31 to

Economics

smaller than

1 in 151-200

The original

Better

analysis:

ambience;

outlets

around

Layout

Pudong

New

Area

100 for one cup of coffee, 39% consumers

decoration with

condition:

elasticity of

who’re willing toprice

pay isrelatively

when

almost high

the

escalation price

of

demand is

101-150

are willing to pay ¥31 to 50 and 28.6% are

redesign

the

district.

ambience;

rapid price

economy

smaller than 1

index

the same

as thewilling to pay ¥51 to 100.

toCPIget

different

experience.

Layout

redesign

changes.

when price

400

growth in

Economy

condition:

changes.

51-100

31-50

Below 31

outlets around

the district.

300

Pudong New

200

Area

100

0

0.00%

10.00%

20.00%

Better

Story cards

decoration with

the escalation of

20

ambience;

Layout redesign

15

10

5

0

30.00%

40.00%

Elasticity of demand

〈1

Economics

As CPI is also increasing

during recent years. The price

be adjusted,

too.

Theshould

original price

which is ¥30

to 40.

relatively low when we aim to offer

middle and high end coffee service

analysis:

Memory Wall

elasticity of

demand is

smaller than 1

when price

Disposable income in

Main price strategyShanghai always ranks first

changes.

Topic bar style layout redesign

¥50 average in China.

such as memory wall could

create a special, peaceful and

enjoyable ambiance for customs

Step 2: Increase P- Price strategy

Current

Situation

Solutions

P&Q&C

Key Point

KPI

Overall

Value

Price discrimination

$/Q

Pmax

¥30 to 50: offering high Capability/price Ratio experience

P* :Normal customs

A

1

For previous customs, we could offer membership card to them

before the redecoration, The membership card also provide cash

flow. In order to get the card, they have to first deposit no less than

¥100.

2

Online group-buying customs are more cash sensitive, so they are

willing to buy the ultra-discounted tickets with endearing effort and

time. Students and other cash sensitive customs have a higher

demand elasticity than common customs.

3

Special price(¥30-40) everyday aims to promote sales during

afternoon.(fewest customs according to the table 2F)

PC: Price-sensitive Customs

P*

B

MC

PC

D

MR

Q*

QC Quantity

The No. of customers of every operating period

Above ¥50: offering high quality

coffee and fresh experience

For people who pursue various life experience in Pudong, we

provide them with high quality of service and charge more.

Morning (8am to 11am)

Lunch-time (11am to

2pm)

Afternoon (2 pm to

5pm)

Tea-time and early

evening (5pm to 9pm)

Step 3: Control C

Current

Situation

Solutions

P&Q&C

Key Point

KPI

Overall

Value

T

TC (k ) { ( M it Lit Tit U it )eit pvit }

t 1

ik

Encourage Take-out

• Take-out beverage or food

can provide much more

convenience to customers,

which

can

enhance

customer loyalty

• Take-out business can help

the shop decrease

expense, since it won’t

take spaces in the shop

and save human resource

cost.

S&G&A

control

Promotion costs

miimit nt1 f1 /(1 f i ) liilit yit nt1 gi 1 gi

Cit M

eit pvit cit 1

s

is

d

u

iu

v

iv

n

im it mt i it i it t

m1

nt

Pit pi ipit n fi dn

0

Communication

costs

Training costs

tn

Ci t Ci iCit yit n gt dn

0

M

Tit simis it d mt

m 1

Utility costs

U it (ui iuit vi ivit )nt

Average costs will increase as we redecorate to a new style, but our objective is to main its increasing rate at the

previous level, even below.

Key point

Strategy

Key success

factor

Implementation

Current

Situation

Environment

• Decor, temperature and noise level

• Free Wi-Fi

• Cleanliness and overall hygiene

• Availability of space

2

Service

• Friendly staff

• Excellent customer service

3

Product

• Beverages/food provided must be good

quality

• Presentation of food and food offering

Implementation

Product

Service

*Reference: Table 1-Judging criteria for Coffee shops.

Overall

Value

1

Environment

2

Key Point

KPI

Establish the appropriate position,

atmosphere, value of shop based on

customer’s demand and current resources.

Manager and employees all identify with

the position and value of Pudong.

1

3

Solutions

P&Q&C

Key Performance Indicator

CATAGORY

Result

indicator

INDICATOR

DEFINATION

Solutions

P&Q&C

Key Point

KPI

Overall

Value

OBJECTIVE

The amount of new membership card

During certain period, the added

amount of new membership card

Measure membership card promotion

effect

The amount of customers coming to topic

sharing salon

The actual amount of customers

compared to the estimated one

Measure topic sharing salon effect

The amount of customers taking part in

postcards and memory wall service

The actual amount of customers

compared to the estimated one

Measure postcard sending service

effect

The amount of customers coming during

the additional opening hours

Measure additional opening decision

effect

The number of customers coming due to

group buying

Customers use favorable combo

from cooperated website

Measure group buying effect

Cost of main operation

Cost of product sold

Measure cost control effect

Gross profit margin

Calculated based on financial

statement

Measure the operation efficiency and

promotion effect

Satisfaction of customers

Calculated by random customer

survey results

Measure the whole impression of

customers toward product, service and

theme

The amount of returned customer

Action

indicator

Current

Situation

Measure customer loyalty and

customer management effect.

