International Finance

advertisement

International Finance:

Putting Theory Into Practice

Piet Sercu

Leuven School of Business and Economics

Katholieke Universiteit Leuven

14:20 on 2 July 2008

Preface

About this book

This book had a forerunner|\International Financial Markets and The Firm", coauthored with Raman Uppal, which came out in 1995. By 2003 or 2004 Raman

and I had agreed that a text full of Italian Lira or German Marks and where

traders still had a full two minutes to respond to market makers' quotes, might

sooner or later risk getting outdated. Starting the revision itself turned out to be

much more di cult than agreeing on the principle, though. In the end Raman,

being so much busier and more rational than I am, preferred to bow out. How

right he was. Still, now that the e ort has become a sunk cost, forever bygone, I

nd that episodes where I sincerely curse the book (and myself and Princeton

University Press) are becoming fewer and farther between. Actually, there now

are several passages I actually begin to like.

Like the previous book, the book still targets nance students, or at least students

that want a genuine nance text, not an international-management or -strategy text

with a nance slant nor an international monetary economics text with some corporate applications. There is a continued bias in favor of nancial markets and

economic logic; the aim is to provide students with a coherent picture of interna-tional

markets and selected topics in multinational corporate nance. Sure, during everyday

practice later on, this framework will then get amended and corrected and quali ed;

but the feeling of fundamental coherence will remain, we hope.

This book is more analytical than the modal text in the eld. Compared to the

Sercu-Uppal book, some of the math has been dropped and new matter has been

added. As before, a lot of it is in Appendices, thus stressing its optional character.

The main di erence, I think, is that the in-text math is brought in di erently. While in

International Financial Markets we had every theorem or proof followed by an

example, now the example comes rst whenever that is possible. If so, the proof is

often even omitted, or turned into a DoItYourself assignment. In fact, a third

innovation is that, at least in the chapters or sections that are su ciently analytical

rather than just factual, the reader is invited to prove or verify claims and solve

analogous problems. The required level of math is surely not prohibitive; anybody

who has nished a good nance course should be able to master these DoItYourself

assignments. Still, while the required level of mathematical prowess is

iii

iv

low, a capacity for abstract thinking and handling symbols remains vital.

Every Part, except the Intro one, now has its own introductory case, which is

intended to stimulate the reader's appetite and which can be a source of

assignments. The cases usually cover issues from most chapters in the Part.

A fth change is that the Part on exchange-rate pricing is much reduced. The

former three Chapters on exchange-rate theories, predictability, and forward bias

are now shrunk to two. And, lastly, three wholly new chapters have been added:

two on international stock markets|especially crosslisting with the associated

corporate-governance issues|and one on Value at Risk.

Typically, a preface like this one continues with a discussion and motivation of

the book's content. But my feeling is that most readers|and surely students| skip

prefaces anyway. Since the motivation of the structure is quite relevant, that

material is now merged into the general introduction chapter, Chapter 1.

How to use this book

The text contains material for about two courses. One possibility is to take the

second Part, International Financial Markets, as one course, and group the more

business- nance oriented material (grouped into Exchange Risk, Exposure, and

Risk Management (III) and Long-Term Financing and Investments (IV)) as a

second. Fixed-income markets, which now is in Part III, could be included in the

mar-kets/instruments course, like it was in the 1995 book; and the whole

package can also duplicate as an intro derivatives course, along with the

apocryphal Chapter ?? that is available on my website. I myself run two 40-hr

courses covering, respectively Parts II-III (Instruments, Risk Management) and

Part IV (Stocks, bonds, capital budgeting).

For one single course one could focus, in Part II, on spot (Chapter 3) and

forwards (Chapters 4 and 5), and then continue with the chapters on relevance of

hedging and exposure (Chapters 12 and 13), to nish with capital budgeting

(Chapter 21); this shortlist can be complemented by a few chapters of your liking.

Leuven, December 2006.

c P. Sercu, K.U.Leuven. Free copying stops Oct 1st, '08

Formatted 2 July 2008|14:20.

About the author

Piet Sercu is Professor of International Finance at the Katholieke Universiteit Leuven. He holds the degrees of Business Engineer, Master of Business Administration,

and Doctor in Applied Economics from K.U. Leuven. He taught at the Flemish

Business School in Brussels (1980-1986), prior to returning to Leuven, where he

currently teaches the International Business Finance courses in the Masters and

Advanced Masters programs. He also held Visiting Professor appointments at New

York University, Cornell University, the University of British Columbia, the Lon-don

Business School, and Universit Libre de Bruxelles. He taught shorter nance courses

in Helsinki, Bandung (Indonesia), Leningrad, and India (as an UNDP ex-pert and, in

1994, as a fellow of the European Indian Cooperation and Exchange Programme),

and regularly teaches executive courses. He held the 1996/7 Franc-qui Chair at the

Facultes Universitaires Notre-Dame de la Paix at Namur, and the 2000/04

PricewaterhouseCoopers Chair on Value and Risk at KU Leuven, together with

Marleen Willekens. Until 2000, he organized and taught doctoral courses in the

European Doctoral Education Network, as part of the Finance faculty of the

European Institute for Advanced Studies in Management. He was the 1994 VicePresident and 1995 President of the European Finance Association, won the 1999

Western Finance Association award for Corporate Finance (with Xueping Wu and

Charley Park) and was Hanken Fellow in 2002.

His early research focused on International Asset Pricing with real exchange risk

and in ation risk. He also did some work on corporate take-over models and lending

but has recently returned to International Finance and hedging. He has published in

the Journal of Finance, Journal of Banking and Finance, Journal of International

Money and Finance, European Economic Review, and other journals. He is on the

editorial boards of the European Financial Management Journal and the Journal for

International Financial Markets, Institutions and Money.

Piet Sercu and Raman Uppal jointly won the 1995 Sanwa Prize for a monograph

in International Finance, Exchange Rate Volatility, Trade, and Capital Flows under

Alternative Currency Regimes, published by Cambridge University Press in 2000 and

2006. They also have produced International Financial Markets and The Firm

(International Thomson Publishers, Cincinnati-London, 1995), the forerunner to

this book and the source of much of its material. There are also a number of joint

academic articles.

v

Acknowledgments

There are many individuals who played an important role in the production of this

book. First and foremost I thank Raman Uppal, not only for his invaluable

contribution to the rst book but also for the discussions about how to structure a new

version, for translating the text parts of the old manuscript into LaTeX, and setting up

a master le system to produce the whole. Thanks also to the former and current

doctoral students or assistants who read earlier drafts of the rst and second book

and suggested several improvements: Badrinath H. R., Thi Ngoc Tuan Bui, Katelijne

Carbonez, Cedric de Ville de Goyet, Kathy Dehopere, Marian Kane, Fang Liu,

Rosanne Vanpee, Tom Vinaimont, and Xueping Wu. Marian, especially, did lots of

work on the exercises, and Katelijne on the revised text. Prof. Martina Vandebroek

occasionally helped with spreadsheets and graphs, at which she Excels; she, Fang

Liu and Badrinath H. R. provided the empirical results for Chapters 10 and 11. Many

thanks, lastly, to colleagues who read drafts and provided comments, some of them

at Princeton's request but some even of their free will: Hu Shengmei, Karen Lewis,

Bernard Dumas, Stan Standaert, Charles van Wymeersch, and an anonymous (but

wholly positive) referee reporting to Princeton UP. Of course, I remain responsible for

all remaining errors. Comments and feedback from readers about errors,

presentation,

and

contents

are

very

welcome:

do

email

to

piet.sercu@econ.kuleuven.be.

I dedicate this book to my parents, Jan Sercu and the late Terese Reynaert,

and to my wife Rita and children Maarten and Jorinde, who have patiently put up

with my inattentive absent-mindedness during the time it has taken to complete

this project and, come to think of it, most of the time before and after.

December 2007

vii

Contents

I Introduction and Motivation for International Finance

1

1 Why does the Existence of Borders Matter for Finance?

1.1 Key Issues in International Business Finance . . . . . . . . . . . . . . . . .

1.1.1 Exchange-rate Risk . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.1.2 Segmentation of the Consumer-good Markets . . . . . . . . . . . .

