DILIGENCE PAYS 3/16/16

Add the Best Large Cap Growth Stocks to Your Portfolio:

Style Analysis 1Q15

The Large Cap Growth style ranks fourth out of the 12 styles as detailed in the 1Q15 Style Ratings report and

receives our Neutral rating. The Large Cap Value style as a whole outperformed the Russell 3000 in 2014, rising

12% to the Russell’s 11%. It was the sixth-best performing style last year, surpassing All Cap and Small Cap

styles in terms of performance. While a 12% annual return is nothing to be ashamed of, there’s greater value

here for investors that play their cards right.

The Large Cap Growth style is comprised of large cap companies that are commonly classified as growth stocks.

Growth stocks consist of companies that generally have low dividends due to management’s desire to reinvest

earnings at a high rate to create exponential growth in share price. At New Constructs, we define growth stocks

as those for which the market has priced in a significant growth premium above the company’s current economic

earnings. As such, these stocks possess a higher price to economic book value (PEBV) than other stocks.

The Large Cap Growth style is a popular option for investors who are willing to wait for a company to grow, but

aren’t ready to jump into the risk-loving world of small cap stocks. The inherent risk in betting on a stock

classified as Large Cap Growth is that the growth happened well before you decided to invest. There are plenty

of large companies that falter in the stock market due to an inability to expand, diversify, or create new product

offerings.

Stock Picking is Paramount to Success

Last year, investors saw just how important buying quality stocks can be. Delta Airlines (DAL) and Dr. Pepper

Snapple were two of the best performing stocks in this style, up 77% and 50% over 2014. Both of these

companies earned our Attractive ratings in 2013. Due to their large price gains, they have settled at Neutral until

we believe their fundamentals change and they are ready to be upgraded.

On the other hand, Helmerick & Payne (HP) was one of the worst-performing stocks, declining by 18% during

2014. HP earned our Dangerous rating at the beginning of 2014, but has been upgraded to Neutral as the lower

stock price has started to reflect the company’s economic reality.

There are 182 stocks that receive our Attractive or Very Attractive ratings in the Large Cap Value style. These

are some of the most profitable and cash flow-strong business in the market, and they offer limited downside at

their current valuations.

The following are some of our favorite Large Cap Growth stocks. Investors seeking the best chance of

outperforming should look no further than the following:

1. Put Your Portfolio in the Cloud — Oracle (ORCL)

Oracle is the world’s largest software company, and produces and distributes hardware and software along with

support services to over 400,000 firms in over 145 countries. Enterprise software is at the heart of Oracle’s

business, but this segment is supported by other product offerings, including servers, databases, and storage

services aligned to provide businesses with a holistic package for all of their IT needs.

Over the last decade, Oracle’s after-tax operating profit (NOPAT) has grown by 17% compounded annually.

ORCL earns our Attractive rating due to its high 33% return on invested capital (ROIC) and 3.6% free cash flow

(FCF) yield. In addition, Oracle is able to achieve operational efficiencies with a high NOPAT margin of 31%.

Oracle’s main source of revenue — 48% in fiscal 2014 — comes from software license updates and product

support. But a growing portion comes from the company’s Cloud software services, with sales up 15% in 2014

over 2013. With two recent acquisitions, Datalogix and MICROS Systems, Oracle’s clear strategic focus is to

dominate this sector as it does many others. Between the first and second quarter of fiscal 2015, Oracle’s cloud

systems revenue increased by about 8%.

Page 1 of 6

Important Disclosure Information is contained on the last page of this report.

The recipient of this report is directed to read these disclosures.

DILIGENCE PAYS 3/16/16

Oracle’s current share price of ~$41/share gives its stock a PEBV of 1.1, which implies only a 10% growth in

NOPAT for the rest of the company’s lifetime. If ORCL can grow NOPAT by 5% compounded annually for 10

years, well below its historical rate, ORCL’s stock today is worth ~$48/share –– a 17% upside.