Food/beverage service quality

Example: employee should finish a

cup of coffee/sandwich within

certain minutes with high quality

Conduct the behavior of employees

Polite term standardization

Set unified tongue for employees

used during each

Conduct the behavior of employees

The responsiveness of employees towards

shop’s activities

Measure the organizational culture

building effect

Compare Break-even point

Current

Situation

Solutions

P&Q&C

Key Point

KPI

Overall

Value

Break-even point calculation

2010(before

2,010

2011

2012

2013

2014

adjustments)

420,000 45.7% 436,800 46.2% 588,000 50.0% 646,800 56.0%711,480 57.7% 782,628 63.3% 860,891 64.7%

2009

Variable Cost (COGS)

Fixed Cost(operating

expenses)

500,000 54.3% 508,720 53.8% 588,200 50.0% 508,596 44.0%521,871 42.3% 454,097 36.7% 469,356 35.3%

Break-even point revenue

920,000

945,520

1,176,200

1,155,3

96

1,233,3

51

1,236,72

5

1,330,24

7

Forecast or actual sales

revenue

930,000

1,005,79

5

1,505,700

1,656,2

70

1,821,8

97

2,004,08

7

2,204,49

5

2,500,000

150.0%

2,000,000

1,500,000

100.0%

1,000,000

500,000

0

50.0%

Break-even

point

0.0%

revenue

Forecast or

actual sales

revenue

Fixed Cost

Variable Cost

The ability of generating profits will be stronger and stronger, mainly due to the increase of variable

cost, which decreases the operating leverage.

Financial forecast & contrast

Financial forecast for 2010 before renovation

Current

Situation

The Pudong Coffee Shop

Income Statement for year ended (forecast)

31 Dec 2010 ¥

No adjustments

Revenue(beverages/drinks)

524,528

Revenue(food sales)

481,268

Total Revenue (food and beverages)

1,005,795

Cost of sales

(436,800)

Gross profits

568,995

Less Operating expenses:

Depreciation of tangible assets

(82,000)

Wages and remuneration

(135,200)

Rental

(200,000)

Utilities(lighting and heating etc.)

(49,920)

Decoration expense

Garbage collection

(10,400)

Advertising and promotions

(31,200)

Total Operating Expenses

(508,720)

Operating Profit for year

60,275

Interest payable on loans

(18,369)

Profit(loss) for year

41,906

Key Point

KPI

Overall

Value

The Pudong Coffee Shop

Balance Sheet as at

Li’s assumptions:

Prices increase by 3%; sales volume will increase

by 5%; Inflation 4%; Other factors unchanged

Solutions

P&Q&C

Goodwill

Furniture and Fittings(net)

Inventories

Cash at bank

Total Assets

31 Dec 2010

No adjustments

¥

¥

400,000

164,000

43,360

241,966

849,326

460,496

2009 ¥ Owner's Equity

Bank loan payable

184,715

485,000

Trade payables(8.4%)

204,115

445,000

Total liabilities and owner's equity

849,326

930,000

The Pudong Coffee Shop

(420,000)

Cash flow statements for year ended

31 Dec 2010 ¥ 31 Dec 2009 ¥

510,000

Operating cash flow

(82,000)

(130,000)

(200,000)

(48,000)

(10,000)

(30,000)

(500,000)

10,000

(23,710)

(13,710)

operating profit(loss) for year

41,906

10,000

Add: depreciation

82,000

82,000

123,906

92,000

2,720

6,000

17,340

16,000

143,966

102,000

Changes in working capital:

Less: increase in inventories

Add: increase in trade payables

Investing activities

Nil

Financing activities:

repayment of loan including interest

=Overal cash flow (deficit) for year

Equals: Closing bank balance

(100,000)

(100,000)

43,966

2,000

198,000

196,000

241,966

198,000

Financial forecast & contrast

Current

Situation

Solutions

P&Q&C

Key Point

KPI

Overall

Value

The Pudong Coffee Shop

31 Dec 2010

Adjusted

The Pudong Coffee Shop(Adjusted)

The Pudong Coffee Shop(No adjustments)

¥

Goodwill

400,000

Income Statement for year ended

Income

Statement for year ended

31 Dec 2010 ¥

¥

31 Dec 2010 ¥

(forecast)

(forecast)

Furniture and Fittings(net)

164,000

Inventories

74,240

Revenue(beverages/drinks)

882,700

Revenue(beverages/drinks)

524,528

Profitability Analysis

for 2010

Cash at bank

611,040

Revenue(food sales)

623,000

Revenue(food sales)

481,268

31-Dec-10

Total Assets

31-Dec-08

31-Dec-09

(food and

beverages)

1,005,795

Without

adjustment

After adjustment

Total Revenue (food and beverages)

1,505,700 Total Revenue

Owner's

Equity

817,066

of sales

(436,800)

Return on sales

(588,000) Cost

Bank loan payable

184,715

Gross profits

Gross profits

917,700

Gross margin ratio

57.5%

54.8%

56.6%

60.9%568,995

Trade payables(8.4%)

