Word

advertisement

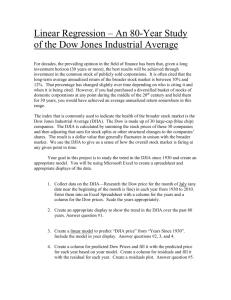

FINA 351 – Managerial Finance, Market Indices Assignment, (Ref. 11a) Instructions 1. Read the discussion below untitled “Market Indices” and answer the following questions: (A) What is the DJIA? (B) What are its weaknesses? (C) What does the S&P500 represent? (D) What does the Nasdaq Composite represent? (E) What does the DJ Wilshire 5000 index represent? (F) Which index reflects most closely the prices of technology and small-company stocks? (G) Which index reflects most closely the prices of blue-chip and large-industrial stocks? (H) Which index has the broadest representation of the overall U.S. equity market? (I) Which index do academics and analysts usually prefer? 2. Go to http://finance.yahoo.com/echarts?s=%5EDJI+Interactive#symbol=%5EDJI;range=my to create an interactive chart of the DJIA for the maximum period allowed. Next select Comparison to add the S&P500 (^GSPC) and Nasdaq Composite (^IXIC). (A) Which index appears to be the most volatile? Based on the information in Ch. 10, is that what you would expect? Why or why not? (B) Can you see the tech bubble around 2000? Haw many years (approx.) did it take for the Nasdaq to fully recover back to its high point before the dot-com/dot-bomb crash? (C) Based on these charts, which appears to be more risky (but also have more potential return): small cap or large cap stocks? (Note: Small or large cap refers to a company’s market capitalization, which represents the total value of the company according to the stock market.) 3. Go to http://finviz.com/map.ashx to get a graphical illustration of the S&P500. (A) What are the eight different sectors in the S&P500? (separate by black/blank space) (B) Which is the largest company in the S&P500 by market cap? (C) Does the heatmap indicate a mostly up or down day for stocks in the S&P500 (based on the color)? 4. Go to http://money.cnn.com/data/dow30/. (A) Review the list of 30 stocks. Based on the ticker, identify and record the stocks that are traded on the Nasdaq market (Hint: Nasdaq stocks usually have tickers with four or more letters while the NYSE tickers are 1-3 letters). (B) Record which of the 30 stocks had the most volume of shares traded during the day so far. (C) Highlight the table of the 30 stocks and paste it into Excel. Use the sum formula in Excel to add up the prices of the 30 stocks. The resulting total is the numerator of the DJIA. (D) What is the average price of all 30 stocks? (Divide sum in previous question by 30.) (E) Use the numerator (in Step D) to calculate the denominator of the DJIA. (Hint: The denominator equals the sum of the 30 stock prices (Step D) divided by the current DJIA figure (e.g. 17500 or whatever). The denominator should be a small fraction, such as 0.13 or so. (F) Why do you suppose the denominator is such a small number and not 30? See the discussion at the end of this document. 5. Go to http://www.djindexes.com/mdsidx/downloads/brochure_info/Dow_Jones_Industrial_Average_Historical_ Components.pdf and answer the following questions: (A) Review the 12 stocks in the DJIA when it was officially formed on May 26, 1896. Are any of those companies still around? If so, which? (B) At the bottom of the downloaded document, the most recent changes to the DJIA are supposed to be shown. [Actually, just recently AAPL replaced AT&T on the Dow but apparently this change has not been reflected yet.] List the most recent stock(s) replaced and the replacement(s). Speculate as to why the Dow might need to change the stocks in the index over time. (C) In what year did Microsoft and Intel join the DJIA? (Hint: this was around the end of the 20th century). Note that these were the first computer-related companies to join. (D) Refer to the picture below. How do the component changes illustrate a move away from the industrial age to the information and service age? 6. Use the information in the table below (Dow Milestones) to prepare a line chart of the DJIA with Excel. The easiest way to call up this data is to access the Excel file labeled “DJIA” on the linked on the course website for today’s assignment. Alternatively, you could enter (or copy) the DJIA values and the dates into two columns in a new Excel file that you create. Show the years on the bottom-horizontal axis and the DJIA along the vertical axis. Bring the graph up to date, ending with the most recent closing price. Email the Excel worksheet to the class email address. [NOTE: Make sure that the date column is formatted for dates. Otherwise, the graph will not be time-sensitive (i.e. decades won’t be evenly spaced) and your graph will show a straight-line rather than a curved line. You may have to enter the date values after you format the cells for dates in order for the format to be activated. The individual date values usually won’t show on your x-axis since the program automatically divides the total time into equal periods and puts the date of Jan. 1 for the first year in each block of years.] Dow Milestones 1/1/1906 11/1/1972 1/1/1987 4/1/1991 2/1/1995 11/1/1995 10/1/1996 2/1/1997 7/1/1997 4/1/1998 3/1/1999 5/1/1999 1/1/2000 7/1/2002 10/1/2006 4/1/2007 10/1/2007 3/1/2009 Current Date 100 1000 2000 3000 4000 5000 6000 7000 8000 9000 10000 11000 11723 7490 12000 13000 14165 6547 ???? Dow reaches 100 ten years after its launch. Dow finally reaches 1000 mark. Dow