1.1.3 Credit risk . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.1.4 Political risk . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.1.5 Capital-Market Segmentation Issues, including Aspects of Corporate Governance . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.1.6 International Tax Issues . . . . . . . . . . . . . . . . . . . . . . . . 10

1.2 What is on the International CFO's desk? . . . . . . . . . . . . . . . . . . 11

1.2.1 Valuation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.2.2 Funding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.2.3 Hedging and, more Generally, Risk Management . . . . . . . . . . 12

1.2.4 Interrelations Between Risk Management, Funding and Valuation .

1.3 Overview of this Book . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.3.1 Part I: Motivation and Background Matter . . . . . . . . . . . . .

1.3.2 Part II: International Financial Markets . . . . . . . . . . . . . . .

1.3.3 Part III: Exchange Risk, Exposure, and Risk Management . . . . .

1.3.4 Part IV: Long-term Financing and Investment Decisions . . . . . .

3

2 International Finance: Institutional Background

2.1 Money and Banking: A Brief Review . . . . . . . . . . . . . . . . . . . . .

2.1.1 The Roles of Money . . . . . . . . . . . . . . . . . . . . . . . . . .

2.1.2 How Money Is Created . . . . . . . . . . . . . . . . . . . . . . . .

2.2 The International Payment Mechanism . . . . . . . . . . . . . . . . . . . .

2.2.1 Some Basic Principles . . . . . . . . . . . . . . . . . . . . . . . . .

2.2.2 Domestic Interbank Transfers: Real-time Gross Settlement vs. Periodic Netting . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.2.3 International payments . . . . . . . . . . . . . . . . . . . . . . . .

2.3 International (\Euro") Money and Bond Markets . . . . . . . . . . . . . .

2.4 What is the Balance of Payments? . . . . . . . . . . . . . . . . . . . . . .

2.4.1 De nition & Principles Underlying the Balance of Payments . . .

2.4.2 Some Nitty-gritty . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.4.3 Statistical Discrepancy/Errors and Omissions . . . . . . . . . . . .

2.4.4 Where do Current Account Surpluses or De cits Come From? . . .

2.4.5 The Net International Investment Account . . . . . . . . . . . . .

2.5 Exchange-rate Regimes . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.5.1 Fixed Exchange Rates Relative to Gold . . . . . . . . . . . . . . .

xi

4

4

6

7

7

8

11

11

12

13

13

13

14

14

17

17

18

18

30

30

32

34

35

37

37

40

43

44

45

47

48

xii

CONTENTS

2.5.2 Fixed Exchange Rates vis-a-vis a Single Currency . . . . . . . . . 49

2.5.3 Fixed Exchange Rates Relative to a Basket . . . . . . . . . . . . . 53

2.5.4 The 1979{1993 Exchange Rate Mechanism (ERM) of the European

Monetary System . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.5.5 Other Exchange Rate Systems . . . . . . . . . . . . . . . . . . . .

2.6 Test Your Understanding . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.6.1

Quiz Questions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.6.2

Applications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

II Currency Markets

55

60

61

61

63

67

3 Spot Markets for Foreign Currency

73

3.1 Exchange Rates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 73

3.1.1 De nition of Exchange Rates . . . . . . . . . . . . . . . . . . . . . 74

3.1.2

Our Convention: Home Currency per Unit of Foreign Currency . . 75

3.1.3 The Indirect Quoting Convention . . . . . . . . . . . . . . . . . . . 76

3.1.4 Bid and Ask Rates . . . . . . . . . . . . . . . . . . . . . . . . . . . 78

3.1.5

Primary rates v cross rates . . . . . . . . . . . . . . . . . . . . . . 79

3.1.6 Inverting Exchange Rates in the Presence of Spreads . . . . . . . . 81

3.2 Major Markets for Foreign Exchange . . . . . . . . . . . . . . . . . . . . . 82

3.2.1 How Exchange Markets Work . . . . . . . . . . . . . . . . . . . . . 82

3.2.2 Markets by Location and by Currency . . . . . . . . . . . . . . . . 89

3.2.3 Markets by Delivery Date . . . . . . . . . . . . . . . . . . . . . . . 90

3.3 The Law of One Price for Spot Exchange Quotes . . . . . . . . . . . . . . 92

3.3.1 Arbitrage across Competing Market Makers . . . . . . . . . . . . . 95

3.3.2 Shopping Around across Competing Market Makers . . . . . . . . 95

3.3.3

Triangular Arbitrage . . . . . . . . . . . . . . . . . . . . . . . . . . 96

3.4 Translating FC Figures: Nominal rates, PPP rates, and Deviations from PPP 102

3.4.1 The PPP rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 103 3.4.2 Commodity

Price Parity . . . . . . . . . . . . . . . . . . . . . . . . 107

3.4.3 The Real Exchange Rate and (Deviations from) Absolute PPP . . 108

3.4.4 The Change in the Real Rate and (deviations from) Relative PPP

109

3.5 CFO's Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

114

3.6 TekNotes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

116

3.7 Test Your Understanding . . . . . . . . . . . . . . . . . . . . . . . . . . . .

117

3.7.1 Quiz Questions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

117

3.7.2 Applications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

119

4 Understanding Forward Exchange Rates for Currency

123

4.1 Introduction to Forward Contracts . . . . . . . . . . . . . . . . . . . . . .

123

4.2 The Relation Between Exchange and Money Markets . . . . . . . . . . . .

127

4.3 The Law of One Price and Covered Interest Parity . . . . . . . . . . . . .

132

4.3.1 Arbitrage and Covered Interest Parity . . . . . . . . . . . . . . . .

133

4.3.2 Shopping Around (The Pointlessness of |) . . . . . . . . . . . . .

135

4.3.3 Unfrequently Asked Questions on CIP . . . . . . . . . . . . . . . .

135

4.4 The Market Value of an Outstanding Forward Contract . . . . . . . . . . .

140

4.4.1 A general formula . . . . . . . . . . . . . . . . . . . . . . . . . . .

140

4.4.2 Corollary 1: The Value of a Forward Contract at Expiration . . .

142

4.4.3 Corollary 2: The Value of a Forward Contract at Inception . . . . 144

c P. Sercu, K.U.Leuven. Free copying stops Oct 1st, '08

Formatted 2 July 2008|14:20.

CONTENTS

4.5

4.6

4.7

4.8

xiii

4.4.4 Corollary 3: The Forward Rate and the Risk-Adjusted Expected

Future Spot Rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . 145

4.4.5 Implications for Spot Values; the Role of Interest Rates . . . . . . 147

4.4.6 Implications for the Valuation of Foreign-Currency Assets or Liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 149

4.4.7 Implication for the Relevance of Hedging . . . . . . . . . . . . . . 150

CFO's Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 151

Appendix: Interest Rates, Returns, and Bond Yields . . . . . . . . . . . . 153

4.6.1 Links Between Interest Rates and E ective Returns . . . . . . . . 153

4.6.2 Common Pitfalls in Computing E ective Returns . . . . . . . . . . 156

Appendix: The Forward Forward and the Forward Rate Agreement . . . . 158

4.7.1 Forward Contracts on Interest Rates . . . . . . . . . . . . . . . .

158

4.7.2 Why FRAs Exist . . . . . . . . . . . . . . . . . . . . . . . . . . . .

159

4.7.3 The Valuation of FFs (or FRAs) . . . . . . . . . . . . . . . . . . .

159

4.7.4 Forward Interest Rates as the Core of the Term Structure(s) . . .

163

Test Your Understanding . . . . . . . . . . . . . . . . . . . . . . . . . . . .