2. A Powerhouse Pharmaceutical Company That Keeps on Growing — Gilead Sciences (GILD)

Gilead Sciences started as a therapeutics firm primarily focused on developing and distributing HIV and Hepatitis

antivirals, but has grown to become one of the largest biopharmaceutical companies in the world. Gilead now

produces over 15 brand name drugs focused on treating HIV/AIDs, liver disease, cancer, and cardiovascular and

respiratory diseases.

Over the last decade, Gilead’s NOPAT grew by 26% compounded annually. GILD earns our Attractive rating due

to its ROIC of 45% and a free cash flow yield of 4.7%. In addition, Gilead’s ROIC and FCF yield have been

increasing for the past two years, rising from lows of 17% and -11.8% in 2012, respectively.

One concerning feature about Gilead is that the pharmaceutical sector is in flux. Various acquisitions and

divestitures of certain drug product lines can make for tricky forecasting of future returns of any pharmaceutical

company. However, Gilead’s aggregate drug sales increased by 15% last year with an 837% increase in sales of

Stribild, Gilead’s once-a-day prescription pill for the treatment of HIV-1. This development, as well as the

company’s impressive drug approval rate, indicates that Gilead has the ability to continue providing specialized

and groundbreaking drugs that will keep margins strong and after-tax operating profits rising.

At its current price of ~$102/share, GILD has a PEBV of 1.3. This ratio implies the market does not expect more

than a 30% growth in after-tax profits for the rest of the company’s lifetime. If we forecast even just a 10%

NOPAT growth rate (far below Gilead’s historical rate) for 10 years, the stock is worth ~$156/share –– a 50%

upside. For this reason, Gilead made our Hot Stock Commentary feature in January.

3.

More Than Just Credit Cards — Visa (V)

Visa is no longer just a credit card company: it’s a payments technology firm. This strategic shift in how the

company’s brands itself and perceives its own business acknowledges the fact that Visa has grown far beyond a

piece of plastic.

Over the past five years, Visa has grown NOPAT by 22% compounded annually. V earns our Attractive rating

because of its strong 23% ROIC and encouraging 3.6% FCF yield. Visa’s high ROIC, which is up from 10% in

2009, is due in part to better NOPAT margins, up 16 basis points since 2009. Over this time, Visa only increased

its invested capital by 11%.

One concern with Visa will be its ability to maintain margins and growth as competition from mobile payment

systems like Apple Pay and Venmo continues to grow. Apple Pay has partnered with Visa to actualize its

transactions, and Venmo can only transfer payments between bank accounts. But as the sector expands and

more technology firms find ways to manage quick credit payment systems, it may spell trouble for this giant. Of

course, Visa could also purchase any smaller competitors or develop its own forward-thinking electronic system.

At its current price of ~$246/share, V has a PEBV of 2.1, implying that the market expects V to double after-tax

profits. If we expect that Visa will be able to grow NOPAT by 12% compounded annually for 12 years, V is worth

$312/share –– a 27% upside.

The Best & Worst Large Cap Growth ETFs and Mutual Funds

Not the type to buy individual stocks? We also cover 687 ETFs and mutual funds in this style. We rate these

ETFs and mutual funds based on their holdings as well as their total annual costs (TAC).

The following are the top three ETFs or mutual funds in the Large Cap Growth style:

1. iShares MSCI USA Quality Factor ETF (QUAL) — Very Attractive

Quick Take: QUAL’s 10 top holdings only account for about 40% of its total portfolio. ORCL, GILD, and V are all

holdings. QUAL has Very Attractive Total Annual Costs of 0.17%.

2. iShares Russell Top 200 Growth Index Fund ETF (IWY) — Very Attractive

Quick Take: IWY has a similar holding concentration as QUAL, except that IWY has about 9% of holdings

concentrated in Apple (AAPL). ORCL, GILD, and V are all holdings as well. XLU fund has Very Attractive Total

Annual Costs of 0.22%.

Page 2 of 6

DILIGENCE PAYS 3/16/16

3. PowerShares Fundamental Pure Large Growth ETF (PXLG) — Very Attractive

Quick Take: PXLG’s holdings are less diversified than those of QUAL and IWY, with its top five holdings

accounting for about 36% of the total portfolio. In addition, ORCL, GILD, and V are all holdings. Like IWY, 9% of

these holdings are currently invested in AAPL. FIUIX has Very Attractive Total Annual Costs of 0.43%.

