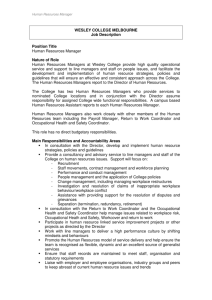

Annual Report 2010/11

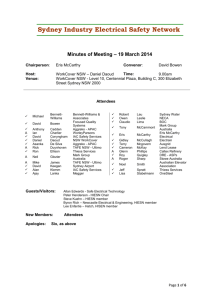

advertisement