168

4.8.1 Quiz Questions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

168

4.8.2 Applications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

169

5 Using Forwards for International Financial Management

171

5.1 Practical Aspects of Forwards in Real-world Markets . . . . . . . . . . . .

171

5.1.1 Quoting Forward Rates with Bid-Ask Spreads . . . . . . . . . . . .

171

5.1.2 Provisions for Default . . . . . . . . . . . . . . . . . . . . . . . . .

173

5.2 Using Forward Contracts (1): Arbitrage . . . . . . . . . . . . . . . . . . .

176

5.2.1 Synthetic Forward Rates . . . . . . . . . . . . . . . . . . . . . . . .

177

5.2.2 Implications of Arbitrage and Shopping-around . . . . . . . . . . .

177

5.2.3 Back to the Second Law . . . . . . . . . . . . . . . . . . . . . . . .

178

5.3 Using Forward Contracts (2): Hedging Contractual Exposure . . . . . . .

179

5.3.1 Measuring Exposure from Transactions on a Particular Date . . .

180

5.3.2 Hedging Contractual Exposure from Transactions on a Particular

Date . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 182 5.4 Using Forward Contracts

(3): Speculation . . . . . . . . . . . . . . . . . . 188 5.4.1 Speculating on the Future Spot

Rate . . . . . . . . . . . . . . . . . 188 5.4.2 Speculating on the Forward Rate or on the

Swap Rate . . . . . . . 190

5.5 Using Forward Contracts (4): Minimizing the Impact of Market Imperfections . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 192

5.5.1 Shopping Around to Minimize Transaction Costs . . . . . . . . . . 192

5.5.2 Swapping for Tax Reasons . . . . . . . . . . . . . . . . . . . . . . . 196

5.5.3 Swapping for Information-cost Reasons . . . . . . . . . . . . . . . 197

5.5.4 Swapping for Legal Reasons: Replicating Back-to-Back Loans . . . 199

5.6 Using the Forward Rate in Commercial, Financial and Accounting Decisions 207

5.6.1 The Forward Rate as the Intelligent Accountant's Guide . . . . . . 207

5.6.2 The Forward Rate as the Intelligent Salesperson's Guide . . . . . . 209

5.6.3 The Forward Rate as the Intelligent CFO's Guide . . . . . . . . . . 209

5.7 CFO's Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 211

5.7.1 Key Ideas for Arbitrageurs, Hedgers, and Speculators . . . . . . . 211

5.7.2 The Economic Roles of Arbitrageurs, Hedgers, and Speculators . . 213

5.8 Test Your Understanding . . . . . . . . . . . . . . . . . . . . . . . . . . . . 215

5.8.1 Quiz Questions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 215

5.8.2 Applications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 217

c P. Sercu, K.U.Leuven. Free copying stops Oct 1st, '08

Formatted 2 July 2008|14:20.

xiv

CONTENTS

6 The Market for Currency Futures

219

6.1 Handling Default Risk in Forward Markets: Old & New Tricks . . . . . . . 220

6.1.1 Default Risk and Illiquidity of Forward Contracts . . . . . . . . . . 220

6.1.2 Standard Ways of Reducing Default Risk in the Forward Market . 221

6.1.3 Reducing Default Risk by Variable Collateral or Periodic Recontracting . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 222

6.2 How Futures Contracts Di er from Forward Markets . . . . . . . . . . . . 225

6.2.1 Marking to Market . . . . . . . . . . . . . . . . . . . . . . . . . . . 225

6.2.2 Margin Requirements . . . . . . . . . . . . . . . . . . . . . . . . . 227

6.2.3 Organized Markets . . . . . . . . . . . . . . . . . . . . . . . . . . . 228

6.2.4 Standardized Contracts . . . . . . . . . . . . . . . . . . . . . . . . 230

6.2.5 The Clearing Corporation . . . . . . . . . . . . . . . . . . . . . . . 231

6.2.6 How Futures Prices Are Reported . . . . . . . . . . . . . . . . . . 232

6.3 E ect of Marking to Market on Futures Prices . . . . . . . . . . . . . . . . 233

6.4 Hedging with Futures Contracts . . . . . . . . . . . . . . . . . . . . . . . . 236

6.4.1 The Generic Problem and its Theoretical Solution . . . . . . . . . 237

6.4.2 Case 1: The Perfect Match . . . . . . . . . . . . . . . . . . . . . . 238

6.4.3 Case 2: The Currency-Mismatch Hedge or Cross-Hedge . . . . . . 239

6.4.4 Case 3: The Delta hedge . . . . . . . . . . . . . . . . . . . . . . . 241

6.4.5 Case 4: The Cross-and-Delta hedge . . . . . . . . . . . . . . . . . 242

6.4.6 Adjusting for the Sizes of the Spot Exposure and the Futures Contract 243

6.4.7 More About Regression-based Hedges . . . . . . . . . . . . . . . . 243

6.4.8 Hedging with Futures Using Contracts on More than One Currency 245

6.5 The CFO's conclusion: Pros and Cons of Futures Contracts Relative to

Forward Contracts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

245

6.6 Appendix: Eurocurrency Futures Contracts . . . . . . . . . . . . . . . . .

247

6.6.1 The Forward Price on a CD . . . . . . . . . . . . . . . . . . . . . .

248

6.6.2 Modern Eurodollar Futures Quotes . . . . . . . . . . . . . . . . . .

249

6.7 Test Your Understanding . . . . . . . . . . . . . . . . . . . . . . . . . . . .

254

6.7.1 Quiz Questions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

254

6.7.2 Applications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

257

7 Markets for Currency Swaps

7.1 How the Modern Swap came About . . . . . . . . . . . . . . . . . . . . . .

7.1.1 The Grandfather Tailor-made Swap: IBM-WB . . . . . . . . . . . .

7.1.2 Subsequent Evolution of the Swap Market . . . . . . . . . . . . . .

7.2 The Fixed-for-Fixed Currency Swaps . . . . . . . . . . . . . . . . . . . . .

7.2.1 Motivations for Undertaking a Currency Swap . . . . . . . . . . .

7.2.2 Characteristics of the Modern Currency Swap . . . . . . . . . . . .

7.3 Interest Rate Swaps . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.3.1 Coupon Swaps (Fixed-for-Floating) . . . . . . . . . . . . . . . . .

7.3.2 Base Swaps . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.4 Cross-Currency Swaps . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.5 CFO's Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.6 TekNotes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.7 Test Your Understanding . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.7.1 Quiz Questions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.7.2 Applications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

261

262

262

265

267

267

267

274

275

279

280

281

283

284

284

284

8 Currency Options (1): Concepts and Uses

8.1 An Introduction to Currency Options . . . . . . . . . . . . . . . . . . . . .

287

288

c P. Sercu, K.U.Leuven. Free copying stops Oct 1st, '08

Formatted 2 July 2008|14:20.

CONTENTS

8.2

8.3

8.4

8.5

8.6

8.7

8.8

xv

8.1.1 Call Options . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

288

8.1.2 Put Options . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

291

8.1.3 Option Premiums and Option Writing . . . . . . . . . . . . . . . .

292

8.1.4 European-style Puts and Calls as Chopped-up Forwards . . . . . .

292

8.1.5 Jargon: Moneyness, Intrinsic Value, and Time Value . . . . . . . .

293

Institutional Aspects of Options Markets . . . . . . . . . . . . . . . . . .

294

8.2.1 Traded Options . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

294

8.2.2 Over-The-Counter Markets . . . . . . . . . . . . . . . . . . . . . .

297

An Aside: Futures-style Options on Futures . . . . . . . . . . . . . . . . .

298

8.3.1 Options on Currency Futures . . . . . . . . . . . . . . . . . . . . .

298

8.3.2 Forward-style options . . . . . . . . . . . . . . . . . . . . . . . . .

299

8.3.3 Futures-Style Options . . . . . . . . . . . . . . . . . . . . . . . . .

299

8.3.4 Futures-Style Options on Futures . . . . . . . . . . . . . . . . . . .

300

Using Options (1): Arbitrage . . . . . . . . . . . . . . . . . . . . . . . . . .

301

Using Options (2): Hedging . . . . . . . . . . . . . . . . . . . . . . . . . .

308

8.5.1 Hedging the Risk of a Loss without Eliminating Possible Gains . . 308

8.5.2 Hedging Positions with Quantity Risk . . . . . . . . . . . . . . . .

310

8.5.3 Hedging Nonlinear Exposure . . . . . . . . . . . . . . . . . . . . .

312

Using Options (3): Speculation . . . . . . . . . . . . . . . . . . . . . . . .

315

8.6.1 Speculating on the Direction of Changes . . . . . . . . . . . . . . .

316

8.6.2 Speculating on Changes in Volatility . . . . . . . . . . . . . . . . .

316

CFO's Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

318

Test Your Understanding . . . . . . . . . . . . . . . . . . . . . . . . . . . .