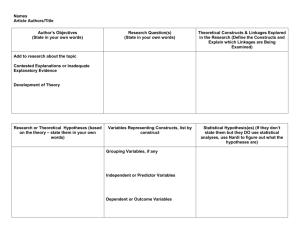

Figure 1 ranks from best to worst all nine Utilities ETFs and Figure 2 shows the five best and worst-rated Utilities

mutual funds.

Figure 1: ETFs with the Best & Worst Ratings – Top 5

Allocation of ETF Holdings

Ticker

Attractiveor-better

Stocks

QUAL

IWY

PXLG

54%

42%

39%

PWB

VOOG

14%

35%

QQXT

FTC

RPG

ALFA

RWG

19%

14%

18%

14%

12%

Neutral

Stocks

Dangerousor-worse Predictive Rating

Stocks

Best ETFs

42%

2%

42%

14%

48%

12%

59%

41%

Worst ETFs

45%

48%

42%

32%

33%

Very Attractive

Very Attractive

Very Attractive

24%

22%

Very Attractive

Attractive

29%

38%

39%

42%

51%

Attractive

Attractive

Neutral

Neutral

Neutral

Source: New Constructs, LLC and company filings

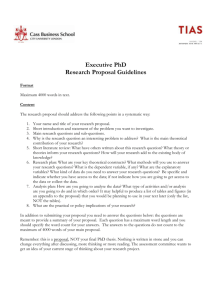

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5

Allocation of Mutual Fund Holdings

Ticker

Attractiveor-better

Stocks

MIGNX

MGTIX

MIGKX

26%

26%

26%

FLGEX

JGIRX

40%

36%

IALAX

SIAAX

AIXAX

QUAGX

MDFOX

14%

6%

18%

19%

24%

Neutral

Stocks

Dangerousor-worse Predictive Rating

Stocks

Best Mutual Funds

48%

17%

48%

17%

48%

17%

41%

12%

33%

23%

Worst Mutual Funds

26%

44%

50%

39%

5%

57%

42%

23%

25%

45%

* Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

Page 3 of 6

Very Attractive

Very Attractive

Very Attractive

Very Attractive

Very Attractive

Dangerous

Very Dangerous

Very Dangerous

Very Dangerous

Very Dangerous

DILIGENCE PAYS 3/16/16

Disclosure: David Trainer owns AAPL and ORCL. David Trainer and Hunter Gray receive no compensation to

write about any specific stock, style, or theme.

Page 4 of 6

DILIGENCE PAYS 3/16/16

New Constructs® – Profile

How New Constructs Creates Value for Clients

1. Superior Recommendations – Our stock picks consistently outperform. See our track record

in our stock-picking accolades and Proof Is In Performance reports.

2. More Accurate Research – Our patented Research Platform for reversing accounting

distortions and discounted cash flow analysis leverages better data to deliver smarter research.

3. Time Savings – We check the fine print in thousands of corporate filings so you don't have to.

As reported by Barron’s, our expertise in analyzing SEC filings delivers Hidden Gems and Red

Flags that drive long-term stock-picking success.

4. Transparency – We are proud to share the results of our analysis of over 50,000 10Ks. See

the Corporate Disclosure Transgressions report we provided the SEC. Our reports detail all

data and assumptions. Company Models enable users to change them.

5. Objectivity – New Constructs is an independent research firm, not tied to Wall Street or

investment banking services. Our models are driven by comprehensive high-quality data not

stories. See our presentation to the Senate Banking Committee, the SEC and many others in

DC.

Our Philosophy About Research

Accounting data is not designed for equity investors, but for debt investors. Accounting data must be

translated into economic earnings to understand the profitability and valuation relevant to equity

investors. Respected investors (e.g. Adam Smith, Warren Buffett and Ben Graham) have repeatedly

emphasized that accounting results should not be used to value stocks. Economic earnings are what

matter because they are:

1.

2.

3.

Based on the complete set of financial information available.

Standard for all companies.

A more accurate representation of the true underlying cash flows of the business.