reaches 2000 after four years of bull market. Dow rallies after Gulf War. Dow enters the beginning of a serious bull market. Dow surges past 5000 just nine months after breaking 4000. Dow shrugs off a bad summer and breaks the 6000 barrier. Dow vaults the fastest 1000 point gain in history (so far.) Dow recovers from 10% plunge in March to continue bull market. Dow rockets past 9000 feet. Dow makes the five-digit range Dow shows that the bull is still charging ahead with utmost enthusiasm. Dow peaks in the dot-com/e-biz bubble Dow bottoms out in the dot-bomb/e-fiz crash Dow takes six years to recover from the dot.com crash and reach the 12k mark Dow closes above 13,000 on a major surge. Dow reaches a new high. Dow sinks at the bottom of the economic crisis (you’ll need to look this figure up.) 7. According to your graph, (A) What is the approximate value of the Dow in the year you were born? (B) In words, how would you describe the overall trend of the graph during your lifetime? Generally a bear or bull market? (C) A number of investment talking heads have peered into crystal balls and determined that the Dow will top 20,000 in the next year. Do you think they really know what they’re talking about or are they just blowing blue smoke (e.g. guessing along with everyone else)? Market Indices A market index (plural is indices or indexes) is made from a sample of securities that represent a particular market. There are dozens of stock and bond indices, both in the U.S. and in other countries. Undoubtedly the most famous index is the Dow Jones Industrial Average. The DJIA is a simple, back-of-the-envelope average that takes into consideration the prices of thirty, large, well-known companies, such as Boeing, Coca-Cola, Exxon, IBM, McDonalds, etc. The idea behind the index is that by keeping track of the price movements of these 30 stocks, one can estimate the price movements of all of the stocks traded on the stock market. How well does the DJIA represent the price movements in the overall stock market? Fairly well. But it has a number of weaknesses. First, it is a stretch to think that 30 non-randomly selected stocks can represent several thousand corporations in a broad array of industries. The DJIA does not do good job, for example, of reflecting the health care, technology, transportation, and utility sectors. It wasn’t until late 1999 that the DJIA was modified to include some computer-technology related stocks (it added Microsoft, HP, and Intel). Second, the DJIA mostly includes stocks of large, well-known, longestablished, blue chip corporations traded on the NYSE. The stocks of small entrepreneurial, technologyrelated companies are ignored. Finally, the DJIA is price-weighted, which means the average can be skewed by companies with high stock prices that are ready for a stock split. It would be more meaningful to weight the average based on the company’s overall market capitalization value. If the DJIA is an average of 30 stock prices, why is it a huge, four-to-five-digit number when the average of these stock prices is probably $70-$100? Good question. Well, back when the Dow was initially formed, the denominator was 30, as you might expect. However, because of stock splits and company substitutions, the denominator has been adjusted over time until now it is just a small fraction. Stock splits, which result in more shares each with a smaller price, would obviously cause problems to the average unless the denominator was adjusted. Also, since only about a dozen of the original 30 companies composing the DJIA still remain, there have clearly been many substitutions over the years necessitated by mergers and bankruptcies. Although the DJIA is the best known and most quoted stock index, there are many other indices as well. For example, Dow Jones also has a transportation index, a utilities index, and a composite index. After the DJIA, perhaps the next most famous stock index is the S&P500 (Standard & Poors 500 Composite). The S&P500, which consists of 500 stocks representing leading U.S. companies in a variety of industries, is superior to the DJIA because it obviously includes more stocks of different industries, the stocks are traded on the Nasdaq as well as the NYSE, and the index is weighted based on the overall market value of the companies. Academics and analysts usually prefer the S&P500 index and ignore the DJIA. Even though the S&P500 is superior to the DJIA, the differences between the two indices over time has been remarkably small, which is maybe why the DJIA has remained as popular as it is. Another important index is the Nasdaq Composite, which consists of thousands of stocks traded on the Nasdaq market. These stocks are mostly associated with newer, smaller companies (a few exceptions being Microsoft, Apple, Intel, Nike, etc.). The Nasdaq does not have the stringent listing requirements of the NYSE (e.g. to be listed on the NYSE, the company must have a market value of many millions of dollars and have thousands of shareholders, etc.). One final index to note is the DJ Wilshire 5000 Index (renamed DJ U.S. Total Stock Market Index), which is the broadest index for the U.S. equity market, measuring the performance of all U.S. equity securities (about 5400) with readily available price data. When the index was created, there were about 5,000 U.S. stocks publically traded – thus its name.