322

8.8.1 Quiz Questions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

322

8.8.2 Applications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

325

9 Currency Options (2): Hedging and Valuation

9.1 The Logic of Binomial Option Pricing: One-period Problems . . . . . . . .

9.1.1 The Replication Approach . . . . . . . . . . . . . . . . . . . . . . .

9.1.2 The Forward Hedging Approach . . . . . . . . . . . . . . . . . . .

9.1.3 The Risk-Adjusted Probability Interpretation . . . . . . . . . . . .

9.1.4 American-style Options . . . . . . . . . . . . . . . . . . . . . . . .

9.2 Notation and Assumptions for the Multiperiod Binomial Model . . . . . .

9.2.1 The Standard Version of the Binomial Model . . . . . . . . . . . .

9.2.2 Does the Model make Sense? . . . . . . . . . . . . . . . . . . . . .

9.2.3 Further Notation . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.2.4 How to Choose u and d? . . . . . . . . . . . . . . . . . . . . . . . .

9.3 Stepwise Multiperiod Binomial Option Pricing . . . . . . . . . . . . . . . .

9.3.1 Dynamic Hedging or Replication: a European-style option . . . . .

9.3.2 What can go Wrong? . . . . . . . . . . . . . . . . . . . . . . . . .

9.3.3 American-style Options . . . . . . . . . . . . . . . . . . . . . . . .

9.4 Toward Black-Merton-Scholes (European Options) . . . . . . . . . . . . . .

9.4.1 A Shortcut for European Options . . . . . . . . . . . . . . . . . . .

9.4.2 The General Formula . . . . . . . . . . . . . . . . . . . . . . . . .

9.4.3 The Delta of an Option . . . . . . . . . . . . . . . . . . . . . . . .

9.5 CFO's Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.6 TekNotes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.7 Test Your Understanding . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.7.1 Quiz Questions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.7.2 Applications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c P. Sercu, K.U.Leuven. Free copying stops Oct 1st, '08

329

330

332

332

334

336

337

337

339

341

342

344

344

348

349

350

351

352

355

355

357

363

363

365

Formatted 2 July 2008|14:20.

xvi

CONTENTS

III Exchange Risk, Exposure, and Risk Management

369

10 Do We Know What Makes Forex Markets Tick?

375

10.1 The behavior of spot exchange rates . . . . . . . . . . . . . . . . . . . . . .

378

10.1.1 Why Levels of (log) exchange rates have bad statistical properties 378

10.1.2 Changes in log rates: ndings . . . . . . . . . . . . . . . . . . . . .

381

10.1.3 Concluding Discussion . . . . . . . . . . . . . . . . . . . . . . . . .

389

10.2 The PPP Theory and the behavior of the Real Exchange Rate. . . . . . . 392

10.2.1 Issues with PPP Tests . . . . . . . . . . . . . . . . . . . . . . . . .

392

10.2.2 Computations and Findings . . . . . . . . . . . . . . . . . . . . . .

395

10.2.3 Concluding Discussion . . . . . . . . . . . . . . . . . . . . . . . . .

401

10.3 Exchange Rates and Economic Policy Fundamentals . . . . . . . . . . . .

407

10.3.1 The Monetary Approach to the Exchange Rate . . . . . . . . . . .

408

10.3.2 Computations and Findings . . . . . . . . . . . . . . . . . . . . . .

410

10.3.3 Real Business Cycle Models . . . . . . . . . . . . . . . . . . . . . .

415

10.3.4 Taylor Rule Models . . . . . . . . . . . . . . . . . . . . . . . . . .

416

10.3.5 Concluding discussion . . . . . . . . . . . . . . . . . . . . . . . . .

417

10.4 Conclusion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

419

11 Do Forex Markets Themselves See What's Coming?

11.1 The Forward Rate as a Black-Box Predictor . . . . . . . . . . . . . . . . .

11.1.1 How to Verify the Forward Rate's Performance as a Predictor . . .

11.1.2 Statistical Analysis of Forecast Errors: Computations and ndings

11.1.3 Trading rules . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11.1.4 The Forward Bias: Concluding discussion . . . . . . . . . . . . . .

11.2 Forecasts by Specialists . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11.2.1 Forecasts Implied by Central Bank Interventions . . . . . . . . . .

11.2.2 Evaluating the Performance of Professional Traders and Forecasters

11.3 The CFO's summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11.4 Test Your Understanding . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11.4.1 Quiz Questions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

433

433

433

436

443

447

453

453

455

458

464

464

12 (When) Should a Firm Hedge its Exchange Risk?

471

12.1 The e ect of corporate hedging may not just be \additive" . . . . . . . . .

472

12.1.1 Corporate Hedging Reduces Costs of Bankruptcy and Financial

Distress . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

473

12.1.2 Hedging Reduces Agency Costs . . . . . . . . . . . . . . . . . . .

476

12.1.3 Hedging Reduces Expected Taxes . . . . . . . . . . . . . . . . . . .

478

12.1.4 Hedging May Also Provide Better Information for Internal Decision

Making . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

479

12.1.5 Hedged Results May Better Show Management's Quality to Shareholders, and Pleases Wall Street . . . . . . . . . . . . . . . . . . .

480

12.2 FAQs about hedging . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

480

12.2.1 FAQ1: Why can't Firms leave Hedging to the Shareholders|Homemade Hedging? . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

480

12.2.2 FAQ2: Does Hedging make the Currency of Invoicing Irrelevant? . 481

12.2.3 FAQ3: \My Accountant tells me that Hedging has cost me 2.17m.

So how can you call this a Zero-cost Option?" . . . . . . . . . . . . 484

12.2.4 FAQ4: \Doesn't Spot Hedging A ect the Interest Tax Shield, as

Interest Rates are so Di erent Across Currencies?" . . . . . . . . . 485

12.3 CFO's Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 486

c P. Sercu, K.U.Leuven. Free copying stops Oct 1st, '08

Formatted 2 July 2008|14:20.

CONTENTS

xvii

12.4 Test Your Understanding . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12.4.1 Quiz Questions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12.4.2 Applications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

487

487

489

13 Measuring Exposure to Exchange Rates

491

13.1 The Concepts of Risk and Exposure: a brief survey . . . . . . . . . . . . .

492

13.2 Contractual-Exposure Hedging and its Limits . . . . . . . . . . . . . . . .

494

13.2.1 What does Management of Contractual Exposure Achieve? . . . . 494

13.2.2 How Certain are Certain Cash ows Anyway? . . . . . . . . . . . .

496

13.2.3 Hedging \Likely" Cash ows: what's new? . . . . . . . . . . . . . .

497

13.3 Measuring and Hedging of Operating Exposure . . . . . . . . . . . . . . .

498

13.3.1 Operating Exposure Comes in all Shapes & Sizes . . . . . . . . . .

499

13.3.2 The Minimum-Variance Approach to Measuring and Hedging Operating Exposure . . . . . . . . . . . . . . . . . . . . . . . . . . . .