Additional Information

Incorporated in July 2002, New Constructs is an independent publisher of investment research that

provides clients with consulting and research services. We specialize in quality-of-earnings, forensic

accounting and discounted cash flow valuation analyses for all U.S. public companies. We translate

accounting data from 10Ks into economic financial statements, i.e. NOPAT, Invested Capital, and

WACC, to create economic earnings models, which are necessary to understand the true profitability

and valuation of companies. Visit the Free Archive to download samples of our research. New

Constructs is a BBB accredited business and a member of the Investorside Research Association.

Page 5 of 6

DILIGENCE PAYS 3/16/16

DISCLOSURES

New Constructs®, LLC (together with any subsidiaries and/or affiliates, “New Constructs”) is an independent organization with no

management ties to the companies it covers. None of the members of New Constructs’ management team or the management team of any

New Constructs’ affiliate holds a seat on the Board of Directors of any of the companies New Constructs covers. New Constructs does not

perform any investment or merchant banking functions and does not operate a trading desk.

New Constructs’ Stock Ownership Policy prevents any of its employees or managers from engaging in Insider Trading and restricts any

trading whereby an employee may exploit inside information regarding our stock research. In addition, employees and managers of the

company are bound by a code of ethics that restricts them from purchasing or selling a security that they know or should have known was

under consideration for inclusion in a New Constructs report nor may they purchase or sell a security for the first 15 days after New

Constructs issues a report on that security.

New Constructs is affiliated with Novo Capital Management, LLC, the general partner of a hedge fund. At any particular time, New

Constructs’ research recommendations may not coincide with the hedge fund’s holdings. However, in no event will the hedge fund receive

any research information or recommendations in advance of the information that New Constructs provides to its other clients.

DISCLAIMERS

The information and opinions presented in this report are provided to you for information purposes only and are not to be used or considered

as an offer or solicitation of an offer to buy or sell securities or other financial instruments. New Constructs has not taken any steps to ensure

that the securities referred to in this report are suitable for any particular investor and nothing in this report constitutes investment, legal,

accounting or tax advice. This report includes general information that does not take into account your individual circumstance, financial

situation or needs, nor does it represent a personal recommendation to you. The investments or services contained or referred to in this

report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about any

such investments or investment services.

Information and opinions presented in this report have been obtained or derived from sources believed by New Constructs to be reliable, but

New Constructs makes no representation as to their accuracy, authority, usefulness, reliability, timeliness or completeness. New Constructs

accepts no liability for loss arising from the use of the information presented in this report, and New Constructs makes no warranty as to

results that may be obtained from the information presented in this report. Past performance should not be taken as an indication or

guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information

and opinions contained in this report reflect a judgment at its original date of publication by New Constructs and are subject to change

without notice. New Constructs may have issued, and may in the future issue, other reports that are inconsistent with, and reach different

conclusions from, the information presented in this report. Those reports reflect the different assumptions, views and analytical methods of

the analysts who prepared them and New Constructs is under no obligation to insure that such other reports are brought to the attention of

any recipient of this report.

New Constructs’ reports are intended for distribution to its professional and institutional investor customers. Recipients who are not

professionals or institutional investor customers of New Constructs should seek the advice of their independent financial advisor prior to

making any investment decision or for any necessary explanation of its contents.

This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any

locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which

would be subject New Constructs to any registration or licensing requirement within such jurisdiction.

This report may provide the addresses of websites. Except to the extent to which the report refers to New Constructs own website material,

New Constructs has not reviewed the linked site and takes no responsibility for the content therein. Such address or hyperlink (including

addresses or hyperlinks to New Constructs own website material) is provided solely for your convenience and the information and content of

the linked site do not in any way form part of this report. Accessing such websites or following such hyperlink through this report shall be at

your own risk.

All material in this report is the property of, and under copyright, of New Constructs. None of the contents, nor any copy of it, may be altered

in any way, copied, or distributed or transmitted to any other party without the prior express written consent of New Constructs. All

trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of New

Constructs.

Copyright New Constructs, LLC 2003 through the present date. All rights reserved.

Page 6 of 6