247,499

Less

Operating

expenses:

Less Operating expenses:

Profit margin ratio

3.5%

-1.5%

23.7%

Total liabilities and4.2%

owner's equity

Financial forecast for 2010 after renovation

Depreciation of

tangible

Return

onassets

investments

(82,000)

Wages and remuneration

ROA(return on assets)

Rental

ROE(return on equity)

Utilities(lighting and heating etc.)(10%)

(182,000)

6.3%

(200,000)

7.5%

(52,800)

Decoration expense

Garbage collection(10%)

(11,000)

Advertising and promotions

(20,400)

Total Operating Expenses

Operating Profit for year(EBIT)

Interest payable on loans

Profit(loss) for year

Balance Sheet as at

Depreciation of tangible assets

(82,000)

The Pudong Coffee Shop

(135,200)

1.1%Wages and remuneration

29.6%

Cash7.1%

flow statements for year ended

Rental

(200,000)

-3.3%

9.1%

42.0%

Operating cash and

flowheating etc.)

Utilities(lighting

(49,920)

operating profit(loss) for year

Decoration expense

Add: depreciation

Garbage collection

(10,400)

Changes in and

working

capital:

Advertising

promotions

Less: increase in inventories

(548,200) Total Operating Expenses

Add: increase in trade payables

369,500 Operating Profit for year

Investing

activities

(26,004) Interest

payable

on loans

Decoration Expenditure

year

343,496 Profit(loss)

Financing for

activities:

Repayment of loan including interest

=Overall cash flow (deficit) for year

Opening bank balance

Equals: Closing bank balance

(31,200)

(508,720)

60,275

(18,369)

41,906

¥

2009 ¥

485,000

445,000

1,249,280

930,000

(420,000)

510,000

1,249,280

(82,000)

(130,000)

31 Dec 2010

(200,000)

Adjusted

(48,000)

369,500

82,000

(10,000)

451,500

(30,000)

30,240

(500,000)

40,499

10,000

(23,710)

(40,000)

(13,710)

(28,700)

413,040

198,000

611,040

Value Evaluation

Based Model

----FCFF Model

Current

Situation

Solutions

P&Q&C

Key Point

KPI

i

Vo FCFF

i

1

r

i 1

n

Reasons for choice

Issues related to differences

in accounting policies and of

income versus cash flows

disappear

Easy to distinguish operating

and investment items.

Any cash held within the

firm is needed as operating

working capital

Reported earnings are

readily available

•FCFF---the free cash flow equals cash from

deducts capitalization expenditure

•n---the No. of the period

•r---WACC=Interest rate of debt*(1-tax

rate)*Long-term debt/ Total liability and

Equity +capital cost rate*owner’s equity/

Total liability and Equity

Overall

Value

Value Evaluation

Current

Situation

Solutions

P&Q&C

Key Point

KPI

Overall

Value

FCFF for Pudong Coffee Shop(No adjustment)

EBIT

Plus: Depreciation

Tax Rate

2009

10,000

82000

2010 2011

2012

60,275 73,966 88,205

82000 82000 82000

25%

92,000

WACC

Value at the end of 2014

2014

118,413

82000

(410,000.

0)

Capitalization Expenditure

FCFF

2013

103,013

82000

142,275

155,96

(224,987.

170,205

6

2)

200,413

6.27%

¥449,108.18

FCFF for Pudong Coffee Shop(Adjusted)

EBIT

Plus Depreciation

Tax Rate

Capitalization Expenditure

2010

329,500

82,000

2011

500,874

82,000

(40000)

2012

2013

588,546 629,841

82,000 82,000

25%

2014

672,878

82,000

(410000)

Notes:

Interest Rate for long-term debt

Tax Rate

Long-term debt/ Total liability and

Equity

Cost rate for Owner's equity

Free cash flow

WACC

2010

371,500

2011

418,874

2012

2013

506,546 137,841

2014

590,878

Owner's equity/Total liability and

Equity

6.27%

Value at the end of 2014

¥1,686,815.20

Conclusion:

After effective measures, the current value of Pudong Coffee Shop is almost four times

compared with the that in 2010 without adjustments

7%

25%

29.55%

10.0%

47.14%

Logical Line

Appropriate

Position

Strategy

Success

Factors

External

Factors

Customers

Position

Internal

Factors

Product

Raise

Price

Solutions

Profits=

Price*Quantity-Cost

Operation

Performance

Comparison

Overall

Value

Business Value

Evaluation

Product

Environment

Competitors

Current

Situation

Service

Implemen

-tation

Industry Trend

Identify

Strategy

Financial performance

before change

Financial performance

after change

FCF Model

Increase

Quantity

Control

Cost

KPI

PK FUN

Consulting elites-------Wang lingkai, Jiang yi, Liu wenwen, Yin

xiaolin, Xu hua

From HSBC Business School, Peking

University

![저기요[jeo-gi-yo] - WordPress.com](http://s2.studylib.net/store/data/005572742_1-676dcc06fe6d6aaa8f3ba5da35df9fe7-300x300.png)