502

13.3.3 Economic Exposure: CFO's Summary . . . . . . . . . . . . . . . .

509

13.4 Accounting Exposure . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

511

13.4.1 Accounting Exposure of Contractual Forex Positions . . . . . . . .

512

13.4.2 Why Firms Need to Translate Financial Statements . . . . . . . .

514

13.4.3 The Choice of Di erent Translation Methods . . . . . . . . . . . .

516

13.4.4 Accounting Exposure: CFO's Summary . . . . . . . . . . . . . . .

522

13.5 Test Your Understanding: contractual exposure . . . . . . . . . . . . . . .

524

13.5.1 Quiz Questions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

524

13.5.2 Applications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

526

13.6 Test Your Understanding: Operating exposure . . . . . . . . . . . . . . . .

528

13.6.1 Quiz Questions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

528

13.6.2 Applications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

530

14 Value-at-Risk: Quantifying Overall net Market Risks

533

14.1 Risk Budgeting|a Factor-based, Linear Approach . . . . . . . . . . . . . .

534

14.1.1 Factors and Exposures: a Sneak Preview . . . . . . . . . . . . . .

535

14.1.2 Domestic Interest risk . . . . . . . . . . . . . . . . . . . . . . . . .

538

14.1.3 Equity Investments . . . . . . . . . . . . . . . . . . . . . . . . . . .

540

14.1.4 Foreign Bonds; Currency Forwards and Swaps; Options . . . . . .

541

14.1.5 Aggregates for the portfolio as a whole . . . . . . . . . . . . . . . .

542

14.2 The Linear/Normal VaR Model: Potential Flaws & Corrections . . . . . .

543

14.2.1 A Zero-Drift (\Martingale") Process . . . . . . . . . . . . . . . . .

543

14.2.2 A Constant-Variance Process . . . . . . . . . . . . . . . . . . . . .

544

14.2.3 Constant Linear Relationships Between Factors. . . . . . . . . . .

550

14.2.4 Linearizations in the Mapping from Factors to Returns . . . . . .

551

14.2.5 Choice of the factors . . . . . . . . . . . . . . . . . . . . . . . . . .

552

14.2.6 Normality of Changes in the Portfolio Value . . . . . . . . . . . . .

552

14.2.7 All Assets can be Liquidated in one Day . . . . . . . . . . . . . . .

554

14.2.8 Parametric VaR: Summing up . . . . . . . . . . . . . . . . . . . .

555

14.3 Historical Backtesting, Bootstrapping, Monte Carlo, and Stress Testing . 556

14.3.1 Backtesting . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

556

14.3.2 Bootstrapping and Monte Carlo Simulation . . . . . . . . . . . . .

558

14.3.3 Stress Testing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

559

14.4 CFO's summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

561

14.5 Test Your Understanding . . . . . . . . . . . . . . . . . . . . . . . . . . . .

565

14.5.1 Quiz Questions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

565

14.5.2 Applications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

566

c P. Sercu, K.U.Leuven. Free copying stops Oct 1st, '08

Formatted 2 July 2008|14:20.

xviii

CONTENTS

15 Managing Credit Risk in International Trade

15.1 Payment Modes Without Bank Participation . . . . . . . . . . . . . . . . .

15.1.1 Cash Payment after Delivery . . . . . . . . . . . . . . . . . . . . .

15.1.2 Cash Payment before Shipping . . . . . . . . . . . . . . . . . . . .

15.1.3 Trade Bills . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15.1.4 The Problems with Legal Redress . . . . . . . . . . . . . . . . . .

15.2 Documentary Payment Modes with Bank Participation . . . . . . . . . . .

15.2.1 Documents against Payment . . . . . . . . . . . . . . . . . . . . .

15.2.2 Documents against Acceptance . . . . . . . . . . . . . . . . . . . .

15.2.3 Obtaining a Guarantee from the Importer's Bank: The Letter of

Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15.2.4 Advised L/Cs and Con rmed L/Cs . . . . . . . . . . . . . . . . . .

15.3 Other Standard Ways to cope with Default Risk . . . . . . . . . . . . . . .

15.3.1 Factoring . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15.3.2 Credit Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15.3.3 Export-Backed Financing . . . . . . . . . . . . . . . . . . . . . . .

15.4 CEO's Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15.5 Test your Understanding . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15.5.1 Quiz Questions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15.5.2 Applications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

IV Long-Term International Funding and Direct Investment

569

570

570

571

572

574

575

576

578

578

580

582

582

583

583

585

587

587

588

591

16 International Fixed-Income Markets

599

16.1 \Euro" Deposits and Loans . . . . . . . . . . . . . . . . . . . . . . . . . .

600

16.1.1 Historic, Proximate Causes of Euromoney's growth . . . . . . . . .

600

16.1.2 Comparative Advantages in the Medium Run . . . . . . . . . . . .

602

16.1.3 Where we are now: a Truly International Market . . . . . . . . . .

603

16.1.4 International Deposits . . . . . . . . . . . . . . . . . . . . . . . . .

605

16.1.5 International Credits and Loans . . . . . . . . . . . . . . . . . . .

606

16.2 International Bond & Commercial-paper Markets . . . . . . . . . . . . . .

613

16.2.1 Why Eurobond Markets Exist . . . . . . . . . . . . . . . . . . . .

614

16.2.2 Institutional Aspects of the International Bond Market . . . . . .

616

16.2.3 Commercial Paper . . . . . . . . . . . . . . . . . . . . . . . . . . .

620

16.3 How to Weigh your Borrowing Alternatives . . . . . . . . . . . . . . . . . .

621

16.3.1 Comparing all-in Costs of Alternatives in Open, Developed Markets 622

16.3.2 Comparing all-in Costs of Alternatives in Regulated, Incomplete

Markets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

628

16.4 CFO's Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

631

16.5 Test Your Understanding . . . . . . . . . . . . . . . . . . . . . . . . . . . .

633

16.5.1 Quiz Questions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

633

16.5.2 Applications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

635

17 Segmentation and Integration in the World's Stock Exchanges

17.1 Background Information on International Stock Markets . . . . . . . . . .

17.1.1 How Large and how International are Stock Markets? . . . . . . .

17.1.2 How do Stock Markets Work? . . . . . . . . . . . . . . . . . . . . .

17.1.3 Certi cates, Receipts: Di erent Aliases for a Company's Stocks . .

17.2 Why don't Exchanges Simply Merge? . . . . . . . . . . . . . . . . . . . . .

17.2.1 Home bias . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c P. Sercu, K.U.Leuven. Free copying stops Oct 1st, '08

637

641

641

646

654

660

660

Formatted 2 July 2008|14:20.

CONTENTS

xix

17.2.2 Di erences in Corporate Governance and Legal/Regulatory Environment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17.3 Can Uni cation be Achieved by A Winner Taking All? . . . . . . . . . . .

17.3.1 Centripetal v Centrifugal E ects in Networks . . . . . . . . . . . .

17.3.2 Clienteles for Regional and Niche Players? . . . . . . . . . . . . . .

17.3.3 Even New York is not perfect . . . . . . . . . . . . . . . . . . . . .

17.3.4 London's Comeback . . . . . . . . . . . . . . . . . . . . . . . . . .

17.4 The CEO's Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17.5 Test Your Understanding . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17.5.1 Quiz Questions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

661

667

668

669

671

677

680

682

682

18 Why|or when|Should we Cross-list our Shares?

18.1 Why Might Companies Want to list Shares Abroad? . . . . . . . . . . . .

18.1.1 Possible Gains from Foreign or Cross-listings . . . . . . . . . . . .

18.1.2 Costs of a cross-listing . . . . . . . . . . . . . . . . . . . . . . . . .

18.2 Shareholders Likely Reaction to Diversi cation Opportunities . . . . . . .

18.2.1 Why would Investors Diversify Internationally? . . . . . . . . . . .

18.2.2 Why would Companies Prefer Global Investors? a Partial-equilibrium

Exploration . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18.3 Sifting Through The Empirics on Cross-listing E ects . . . . . . . . . . . .

18.3.1 The 1980-2000 Conventional Wisdom . . . . . . . . . . . . . . . .

18.3.2 Puzzles with the Received Wisdom . . . . . . . . . . . . . . . . . .

18.3.3 Five Lessons from the Recent Lit . . . . . . . . . . . . . . . . . . .

18.4 The CFO's Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18.5 Test Your Understanding . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18.5.1 Quiz Questions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

683

684

685

687

688

688

19 Setting the Cost of International Capital

19.1 The Link between Capital-market Segmentation and the Sequencing of Discounting and Translation . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19.2 The Single-Country CAPM . . . . . . . . . . . . . . . . . . . . . . . . . . .

19.2.1 How Asset Returns Determine the Portfolio Return . . . . . . . .

19.2.2 The Tangency Solution: Graphical Discussion . . . . . . . . . . . .

19.2.3 How Portfolio Choice A ects Mean and Variance of the Portfolio

Return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19.2.4 E cient Portfolios: A Review . . . . . . . . . . . . . . . . . . . . .

19.2.5 The Market Portfolio as the Benchmark . . . . . . . . . . . . . . .

19.2.6 A Replication Interpretation of the CAPM . . . . . . . . . . . . . .

19.2.7 When to Use the Single-Country CAPM . . . . . . . . . . . . . . .

19.3 The International CAPM . . . . . . . . . . . . . . . . . . . . . . . . . . .

19.3.1 International diversi cation and the traditional CAPM . . . . . . .

19.3.2 Why Exchange Risk Pops up in the International Asset Pricing

Model . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19.3.3 Do Assets have a Clear Nationality? . . . . . . . . . . . . . . . . .

