amgprofessionals LIMITING FACTOR ANALYSIS Where there are

LIMITING FACTOR ANALYSIS

Where there are no constraints, produce all products that give profit/contribution. If a constraint exists, ration the resource available amongst the products that will produce the highest contribution despite the limitation.

Examiner can test this analysis under:

1. Key factor analysis using contribution per limiting factor

2. Throughput accounting

3. Linear programming

Both 1 and 2 use similar analysis and they will be the object of my discussion.

Using contribution per limiting factor

1. use only when there is a single constraint

2. follow the below steps a. identify the limiting factor (labour hours, material, etc) b. cal. contribution per unit c. cal. contribution per limiting factor (i.e. contribution/labour hour per unit assuming labour is the limiting factor) d. rank according to c above e. allocate resources and determine the optimum production plan.

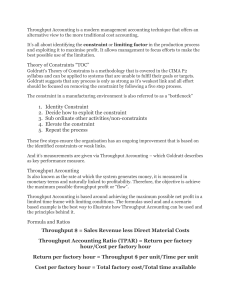

Throughput accounting

Concept.

1. In the short-run, only direct material costs are variable. Labour and overheads (conversion costs) are fixed and are grouped together and called Total factory costs. (NB: This is the differentiating factor from the conventional method above where we assume direct material, direct labour and variable o/hs to be variable costs)

2. In a JIT environment, goods should only be produced when there is demand for them. This ensures faster time to market. Producing for inventory does not create sales.

3. Factory spends money when goods are produced. The company makes money when goods are sold.

Overall profitability is determined by the relative rate at which the company makes money and the rate at which the factory spends money.

*throughput calls constraint ‘’bottleneck resource’’

*throughput means steady, smooth flow of production.

*a bottleneck resource is that factor that will not allow production to flow without delay.

*In a process, it is the process that will take the longest time that will delay other processes. Other processes will have to wait for it.

Question 1

The factory has 50 production lines each of which contain the three processes: Raw material for the sheet metal is first pressed then stretched and finally rolled. The processing capacity varies for each process and the factory manager has provided the following data:

Processing time per metre in hours

Product A Product B Product C

Pressing 0·50 0·50 0·40

Stretching 0·25 0·40 0·25

Rolling 0·40 0·25 0·25

Required:

(a) Identify the bottleneck process and briefly explain why this process is described as a

‘bottleneck’. (adapted from F5 June 2009, Q1) (3 marks)

Solution:

You don’t have to do any calculation. By observation, you will see that for product A, pressing will take the longest time and other processes (stretching and rolling) will have to wait. The same thing goes for product B and C.

*the process with the lowest output, will be the bottleneck if output is the yardstick.

Format for key factor analysis

PRODUCTS A B C

$ $ $ $ $ $

Selling price 400 600 500

Variable cost/unit

Dm 20 30 40 dl 10 10 10 v. o/hs 15 (45) 15 (45) 20 (70)

Contribution/unit (a) 355 555 430

Labour hour (key factor)/unit (b) 5hrs 15hrs 10hrs

Contribution/labour hour (a/b) $71 $37 $43

Ranking 1 st 3 rd 2 nd

Allocation of available resource (total labour hours)

Hours hrs/unit units

Product A 5,000 5 1000

Product C 15,000 15 1000

Product B (the remaining hrs if any) 2,000 10 200

22,000 2200

Throughput format

Product A Product B Product C

Selling price

70·0 60·0 27·0

Raw materials 3·0 2·5 1·8

Throughput 67·0 57·5 25·2

Bottleneck hours

0·50 0·50 0·40

Throughput per bottleneck hour* (a)134·0 115·0 63·0

Fixed costs per hour (b) 90·0 90·0 90·0

TPAR

1·49 1·28 0·7

Working* 67/0·5 = 134 57·5/0·5 = 115 25·2/0·4 = 63 .

Decision rule:

Any product(s) with throughput accounting ratio (TPAR) of less than 1, do not produce. HERE PRODUCT

C.

Produce product(s) with TPAR> 1. HERE PRODUCT A AND B.

*Any product with a TPAR<1, the factory is spending more money than the cash the company is generating from sales.

*TPAR>1, the rate at which cash is generated from sales is higher than the rate at which the factory is spending money.

*Companies should improve on TPAR<1. How?

Start from sales in the calculation above and follow the table downward.

How to improve TPAR<1 a. increase the selling price(consider competition, increase sales volume) b. reduce the raw material costs (better negotiation, alternative supplier e.g china products, etc) c. design out cost or control fixed costs(use target costing, work on costs drivers, outsource, etc) d. reduce bottleneck time.

*when answering questions, give points relevant to the questions. There will always an answer in the question.

*remember, if TA ratio is <1 close down the product line.

*before you close than consider the following factors

1. customers perception could be negative

2. competitors may see opportunity to win or de-market the company

3. what other profitable use can the company put resources freed up on the product to?

4. the effect the close than will have on employee morale

5. the reaction of suppliers that are disproportionately affected.

6. is the product used to sell other products(complimentary goods)?

7. accuracy of the assumption made for costs classification, etc.

I love you all.

Now try question no1, june 2009. Discuss your challenges with me here. amgprofessionals@gmail.com