19.3.4 The International CAPM . . . . . . . . . . . . . . . . . . . . . . .

19.3.5 The N-Country CAPM . . . . . . . . . . . . . . . . . . . . . . . . .

19.3.6 Empirical Tests of the International CAPM . . . . . . . . . . . . .

19.4 The CFO's Summary re Capital Budgeting . . . . . . . . . . . . . . . . . .

19.4.1 Determining the Relevant Model . . . . . . . . . . . . . . . . . . .

19.4.2 Estimating the Risk of a Project . . . . . . . . . . . . . . . . . . .

19.4.3 Estimating the Risk premia . . . . . . . . . . . . . . . . . . . . . .

705

c P. Sercu, K.U.Leuven. Free copying stops Oct 1st, '08

690

693

693

694

695

702

704

704

708

711

712

713

715

717

720

721

722

723

723

724

727

729

730

731

733

733

734

736

Formatted 2 July 2008|14:20.

xx

CONTENTS

19.5 Technical Notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19.6 Test Your Understanding: basics of the CAPM . . . . . . . . . . . . . . . .

19.6.1 Quiz Questions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19.6.2 Applications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19.7 Test Your Understanding: iCAPM . . . . . . . . . . . . . . . . . . . . . . .

19.7.1 Quiz Questions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19.7.2 Applications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

737

742

742

742

744

744

747

20 International Taxation of Foreign Investments

749

20.1 Forms of Foreign Activity . . . . . . . . . . . . . . . . . . . . . . . . . . .

749

20.1.1 Modes of Operation (1): A Managerial Perspective . . . . . . . . .

750

20.1.2 Modes of Operation (2): A Legal Perspective . . . . . . . . . . . .

751

20.1.3 Modes of Operation (3): A Fiscal Perspective . . . . . . . . . . . .

752

20.2 Multiple Taxation versus Tax Neutrality . . . . . . . . . . . . . . . . . . .

755

20.2.1 Tax Neutrality . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

756

20.3 International Taxation of a Branch (1): the Credit System . . . . . . . . .

759

20.3.1 Disagreement on the Tax Basis . . . . . . . . . . . . . . . . . . . .

759

20.3.2 The Problem of Excess Tax Credits . . . . . . . . . . . . . . . . .

760

20.3.3 Tax Planning for a Branch under the Credit System . . . . . . . .

763

20.4 International Taxation of a Branch (2): the Exclusion System . . . . . . .

765

20.4.1 Partial Exclusion and Progressive Taxes . . . . . . . . . . . . . . .

765

20.4.2 Disagreement on the Tax Basis . . . . . . . . . . . . . . . . . . . .

766

20.4.3 Tax Planning for a Branch under the Exclusion System . . . . . .

766

20.5 Remittances from a Subsidiary: An Overview . . . . . . . . . . . . . . . .

768

20.5.1 Capital Transactions . . . . . . . . . . . . . . . . . . . . . . . . . .

768

20.5.2 Dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

769

20.5.3 Other Forms of Remittances (Unbundling) . . . . . . . . . . . . .

770

20.5.4 Transfer Pricing . . . . . . . . . . . . . . . . . . . . . . . . . . . .

771

20.6 International Taxation of a Subsidiary (1): the Credit System . . . . . . .

771

20.6.1 Direct and Indirect Tax Credits on Foreign Dividends . . . . . . .

771

20.6.2 Tax Planning through Unbundling of the Intragroup Transfers . . 775

20.7 International Taxation of a Subsidiary (2): the Exclusion System . . . . . 777

20.8 CFO's Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

779

20.9 Test Your Understanding . . . . . . . . . . . . . . . . . . . . . . . . . . . .

781

20.9.1 Quiz Questions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

781

20.9.2 Applications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

783

21 Putting it all Together: International Capital Budgeting

21.1 Domestic Capital Budgeting: A Quick Review . . . . . . . . . . . . . . . .

21.1.1 Net Present Value (NPV) . . . . . . . . . . . . . . . . . . . . . . .

21.1.2 Adjusted Net Present Value (ANPV) . . . . . . . . . . . . . . . . .

21.1.3 The Interest Tax Shield Controversy . . . . . . . . . . . . . . . . .

21.1.4 Why We Use ANPV Rather than the Weighted Average Cost of

Capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21.2 i-NPV issue #1: How to Deal with the Implications of Non-equity Financing

21.2.1 Step 1: The Branch Scenario or Bundled Approach . . . . . . . . .

21.2.2 Step 2: The Unbundling Stage . . . . . . . . . . . . . . . . . . . .

21.2.3 Step 3: The Implications of External Financing . . . . . . . . . . .

21.3 i-NPV issue #2: How to Deal with Exchange Rates . . . . . . . . . . . . .

21.4 i-NPV issue #3: How to Deal with Political Risks . . . . . . . . . . . . . .

21.4.1 Proactive Management of Transfer Risk . . . . . . . . . . . . . . .

c P. Sercu, K.U.Leuven. Free copying stops Oct 1st, '08

787

787

788

793

794

797

799

801

803

805

807

809

809

Formatted 2 July 2008|14:20.

CONTENTS

21.5

21.6

21.7

21.8

21.9

xxi

21.4.2 Management of Transfer Risk after the Imposition of Capital Controls 811

21.4.3 How to Account for Transfer Risk in NPV Calculations . . . . . .

812

21.4.4 Other Political Risks . . . . . . . . . . . . . . . . . . . . . . . . . .

813

Issue #4: Make sure to Include All Incremental Cash Flows . . . . . . . .

814

Other Things to do in Spreadsheets While you're There . . . . . . . . . . .

815

CFO's summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

817

TekNotes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

820

Test Your Understanding . . . . . . . . . . . . . . . . . . . . . . . . . . . .

823

21.9.1 Quiz Questions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

823

21.9.2 Applications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

825

22 Negotiating a Joint-Venture Contract: the NPV Perspective

22.1 The Three-Step Approach to Joint-Venture Capital Budgeting . . . . . . .

22.2 A Framework for Pro t Sharing . . . . . . . . . . . . . . . . . . . . . . . .

22.3 Case I: A Simple Pro-Rata Joint Branch with Neutral Taxes and Integrated

Capital Markets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22.4 Case II: Valuing A Pro-Rata Joint Branch When Taxes Di er . . . . . . .

22.5 Case III: An Unbundled Joint Venture with a License Contract or a Management Contract . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22.5.1 Possible Motivations for a License Contract . . . . . . . . . . . . .

22.5.2 The Equal-Gains Principle with a License Contract . . . . . . . . .

22.5.3 Finding Fair Equity Share when Terms of License Contract Are

Given . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22.5.4 Finding the Fair Royalty for a Given Equity Share . . . . . . . . .

22.6 CFO's Summary & Extensions . . . . . . . . . . . . . . . . . . . . . . . . .

22.7 Test Your Understanding . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22.7.1 Quiz Questions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22.7.2 Applications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c P. Sercu, K.U.Leuven. Free copying stops Oct 1st, '08

827

829

831

832

834

837

838

840

842

843

844

849

849

850

Formatted 2 July 2008|14:20.

Part I

Introduction and Motivation for

International Finance

1

Chapter 1

Why does the Existence of

Borders Matter for Finance?

Almost tautologically, international nance selects from the broad eld of nance

those issues that have to do with the existence of many distinct countries. The

fact that the world is organized into more or less independent entities instead of a

single global state complicates a CFO's life in many ways|ways that matter far

more than does the existence of provinces or states or Landen or departements

within a country. Below, we discuss

the existence of national currencies and, hence, the issue of exchange rates

and exchange risk;

the segmentation of goods markets along predominantly national lines; in combination with price stickiness, this makes most exchange-rate changes \real";

the existence of separate judicial systems, which further complicates the

already big issue of credit risk, and has given rise to private-justice solutions;

the sovereign autonomy of countries, which adds political risks to standard

com-mercial credit risks

the existence of separate and occasionally incompatible tax systems, giving

rise to issues of double and triple taxation.

We review these items in Section 1. Other issues or sources of problems, like differences in legal systems, investor protection, corporate governance, and

accounting systems are not discussed in much depth|not because they would be

irrelevant but for the simple reasons that there is too much heterogeneity across

countries and I have no expertise in them. Still, there is a chapter that should

create a basic awareness in these issues, so that the reader can then critically

look at the local regulation and see its relative strengths and weaknesses,

The above list includes some of the extra issues a CFO in an international company

needs to handle when doing the standard tasks of funding, evaluation, and risk

3

4

CHAPTER 1. WHY DOES THE EXISTENCE OF BORDERS MATTER FOR FINANCE?

management (Section 2). The outline of how we will work our way through all this

matter follows in Section 3.

1.1

1.1.1

Key Issues in International Business Finance

Exchange-rate Risk

Why do most countries have their own money? One disarmingly simple reason is

that printing bank notes is pro table, obviously, and even the minting of coins is

usually a positive-NPV business. In the West, at least since the days of the Greeks

and Romans, governments have been involved as monopoly producers of coins

or at least as receivers of a royalty (\seignorage") from the use of the o cial logo.

More recently, the ascent of paper money, where pro t margins are almost too

good to be true, has led to o cial monopolies virtually everywhere. One reason

why money production is not handed over to the UN or the IMF or WB is that

governments dislike giving up their monopoly rents. For instance, the

shareholders of the European Central Bank are the individual Euro-countries, not

the eu itself; that is, the countries have given up their monetary independence,

but not their seignorage. In addition, having one's own money is a matter of

national pride too: most Brits or Danes would not even dream of surrendering

their beloved Pound Sterling or Crown for, of all things, a European currency.

Lastly, a country with its own money can adopt a monetary policy of its own,

tailored to the local situation. Giving up a local policy was a big issue at the time

the introduction of a common European money was being debated.1

If money had intrinsic value (e.g. a silver content), if that intrinsic value were

stable and immediately obvious to anybody, and if coins could be de-minted into

silver and silver re-minted into coins at no cost and without any delay, then the value

of a German Joachimsthaler relative to a Dutch Florin and a Spanish Real would all

be based on their relative silver content, and would be stable. But in practice, many

sovereigns were cheating with the silver content of their currency, and got away with

it in the short run. Also, there are costs in identifying a coin's true intrinsic value and

in converting Indian coins, say, into Moroccan ones. Finds of hoards dating from

1Following a national monetary policy assumes that prices for goods & services are sticky, that

is, do not adjust quickly when money supply or the exchange rate are being changed. (If prices

would fully and immediately react, monetary policy would not have any `real' e ects). Small open

economies do face the problem that local prices adjust too fast to the level of the countries that

surround them. So it's not a coincidence that Monaco, San Marino, Andorra and the Vatican don't

bother to create their own currencies. Not-so-tiny Luxembourg similarly formed a monetary union

with Belgium as of 1922. Those two then xed their rate to the dem and nlg with a 1% band in 1982.

For more countries that gave up, or never had, an own money see Wikipedia, Monetary Union. See

the section on Currency Boards, in this chapter, about countries that give up monetary policy but

not seignorage.

c P. Sercu, K.U.Leuven. Free copying stops Oct 1st, '08

Formatted 2 July 2008|14:20.

translated price level (US=1)

2.500

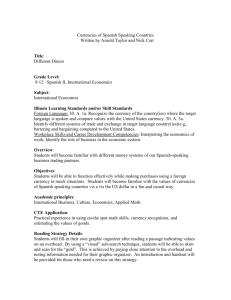

Figure 1.1: Relative prices of the Big Mac across the World, May 2006

2.000

1.500

1.000

0.500

0.000

5

1.1. KEY ISSUES IN INTERNATIONAL BUSINESS FINANCE

Norway

Icelan d

Switzerla nd

Denmark

Sweden

Eurola nd

Britain

Canada

Uniteds tates

Chile

Peru

Morocco

Brazil

Aruba

Slovenia

NewZealand

Turkey

Hunga ry

Fiju

Czech

SouthKorea

Croatia

Colombia

Mexico

Latvia

UAE

Austral ia

Lith uania

SaudiArabia

Eston ia

Taiwan

Georg ia

Argenti na

Guatemala

Singapore

Japan

CostaRica

Venezuela

Pakistan

SouthAfrica

Thailand

Poland

Slovakia

Bulgaria

Hondu ras

SriLanka

Domini canRep

Russia

Uruguay

Moldava

Ukraine

Egypt

Paraguay

Philip pines

Indone sia

HongKong

Malaysia

Macau

China

Source Based on data from The Economist, May 26, 2006

the Roman or Medieval times reveal astounding di erences in the silver content

of various coins with the same denomination. For instance, among solidus pieces

from various mints and of many vintages, some have silver contents that are

twice that of other solidus coins found in the same hoard. In short, intrinsic value

did never nail down the market value in a precise way, not even in the days when

coins really were made of silver, and as a result exchange rates have always

uctuated. Since the advent of paper money and electronic money, of course,

intrinsic value no longer exists: the idea that paper money was convertible into

gold coins lost all credibility after WW1. After WW2, governments for some time

controlled the exchange rates, but largely threw in the towel in 1973-4. Since

then, exchange rates are based on relative trust, a ckle good, and the resulting

exchange-rate risk is a fact of life for all major currency pairs.

Exchange risk means that there is uncertainty about the value of an asset or

liability that expires at some future point in time and is denominated in a foreign

currency (\contractual exposure"). But exchange risk a ects a company's nancial

health also via another channel|an interaction, in fact, with another inter-national

issue: segmentation of the consumption goods markets.

c P. Sercu, K.U.Leuven. Free copying stops Oct 1st, '08

Formatted 2 July 2008|14:20.

6

CHAPTER 1. WHY DOES THE EXISTENCE OF BORDERS MATTER FOR FINANCE?

1.1.2

Segmentation of the Consumer-good Markets

While there are true world markets|and, therefore, world prices|for commodities,

many consumer goods are really priced locally, and for traditional services the international in uence is virtually absent. Unlike corporate buyers of say oil or corn

or aluminum, private consumers do not bother to shop around internationally for

the best prices: the amounts at stake are too small, and the transportation cost

and hassle and delay from international trade would be prohibitive anyway. Distributors, who are better placed for international shopping-around, prefer to

pocket the resulting quasi-rents themselves rather than passing them on to

consumers. For traditional services, international trade is not even an option. So

prices are not homogenized internationally even after conversion into a common

currency. One strong empirical regularity is that, internationally, prices rise with

GDP/capita. In Figure 1.1, for instance, you see prices of the Big Mac in various

countries, relative to the us price. Obviously, developed countries lead this list,

with growth countries showing up as less expensive by The Economist's Big Mac

standard. The ratio of Big Mac prices Switzerland/China is 3.80. Norway (not

shown here) was even more than ve times more expensive than China, in early

2006; and two years before, the gap Iceland/South Africa was equally wide.

Within a country, by contrast, there is less of this price heterogeneity. For example, price di erences between \twin" towns that face each other across the usCanadian or us-Mexican border are many times larger than di erences between

East- and West-coast towns within the us. One likely reason that contributes to

more homogenous pricing within a country is that distributors are typically organized nationally. Of course, the absence of hassle with customs and international

shippers and foreign indirect tax administrations also helps.

A second observation is that prices tend to be sticky. Companies prefer to

avoid price increases, because the harm done to sales is not easily reversed:

consumers are resentful, or they just write o the company as \too expensive" so

that they do not even notice when prices come down again. Price decreases, on

the other hand, risk setting o price wars, and so on.

Now look at the combined picture of (i) price stickiness, (ii) lack of international

price arbitrage in consumption-good markets, and (iii) exchange-rate uctuations. The

result is real exchange risk. Barring cases of hyperin ation, short-run exchange-rate

uctuations have little or nothing to do with the internal prices in the countries that are

involved. So the appreciation of a currency is not systematically accompa-nied by

falling prices abroad or soaring prices at home so as to keep goods prices similar in

both countries. As a result, appreciation or depreciation can make a country less

attractive as a place to produce and export from or as a market to ex-port to. They

therefore a ect the market values and competitiveness of companies and economies

(\economic exposure"). For instance, the soaring usd in the Reagan years has meant

the end of many a us company's export business, and the rise of the dem in the 70s

forced Volkswagen to become a multi-country producer.

c P. Sercu, K.U.Leuven. Free copying stops Oct 1st, '08

Formatted 2 July 2008|14:20.

1.1. KEY ISSUES IN INTERNATIONAL BUSINESS FINANCE

7

Real exchange risk also a ects asset values in a more subtle way. Depending

on where they live, investors from di erent countries realize di erent real returns

from one given asset if the real exchange rate changes. Thus, one of the

fundamental assumptions of e.g. the capm, that investors all agree on the returns

and risks of all assets, becomes untenable. While this may sound like a very

theoretical issue, it becomes more important once you start thinking about capital

budgeting. For instance, a us rm may be considering an investment in South

Africa, starting from projected cash ows in South-African Rand (sar). How to

proceed? Should the managers discount them using a sar discount rate, the way

a local investor would presumably do it, and then convert the PV into usd using

the current spot rate? Or should they do it the us way: use expected future spot

rates to convert the data into expected usd cash ows, to be discounted at a usd

rate? Should both approaches lead to the same answer? Can they, in fact?

Exchange risk is the issue that takes up more space than any other separate topic

in this book. Its importance can be seen from the fact that so many instruments exist

that help us cope with this type of uncertainty: forward contracts, currency futures

and options, and swaps. You need to understand all these instruments, their

interconnections, their uses and limitations, and their risks.

1.1.3

Credit risk

If a domestic customer does not pay, you resort to legal redress, and the courts

enforce the ruling. Internationally, one problem is that at least two legal systems

are involved, and they may contradict each other. Usually, therefore, the contract

will stipulate what court will rule and on the basis of what law|say Scottish law in

a New York court (I did not make this up). Even then, the new issue is that this

court cannot enforce its ruling outside its own jurisdiction.

This has given rise to private-contract solutions: we seek guarantees from

special-ized nancial institutions (banks, factors, insurance companies) that (i) are

better placed to deal with the credit risks we shifted towards them, and (ii) have

an in-centive to honor their own undertakings because they need to preserve a

reputation and safeguard relations with fellow banks etc. So you need to

understand where these perhaps Byzantine-sounding payment options (like D/A,

D/P, L/C without or with con rmation, factoring, and so on) come from, and why and

where they make sense.

1.1.4

Political risk

Governments that decide or rule as sovereigns, having in mind the interest of their

country (or claiming to have this in mind), cannot be sued in court as long as what

they do is constitutional. Still, these decisions can hurt a company. One example is

imposing currency controls, that is, block some or all exchange contracts, so that

c P. Sercu, K.U.Leuven. Free copying stops Oct 1st, '08

Formatted 2 July 2008|14:20.

8

CHAPTER 1. WHY DOES THE EXISTENCE OF BORDERS MATTER FOR FINANCE?

the money you have in a foreign bank account gets stuck there (transfer risk). You

need to know how you can react pro- and retroactively. You also need to know how

this risk has to be taken into account in international capital budgeting. If and when

your foreign-earned cash ow gets stuck abroad, it is obviously worth less than its

nominal converted value because you cannot spend the money freely where and

how you want|but how does one estimate the probabilities of this happening at

various dates, and how does one predict the size of the value loss?

Another political risk is expropriation or nationalization, overtly or on the

stealth. While governments can also expropriate locally-owned companies (like

banks, in 1981 France), foreign companies in the \strategic" sectors (energy,

transportation, mining & extraction, and, atteringly, nance) are especially

vulnerable: most of them were expropriated or had to sell to locals in the 1970s.

The 2006 Bolivian example, where President Evo Morales announced that \The

state recovers title, possession and total and absolute control over [our oil and

gas] resources" (The Economist, May 4, 2006.) also has to do with such a sector.

Again, one issue for the nance sta is how to factor this in into NPV calculations.

1.1.5

Capital-Market Segmentation

Corporate Governance

Issues,

including

Aspects

of

A truly international stock and bond market does not exist. First, while stocks and

bonds of big corporations do get traded in many places and are held by investors

all over the world, mid-size or small-cap companies are largely one-country

instru-ments. Second, portfolios of individual and institutional investors exhibit

strong home bias|that is, heavy overweighting of local stocks relative to foreign

stocks| even regarding their holdings of shares in large corporations. A third

aspect of fragmentation in stock markets is that we see no genuine international

stock ex-changes (in the sense of institutions where organized trading of shares

takes place); instead, we have a lot of local bourses. A company that wants its

shares to be held in many places gets a listing on two or three or more

exchanges (dual or multiple listings; cross-listing): being traded in relatively

international places like London or New York is not enough, apparently, to

generate worldwide shareholdership. How come?

The three phenomena might be related, and caused by the problem of

asymmetric information and investor protection. Valuing a stock is more di cult

than valuing a bond, even a corporate bond, and the scope for misrepresentation

is huge, as the railroad and dotcom bubbles have shown. All countries have set

up some legislation and regulation to reduce the risks for investors, but there are

enormous di erences in the amount of information, certi cation and vetting

required for an initial public o ering (IPO). All countries think, or claim to think, the

other countries are fools by imposing so much/little regulation. The scope for

establishing a common world standard in the foreseeable future is nil. Pending

this, there can be no single world market for stocks.

c P. Sercu, K.U.Leuven. Free copying stops Oct 1st, '08

Formatted 2 July 2008|14:20.

1.1. KEY ISSUES IN INTERNATIONAL BUSINESS FINANCE

9

The same holds for disclosure requirements once the stock has been launched, and

the whole issue of corporate governance. The big issue here is how to avoid man-agers

selfdealing or otherwise siphoning o cash that ought to be the shareholders'. Good

governance systems contain checks and balances, like separation of the jobs of

chairman of the Board of Directors and CEO; a su cient presence of independent directors

on the Board; an audit committee that closely watches the accounts; com-prehensive

information provision towards investors; a willingness, among the board members, to re

poorly performing CEO's, perhaps on the basis of pre-set perfor-mance criteria; a board

that can be red by the Assembly General Meeting in one shot (as opposed to staggered

boards, where every year only one fth comes up for (re)election, for example); and a AGM

that can formulate binding instructions to the Board and the CEO. Good governance also

requires good information provision, with detailed nancial statements accompanied by all

kinds of qualitative information.

But governance is not just a matter of corporate policies: it can, and ideally must,

be complemented by adequately functioning institutions in the country. For instance,

how active and independent are auditors, analysts (and, occasionally, news-paper

reporters)? Is a periodic evaluation of the company's nancial health by its house

bank(s), each time loans are rolled over or extended, a good substitute for outside

scrutiny? Are minority shareholders well protected, legally? How stringent are the

disclosure and certi cation requirements, and are they enforced? Are there active

large shareholders, like pension funds, that follow the company's performance and

put pressure onto management teams they are unhappy with? Is there an active

market for corporate o cers, so that good managers get rewarded and (especially)

vice versa? Is there an active acquisition market where poorly performing companies get taken over and reorganized? Again, on all these counts there are huge di

erences across countries, which makes it impossible to set up one world stock

market. The OECD has been unable to come up with a common stance on even

something as fundamental as accounting standards. Telenet, a company discussed

in a case study in Part IV, has three sets of accounts: Belgian GAAP, US GAAP, and IFRS.

Even though in the us its shares are only sold to large private investors rather than the

general public, Telenet still had to create a special type of security for the us markets.

In short, markets are di erentiated by regulation and legal environment. In addition, companies occasionally issue two types of shares: those available for residents

of their home country, and unrestricted stocks that can be held internationally. Some

countries even impose this by law. China is a prominent example, but the list used to

include Korea, Taiwan, and Finland/Sweden/Norway. Typically, only a small fraction

of the shares was open to non-residents. Other legislation that occasionally still

fragments markets is a prohibition to hold forex; restrictions or prohibitions on

purchases of forex, especially for nancial (i.e. investment) purposes; caps on the

percentage of mutual funds or pension funds invested abroad, or minima for domestic investments; dual exchange rates that penalize nancial transactions relative

to commercial ones; taxes on deposits by non-residents; requirements to invest at

zero interest rates at home, proportionally with foreign investments or even with

c P. Sercu, K.U.Leuven. Free copying stops Oct 1st, '08

Formatted 2 July 2008|14:20.

10 CHAPTER 1. WHY DOES THE EXISTENCE OF BORDERS MATTER FOR FINANCE?

imports, and so on|you name it.

In OECD countries or NICs, this type of restrictions is now mostly gone. In December

2006, Thailand imposed some new regulations in order to discourage in ows|usually

the objective is to stop out ows|but hastily reversed them after the Bangkok stock

market had crashed by 15 percent; this example goes to show that this type of

restriction is simply not done anymore. But some countries never lifted them

altogether, like Chile, while in other countries the bureaucratic hassle is still strongly